20 stocks offer a "margin of safety" via Goldman

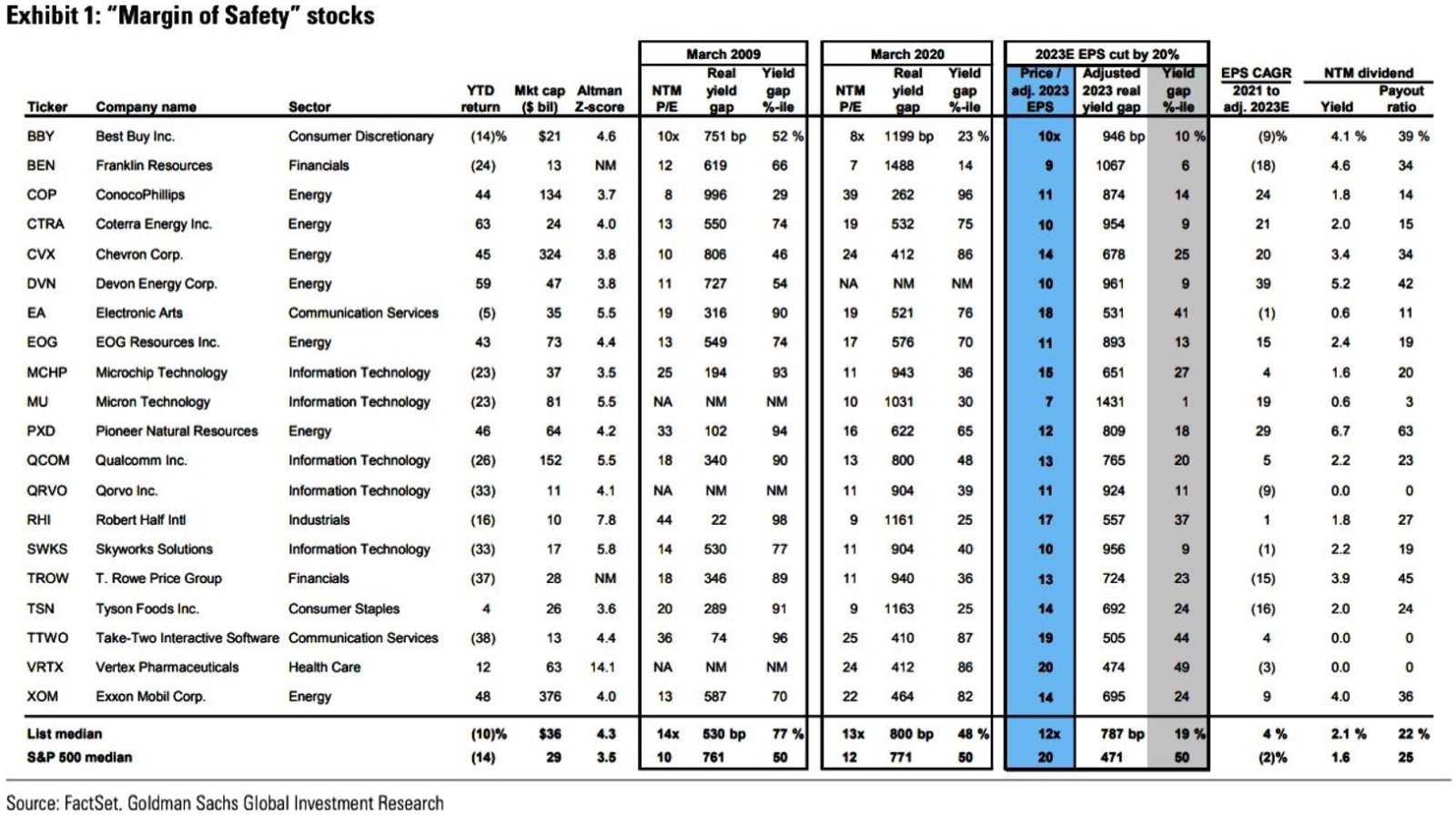

For equity investors, Goldman identifies 20 stocks that offer a "Margin of Safety" with three characteristics of size and liquidity, balance sheet strength as well as attractive valuation. Noticed that the valuation of these stocks is more attractive than how they were valued in previous bear markets.

1. Size and liquidity: Goldman set a threshold of capitalization greater than $10 billion, while investors seek liquidity in uncertain times meaning an above-average market cap in practical terms.

2. Balance sheet strength: Goldman defines balance sheet strength using Altman Z-score, which is a formula to determine whether a firm is headed for bankruptcy. Firms are generally considered to be in good financial health while scoring above 3 and vice versa.

On Goldman's list, most firms are with an Altman Z-score greater than the S&P 500 median of 3.5, and firms in the Financials and Real Estate sectors are with an asset/liability ratio below the S&P 500 median of 2.9.

3. Margin of Safety: Goldman expects downward revision in the latter half of this year for consensus estimates of 2022 and 2023 EPS. Assuming EPS estimates for next year are reduced by 20%, the valuation today of the listed margin-of-safety stocks is still attractive compared to the shares valued during previous bear markets, followed by several reasons below:

• Absolute valuation: The median stock in Goldman's screen today trades at an adjusted P/E of 12x, below their forward P/E in March 2009 (14x) and March 2020 (13x). The median stock also trades below the current S&P 500 median of 20x.

• Relative valuation: Goldman concludes that the listed stocks are more attractive today on an "adjusted earnings yield gap basis vs. real 10-year Treasury yields" compared to the rest of the index than they were in 2009 or 2020.

Besides, the relative valuations of these stocks are required to be attractive currently compared with the rest of the index.

• Growth and income: After a potential 20% reduction in 2023 EPS, the listed stocks would still have 2021-2023E CAGR EPS growth of +4%, compared to -2% for the median S&P 500 company.

Source: Goldman, FactSet

Disclamier: Investing involves risk and the potential to lose principal. Past performance does not guarantee future results. This is for information and illustrative purposes only. It should not be relied on as advice or recommendation.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

煥發的克里斯蒂 : Goldman Sachs Group bought the villa against the sea.

C L7 : Good read

Cool Hand Luke : Ha, so last ditch to get FOMO retail buying these before they drop