Market Whales and Their Recent Bets on AMZN Options

Market Whales and Their Recent Bets on AMZN Options

Financial giants have made a conspicuous bearish move on Amazon.com. Our analysis of options history for Amazon.com (NASDAQ:AMZN) revealed 17 unusual trades.

金融巨頭在亞馬遜上採取了明顯的看跌舉動。我們對亞馬遜(納斯達克股票代碼:AMZN)期權歷史的分析顯示了17筆不尋常的交易。

Delving into the details, we found 35% of traders were bullish, while 47% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $133,537, and 14 were calls, valued at $719,827.

深入研究細節,我們發現35%的交易者看漲,而47%的交易者表現出看跌傾向。在我們發現的所有交易中,有3筆是看跌期權,價值爲133,537美元,14筆是看漲期權,價值719,827美元。

Predicted Price Range

預測的價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $150.0 and $200.0 for Amazon.com, spanning the last three months.

在評估了交易量和未平倉合約之後,很明顯,主要市場走勢者將注意力集中在亞馬遜過去三個月的150.0美元至200.0美元之間的價格區間上。

Analyzing Volume & Open Interest

分析交易量和未平倉合約

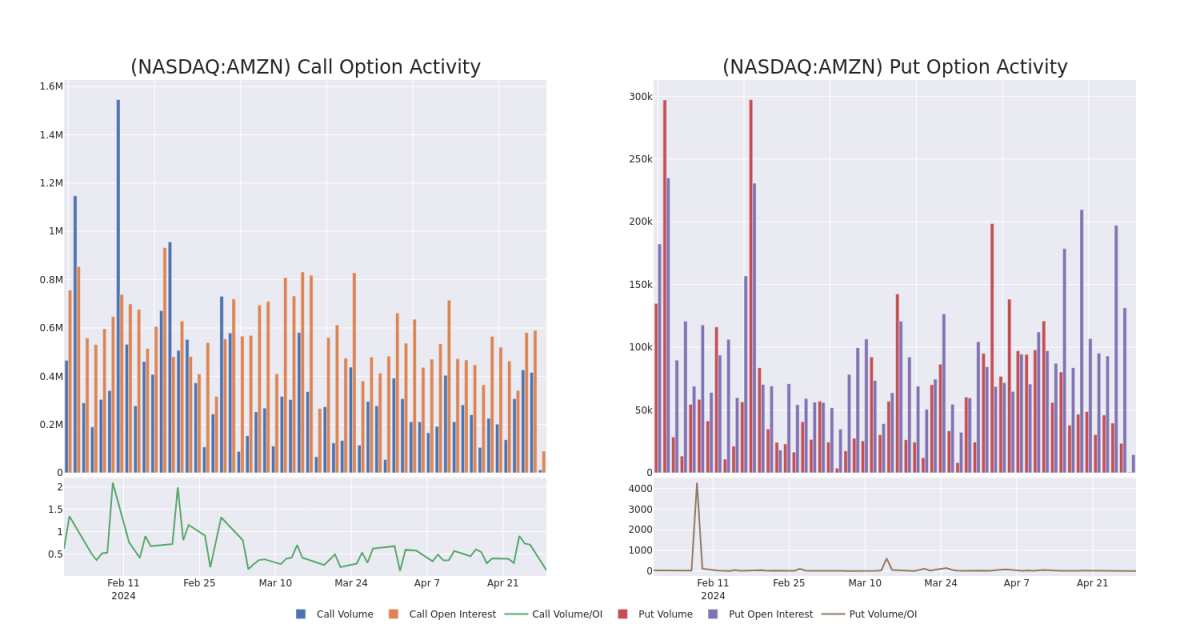

In today's trading context, the average open interest for options of Amazon.com stands at 11633.0, with a total volume reaching 12,707.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Amazon.com, situated within the strike price corridor from $150.0 to $200.0, throughout the last 30 days.

在當今的交易背景下,亞馬遜期權的平均未平倉合約爲11633.0,總交易量達到12,707.00。隨附的圖表描繪了過去30天內亞馬遜高價值交易的看漲和看跌期權交易量以及未平倉合約的變化,行使價走勢從150.0美元到200.0美元不等。

Amazon.com Option Activity Analysis: Last 30 Days

亞馬遜期權活動分析:過去 30 天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMZN | CALL | SWEEP | BULLISH | 05/03/24 | $6.05 | $6.0 | $6.05 | $185.00 | $122.2K | 18.5K | 1.2K |

| AMZN | CALL | TRADE | BEARISH | 05/03/24 | $4.75 | $4.65 | $4.65 | $187.50 | $116.2K | 4.2K | 778 |

| AMZN | CALL | SWEEP | BEARISH | 05/03/24 | $1.32 | $1.3 | $1.24 | $200.00 | $95.4K | 13.7K | 2.4K |

| AMZN | CALL | SWEEP | BULLISH | 05/03/24 | $5.95 | $5.85 | $5.93 | $185.00 | $59.4K | 18.5K | 2.4K |

| AMZN | PUT | SWEEP | NEUTRAL | 05/03/24 | $3.75 | $3.65 | $3.71 | $175.00 | $48.9K | 8.5K | 467 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMZN | 打電話 | 掃 | 看漲 | 05/03/24 | 6.05 美元 | 6.0 美元 | 6.05 美元 | 185.00 美元 | 122.2 萬美元 | 18.5K | 1.2K |

| AMZN | 打電話 | 貿易 | 粗魯的 | 05/03/24 | 4.75 美元 | 4.65 美元 | 4.65 美元 | 187.50 美元 | 116.2 萬美元 | 4.2K | 778 |

| AMZN | 打電話 | 掃 | 粗魯的 | 05/03/24 | 1.32 | 1.3 美元 | 1.24 美元 | 200.00 美元 | 95.4 萬美元 | 13.7K | 2.4K |

| AMZN | 打電話 | 掃 | 看漲 | 05/03/24 | 5.95 美元 | 5.85 美元 | 5.93 美元 | 185.00 美元 | 59.4 萬美元 | 18.5K | 2.4K |

| AMZN | 放 | 掃 | 中立 | 05/03/24 | 3.75 美元 | 3.65 美元 | 3.71 美元 | 175.00 美元 | 48.9 萬美元 | 8.5K | 467 |

About Amazon.com

關於亞馬遜

Amazon is a leading online retailer and one of the highest-grossing e-commerce aggregators, with $386 billion in net sales and approximately $578 billion in estimated physical/digital online gross merchandise volume in 2021. Retail-related revenue represents approximately 80% of the total, followed by Amazon Web Services' cloud computing, storage, database, and other offerings (10%-15%), advertising services (5%), and other. International segments constitute 25%-30% of Amazon's non-AWS sales, led by Germany, the United Kingdom, and Japan.

亞馬遜是領先的在線零售商,也是收入最高的電子商務聚合商之一,2021年的淨銷售額爲3,860億美元,估計的實體/數字在線商品總額約爲5,780億美元。零售相關收入約佔總收入的80%,其次是亞馬遜網絡服務的雲計算、存儲、數據庫和其他產品(10%-15%)、廣告服務(5%)等。國際細分市場佔亞馬遜非AWS銷售額的25%-30%,其中以德國、英國和日本爲首。

After a thorough review of the options trading surrounding Amazon.com, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對圍繞亞馬遜的期權交易進行了全面審查之後,我們將對該公司進行更詳細的審查。這包括評估其當前的市場狀況和表現。

Present Market Standing of Amazon.com

亞馬遜目前的市場地位

- Trading volume stands at 2,944,812, with AMZN's price up by 1.3%, positioned at $181.95.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 1 days.

- 交易量爲2,944,812美元,亞馬遜的價格上漲了1.3%,爲181.95美元。

- RSI指標顯示該股可能接近超買。

- 預計將在1天后公佈業績。

What Analysts Are Saying About Amazon.com

分析師對亞馬遜的看法

5 market experts have recently issued ratings for this stock, with a consensus target price of $210.6.

5位市場專家最近發佈了該股的評級,共識目標價爲210.6美元。

- An analyst from Roth MKM has decided to maintain their Buy rating on Amazon.com, which currently sits at a price target of $205.

- In a cautious move, an analyst from Benchmark downgraded its rating to Buy, setting a price target of $200.

- An analyst from BMO Capital persists with their Outperform rating on Amazon.com, maintaining a target price of $215.

- An analyst from Wells Fargo persists with their Overweight rating on Amazon.com, maintaining a target price of $217.

- Maintaining their stance, an analyst from Truist Securities continues to hold a Buy rating for Amazon.com, targeting a price of $216.

- Roth MKM的一位分析師已決定維持其在亞馬遜的買入評級,目前的目標股價爲205美元。

- Benchmark的一位分析師謹慎地將其評級下調至買入,將目標股價定爲200美元。

- BMO Capital的一位分析師堅持對亞馬遜的跑贏大盤評級,維持215美元的目標價格。

- 富國銀行的一位分析師堅持對亞馬遜的增持評級,將目標價維持在217美元。

- Truist Securities的一位分析師保持立場,繼續維持亞馬遜的買入評級,目標價格爲216美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Amazon.com with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略貿易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro獲取實時提醒,隨時了解亞馬遜的最新期權交易。

In today's trading context, the average open interest for options of Amazon.com stands at 11633.0, with a total volume reaching 12,707.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Amazon.com, situated within the strike price corridor from $150.0 to $200.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Amazon.com stands at 11633.0, with a total volume reaching 12,707.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Amazon.com, situated within the strike price corridor from $150.0 to $200.0, throughout the last 30 days.