Zooreal

commented on

In 2021, the price of shipping 🚢 skyrocketed, and it was hard to find a container. There was Malaysia's Glove 🧤 frenzy in 2020, and Taiwan also had the Age of Discovery in 2021. The three major shipping companies, Evergreen Shipping, Wanhai, and Yangming, skyrocketed 10-20 times. Meanwhile, Malaysia's HARBOUR also broke through a new high of RM1.73 in September 2021, and the single-day limit was up 30% on September 29, 2021.

⚠️ Container shipping stocks are cyclical stocks. They can only be in the short to medium term, not suitable for the long term ⚠️⚠️

Beginning in April, freight rates on European and American routes have been rising steadily, leading to a sharp rise in demand for containers in China and Taiwan. There are many factors that have caused the increase in freight rates 📈. One of them is that shipping companies are taking advantage of this opportunity 🈹️ and there is also talk of a wave of chives.

The picture above shows the stock price trends of Taiwan's Sanjiong, China's COSCO Sea & Air, and Malaysia's HARBOUR. Taiwan's Q1 has been released, and Q2 is expected to be better. Meanwhile, the Malaysian stock company HARBOUR is still awaiting Q1 results, and its counterpart SYGROUP has been trending very well over the past month.

$SYGROUP(5173.MY$

The chart above shows the stock price trend over the past 6 months.

At the end of August last year, the Moo Moo community shared that Harbor's cash flow was very strong. At the time, the stock price was in the RM1.20 range. Since the Age of Discovery in 2021, HARBOUR has caught that round of wealth and kept cash for years...

⚠️ Container shipping stocks are cyclical stocks. They can only be in the short to medium term, not suitable for the long term ⚠️⚠️

Beginning in April, freight rates on European and American routes have been rising steadily, leading to a sharp rise in demand for containers in China and Taiwan. There are many factors that have caused the increase in freight rates 📈. One of them is that shipping companies are taking advantage of this opportunity 🈹️ and there is also talk of a wave of chives.

The picture above shows the stock price trends of Taiwan's Sanjiong, China's COSCO Sea & Air, and Malaysia's HARBOUR. Taiwan's Q1 has been released, and Q2 is expected to be better. Meanwhile, the Malaysian stock company HARBOUR is still awaiting Q1 results, and its counterpart SYGROUP has been trending very well over the past month.

$SYGROUP(5173.MY$

The chart above shows the stock price trend over the past 6 months.

At the end of August last year, the Moo Moo community shared that Harbor's cash flow was very strong. At the time, the stock price was in the RM1.20 range. Since the Age of Discovery in 2021, HARBOUR has caught that round of wealth and kept cash for years...

Translated

+1

62

3

Zooreal

reacted to and commented on

Zooreal

voted

Am I finally have the chance to buy 1 unit of $NVIDIA(NVDA.US$ ?

To be honest, as an investor with normal income level in Malaysia, it is hard for me to even buy a unit of NVDA, which can worth USD1000 per unit, and about RM5000. thanks to US fractional share trading, I am able to buy less than 1 unit.

But now with stock split announcement 10 for 1, USD1000 per unit can become USD100 per unit, which is friendlier for investors like me!

Yes, NVDA s...

To be honest, as an investor with normal income level in Malaysia, it is hard for me to even buy a unit of NVDA, which can worth USD1000 per unit, and about RM5000. thanks to US fractional share trading, I am able to buy less than 1 unit.

But now with stock split announcement 10 for 1, USD1000 per unit can become USD100 per unit, which is friendlier for investors like me!

Yes, NVDA s...

24

4

Zooreal

voted

😊Hi, Malaysian mooers!

MAYBANK is set to release its next earnings report on May 24. How do you think the market will react to the company's quarterly results? Cast your vote to participate!

(Vote will close on 16:30 MYT May 24)

🎁 Rewards

👌 An equal share of 1,000 points: For mooers who correctly guess the price range of $MAYBANK(1155.MY$'s closing price at 16:45 MYT May 24 (e.g., If 50 mooers make a correct guess, ...

MAYBANK is set to release its next earnings report on May 24. How do you think the market will react to the company's quarterly results? Cast your vote to participate!

(Vote will close on 16:30 MYT May 24)

🎁 Rewards

👌 An equal share of 1,000 points: For mooers who correctly guess the price range of $MAYBANK(1155.MY$'s closing price at 16:45 MYT May 24 (e.g., If 50 mooers make a correct guess, ...

83

136

Zooreal

reacted to

Zooreal

liked

$KOSSAN(7153.MY$

With the development of the gloves 🧤 sector in Malaysia 🇲🇾, production reduction strategies over the past few years, and 🇨🇳 the rush from China and Thailand, China's global exports have declined from 60% + at their peak to less than 40%. Although it is still number one in the world, it will retreat if it does not advance. I hope to take back more markets in the future.

During the pandemic, KOSSAN had the least amount of cash in the big four packages. However, it overtook its counterpart in FY23 and was the richest cash stock in Malaysian stocks. KOSSAN has invested only RM211 miles in CAPEX in the past two years. The main strategy is to attack by defending and waiting until spring.

TOPGLOV distributed a large number of dividends and expanded wildly during the pandemic. Seven consecutive quarters of losses led to the least amount of cash in the 4 companies. SUPERMX's CAPEX was crazy. It was revealed that buying private jets and losing money for 5 consecutive quarters caused cash to fall incessantly. In terms of this year's stock price performance, both companies have declined slightly.

$TOPGLOV(7113.MY$

However, KOSSAN and HARTA have been profitable for two consecutive quarters, mainly due to layoffs, production cuts and cost reduction, and interest income from large sums of cash has also enabled the company to withstand the cold winter. This also brought KOSSAN RM60 mil of interest income and fair value gain in investment assets in 2023. And HARTA's past 9...

With the development of the gloves 🧤 sector in Malaysia 🇲🇾, production reduction strategies over the past few years, and 🇨🇳 the rush from China and Thailand, China's global exports have declined from 60% + at their peak to less than 40%. Although it is still number one in the world, it will retreat if it does not advance. I hope to take back more markets in the future.

During the pandemic, KOSSAN had the least amount of cash in the big four packages. However, it overtook its counterpart in FY23 and was the richest cash stock in Malaysian stocks. KOSSAN has invested only RM211 miles in CAPEX in the past two years. The main strategy is to attack by defending and waiting until spring.

TOPGLOV distributed a large number of dividends and expanded wildly during the pandemic. Seven consecutive quarters of losses led to the least amount of cash in the 4 companies. SUPERMX's CAPEX was crazy. It was revealed that buying private jets and losing money for 5 consecutive quarters caused cash to fall incessantly. In terms of this year's stock price performance, both companies have declined slightly.

$TOPGLOV(7113.MY$

However, KOSSAN and HARTA have been profitable for two consecutive quarters, mainly due to layoffs, production cuts and cost reduction, and interest income from large sums of cash has also enabled the company to withstand the cold winter. This also brought KOSSAN RM60 mil of interest income and fair value gain in investment assets in 2023. And HARTA's past 9...

Translated

87

5

Zooreal

reacted to and commented on

$KSL(5038.MY$

#南马产业股KSL三高

KSL's stock price has doubled in 8 months since the results were released in August last year. Although it has increased quite a bit, the PE valuation is only 4.30 times. FY achieved 3 highs in fiscal year 2023, with a record high in turnover, a record high in net profit, and a record high in net cash.

The stock price has risen to a 9-year high, but it has also been almost 9 years since dividends have not been paid. Assuming they are willing to pay 25% of the profit, or 10 percent, as a dividend, the market should go crazy.

On April 30th, or today, KSL announced the purchase of 183.3323 land for RM211.58 mil. The location is Mukim Pulai, Johor Bahru. In the past six months, South Malaysia was the state with the strongest industry, and the big trend of data centers has also driven the South Malaysian economy, so the industrial sector is expected to continue to be driven.

I have always believed that if KSL were willing to pay a 5 point dividend, the valuation could be at least 6 times more. Management has the ability to distribute but doesn't, and shareholders can't do anything. Fortunately, investors who hold shares have earned quite a bit in stock prices over the past year. Mutual encouragement.

#南马产业股KSL三高

KSL's stock price has doubled in 8 months since the results were released in August last year. Although it has increased quite a bit, the PE valuation is only 4.30 times. FY achieved 3 highs in fiscal year 2023, with a record high in turnover, a record high in net profit, and a record high in net cash.

The stock price has risen to a 9-year high, but it has also been almost 9 years since dividends have not been paid. Assuming they are willing to pay 25% of the profit, or 10 percent, as a dividend, the market should go crazy.

On April 30th, or today, KSL announced the purchase of 183.3323 land for RM211.58 mil. The location is Mukim Pulai, Johor Bahru. In the past six months, South Malaysia was the state with the strongest industry, and the big trend of data centers has also driven the South Malaysian economy, so the industrial sector is expected to continue to be driven.

I have always believed that if KSL were willing to pay a 5 point dividend, the valuation could be at least 6 times more. Management has the ability to distribute but doesn't, and shareholders can't do anything. Fortunately, investors who hold shares have earned quite a bit in stock prices over the past year. Mutual encouragement.

Translated

44

2

Zooreal

commented on and voted

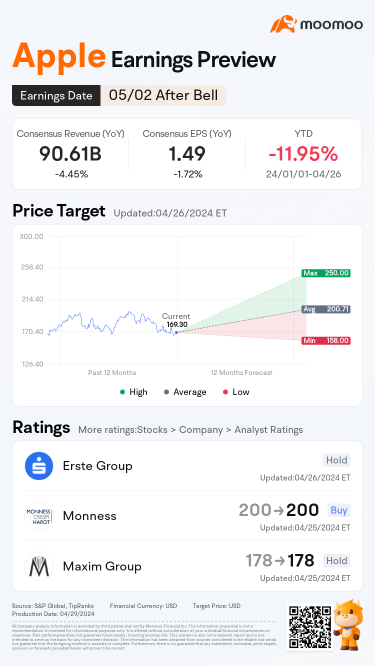

Apple is releasing its Q2 2024 earnings after the market closes on May 2.

Since its Q1 earnings release, shares of $Apple(AAPL.US$ have seen a decrease of 6%.![]() Its implied move on the earnings date is 4.2%. How will the market react to the upcoming results? Make your guess now!

Its implied move on the earnings date is 4.2%. How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $Apple(AAPL.US$'s opening price at 9:30 AM ET Ma...

Since its Q1 earnings release, shares of $Apple(AAPL.US$ have seen a decrease of 6%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $Apple(AAPL.US$'s opening price at 9:30 AM ET Ma...

116

222

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)