Apple Earnings Preview: Will the Upcoming Results Be the Catalyst for a Stock Rebound Following a 12% Dip This Year?

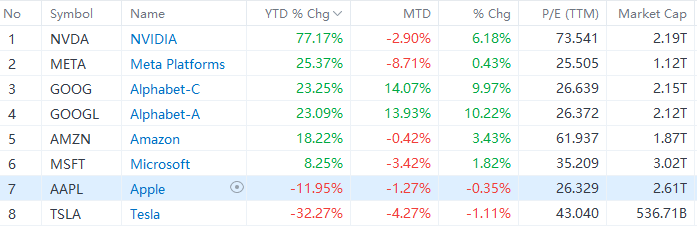

$Apple(AAPL.US$ is expected to release its Q2 FY 2024 earnings report on Thursday, May 2, after the market closes. So far this year, the tech giant has faltered by almost 12%, significantly lagging behind the $S&P 500 Index(.SPX.US$ and its Mag 7 peers, except for $Tesla(TSLA.US$. As analysts express apprehension regarding the company's challenges in China, ambiguity surrounding novel general artificial intelligence undertakings, and rivalry from more economical alternatives, investors are closely watching whether the forthcoming Q2 earnings will give Apple's stock the much-needed boost it requires.

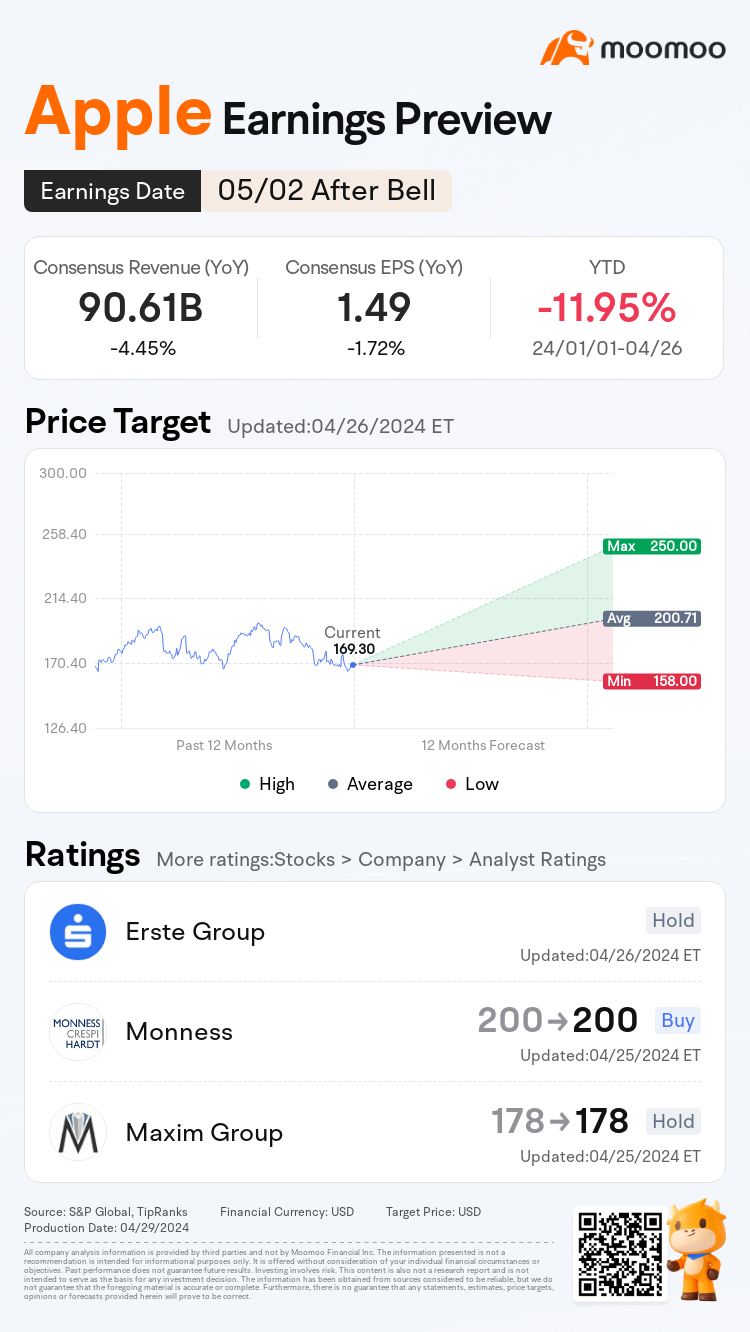

● Analysts expect Apple's Q2 revenue to be $90.61 billion, which represents a decline of 4.45% from the year-ago period.

● Earnings per share (EPS) are expected to be $1.49, slightly down from $1.52 a year earlier.

Analysts are predicting another weak quarter for iPhone sales, which is in line with Apple's own guidance to Wall Street. As the iPhone is still the company's primary revenue driver, this is expected to result in an overall poor quarter for the firm.

According to IDC, Apple's smartphone shipments declined by approximately 10% in the first quarter of 2024, largely due to increased competition from Android smartphone makers vying for the top spot. More specifically, iPhone sales have been impacted by strong domestic alternatives in China. The latest data from Counterpoint Research reveals that iPhone sales in China fell by 19% in Q1 2024, marking the weakest performance in the country since 2020. Furthermore, longer replacement cycles among consumers worldwide are also weighing on sales growth. Barclays analysts noted that US iPhone sell-through has also declined due to weak carrier upgrades and sluggish macroeconomic conditions, as well as increased competition from Samsung's S24.

Nonetheless, Bloomberg Intelligence has pointed out that the forthcoming iPhone results may not be as dismal as anticipated by Wall Street, and it is predicted that the outcome may modestly beat consensus, albeit moderately, as higher average selling prices could offset the decline in sales volume.

"Apple's 2Q iPhone sales growth could come in 200-300 bps above consensus' 11% decline, as a 10% drop in unit shipments, according to IDC, is slightly offset by a boost in average selling prices due to the iPhone 15 Pro Max, based on our calculations."

Benefiting from a higher mix of its services business, analysts expect that Apple's Services revenue will continue its momentum. Barclays sees Services growth in line at around 11%. Meanwhile, Bloomberg Intelligence analysts predict that Apple's services segment is expected to see low-double digit gains this quarter:

"We expect double-digit growth momentum to continue for paid subscriptions, led by advertising, payments and iCloud. Additionally, the unit could receive a slight boost from price increases, most notably those implemented in October for AppleTV+ and its Apple One services bundle."

Considering that Apple has been progressing more slowly in AI than other Mag 7 peers, many market participants and analysts believe that any potential AI announcements from the company could provide a much-needed boost to investor sentiment. Apple is recently in talks with potential partners including Alphabet's Google and OpenAI to provide generative AI services. According to Bloomberg, Apple's potential licensing partnership for Google's Gemirhi generative-AI models is likely to improve the iPhone's refresh rate and prevent any loss of market share. This partnership may be Apple's best option to catch up in the field of AI.

Wells Fargo analyst Aaron Rakers, who has been bullish on Apple also believes that confidence in Apple's GenAI strategy could be a positive catalyst. He set a target price of $225 for Apple on April 22 and suggested that investors should "consider buy on weakness", even if shares drop after the company reports its Q2 earnings on May 2.

Apple is set to kick off its annual Worldwide Developers Conference on June 10, during which the company is expected to unveil its long-awaited AI strategy, which will be front and centre for the planned iOS 18 upgrade. Apple marketing executive Greg Joswiak commented that "It's going to be absolutely incredible".

As for the concerns about Apple falling behind in the development of AI technology, Melius Research analyst Ben Reitzes suggested in a March note that "Apple may still have the last laugh". He believes that Apple can succeed without necessarily producing world-class AI models. Instead, the company can leverage its expertise in providing an interface that allow users to enjoy the benefits of AI-powered apps. Reitzes predicts that Apple's iPhone will continue to improve, thanks to "their own AI apps, perhaps through an upgraded Siri and its own assistant that can be integrated into non-Apple Apps too."

Jim Cramer, the host of CNBC's "Mad Money," also noted that Apple's partnership with Nvidia to enable enterprise applications for the Vision Pro could potentially boost the company's stock.

According to moomoo, as of the latest update, among the 32 analysts covering Apple in the past three months, 53% and 41% rated the stock as buy and hold, respectively. The average target price among analysts is $200.71, indicating an 18.6% upside potential compared to the latest closing price of $169.30. The highest target price, given by Wedbush on April 9th, is $250, implying a 47.7% upside potential.

Slumping iPhone demand in China has dragged Apple stock to an almost 12-month low. Looking ahead, the biggest potential risk for Apple is still likely to be a decline in iPhone sales, unless there is an improvement in sentiment towards China. The consensus among Wall Street analysts is for a 2% decline in iPhone sales guidance for Q3. Additionally, Apple faces challenges such as lower-than-expected sales of the Vision Pro, slower progress in AI, and regulatory risks.

Source: Bloomberg, Yahoo Finance, Barclays

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

ATS A trade sniper : hohoho red apple

Ash 李汇聪 : The brand's appeal is still there

Zunnurain Jasni :

華爾街之蟲 : Because he's an apple

103979878 : love apple products