Ya2NVEmD79

liked

$Affirm Holdings(AFRM.US$ shares slip 1.9% in premarket trading after rival $AFTERPAY LTD SPONS ADS ECH REP 1 ORD SHS(AFTPY.US$ introduces a Buy Now, Pay Later subscription service in the U.S.

Afterpay stock gains 0.9%.

Merchants, including Fabletics, IPSY, BoxyCharm, and Savage X Fenty, will be among the first to offer consumers the option to pay for recurring purchases in installments starting early next year.

The new service allows qualified merchant partners to potentially offer Afterpay for everyday payment needs including gym memberships, entertainment subscriptions, online services and more.

The subscriptions will be available to consumers across online platforms in the U.S. and Australia by early 2022, with plans to extend the feature in-store and to other regions including Canada, New Zealand, the U.K., and Europe.

$PayPal(PYPL.US$, which also has a BNPL service, drops 0.7% in premarket trading.

In August, $Block(SQ.US$ agreed to buy Afterpay for ~$29B in stock.

Afterpay stock gains 0.9%.

Merchants, including Fabletics, IPSY, BoxyCharm, and Savage X Fenty, will be among the first to offer consumers the option to pay for recurring purchases in installments starting early next year.

The new service allows qualified merchant partners to potentially offer Afterpay for everyday payment needs including gym memberships, entertainment subscriptions, online services and more.

The subscriptions will be available to consumers across online platforms in the U.S. and Australia by early 2022, with plans to extend the feature in-store and to other regions including Canada, New Zealand, the U.K., and Europe.

$PayPal(PYPL.US$, which also has a BNPL service, drops 0.7% in premarket trading.

In August, $Block(SQ.US$ agreed to buy Afterpay for ~$29B in stock.

47

12

Ya2NVEmD79

reacted to

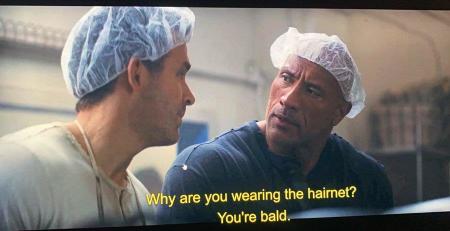

$Netflix(NFLX.US$ Really it takes an old straight married woman to mention Gal Gadot…plus I like the Rock and Ryan Reynolds as far as sheer entertainment value. It feels like a theatre movie and you can pause for popcorn and bathroom breaks…I guess we all have our own rating system:)

Squid Games just finished and it was hard to watch the brutality of it for me but was unique plot, set, film style and held our attention although had to look away at some of those scenes.

Squid Games just finished and it was hard to watch the brutality of it for me but was unique plot, set, film style and held our attention although had to look away at some of those scenes.

8

3

Ya2NVEmD79

reacted to

$Novavax(NVAX.US$ announces its submission to the Singapore Health Sciences Authority (HSA) for interim authorization of its COVID-19 vaccine, NVX-CoV2373, under the Pandemic Special Access Route.

Shares down 1.4% premarket at $198.

The filing includes clinical data from two pivotal Phase 3 clinical trials, PREVENT-19 conducted in U.S. and Mexico; and U.K. trial including 15,000 participants.

Novavax recently received Emergency Use Authorization (EUA) for the vaccine in Philippines, and has filed for vaccine approval in South Korea.

Novavax' COVID-19 vaccine is packaged as a ready-to-use liquid formulation in a vial containing ten doses. The vaccination regimen calls for two 0.5 ml doses (5 microgram antigen and 50 microgram Matrix-M adjuvant) given intramuscularly 21 days apart. The vaccine is stored at 2°- 8° Celsius, enabling the use of existing vaccine supply and cold chain channels.

The EMA has also started evaluating Novavax's marketing application for its COVID-19 vaccine.

Shares down 1.4% premarket at $198.

The filing includes clinical data from two pivotal Phase 3 clinical trials, PREVENT-19 conducted in U.S. and Mexico; and U.K. trial including 15,000 participants.

Novavax recently received Emergency Use Authorization (EUA) for the vaccine in Philippines, and has filed for vaccine approval in South Korea.

Novavax' COVID-19 vaccine is packaged as a ready-to-use liquid formulation in a vial containing ten doses. The vaccination regimen calls for two 0.5 ml doses (5 microgram antigen and 50 microgram Matrix-M adjuvant) given intramuscularly 21 days apart. The vaccine is stored at 2°- 8° Celsius, enabling the use of existing vaccine supply and cold chain channels.

The EMA has also started evaluating Novavax's marketing application for its COVID-19 vaccine.

23

7

Ya2NVEmD79

liked

$Netflix(NFLX.US$ The big hits only just started. December is packed with some of their most anticipated releases:

🔥The Witcher

🔥 Money Heist

🔥 Cobra Kai

🔥 Lost in Space

🔥 Dont look up

🔥 The Unforgiveable

🔥 The Power of the Dog

🔥 The Lost Daughter

🔥 The Hand of God

🔥The Witcher

🔥 Money Heist

🔥 Cobra Kai

🔥 Lost in Space

🔥 Dont look up

🔥 The Unforgiveable

🔥 The Power of the Dog

🔥 The Lost Daughter

🔥 The Hand of God

10

3

Ya2NVEmD79

liked

Fintech Ant Group's $Alibaba(BABA.US$ valuation is said to have been cut by 15% to below $200B by major investor Warburg Pincus.

Private equity firm Warburg Pincus, who was a large investor in Ant's 2018 fundraising, cut the company's valuation to $191B at end of September from $224B at the end of June, according to a Reuters report, which cited sources. The report also said there are signs that Ant's planned IPO won't be happening anytime soon.

Warburg changed its valuation methodology for the fintech giant, citing “regulatory developments and the impact of ongoing restructuring," according to Reuters.

Ant Group was ordered by Chinese regulators to restructure into a financial holding company, and Alibaba, which holds Ant Group stake, had to pay a record $2.75B antitrust fine in April.

Last year, Ant was valued at $315B ahead of its blockbuster IPO dual listing, which regulators pulled at the last minute in November. In May, Fidelity cut Ant Group's valuation to $144B implied valuation from its $300B heights.

Separately, the WSJ reported earlier that Ant has set up a new consumer finance company and has folded its credit business into the new entity as part of Ant's restructuring efforts aimed at appeasing Chinese authorities.

Ant Group director Fred Hu told Nikkei in July that he expected that the company will be able to resume its suspended IPO "before too long."

Earlier this week, Alibaba, Baidu among decliners in wake of Chinese government fines.

Private equity firm Warburg Pincus, who was a large investor in Ant's 2018 fundraising, cut the company's valuation to $191B at end of September from $224B at the end of June, according to a Reuters report, which cited sources. The report also said there are signs that Ant's planned IPO won't be happening anytime soon.

Warburg changed its valuation methodology for the fintech giant, citing “regulatory developments and the impact of ongoing restructuring," according to Reuters.

Ant Group was ordered by Chinese regulators to restructure into a financial holding company, and Alibaba, which holds Ant Group stake, had to pay a record $2.75B antitrust fine in April.

Last year, Ant was valued at $315B ahead of its blockbuster IPO dual listing, which regulators pulled at the last minute in November. In May, Fidelity cut Ant Group's valuation to $144B implied valuation from its $300B heights.

Separately, the WSJ reported earlier that Ant has set up a new consumer finance company and has folded its credit business into the new entity as part of Ant's restructuring efforts aimed at appeasing Chinese authorities.

Ant Group director Fred Hu told Nikkei in July that he expected that the company will be able to resume its suspended IPO "before too long."

Earlier this week, Alibaba, Baidu among decliners in wake of Chinese government fines.

38

13

Ya2NVEmD79

liked

$Netflix(NFLX.US$ We've subscribed to Netflix since the back in the two DVD's a month era. Only thing that would lead to cancelling our account would be a large increase in subscription costs. So far they've been able to thread the needle. Companies that understand the "sticky bit" seem to prosper.

8

3

Ya2NVEmD79

liked

The stock market wraps up Wednesday near session highs after the latest measure of the Fed's favorite inflation gauge arrived in line with forecasts. And the minutes of the last central bank meeting show that some officials wanted to reduce asset purchases by more than the $15B/month pace to give it more flexibility on when it could adjust interest rates.

Volume is declining as many on Wall Street get a jump on the holiday.

Buying picked up after a weak open when the core PCE price index posted an annual pace of 4.1% for October.

The $NASDAQ 100 Index(.NDX.US$ +0.4% creeps further into the green, while the $S&P 500 Index(.SPX.US$ edges up 0.2%. The $Dow Jones Industrial Average(.DJI.US$ -0.03% stays under the breakeven point.

Treasury yields are are back in the red after early gains. The 10-year Treasury yield is down 3 basis point to 1.64%.

Six out of 11 S&P sectors are lower. Real Estate finishes at the top and Info Tech is in positive territory. Materials is the largest decliner in the session.

Retail is seeing big selloffs, with Gap down 24% and Nordstrom down nearly 30%.

Megacaps are mixed, with Meta in the lead and Amazon trailing.

In a recent note, Morgan Stanley says Big Tech is still underowned.

In other economic reports, personal income and spending rose for October, while the pace of new home sales came in lower than anticipated and November consumer sentiment fell less than expected.

Before the bell, the Labor Department reported weekly claims at 199K.

"We expected a huge drop in jobless claims - the consensus was baffling - which were pushed down by a seasonal adjustment quirk," Pantheon Macro's Ian Shepherdson writes. "It will substantially reverse next week, with claims rebounding to about 250K. That said, the trend in claims is clearly falling, and we expect it to return to the pre-Covid low, about 210K, early next year. Laying off staff is risky when the labor market is so tight, with near-record job openings."

Other premarket indicators weren't as encouraging, though. Durable goods orders fell unexpectedly for October, but that was almost solely due to a decline in plane orders. The GDP Q3 revision came in a little light at 2.1%.

Oil is slightly lower as rumors abound about OPEC+ changing course on production.

Volume is declining as many on Wall Street get a jump on the holiday.

Buying picked up after a weak open when the core PCE price index posted an annual pace of 4.1% for October.

The $NASDAQ 100 Index(.NDX.US$ +0.4% creeps further into the green, while the $S&P 500 Index(.SPX.US$ edges up 0.2%. The $Dow Jones Industrial Average(.DJI.US$ -0.03% stays under the breakeven point.

Treasury yields are are back in the red after early gains. The 10-year Treasury yield is down 3 basis point to 1.64%.

Six out of 11 S&P sectors are lower. Real Estate finishes at the top and Info Tech is in positive territory. Materials is the largest decliner in the session.

Retail is seeing big selloffs, with Gap down 24% and Nordstrom down nearly 30%.

Megacaps are mixed, with Meta in the lead and Amazon trailing.

In a recent note, Morgan Stanley says Big Tech is still underowned.

In other economic reports, personal income and spending rose for October, while the pace of new home sales came in lower than anticipated and November consumer sentiment fell less than expected.

Before the bell, the Labor Department reported weekly claims at 199K.

"We expected a huge drop in jobless claims - the consensus was baffling - which were pushed down by a seasonal adjustment quirk," Pantheon Macro's Ian Shepherdson writes. "It will substantially reverse next week, with claims rebounding to about 250K. That said, the trend in claims is clearly falling, and we expect it to return to the pre-Covid low, about 210K, early next year. Laying off staff is risky when the labor market is so tight, with near-record job openings."

Other premarket indicators weren't as encouraging, though. Durable goods orders fell unexpectedly for October, but that was almost solely due to a decline in plane orders. The GDP Q3 revision came in a little light at 2.1%.

Oil is slightly lower as rumors abound about OPEC+ changing course on production.

25

6

Ya2NVEmD79

liked

$Netflix(NFLX.US$ Hated the movie so much that I watched it 3 times, mostly on background white noise, until Gal Gadot appeared on screen again. They all playing themselves, or rather, their “on screen” selves. Lousy movie but love the stock…owner since $7.63 per share….

7

3

Ya2NVEmD79

liked and commented on

$Netflix(NFLX.US$Generally enjoy most of the Netflix shows with multiple episodes. It seems to allow development of the story.

The movies aren’t quite as good generally. Red Notice was overhyped grade B movie. The Rock wasn’t very good in this role. I remember him doing better in that movie with the kids from another planet and getting them back to their way home. I thought he would be better. Now he wants to do James Bond. Yeah, well, me too.

Ryan Reynolds has had better movies as well. Hopefully this is not a pattern for Netflix of making consistently mediocre movies.

I’m enjoying the series titled ‘You’. Good if you like suspenseful tongue in cheek psychopaths.

cr. kaafi_sanskarii

The movies aren’t quite as good generally. Red Notice was overhyped grade B movie. The Rock wasn’t very good in this role. I remember him doing better in that movie with the kids from another planet and getting them back to their way home. I thought he would be better. Now he wants to do James Bond. Yeah, well, me too.

Ryan Reynolds has had better movies as well. Hopefully this is not a pattern for Netflix of making consistently mediocre movies.

I’m enjoying the series titled ‘You’. Good if you like suspenseful tongue in cheek psychopaths.

cr. kaafi_sanskarii

10

7

Ya2NVEmD79

liked

$Benessere Capital Acquisition Corp(BENE.US$, the SPAC that is run by Patrick Orlando, who is also behind the Trump's media deal with SPAC $Digital World Acquisition Corp(DWAC.US$, has been halted for news pending.

Another SPAC run by Orlando, $Yunhong International Com Usd0.001 (S/R 31/01/2027)(ZGYHR.US$, on Friday disclosed in an 8-K filing that it plans to dissolve and liquidate after it was unable to consummate a deal within the required timeframe.

$BENESSERE CAP ACQUISITION CORP C/WTS (TO PUR COM)(BENEW.US$ warrants initially jumped on the Digital World deal with Trump back in October.

Benessere Capital also disclosed in an 8-K filing dated Nov. 19 that that the SPAC's audit committee said that the company's financial statements should be no longer be relied upon due to the classification of the company's Class A common stock as temporary equity.

Orlando's dealings with Trump have come under scrutiny in the wake of a New York Times article last month that claimed there might be potential violations of securities laws in regard to the DWAC SPAC. Last week Sen. Elizabeth Warren (D-MA) sent a letter to SEC Chairman Gary Gensler requesting that the agency investigate the transaction.

Another SPAC run by Orlando, $Yunhong International Com Usd0.001 (S/R 31/01/2027)(ZGYHR.US$, on Friday disclosed in an 8-K filing that it plans to dissolve and liquidate after it was unable to consummate a deal within the required timeframe.

$BENESSERE CAP ACQUISITION CORP C/WTS (TO PUR COM)(BENEW.US$ warrants initially jumped on the Digital World deal with Trump back in October.

Benessere Capital also disclosed in an 8-K filing dated Nov. 19 that that the SPAC's audit committee said that the company's financial statements should be no longer be relied upon due to the classification of the company's Class A common stock as temporary equity.

Orlando's dealings with Trump have come under scrutiny in the wake of a New York Times article last month that claimed there might be potential violations of securities laws in regard to the DWAC SPAC. Last week Sen. Elizabeth Warren (D-MA) sent a letter to SEC Chairman Gary Gensler requesting that the agency investigate the transaction.

15

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)