データなし

ログアウト

ライト

ダーク

戻る

-

マーケット

-

注目機能

-

ニュース

-

Moo

-

学ぶ

-

もっと見る

- 日本語

- ダーク

- ライト

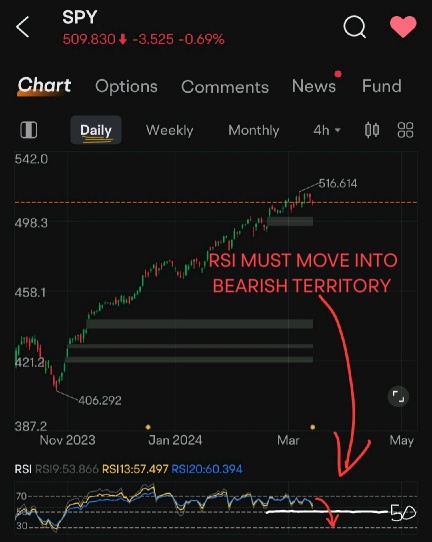

.) But I think this is a failing of TA - it isn’t meaningful in this context. I am learning that it is very much so moment to moment for entry & exit points, though! There are many reasons that the bull will continue, only fears that it won’t. This is the fun part, I intend to enjoy it.

.) But I think this is a failing of TA - it isn’t meaningful in this context. I am learning that it is very much so moment to moment for entry & exit points, though! There are many reasons that the bull will continue, only fears that it won’t. This is the fun part, I intend to enjoy it.

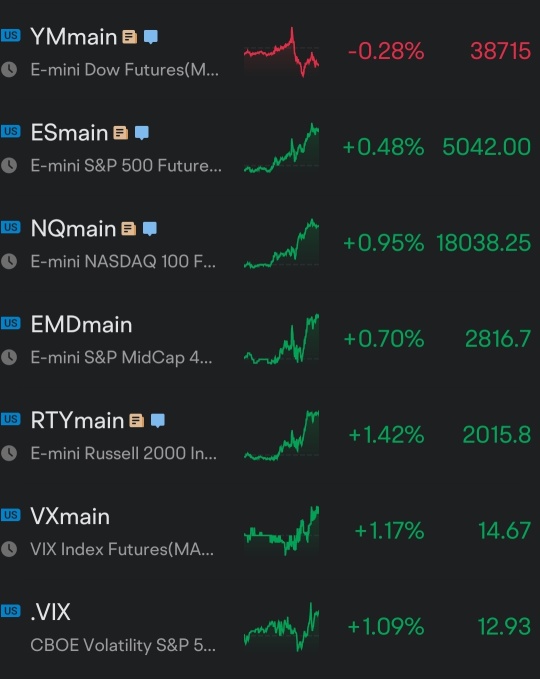

I’m pretty sure currencies are about to crash the stock market. I could very easily be wrong but the market is in the process of de-hedging because of a rumored FED pivot due to inflation coming down. The

I’m pretty sure currencies are about to crash the stock market. I could very easily be wrong but the market is in the process of de-hedging because of a rumored FED pivot due to inflation coming down. The

Sianzsation : The rhymes participate don’t anticipate!

SpyderCallスレ主 Sianzsation: makes it easy to remember.

73475104 : agreed

mypulse : Russell 2000 still seemed stucked, so market has not broadened... This rally is weird.

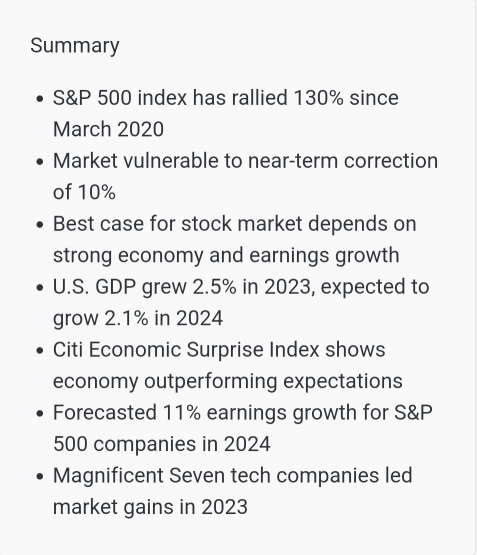

Kevin Matte : a lot of people that I follow on the internet (mostly youtubers) say that from April/May/June there will be a crash in the market until 2025, of the order of -30 to -75%... A lot start to prepare for it. Personally, I don't believe there will be a "big crash" but rather a correction, and maybe not ^^

もっとコメントを見る...