暫無數據

代碼股票名稱

最新價漲跌額漲跌幅成交量成交額今開昨收最高最低總市值流通市值總股本流通股本5日漲跌幅10日漲跌幅20日漲跌幅60日漲跌幅120日漲跌幅250日漲跌幅年初至今漲跌幅股息率TTM換手率市盈率TTM市盈率(靜)振幅所屬行業

快訊 | 紐約證券交易所訂單失衡 66361.0 股賣出方

快訊 | 紐約證券交易所訂單失衡 178502.0 股買入方

業內人士買入森普拉和其他兩隻股票

儘管週五美國股市收高,但仍有一些值得注意的內幕交易。當內部人士購買股票時,這表明他們對公司的前景充滿信心或對股票的看法

董事理查德·馬克收購森普拉(SRE)的股份

桑普拉能源(SRE.US)董事增持1,925股普通股股份,價值約15.01萬美元

5月17日報道,根據美國證券交易委員會(SEC)5月17日披露的文件,$桑普拉能源(SRE.US)$董事MARK RICHARD J於5月17日以每股均價77.97美元增持1,925股普通股股份,價值約為15.01萬美元。圖片來源:SEC官網 什麼是持股變動聲明?SEC要求上市公司內幕人士公開披露其證券交易和持股情況,當內幕人士的持股發生變化時,根據不同情形,需要在交易結束後的一定時間內向SEC提

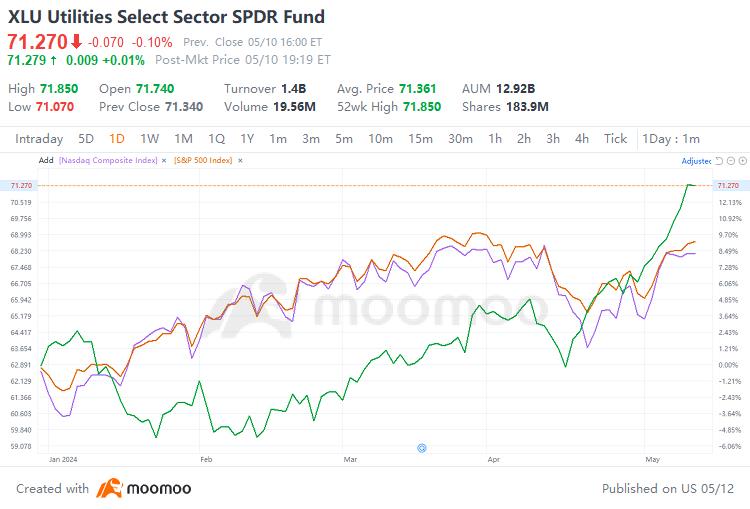

公用事業在過去3個月中飆升,但現在正在發出超買信號

10baggerbamm : 所有這些所謂的專家,他們像往常一樣遲到比賽,通常他們在底部降級,並在接近頂部升級。我在過去的星期五購買的 utsl 大盤,告訴人們以 14 美元購買,並在過去的星期五達到 29。現在我正在購買 DRN.. ETF,12 個月這將在美國市場上估值最低估的個人股票價值高於 20 美元... 它是 KNDI。交易收入 1.6 倍真可笑公司現在獲利公司在開放市場第一季度購回價值 30 萬股票去年第四季公司完成美國配銷網絡美國市場份額上季增長了 50%。過去股價已超過 20 美元,當時它的經營並無法像今天那樣的執行。該公司現在應該以最少的收入為 5 到 10 倍的交易這將把這股票放在 10 到 20 之間,一旦人們意識到它是什麼他們只是要與 NFL 處理使用他們的營銷權利,他們正在構建所有 NFL 球隊標記的 EVS,上週末宣布他們正在增加執行量,而不是 Chase 昨天的英雄 Microsoft 沒有問題我擁有它我已經擁有它 20 年,但我不會在 2 年或一年內在微軟獲得 10 倍的價格,我相信我會在 kndi 中。