After the Plunge of New York Community Bank, Who Will Be the Next?

After announcing an unexpected net loss of $252 million for the fourth quarter and a cut in its dividend, shares of New York Community Bancorp took a sharp dive, plummeting 46% early on Wednesday. The stock ultimately closed the day with a 37% loss, marking the steepest single-day percentage decline it's ever experienced.

This development sent ripples throughout the sector of regional banks, causing the stocks of peers like Valley National Bancorp and BankUnited to tumble as well. An index monitoring these mid-sized lenders finished the day around 6% lower.

■ NYCB has its own peculiarities, but it is not limited to accidental factors

The origins of New York Community Bancorp's troubles can be linked to its reaction to a crisis that shook the regional banking sector in 2023. A prominent failure within the sector, Signature Bank was one of three sizable regional banks that collapsed between March and May, inciting widespread concern over the robustness of mid-sized banks throughout the United States.

By taking on billions in loans from its defunct competitor, NYCB crossed the critical $100 billion threshold in assets, which brought it under more stringent regulatory scrutiny. In the United States, larger banks are mandated to hold higher levels of capital to bolster themselves against potential future losses. As a large lender in the commercial real estate market, NYCB has been under scrutiny as the value of office properties nationwide has declined, raising questions about the broader impact on the banking industry.

The bank saw its net charge-offs surge to $185 million, a significant escalation from just $1 million in the same quarter the previous year. This increase was predominantly due to the diminished value of a single office loan and one co-op loan.

■ The deposit and loan structures are changing in an unfavorable direction

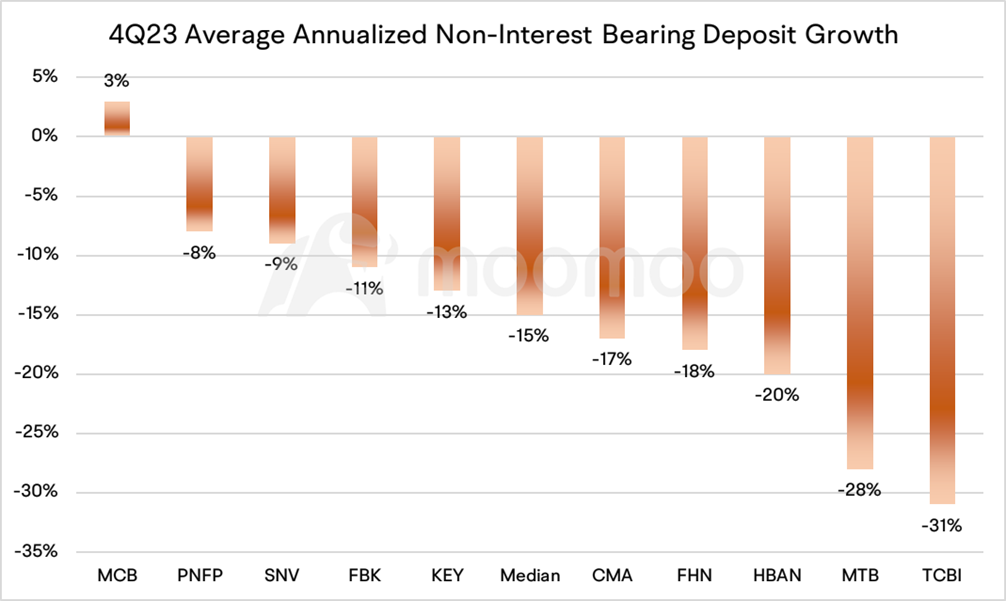

Across the regional bank sector, deposits were modestly lower in 4Q. The interest-free deposits of some small and medium-sized banks have declined rapidly, and the share of interest-bearing liabilities of banks has increased. Zero-cost balances retreated 4% in the latest quarter, with M&T and U.S. Bancorp facing steeper declines.

In the meanwhile, loans reflected muted demand at banks. Regions noted clients are delaying investments, which is crimping demand.

■ Deposit costs continue to rise, posing challenges to net interest income

Regional banks' net interest income decreased by a median of 2% in 4Q. 1Q looks to be another quarter of revenue decline for the group, reflecting muted lending and higher deposit costs.

The sector's NIM (Net Interest Margin)contracted 6 bps q/q in the 4th quarter, driven by interest bearing deposit costs rising 13 bps while loan yields rose 8 bps.Many banks still expected NIM pressure once the Fed starts to cut rates, given a timing difference between how quickly certain earning assets reset lower (such as cash and variable rate loans) and a potential lag in terms of when deposit rates start to decline.

For the upcoming 1Q, regionals struggled to deliver positive operating leverage. Amid revenue constraints, banks like Truist and PNC have reduced branches and headcount to flatten the expense trajectory.

■ Credit defaults are still on the rise

Losses on commercial real-estate loans at US regional banks are not surprising. The burden of higher interest rates may continue to pressure credit quality. Guidance embedded greater loan losses in 2024.

PNC expects losses to rise over time, particularly in office, but sees itself as adequately reserved. Truist anticipates higher charge-offs in 2024 due to further normalization of loss rates. Regional banks' loan losses are rising at a measured pace, with 4Q median net charge-offs equating to 31 bps of average loans vs. 24 bps in 3Q. NYCB surprised with higher apartment losses, which could remain challenged in 2024.

Regional banks' provision for credit losses increased by $10mn to $155mn. Regional banks added $44mn to its reserve in 3Q23.

■ Regional Banks's fee income slightly improved, but capital markets income is still weak

Fee income increased 3% led by growth in other (+$8mn; gains associated with lease sales), market value adjustments on employee benefit assets (+$8mn; offset in expenses), wealth management (+$5mn; better production and improved markets), mortgage (+$3mn; higher servicing income associated with a bulk purchase of the rights to service $6.2bn of residential mortgage loans that closed in 3Q) and commercial credit fees (+$3mn). Still, capital markets income (-$16mn; lower real estate capital markets income, as well as lower M&A advisory services) declined.

■ Will there be more banks with earnings below expectations?

Overall, the divergence in the circumstances of regional banks may intensify in 2024. We highlighted the risks associated with regional banks in our analysis from December last year:"Is it a True Revival for Regional Bank Stocks or Merely Another Deceptive Rally?"By synthesizing data from various institutions, it becomes apparent that banks such as Bank OZK, TCBI, and NYCB are exhibiting relatively weak financial performance and asset distribution across different metrics. However, this does not necessarily mean that localized banking issues will escalate into systemic risks, considering that commercial real estate (CRE) loans only constitute a limited proportion of the overall bank lending.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

lightfoot : I predicted the crash of our financial system High interest rates, poor planning poor management run away tyrant on the Whitrhouse is on the path to destroy the US Currency and the domino effect. well if you can't see it. I have been warning for years.

lightfoot : The White House has many buttons to push. Joe is hitting everyone. You millionaires your Balance Sheets will have large losses, your value will decrease like Enron

lightfoot : you got too cocky. You don't have enough assets as to what is coming

lightfoot : I have complained about how we changed the structure of capitalism as you know has a large impact to all for profit entities. Do we a panel of finance compliance auditors that monitors the impact of Over immigration and the cost effect. failing loans , inflation and a serious supply chain drop, high unsubstantiated interest hikes, consumer credit n lending. wages unable to keep up , failing sales. adventures like EV's had no basis in our lives, useless machines concocted by stupid people the Left. Funding two wars, Deficits that will break this nation's back . GNP will not suffice under Biden and wok. prepare your survival list, your money will be worthless. Rising taxes to fund the idiocy policies will take your properties. your money will not save you.

lightfoot : Even if employment was zero it cannot lift this economy . Shoplifting in the billions, lawlessness has a price effect on our economy diminishing tangible assets. Soon people with money will be taking more risks in fear but to no avail will fall like water over a dam Why are people leaving Blue left states. Taxes are too damn high to fund the idiocy of the work, the left. and Biden. If Trump becomes president he will not be able to save this sovereign nation. Like Rome, we are nearing the end of America. Some states can survive as a sovereign nation. Not all. Marijuana was too an element in ourdecline. Those that puff are useless citizens.

lightfoot : It takes awhile for the bricks to fall but bare witness to the Decline of America

Jose Chavez88 : PUTS ON WAL BABY WOO HOO

MonkeyGee : The question is will Janet succeed with her 2008 2.0!

MonkeyGee lightfoot: no problem, we are just going to legalize the use of stronger drugs. drugged people can't revolt!

MonkeyGee lightfoot: you lost 95% of the Americans with this article

View more comments...