To Moon

liked

$Occidental Petroleum(OXY.US$

[Core Summary: 1. These US securities market knowledge and regulations must be known and understood because they involve tax payment issues. Now, especially when trading for yourself, you must control tax risks. The US is a mature country governed by the rule of law. The regulations are very detailed. The purpose is to prevent money laundering, so don't take it too seriously. I won't be doing a lot of intraday trading or short-term trading in the future, so I won't be writing post-market review chart analysis reports every day. In the past, when I worked for a financial institution, I only had to do arbitrage transactions, but now I have to take care of tax issues when doing transactions for myself.]

[Core Summary: 2. In order to adapt to the tax situation, the original short-term and band-level gaming transactions will be changed to medium- to long-term game-level transactions (non-value investments). The specific period will be tentatively set at least 2 months (61 days). We hereby notify you.]

Disclaimer: This article is a personal trading log, not an opinion or individual stock recommendation. The blogger uses a short-term style of quantitative analysis using mathematical models (regular public fundamental analysis and technical analysis, looking at graphic transactions in my opinion has long been outdated. It has failed. Too many people use it, no different from gambling. What is surprising is that it is more about frustration and hopelessness. Gambling is always expensive.) It's still a style where I can sell at any time (including the same day, or even the next second), but in most cases, my holdings and positions usually last more than 2 months, and when the market is bad, I lose 5% of the total market value...

[Core Summary: 1. These US securities market knowledge and regulations must be known and understood because they involve tax payment issues. Now, especially when trading for yourself, you must control tax risks. The US is a mature country governed by the rule of law. The regulations are very detailed. The purpose is to prevent money laundering, so don't take it too seriously. I won't be doing a lot of intraday trading or short-term trading in the future, so I won't be writing post-market review chart analysis reports every day. In the past, when I worked for a financial institution, I only had to do arbitrage transactions, but now I have to take care of tax issues when doing transactions for myself.]

[Core Summary: 2. In order to adapt to the tax situation, the original short-term and band-level gaming transactions will be changed to medium- to long-term game-level transactions (non-value investments). The specific period will be tentatively set at least 2 months (61 days). We hereby notify you.]

Disclaimer: This article is a personal trading log, not an opinion or individual stock recommendation. The blogger uses a short-term style of quantitative analysis using mathematical models (regular public fundamental analysis and technical analysis, looking at graphic transactions in my opinion has long been outdated. It has failed. Too many people use it, no different from gambling. What is surprising is that it is more about frustration and hopelessness. Gambling is always expensive.) It's still a style where I can sell at any time (including the same day, or even the next second), but in most cases, my holdings and positions usually last more than 2 months, and when the market is bad, I lose 5% of the total market value...

Translated

+8

1

To Moon

liked

$QuantumScape(QS.US$

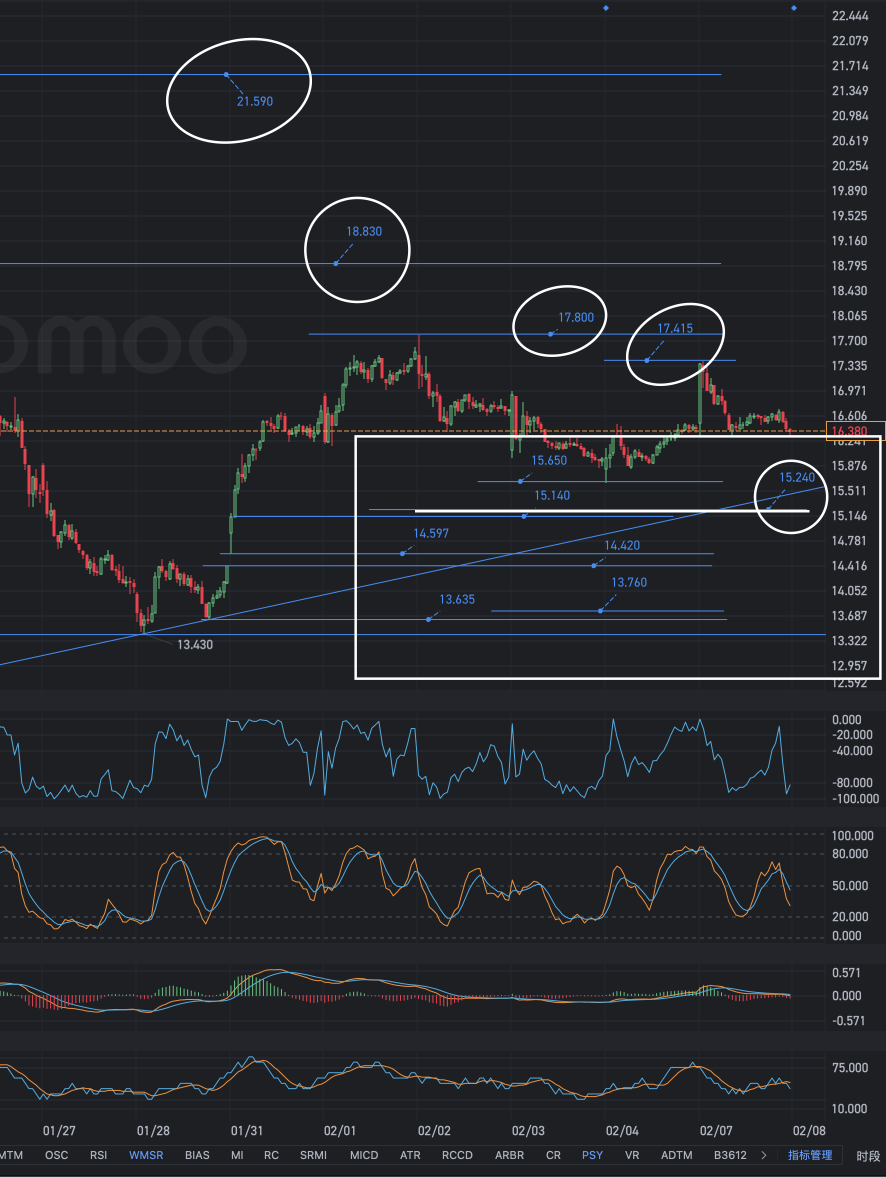

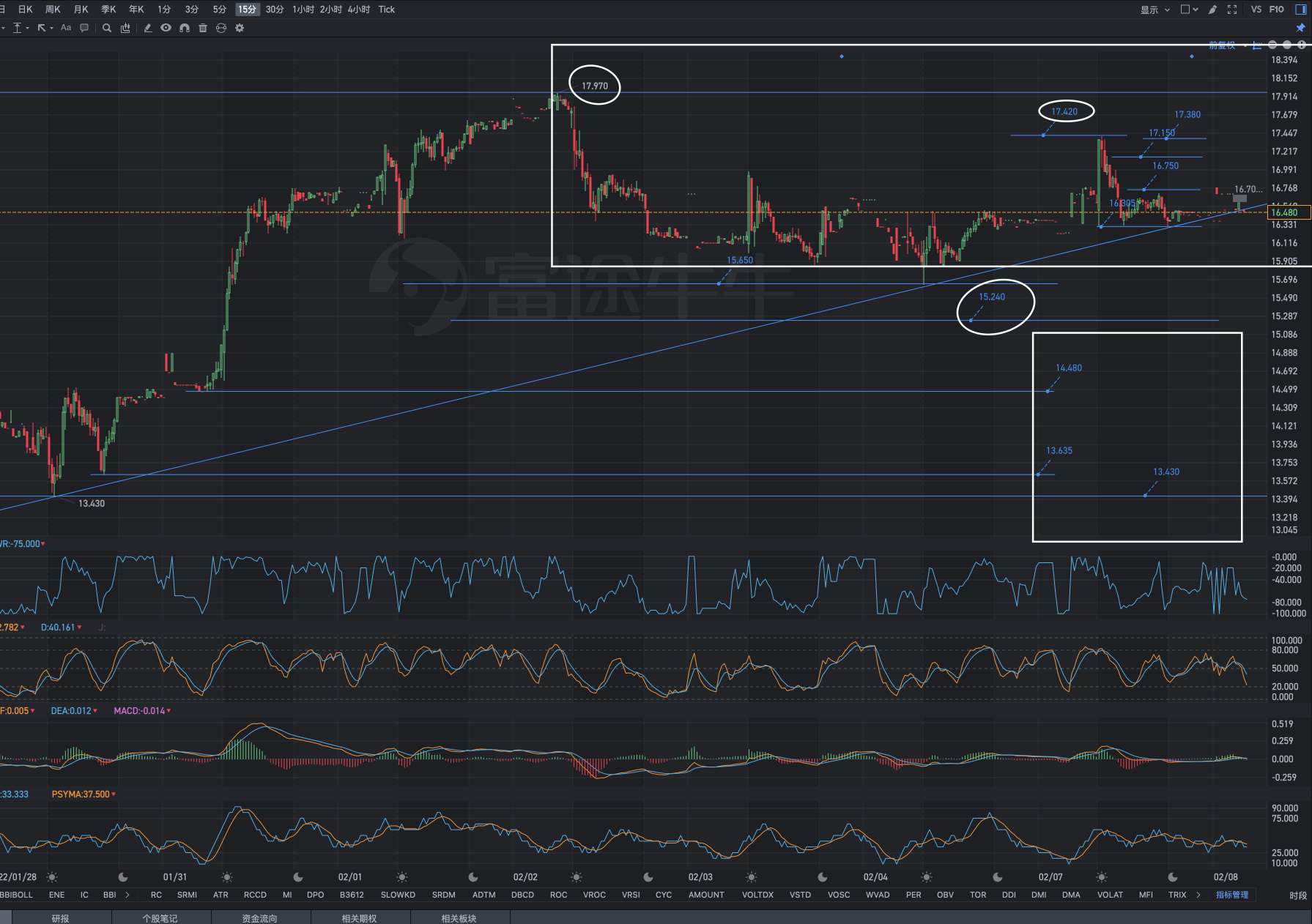

Before the QS earnings report was announced after the main trading period was closed on February 16, EST, gaming trading tried to open positions in the 15.65-15.24-14.48-13.64-13.43 area. If you don't pull back to this zone, you will definitely not open positions. Even if it goes short, the general market index is weak to rise and is more likely to fall. It must be clearly understood that interest rate hikes and contractions have not begun until now; in the 17.42-17.97 zone and above, it is necessary to sell out decisively rather than dream. Why is there such thing as selling off and running short? It's really a mistake; it can hit the market again at any time. There is no saying that the rise and fall of a healthy and mature stock market will stop. The 15.65-17.42 area is a dangerous area where the main players in control of the board carry out deceptive manoeuvres, engulfing the ups and downs of their emotional ups and downs, and are good at chasing higher can truly rise and fall.

In reality, more traders in the 15.65-15.24-14.48-13.64-13.43 area have lost a good opportunity to open positions due to dissatisfaction, anger, and scolding the streets; in the 17.42-17.97 area and above, they are excited by rising and are willing to chase higher prices; in the 15.65-17.42 area, they trade and open positions indiscriminately on the basis of their own feelings of no technical basis, and spend their hard-earned trading capital in vain.

There are many things, if you do all your own research, you may never find a way to get started for the rest of your life. If you want to stand out, you have to put yourself down and step on...

Before the QS earnings report was announced after the main trading period was closed on February 16, EST, gaming trading tried to open positions in the 15.65-15.24-14.48-13.64-13.43 area. If you don't pull back to this zone, you will definitely not open positions. Even if it goes short, the general market index is weak to rise and is more likely to fall. It must be clearly understood that interest rate hikes and contractions have not begun until now; in the 17.42-17.97 zone and above, it is necessary to sell out decisively rather than dream. Why is there such thing as selling off and running short? It's really a mistake; it can hit the market again at any time. There is no saying that the rise and fall of a healthy and mature stock market will stop. The 15.65-17.42 area is a dangerous area where the main players in control of the board carry out deceptive manoeuvres, engulfing the ups and downs of their emotional ups and downs, and are good at chasing higher can truly rise and fall.

In reality, more traders in the 15.65-15.24-14.48-13.64-13.43 area have lost a good opportunity to open positions due to dissatisfaction, anger, and scolding the streets; in the 17.42-17.97 area and above, they are excited by rising and are willing to chase higher prices; in the 15.65-17.42 area, they trade and open positions indiscriminately on the basis of their own feelings of no technical basis, and spend their hard-earned trading capital in vain.

There are many things, if you do all your own research, you may never find a way to get started for the rest of your life. If you want to stand out, you have to put yourself down and step on...

Translated

+2

2

To Moon

liked

$QuantumScape(QS.US$

1. The trick to trading is not greed, not afraid, and not sorry.

2. Not greedy, objective combination of moderation, sustainable development.

3. Don't be afraid, pursue those who know are fearless, do more useful work, and don't gamble.

4. Don't regret it, earn money within the limits of your knowledge, and as soon as you regret it, you will return to the cage of Yongdong Cooker and Yongdong Machine.

5.3 The principle of no is not a slogan, but a detailed practical application.

1. The trick to trading is not greed, not afraid, and not sorry.

2. Not greedy, objective combination of moderation, sustainable development.

3. Don't be afraid, pursue those who know are fearless, do more useful work, and don't gamble.

4. Don't regret it, earn money within the limits of your knowledge, and as soon as you regret it, you will return to the cage of Yongdong Cooker and Yongdong Machine.

5.3 The principle of no is not a slogan, but a detailed practical application.

Translated

2

To Moon

liked

$Virgin Galactic(SPCE.US$ You can follow

Translated

11

To Moon

liked

$Biofrontera(BFRI.US$ - Biofrontera AG Enrolls First Patient To Phase IIb Clinical Study Evaluating Ameluz / BF-RhodoLED For Acne. stock has support at $5.50

$QuantumScape(QS.US$ - stock is near the support area of $22. If held we can see a reversal to $25 plus or more.

$Longeveron(LGVN.US$ - stock in consolidation mode. On watch for a break of $20 to keep moving higher.

$Lucid Group(LCID.US$ - stock bouncing off $35 support as expected. Stock looking bullish above $40

$Galera Therapeutics(GRTX.US$ - Galera Announces Primary Endpoint Met Statistical Significance In Corrected Topline Efficacy Data Of Phase 3 ROMAN Trial Of Avasopasem. Also Hearing BTIG Upgrades To Buy, Sets $15 Price Target

$QuantumScape(QS.US$ - stock is near the support area of $22. If held we can see a reversal to $25 plus or more.

$Longeveron(LGVN.US$ - stock in consolidation mode. On watch for a break of $20 to keep moving higher.

$Lucid Group(LCID.US$ - stock bouncing off $35 support as expected. Stock looking bullish above $40

$Galera Therapeutics(GRTX.US$ - Galera Announces Primary Endpoint Met Statistical Significance In Corrected Topline Efficacy Data Of Phase 3 ROMAN Trial Of Avasopasem. Also Hearing BTIG Upgrades To Buy, Sets $15 Price Target

14

4

To Moon

liked

Undertake short-term transactions without charts

I don't trust technical charts because market psychology and trends are constantly changing, and charts cannot predict external events affecting a particular company. Instead, my short-term trading begins by discovering upcoming events affecting stocks, such as earnings releases, new product releases, etc. For example, if Company A posts earnings, I would buy a call option or open a long position two weeks in advance, depending on my assessment of whether the earnings would exceed or fall short of market expectations. As soon as the profit comes out, I close the position. Another example is trading in anticipation of significant events. To explain this, $Astra Space(ASTR.US$Another rocket will be launched in January 2022. A successful launch could boost stock prices, and vice versa if the rocket fails. Since I'm optimistic that they have the expertise to design a smooth launch, I'll accumulate their shares two weeks ago and sell them when I know the launch results.

I don't trust technical charts because market psychology and trends are constantly changing, and charts cannot predict external events affecting a particular company. Instead, my short-term trading begins by discovering upcoming events affecting stocks, such as earnings releases, new product releases, etc. For example, if Company A posts earnings, I would buy a call option or open a long position two weeks in advance, depending on my assessment of whether the earnings would exceed or fall short of market expectations. As soon as the profit comes out, I close the position. Another example is trading in anticipation of significant events. To explain this, $Astra Space(ASTR.US$Another rocket will be launched in January 2022. A successful launch could boost stock prices, and vice versa if the rocket fails. Since I'm optimistic that they have the expertise to design a smooth launch, I'll accumulate their shares two weeks ago and sell them when I know the launch results.

Translated

9

To Moon

liked

$NVIDIA(NVDA.US$ $Unity Software(U.US$ $Metaverse(BK2567.US$ NVIDIA stock dipped to the 280s yesterday due to the ARMS deal, but quickly 'corrected' itself back to the 300s. It seems like 300 is a solid foundation.

What are people's thoughts on NVIDIA for long term? Metaverse and the AI come up a lot in discussion, but I'm not totally convinced.

What are people's thoughts on NVIDIA for long term? Metaverse and the AI come up a lot in discussion, but I'm not totally convinced.

23

3

To Moon

liked

$Palantir(PLTR.US$ has quite an interesting story. This company is often regarded as the most secretive startup in Silicon Valley. The firm started building cutting-edge software platforms for the CIA and FBI. Furthermore, the CIA and Pentagon deployed Palantir's platform in Afghanistan and Iraq. It also allegedly helped to track and locate Osama Bin Laden.

Sounds kind of cool. For retail investors, Palantir is a company investors have found a reason to jump on. This year, PLTR stock surged during the previous meme stock rally to hit $45 per share. However, like many meme stocks, Palantir has since fallen back to earth.

For many retail investors, this discount may seem intriguing. Personally, I remain neutral on PLTR stock right now. (See Analysts' Top Stocks on TipRanks)

Let's dive into the bull and bear case around this stock.

Impressive Growth Not Enough for the Market

One of the key bull theses driving interest in Palantir is the company's growth prospects moving forward. This software and analytics company has a business model at the intersection of growth and stability that many long-term investors like.

Palantir focuses on providing high-value customers (we'll discuss that more in a second) with meaningful insights via software analytics tools based on big data and AI. Thus, Palantir's success in generating market-beating revenue growth could signal that a strong, long-term cash flow machine is right around the corner.

Now, Palantir has not been consistently profitable, ever. This is a company that's continued investing heavily in its platform at the expense of profit. However, recent earnings suggest the tide may be turning on this front as well.

This past quarter, Palantir brought in $0.04 per share in earnings, meeting analyst expectations. It's earning a profit – a good sign for long-term investors looking at this stock.

However, on the top line, Palantir beat expectations, bringing in $392 million versus an estimated $385 million. That translates to 36% year-over-year growth. Certainly, not bad, particularly for a company of this size.

That said, PLTR stock sold off dramatically following this earnings report. It should be noted that investors had bid up shares prior to the report. Accordingly, it appears the market was pricing in some sort of massive beat this past quarter, which didn't materialize.

This sort of volatile price action has made Palantir a stock that's hard to intrinsically value. On the one hand, market sentiment shifts continue to provide volatile swings to the upside and the downside. With momentum driving shares all over the map, PLTR stock looks more like a trading vehicle right now than a long-term hold.

For those taking the longer view with PLTR stock, perhaps this volatility doesn't matter in the grand scheme of things. However, for those looking to hold this stock for a limited period of time, continued volatility will be something to watch with Palantir in the quarters to come.

Revenue Mix a Key Driver of Interest in Palantir

Another one of the key factors investors seem to like with Palantir is the company's client mix. Unlike many large corporations, which ultimately sell their goods to consumers or other large businesses, Palantir's focus has been on growing its revenue from government agencies.

As of the second quarter of this year, the

Revenue mix as of Q2

Having the U.S. government as the company's core client is generally seen as a good thing. The government will pay its bills and has unlimited resources to do so. However, one misstep and this whole game could be over should the government switch its software analytics provider.

It should be noted that this relationship between Palantir and the government appears to be pretty entrenched. Switching costs are likely very high at this point, and there seems to be a relatively wide moat around Palantir's core customer base. For bulls, this is a good thing.

Overall, Palantir's inability to provide profitable growth over many years has some investors worried about its pricing power with its core customer. Growth is great, but doing so profitably is important. Thus, the extent to which new contracts can be negotiated at better rates remains a key factor investors should keep an eye on.

Wall Street's Take

Turning to Wall Street, Palantir has a Moderate Sell consensus rating, based on one Buy, three Holds, and four Sells assigned in the past three months. The average Palantir price target of $23.14 implies 11.5% upside potential.

Analyst price targets range from a high of $31 per share to a low of $18 per share.

Bottom Line

The hopes for Palantir are high as a "best in breed" player in the field of data analytics, data mining, and security services. With the U.S. government as Palantir's biggest client, what could go wrong? This is a company that continues to grow its top line quickly, providing bulls with a strong investment thesis today.

However, bears seem to be vindicated in their view that this company's earnings potential remains muted. On a forward-looking price-to-earnings valuation basis, this stock is expensive. Accordingly, Palantir has work to do on its bottom line before many fundamental investors jump aboard.

Sounds kind of cool. For retail investors, Palantir is a company investors have found a reason to jump on. This year, PLTR stock surged during the previous meme stock rally to hit $45 per share. However, like many meme stocks, Palantir has since fallen back to earth.

For many retail investors, this discount may seem intriguing. Personally, I remain neutral on PLTR stock right now. (See Analysts' Top Stocks on TipRanks)

Let's dive into the bull and bear case around this stock.

Impressive Growth Not Enough for the Market

One of the key bull theses driving interest in Palantir is the company's growth prospects moving forward. This software and analytics company has a business model at the intersection of growth and stability that many long-term investors like.

Palantir focuses on providing high-value customers (we'll discuss that more in a second) with meaningful insights via software analytics tools based on big data and AI. Thus, Palantir's success in generating market-beating revenue growth could signal that a strong, long-term cash flow machine is right around the corner.

Now, Palantir has not been consistently profitable, ever. This is a company that's continued investing heavily in its platform at the expense of profit. However, recent earnings suggest the tide may be turning on this front as well.

This past quarter, Palantir brought in $0.04 per share in earnings, meeting analyst expectations. It's earning a profit – a good sign for long-term investors looking at this stock.

However, on the top line, Palantir beat expectations, bringing in $392 million versus an estimated $385 million. That translates to 36% year-over-year growth. Certainly, not bad, particularly for a company of this size.

That said, PLTR stock sold off dramatically following this earnings report. It should be noted that investors had bid up shares prior to the report. Accordingly, it appears the market was pricing in some sort of massive beat this past quarter, which didn't materialize.

This sort of volatile price action has made Palantir a stock that's hard to intrinsically value. On the one hand, market sentiment shifts continue to provide volatile swings to the upside and the downside. With momentum driving shares all over the map, PLTR stock looks more like a trading vehicle right now than a long-term hold.

For those taking the longer view with PLTR stock, perhaps this volatility doesn't matter in the grand scheme of things. However, for those looking to hold this stock for a limited period of time, continued volatility will be something to watch with Palantir in the quarters to come.

Revenue Mix a Key Driver of Interest in Palantir

Another one of the key factors investors seem to like with Palantir is the company's client mix. Unlike many large corporations, which ultimately sell their goods to consumers or other large businesses, Palantir's focus has been on growing its revenue from government agencies.

As of the second quarter of this year, the

Revenue mix as of Q2

Having the U.S. government as the company's core client is generally seen as a good thing. The government will pay its bills and has unlimited resources to do so. However, one misstep and this whole game could be over should the government switch its software analytics provider.

It should be noted that this relationship between Palantir and the government appears to be pretty entrenched. Switching costs are likely very high at this point, and there seems to be a relatively wide moat around Palantir's core customer base. For bulls, this is a good thing.

Overall, Palantir's inability to provide profitable growth over many years has some investors worried about its pricing power with its core customer. Growth is great, but doing so profitably is important. Thus, the extent to which new contracts can be negotiated at better rates remains a key factor investors should keep an eye on.

Wall Street's Take

Turning to Wall Street, Palantir has a Moderate Sell consensus rating, based on one Buy, three Holds, and four Sells assigned in the past three months. The average Palantir price target of $23.14 implies 11.5% upside potential.

Analyst price targets range from a high of $31 per share to a low of $18 per share.

Bottom Line

The hopes for Palantir are high as a "best in breed" player in the field of data analytics, data mining, and security services. With the U.S. government as Palantir's biggest client, what could go wrong? This is a company that continues to grow its top line quickly, providing bulls with a strong investment thesis today.

However, bears seem to be vindicated in their view that this company's earnings potential remains muted. On a forward-looking price-to-earnings valuation basis, this stock is expensive. Accordingly, Palantir has work to do on its bottom line before many fundamental investors jump aboard.

37

2

To Moon

liked

Hey mooers just wanted to hear what you think of investing the the space sector.

Companies I know or are: Astra, Rocket-lab, SPCE, Redwire, Ark-K

What do you think of these tickets? what do I need to add? and what do you think about the sector in general in the next 5-10 years

$Virgin Galactic(SPCE.US$ $Astra Space(ASTR.US$ $Rocket Lab(RKLB.US$

Companies I know or are: Astra, Rocket-lab, SPCE, Redwire, Ark-K

What do you think of these tickets? what do I need to add? and what do you think about the sector in general in the next 5-10 years

$Virgin Galactic(SPCE.US$ $Astra Space(ASTR.US$ $Rocket Lab(RKLB.US$

19

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)