ASML's Grim Earnings Spark Chip Stock Sell-off: What Are the Warning Signs?

$ASML Holding(ASML.US$, the sole producer of equipment for manufacturing the most advanced chips, reported orders that were below analysts' expectations, as chipmakers in Taiwan and South Korea delayed purchases of the Dutch company's high-end machines.

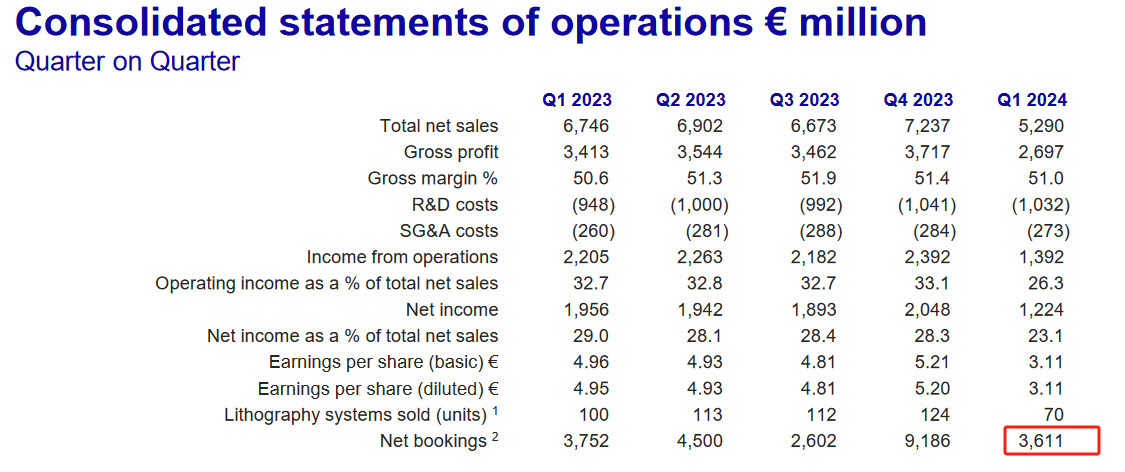

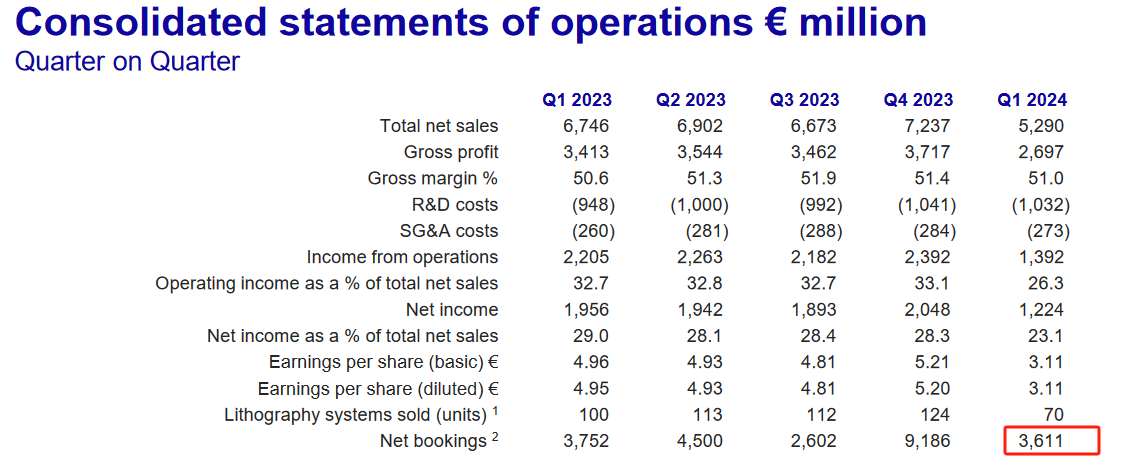

The company's bookings dropped 61% to €3.6 billion in the first quarter, falling short of the anticipated €4.63 billion. This decline is attributed to major chipmakers like $Taiwan Semiconductor(TSM.US$ and $Samsung Electronics Co., Ltd.(SSNLF.US$ pausing new orders while their manufacturer clients address excess inventories of components for smartphones, computers, and cars. Consequently, ASML's shares decreased by 7% Wednesday and the company also projected sales for the current quarter that were lower than analysts had forecasted. Demand for ASML's extreme ultraviolet (EUV) machines saw the most significant drop, with orders plummeting to €656 million from €5.6 billion in the previous quarter.

The level of EUV orders is extremely low, indicating major ASML clients like TSMC, Samsung and $Intel(INTC.US$ didn't increase investments in the high-end equipment," Oddo BHF analyst Stephane Houri said.

Outlook

ASML on Wednesday kept its 2024 financial forecasts unchanged, with sales seen flat from 2023's 27.6 billion euros.

Our outlook for the full year 2024 is unchanged, with the second half of the year expected to be stronger than the first half, in line with the industry's continued recovery from the downturn," Chief Executive Officer Peter Wennink said in a statement Wednesday. "We see 2024 as a transition year."

Part of ASML's bullishness comes from the fact that Samsung, TSMC and Intel are ramping up production capacity in America, with the support of funding from the U.S. CHIPS and Science Act.

I think by 2025 you will see all three of those coming together. New fab openings, strong secular trends and the industry in the midst of its upturn," Roger Dassen, chief financial officer of ASML, said in a pre-recorded video interview.

China Restrictions

The U.S. government is actively working to limit China's capability to produce its own advanced chips by imposing export restrictions on sophisticated chipmaking equipment. In response, China is focusing efforts on a long-term strategy to become less reliant on foreign-made chips. Consequently, Chinese chip manufacturers are increasingly purchasing older versions of ASML equipment, which are not subject to these export restrictions, to produce chips for a wide array of consumer products, including home appliances, vehicles, toys, and smartphones.

ASML has reported that sales to China surged to a record high, accounting for 49% of its total sales in the first quarter, equating to approximately 2 billion euros, as per the company's investor presentation released with its earnings report. In the year 2023, China constituted 29% of ASML's sales, partly due to Chinese buyers acquiring the company's mid-tier equipment ahead of the new export controls taking effect at the beginning of 2024. Over the period from 2020 to 2023, China ranked as ASML's third-largest market, following Taiwan and South Korea and surpassing the United States.

ASML previously said that export restrictions would impact 10% to 15% of China sales this year.

ASML Earnings Weigh on Semiconductor Shares

Chip stocks fell on Wednesday, with the $PHLX Semiconductor Index(.SOX.US$ dropping more than 3%, while the $S&P 500 Index(.SPX.US$ was only down less than 0.6%.

ASML expects revenue growth to improve in the second half of the year and accelerate in 2025, but the update shows that demand from chip manufacturers like TSMC may not be as strong as expected. That, in turn, could be a warning sign for chipmakers as the their stocks soared over the past year after they promised accelerating revenue growth due to AI-related demand.

Analysts' View

• Han Dieperink, chief investment officer at investment firm Aureus, said he was not worried by the quarterly numbers, given ASML's market dominance and strong long-term growth outlook.

You can't get around ASML. And that gives us also some sort of defensive qualities," he said. Aureus has 5-6% of its 2 billion euro equity portfolio in ASML.

• "Although disappointing we would not read too much into it as order intake is notoriously lumpy," said ING analyst Marc Hesselink.

• "ASML's latest financial results were not the numbers many investors had been hoping for or expecting. After an excellent Q4 orders, Q1 orders were expected to shrink due to their lumpy nature, but the amount that they fell was worse than expectations and could potentially be an early warning sign for concern," Ben Barringer, technology analyst at Quilter Cheviot, said in a note on Wednesday.

• Jefferies analysts said in a note following the earnings report that they agree with ASML and are comfortable with their current projections for full-year and beyond sales, maintaining a "buy" rating and calling ASML a "top pick."

Source: CNBC, REUTERS, ASML

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

104790679 : Wtf good news good result still want to drop Nvidia stock.

70515750 : Thanks

Tonyco : "grim" sure... more hyperbole meant to scare boomers