Powell Closes The Door On Early Rate Cut Hopes: Stocks, Bonds Tumble While Dollar Rallies

Powell Closes The Door On Early Rate Cut Hopes: Stocks, Bonds Tumble While Dollar Rallies

While inflation has seen some improvement, it remains above the Federal Reserve's target, Chair Jerome Powell said in remarks Thursday at a conference hosted by the International Monetary Fund.

主席,儘管通貨膨脹有所改善,但仍高於美聯儲的目標 傑羅姆·鮑威爾 在週四主辦的一次會議上發表講話時說 國際貨幣基金組織。

He highlighted the need for continued efforts to bring inflation back to its desired level, emphasizing that there is still a "long way to go" to get to the 2% target.

他強調需要繼續努力使通貨膨脹率恢復到預期水平,並強調要實現2%的目標還有 “很長的路要走”。

The event, featuring renowned economists like Gita Gopinath, the first deputy managing director at the IMF, and Harvard economics professor Kenneth Rogoff, was a platform for Powell to discuss the state of the U.S. economy, following the Fed's decision to hold interest rates steady at 5.25%-5.5% last week.

該活動邀請了知名經濟學家,例如 Gita Gopinath,國際貨幣基金組織第一副董事總經理,哈佛經濟學教授 肯尼思·羅格夫,這是繼美聯儲上週決定將利率穩定在5.25%-5.5%之後,鮑威爾討論美國經濟狀況的平台。

Powell noted an improved supply-demand balance in the labor market, which was confirmed by the latest data showing employment growth moderating more than predicted in October. Yet Powell said he anticipates the robust GDP growth experienced in the third quarter will likely moderate in the coming quarters as the economy adjusts to new conditions.

鮑威爾指出,勞動力市場的供需平衡有所改善,最新數據證實了這一點,顯示10月份就業增長放緩幅度超過預期。然而,鮑威爾表示,他預計,隨着經濟適應新條件,第三季度強勁的國內生產總值增長可能會在未來幾個季度放緩。

Powell's speech took a surprising turn when climate activists interrupted the conference.

當氣候活動家打斷會議時,鮑威爾的講話發生了令人驚訝的轉變。

After the brief interruption, Powell reiterated the Fed is not yet confident that it has achieved a sufficiently restrictive monetary stance. The concern, he said, is that unexpected fluctuations, or "head fakes," in inflation could still occur and necessitate a flexible approach.

在短暫的中斷之後,鮑威爾重申,美聯儲尚未確信自己已經採取了足夠嚴格的貨幣立場。他說,令人擔憂的是,通貨膨脹仍可能出現意想不到的波動或 “假貨”,因此需要採取靈活的方法。

A decline in inflation is likely to result from tight monetary policy, the Fed chair said.

美聯儲主席說,通貨膨脹率下降可能是緊縮貨幣政策造成的。

One of the more notable points raised by Powell was his questioning of the conventional wisdom that monetary policy should always overlook supply shocks.

鮑威爾提出的更值得注意的觀點之一是他質疑貨幣政策應始終忽視供應衝擊的傳統觀點。

He cautioned against ignoring supply shocks that have a restrictive impact on the economic outlook, as has been witnessed in recent years. Powell suggested that such shocks might require a monetary policy response, challenging traditional thinking on this matter.

他警告說,不要像近年來目睹的那樣,忽視對經濟前景具有限制性影響的供應衝擊。鮑威爾表示,此類衝擊可能需要貨幣政策應對措施,這挑戰了關於這個問題的傳統思維。

Powell concluded by addressing the ongoing debate regarding the possibility of a zero interest rate world. He expressed uncertainty about whether the structural factors that have pushed interest rates lower will persist in the future.

最後,鮑威爾談到了正在進行的關於零利率世界可能性的辯論。他對推動降低利率的結構性因素在未來是否會持續存在表示不確定性。

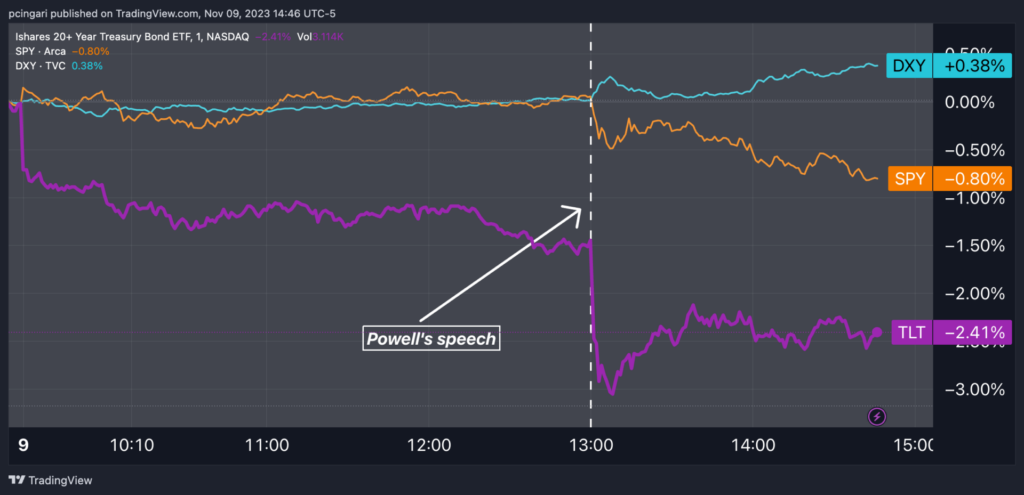

Market Reactions To Powell's Remarks

市場對鮑威爾言論的反應

Powell's remarks were perceived as hawkish by market participants. Traders in U.S. short-term interest rate futures have postponed their expectations for the first Federal Reserve rate cut, moving it from May to June, a shift that occurred following Powell's remarks.

市場參與者認爲鮑威爾的言論是鷹派的。美國短期利率期貨交易者推遲了對美聯儲首次降息的預期,將其從5月移至6月,這一轉變是在鮑威爾發表講話後發生的。

The cumulative rate cuts priced by the market for 2024 moved from nearly a full percentage point to 86 basis points.

市場定價的2024年累計降息幅度從近整整一個百分點上升至86個點子。

The dollar rallied and the S&P 500 Index declined as of 2:40 p.m. ET. The U.S. Dollar Index (DXY), as tracked by the $Powershares Exchange Traded Fd Tst Db Us Dollar Index Bullish Fund Etf (UUP.US)$, was 0.4% higher, while the $SPDR S&P 500 ETF (SPY.US)$ fell 0.8%.

截至美國東部時間下午2點40分,美元上漲,標準普爾500指數下跌。美元指數(DXY),由以下機構追蹤 $美元ETF-PowerShares DB (UUP.US)$,上漲了0.4%,而 $SPDR 標普500指數ETF (SPY.US)$ 下跌0.8%。

Treasury yields spiked, with the 30-year yield rising 18 basis points to 4.8%. The 10-year yield was up 15 basis points to 4.64%. Investors fled bonds, as the $iShares 20+ Year Treasury Bond ETF (TLT.US)$ tumbled 2.4%.

美國國債收益率飆升,30年期國債收益率上漲18個點子至4.8%。10年期國債收益率上漲15個點子至4.64%。投資者逃離了債券,因爲 $20+年以上美國國債ETF-iShares (TLT.US)$ 下跌了2.4%。

Chart: Markets React To Powell's IMF Speech

圖表:市場對鮑威爾國際貨幣基金組織講話的反應