Why BlackBerry, the meme stock, looks revved up for Q1 earnings

Why BlackBerry, the meme stock, looks revved up for Q1 earnings

$BlackBerry Ltd(BB.US)$ is set to print its first-quarter 2022 earnings after the bell on Thursday.

$BlackBerry Ltd(BB.US)$該公司將於週四開盤後公佈2022年第一季度收益。

When the Canadian intelligent security and software company reported its fourth-quarter 2021 earnings on March 30, its stock closed down almost 10% the following day.

3月30日,當這家加拿大智能安全和軟件公司公佈2021年第四季度收益時,其股價第二天收盤下跌近10%。

For the fourth quarter, Blackberry reported revenue of $215 million, missing the analyst estimate of $245.1 million, and earnings per share of 3 cents, down 66.67% from the same period the year prior.

黑莓第四季度營收為2.15億美元,低於分析師預期的2.451億美元,每股收益為3美分,同比下降66.67%。

BlackBerry's stock is trading over 50% higher than when it released its last earnings report at around $13. The stock has seen renewed interest from retail traders and has been trending in Reddit communities over the past few weeks.

與上一次發佈收益報告時相比,黑莓的股價上漲了50%以上,約為13美元。散户交易員對黑莓重新產生了興趣,過去幾周,該股一直是Reddit社區的熱門話題。

Institutions are showing interest as well and have been hammering call option contracts on BlackBerry with strikes as high as $42.

機構也表現出興趣,一直在重創黑莓(BlackBerry)的看漲期權合約,罷工金額高達42美元。

The BlackBerry Chart

黑莓排行榜

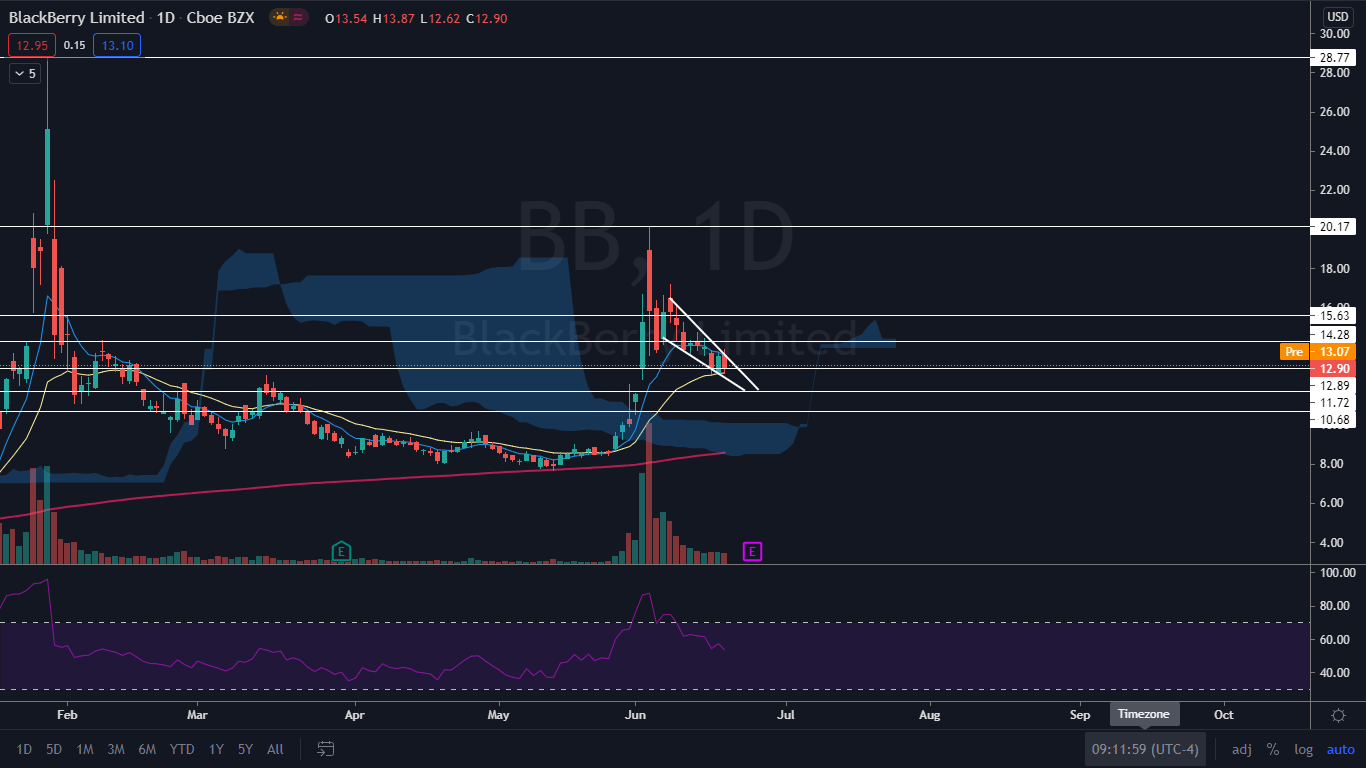

BlackBerry's stock has been consolidating since reaching a high of $20.17 on June 3. Since then, above-average volume on the daily chart has caused BlackBerry’s stock to become volatile and the stock has moved over 6% in each of the last three trading days. In its consolidation, BlackBerry has formed into a bullish falling wedge pattern. On Friday, the stock tried to break up bullish from the pattern but failed.

自6月3日達到20.17美元的高點以來,黑莓的股價一直在盤整。自那以來,日線圖上高於平均水平的成交量導致黑莓股價波動,在過去三個交易日中,該股每一天的漲幅都超過6%。在盤整中,黑莓形成了看漲的下跌楔形格局。上週五,該股試圖打破多頭格局,但失敗了。

BlackBerry’s stock is also holding support within the wedge at the $12.89 level and has not closed below the level since June 1. Although BlackBerry could continue trading down further into the wedge before breaking up from it, the heavy support in this area may mark the trigger point for the break.

黑莓股價也在楔形區域內守住了12.89美元的支撐位,自6月1日以來從未收在該價位下方。儘管黑莓股價在脱離楔形區域之前可能會繼續下跌,但這一區域的強勁支撐可能標誌着跌破的觸發點。

Blackberry is trading below the eight-day exponential moving average (EMA) and above the 21-day EMA with the eight-day EMA is acting as resistance and the 21-day EMA acting as support. This indicates there is indecision on the stock in the short-term. BlackBerry is trading about 50% above the 200-day simple moving average, which indicates overall sentiment in the stock is bullish.

黑莓目前的交易價格低於8日指數移動均線(EMA),高於21日均線,8日均線為阻力,21日均線為支撐。這表明短期內該股存在猶豫不決的情況。黑莓目前的交易價格比200日簡單移動均線高出約50%,這表明該股的整體人氣是看漲的。

Bulls want to see BlackBerry’s stock break up bullishly from the wedge with strong bullish volume and for it to continue a move up over resistance at the $14.28 mark. If BlackBerry’s stock can clear that level, it has room to move up toward $15.63.

看漲黑莓的人希望看到黑莓股價從看漲的楔形通道向上突破強勁的成交量,並繼續向上突破14.28美元關口的阻力。如果黑莓的股價能夠突破這一水平,它就有升向15.63美元的空間。

Bears want to see BlackBerry trading down into the wedge until losing the strong support just below the $13 level. This would also cause BlackBerry’s stock to lose support of the 21-day EMA which could cause BlackBerry to fall down toward $11.72.

看空者希望看到黑莓股價下跌,直到失去略低於13美元的強勁支撐。這也會導致黑莓的股票失去對21日均線的支持,這可能會導致黑莓跌向11.72美元。

BB Price Action

BB價格行動

BlackBerry was trading up 4.77% at $13.41 at market close on Tuesday.

週二收盤時,黑莓股價上漲4.77%,至13.41美元。

BlackBerry's stock is trading over 50% higher than when it released its last earnings report at around $13. The stock has seen renewed interest from retail traders and has been trending in Reddit communities over the past few weeks.

BlackBerry's stock is trading over 50% higher than when it released its last earnings report at around $13. The stock has seen renewed interest from retail traders and has been trending in Reddit communities over the past few weeks.