Super Micro Computer Shares Tumbled 30% from Peak: Will Earnings Results Shift Investor Sentiment?

Super Micro Computer, Inc. (SMCI) is gearing up to unveil its fiscal third-quarter results on April 30, riding the wave of its innovative offerings in AI, core computing, GPUs, storage, and 5G technology.

The company's robust AI-enhanced software pipeline is not just a testament to its technical prowess but also a key factor poised to cement its foothold in the explosive AI market. Moreover, the integration of AI technologies across its Server & Storage Systems segment is anticipated to turbocharge this quarter's growth.

Historical Earnings Performance:

In its previous quarterly earnings, $Super Micro Computer (SMCI.US)$ delivered a stellar performance, surpassing expectations on multiple fronts. The company posted revenue of $3.66 billion, comfortably exceeding the $3.06 billion forecasted by analysts from LSEG. Moreover, adjusted earnings per share (EPS) for the quarter were reported at $5.59, not only outstripping the analyst consensus of $4.93 but also exceeding the company's own earlier guidance set in January.

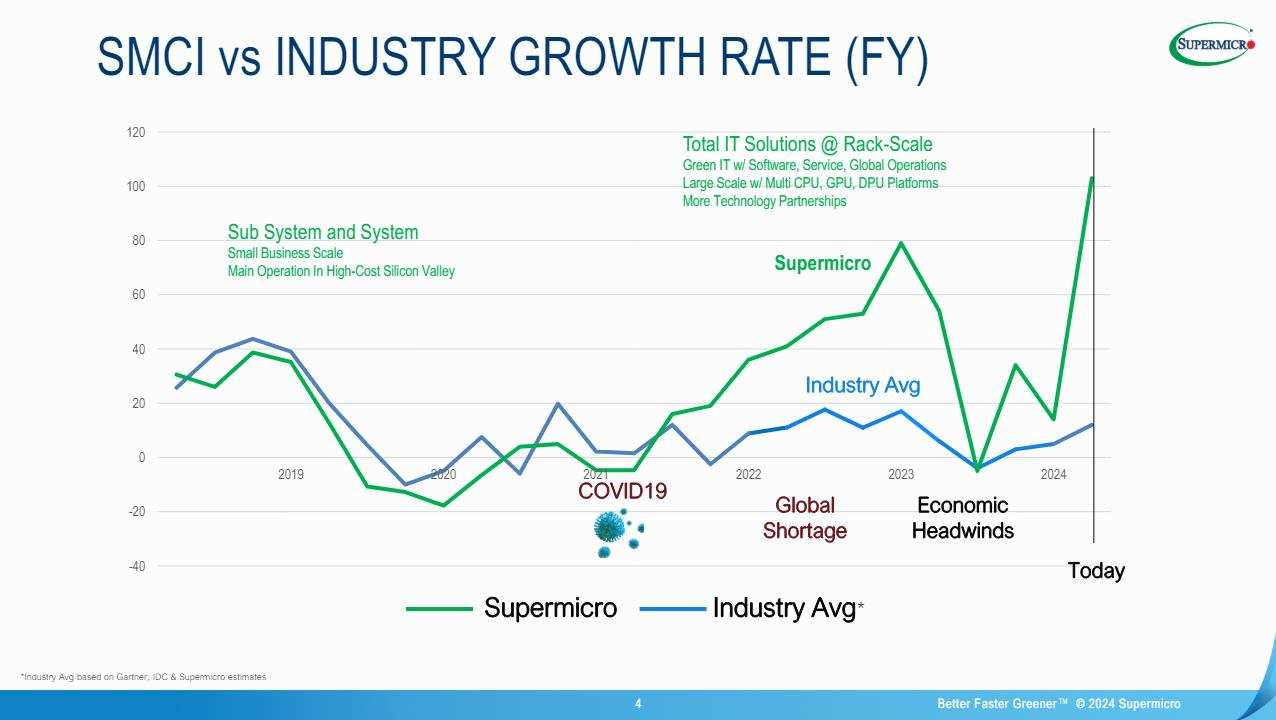

(Slides from SMCI Q2 Earnings Presentation)

What to Expect from Upcoming Earnings:

Heading into the third quarter of fiscal 2024, expectations for SuperMicro are set high by industry analysts. Overall, SMCI is projected to generate revenues between $3.7 billion and $4.1 billion for the quarter. This range is slightly below the Zacks Consensus Estimate, which anticipates sales might tip slightly higher at $4.11 billion, marking a substantial increase from the $1.28 billion recorded in the year-ago period.

The Zacks Consensus Estimate suggests a robust outlook, particularly in the Subsystems and Accessories segment, where revenues are forecasted to reach $277.71 million—a significant leap from $119.60 million reported in the same quarter last year.

On the earnings front, SMCI expects its non-GAAP earnings per share to range from $5.20 to $6.01. The consensus among analysts points to an expected $5.97 per share, signaling strong growth from the $1.63 per share reported in the same quarter the previous year. These projections underscore the bullish sentiment surrounding Super Micro's ongoing expansion and operational efficiency.

Stock Price Movements and Risks:

The company has seen its stock soar, achieving a remarkable 828% increase since the start of 2023, with a further 168% rise this year alone (as of this writing). Its robust performance also contributed to Supermicro's recent inclusion in the S&P 500 Index, making it one of the top 500 most valuable companies traded on the US exchanges.

Since March, the stock price has experienced heightened volatility, plunging over 30% from its highest point during the month. The turbulence intensified on April 19, when the stock plummeted more than 23% in just one day. Market analysts attribute this steep decline to SMCI's unexpected decision to announce its earnings date without the customary preliminary results, a move perceived by investors as a troubling sign.

However, a silver lining emerged last week with the earnings releases from tech giants $Tesla (TSLA.US)$ , $Meta Platforms (META.US)$ , $Alphabet-A (GOOGL.US)$ , and $Microsoft (MSFT.US)$, which provided a much-needed respite for the stock prices of broader semiconductor sector. These companies signaled strong commitments to ramp up AI-driven capital expenditures, injecting optimism into the market. This positive sentiment sparked a robust recovery for SMCI's stock, which surged over 20% this week, regaining much of its lost ground.

Considering the potential volatility of SMCI's stock, the upcoming earnings report could trigger dramatic swings in its share price, with significant movements both upward and downward on the horizon. This forecast underscores the critical juncture at which the company finds itself, poised for sharp reactions based on its financial performance.

Source: Bloomberg, Yahoo Finance, Super Micro Computer, Inc.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

见好就收知足常乐 : Do you own it?

Ab Razak Aripin : ok

Silverbat : Cautious buy

Silverbat : Guessing GAAP 5.6 the most, with saturated near term outlooks amid inflation

Chipi Chipi Chapa : The dump was unjustified. No one knew that the missed preliminaries were regulatory