Stock market has always been volatile, and deciding when is the best time to buy or sell is critical in earning. If a beginner wanna cultivate such a skill, perhaps the best way to start is to follow those professionals. I mean, to try to understand why they buy or sell at such a point. Market sentiment projection? Technical analysis? or other microeconomic factors?

Just try to understand those logics and gradually you will get something![]()

Just try to understand those logics and gradually you will get something

September is really a bad time for me.

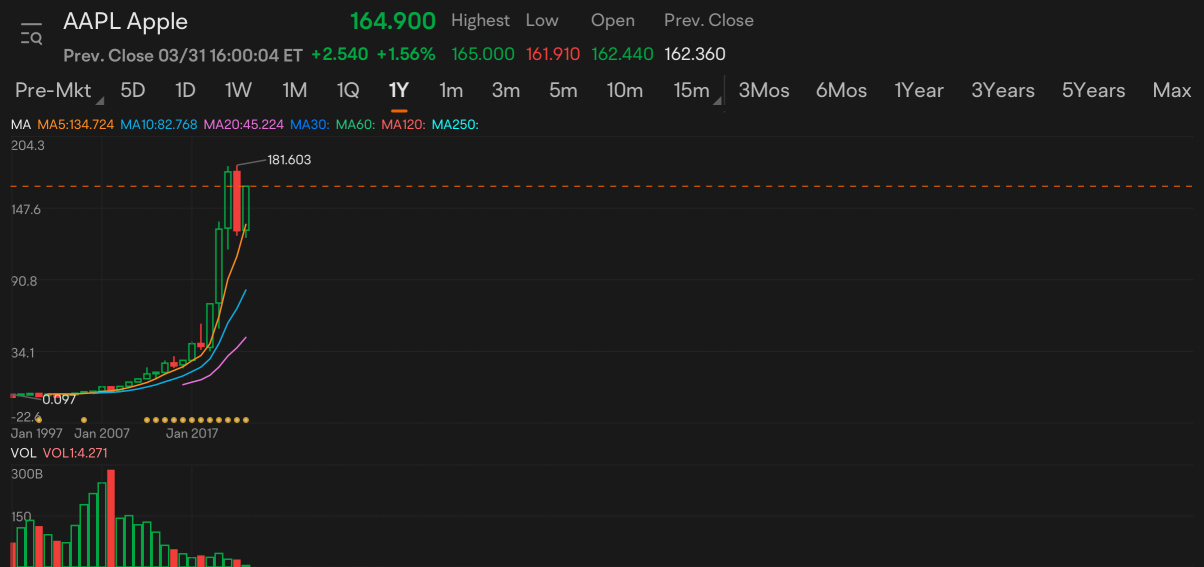

I am a big fan of Apple, so before its conference press, I increased my trading in this stock. However, iPhone 15 pro didn't bring good news

$Apple(AAPL.US$

3

2

Well, I knew I have invested many tech stocks, but I didn't expect it up to 78%. Is it too much? Perhaps I need to optimize my portfolio

$Apple(AAPL.US$ $Tesla(TSLA.US$ $NVIDIA(NVDA.US$

$Apple(AAPL.US$ $Tesla(TSLA.US$ $NVIDIA(NVDA.US$

4

Hi, I'm Tickerron from the U.S. I have been here for around half a year. ![]() I haven't started to make a real trading yet. Most of the time, I watch other mooers analyze those stocks, graphs, ups and downs. It is quite funny.

I haven't started to make a real trading yet. Most of the time, I watch other mooers analyze those stocks, graphs, ups and downs. It is quite funny. ![]() I did learn a lot here, be it knowledge of trading or other big events.

I did learn a lot here, be it knowledge of trading or other big events.

I hope our new friends can enjoy yourselves in the moomoo community too. And if you have any questions, feel free to talk with anyone here including me. Again, nice to meet yo...

I hope our new friends can enjoy yourselves in the moomoo community too. And if you have any questions, feel free to talk with anyone here including me. Again, nice to meet yo...

4

1

China has been increasing investments in chip development while the US is working on restricting China's growth. The temperature of the US-China tech war is rising. As we all know, the chip is a crucial factor for AI, cloud computing, and other high-tech development. Dominance in chip production might correspond to the prominence of the future. So those semiconductor manufacturers are a good trend for investment.

Texas Instrument...

Texas Instrument...

3

4

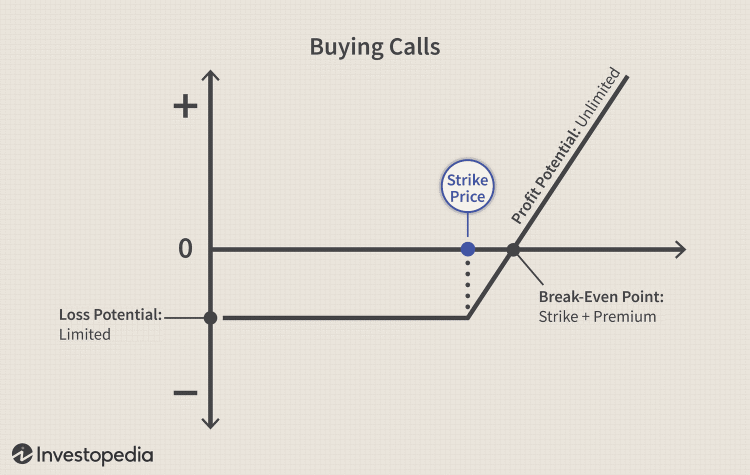

Consider Your Trading Strategy

Before choosing an expiration date for your options contract, you need to consider your trading strategy. Are you looking to make a short-term or long-term trade? If you're looking for a quick profit, choose an option with a shorter expiration date. However, if you're bullish on a stock and want to hold onto it for a longer period, choose an option with a longer expiration date.

For example, let's say you are bullish on a...

Before choosing an expiration date for your options contract, you need to consider your trading strategy. Are you looking to make a short-term or long-term trade? If you're looking for a quick profit, choose an option with a shorter expiration date. However, if you're bullish on a stock and want to hold onto it for a longer period, choose an option with a longer expiration date.

For example, let's say you are bullish on a...

1

1

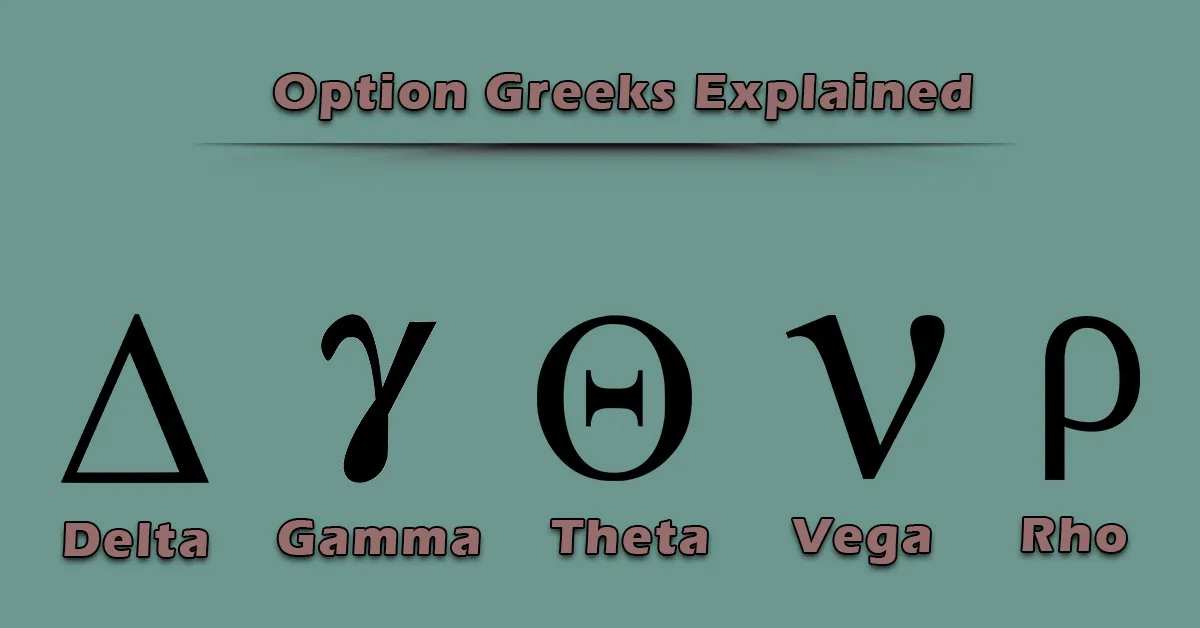

When using option Greeks to construct trading strategies, one common approach is to use delta to hedge against the directional risk of holding an underlying asset. Delta measures how much the price of an option changes in relation to a movement in the underlying asset, with a value of 1 indicating that the option’s price moves in perfect lockstep with the underlying asset.

For example, let's say that you own stock in Company ABC and are concerned that the stoc...

For example, let's say that you own stock in Company ABC and are concerned that the stoc...

2

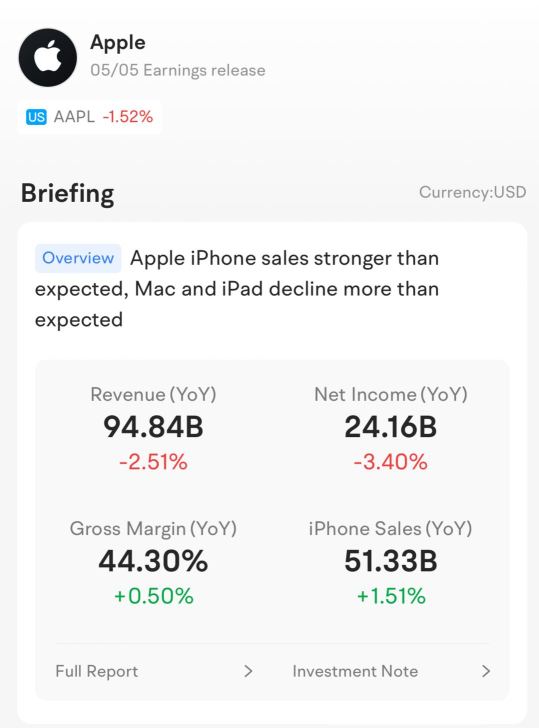

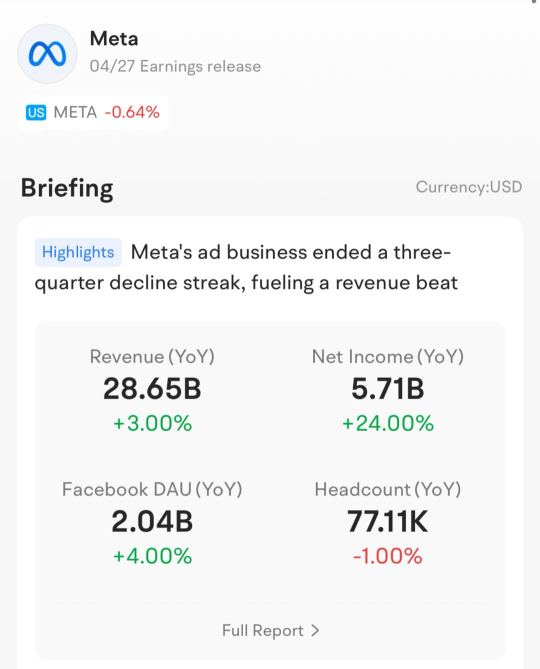

It seems the Q1 2023 earnings season has come to a close. As a novice investor, with an overwhelming amount of information flooding in, it can be quite daunting to navigate the volatile market and make informed decisions during the earnings season. Thankfully, I came to the moomoo community and met you guys-a group of kind and experienced investors who have shared so many invaluable insights. Big thanks to all the investors here!![]()

![]()

![]()

Let me briefl...

Let me briefl...

4

1

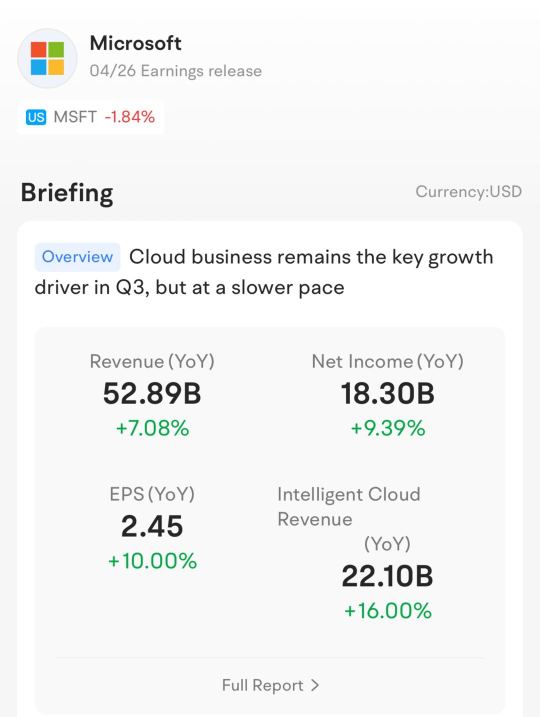

The earnings season has started! Maybe there are some opportunities hidden in the earnings calls, but I'm not sure when to buy![]() … Besides, I still haven't recovered from the turmoil of banking stocks yet

… Besides, I still haven't recovered from the turmoil of banking stocks yet![]() As a beginner, I'm in urgent need of some advice on how to make better decisions. Knowing that there are so many experienced investors on moomoo, could you recommend some mooers whose advice is valuable and worth learning?

As a beginner, I'm in urgent need of some advice on how to make better decisions. Knowing that there are so many experienced investors on moomoo, could you recommend some mooers whose advice is valuable and worth learning?![]()

![]()

$Tesla(TSLA.US$ $Alphabet-A(GOOGL.US$ $Microsoft(MSFT.US$ $Meta Platforms(META.US$ $Intel(INTC.US$

���������...

$Tesla(TSLA.US$ $Alphabet-A(GOOGL.US$ $Microsoft(MSFT.US$ $Meta Platforms(META.US$ $Intel(INTC.US$

���������...

2

10

From my own perspective, considering myself as a shareholder of the company do help me make good decisions, since I won’t sell the stocks easily and casually… I found myself more cautious when making decisions![]()

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)