Sze How Ng

reacted to and commented on

Fellow Investors:

I have been telling everyone for quite a while that $Meta Platforms(FB.US$ and $Alphabet-C(GOOG.US$ are two of the best buys with the best balance sheets, along with deep and wide moats filled with crocs.

I urge investors when they can, to get out of companies that have no earnings, have no margins, because investing them is, at best, "betting on the come." And people who place their money in companies that are eventually supposed to do all these great things that they're not currently able to do, usually lose money, and are sorely disappointed. This is especially true of the most potently hyped companies.

I have been telling everyone for quite a while that $Meta Platforms(FB.US$ and $Alphabet-C(GOOG.US$ are two of the best buys with the best balance sheets, along with deep and wide moats filled with crocs.

I urge investors when they can, to get out of companies that have no earnings, have no margins, because investing them is, at best, "betting on the come." And people who place their money in companies that are eventually supposed to do all these great things that they're not currently able to do, usually lose money, and are sorely disappointed. This is especially true of the most potently hyped companies.

15

3

Sze How Ng

liked

$Microsoft(MSFT.US$ I'm forced to use MS Teams since it's what the DOD has purchased. I hate it. Confusing at times. We usually leave our cameras off because it bogs down if too many video feeds are running.

12

4

Sze How Ng

liked

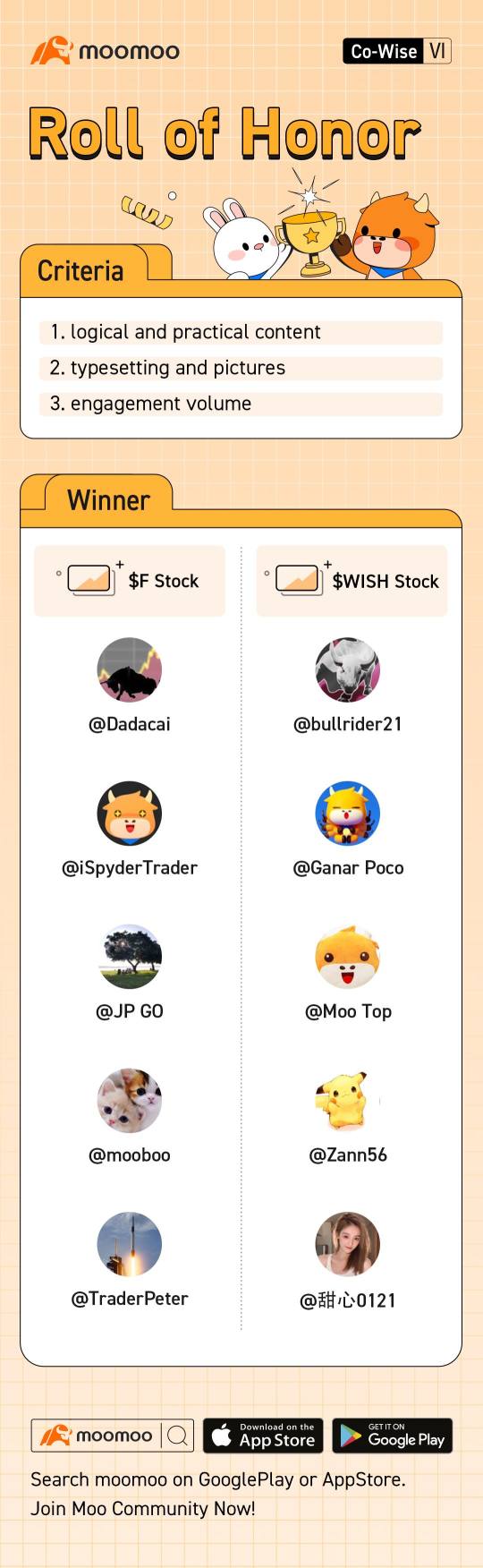

Time flies! You have completed another journey of Co-Wise: What habits help you become a better trader. Thank you all for your participation!![]() In this topic, most mooers mentioned FOMO emotions, panics, and mistakes. When newbies first got in the market, they followed blindly, not knowing what they were doing, and made losses due to succumbing to emotions.

In this topic, most mooers mentioned FOMO emotions, panics, and mistakes. When newbies first got in the market, they followed blindly, not knowing what they were doing, and made losses due to succumbing to emotions.![]()

Will you get sucked into a BULL/FOMO trap when the market plunges? We must learn to stop emotions from getting in the way and take the upper hand in our decision-making.![]() Successful tradings arise from constant practicing and establishing trading rules. Once your trading plan is created, you should be patient and keep plugging away. It would be best to grasp mistakes and be pragmatic to accept them and move on. Let's cultivate good habits to yield consistent results.

Successful tradings arise from constant practicing and establishing trading rules. Once your trading plan is created, you should be patient and keep plugging away. It would be best to grasp mistakes and be pragmatic to accept them and move on. Let's cultivate good habits to yield consistent results.

![]()

![]()

![]() Now, it's time for the winning list of this topic. Let's enjoy the highlight moments together! Congratulation to all the mooers winning $Ford Motor(F.US$ and $ContextLogic(WISH.US$ stocks!

Now, it's time for the winning list of this topic. Let's enjoy the highlight moments together! Congratulation to all the mooers winning $Ford Motor(F.US$ and $ContextLogic(WISH.US$ stocks!

*The rewards will be distributed to winners within 15 working days—the ranking sortes in alphabetical order.

Part Ⅰ: High-Quality Post Collection

@Dadacai Habits To Becoming A Better Trader

One of the key successful habits is to form a trading plan. As Benjamin Franklin rightly said, if you fail to plan, you are planning to fail. Don’t give in to the fear of missing out (FOMO). With practice and perseverance, we can all become successful traders!

@iSpyderTrader Building Good Trading Habits

DO NOT try to copy someone else's idea as that works for them. You need to get insight about it and try it on your own. Practice makes perfect. Do your due diligence (research, articles, news, etc.) Trade with a positive attitude. Don't be greedy and take profits.

@JP GO Set a rule that suitable your lifestyle

Trading have to link with lifestyle and set up a rule of it. More importantly is following it as a habit. I start from small amounts to test that if my thoughts/rule works for me and make some adjustments. I only allow myself to use 3 quarters, leave a last option for myself and I won't fear while look at the red numbers.

@mooboo Habits that made me a better trader

For my value investing, I do a certain amount of due diligence before starting a position in any stock. I fight the urge every time I panic. Emotions are your biggest enemy in the stock market. Lastly, manage your risk well.

@TraderPeter Be mechanical!

The risk and the size are highly correlated. Ask Why first. Knowing the why helps me to make quick decision without second guess myself. Only trade something that is liquid enough. Take profit early and often and let time cure the pain.

@bullrider21Nothing is foolproof

Always do your homework before you buy a stock. Don't speculate. Don't buy on rumours. Find out the support and resistance levels to determine your buying and selling prices. You must be disciplined. Don't be too greedy.

@Ganar PocoGood habits will make you a consistent winner

Trading Psychology is a mental aspect of trading. It involves things like how to control your emotions, eg FOMO. After you have control your emotions & learned the importance of Risk Management. The next important aspect that will give an edge in trading is Strategy.

@Moo Top My 117 days experiences

I am still figuring out what is my plan in investing and trading after 117 days in Moomoo. However, the following are what I gather from my experiences: Investment or Trading. Have an exit plan if trading. Value or Growth or Meme stocks. Trading is not everything. Have a life.

@Zann56 Overcoming emotions

Human emotions (Fear and greed) are inevitably involved when it comes to investing. I have made losses in the past due to succumbing to my emotions. To avoid such mistakes, I have learnt to adopt 3 strategies now. Invest in what I strongly believe in. Dollar Cost Averaging. Diversification.

@甜心0121 My Habits

For me personally, I hold on to these 4 habits to ensure consistency in my trading. Set goals. Manage risks. Research, research and research. Limit time and get a life.

![]() For more engaging posts, please click Co-Wise: What habits help you become a better trader? to check. Don't forget to leave your comments and tell mooers what you've learned!

For more engaging posts, please click Co-Wise: What habits help you become a better trader? to check. Don't forget to leave your comments and tell mooers what you've learned!![]()

Part Ⅱ: Voting on the “Mentor Moo” Title

It's time for voting! Let's vote for the candidates to see who will win the "Mentor Moo" title. Whose post do you think is the best? Your vote means a lot to them!

Emotions and responsibilities could cloud your thinking. Deduction and objectivity could lead you to impulsive and irrational decision-making, resulting in more losses. It is not valid to trade based on feelings or rumors. Analysis and research should be trading fundamentals. Emotional trading may bring back some earnings, but rational trading is how you survive for a long time. Enhance your lifestyle with trading and follow the rules as a habit. Practice makes perfect.![]()

Disclaimer: All investment involves risk. Neither Futu Inc, nor Futu SG, nor moomoo endorses any particular investment strategy. You should carefully consider your investment goals and objectives when deciding on an investment strategy. Past performance is no guarantee of future results.

Will you get sucked into a BULL/FOMO trap when the market plunges? We must learn to stop emotions from getting in the way and take the upper hand in our decision-making.

*The rewards will be distributed to winners within 15 working days—the ranking sortes in alphabetical order.

Part Ⅰ: High-Quality Post Collection

@Dadacai Habits To Becoming A Better Trader

One of the key successful habits is to form a trading plan. As Benjamin Franklin rightly said, if you fail to plan, you are planning to fail. Don’t give in to the fear of missing out (FOMO). With practice and perseverance, we can all become successful traders!

@iSpyderTrader Building Good Trading Habits

DO NOT try to copy someone else's idea as that works for them. You need to get insight about it and try it on your own. Practice makes perfect. Do your due diligence (research, articles, news, etc.) Trade with a positive attitude. Don't be greedy and take profits.

@JP GO Set a rule that suitable your lifestyle

Trading have to link with lifestyle and set up a rule of it. More importantly is following it as a habit. I start from small amounts to test that if my thoughts/rule works for me and make some adjustments. I only allow myself to use 3 quarters, leave a last option for myself and I won't fear while look at the red numbers.

@mooboo Habits that made me a better trader

For my value investing, I do a certain amount of due diligence before starting a position in any stock. I fight the urge every time I panic. Emotions are your biggest enemy in the stock market. Lastly, manage your risk well.

@TraderPeter Be mechanical!

The risk and the size are highly correlated. Ask Why first. Knowing the why helps me to make quick decision without second guess myself. Only trade something that is liquid enough. Take profit early and often and let time cure the pain.

@bullrider21Nothing is foolproof

Always do your homework before you buy a stock. Don't speculate. Don't buy on rumours. Find out the support and resistance levels to determine your buying and selling prices. You must be disciplined. Don't be too greedy.

@Ganar PocoGood habits will make you a consistent winner

Trading Psychology is a mental aspect of trading. It involves things like how to control your emotions, eg FOMO. After you have control your emotions & learned the importance of Risk Management. The next important aspect that will give an edge in trading is Strategy.

@Moo Top My 117 days experiences

I am still figuring out what is my plan in investing and trading after 117 days in Moomoo. However, the following are what I gather from my experiences: Investment or Trading. Have an exit plan if trading. Value or Growth or Meme stocks. Trading is not everything. Have a life.

@Zann56 Overcoming emotions

Human emotions (Fear and greed) are inevitably involved when it comes to investing. I have made losses in the past due to succumbing to my emotions. To avoid such mistakes, I have learnt to adopt 3 strategies now. Invest in what I strongly believe in. Dollar Cost Averaging. Diversification.

@甜心0121 My Habits

For me personally, I hold on to these 4 habits to ensure consistency in my trading. Set goals. Manage risks. Research, research and research. Limit time and get a life.

Part Ⅱ: Voting on the “Mentor Moo” Title

It's time for voting! Let's vote for the candidates to see who will win the "Mentor Moo" title. Whose post do you think is the best? Your vote means a lot to them!

Emotions and responsibilities could cloud your thinking. Deduction and objectivity could lead you to impulsive and irrational decision-making, resulting in more losses. It is not valid to trade based on feelings or rumors. Analysis and research should be trading fundamentals. Emotional trading may bring back some earnings, but rational trading is how you survive for a long time. Enhance your lifestyle with trading and follow the rules as a habit. Practice makes perfect.

Disclaimer: All investment involves risk. Neither Futu Inc, nor Futu SG, nor moomoo endorses any particular investment strategy. You should carefully consider your investment goals and objectives when deciding on an investment strategy. Past performance is no guarantee of future results.

Expand

Expand 72

29

Sze How Ng

liked and commented on

Canada's government has officially excluded $Boeing(BA.US$ Super Hornet from the bidding for a potential C$19B (US$14.8B) contract to build 88 new fighter jets to replace the military's aging CF-18s.

The move by Public Services and Procurement Canada means $Lockheed Martin(LMT.US$ F-35 stealth fighter and Saab's Gripen are the only two aircraft still in contention.

The Super Hornet and F-35 were viewed by some observers as the only real competition because of Canada's relationship with the U.S., which includes using fighter jets together to defend North American air space, while Sweden - Saab's home - is not a member of NATO or NORAD.

Boeing saysit is "working with the U.S. and Canadian governments to better understand the decision and looking for the earliest date to request a debrief to then determine our path forward."

According to a report yesterday, Boeing is in the lead to win an order for nearly 50 freighter planes from Qatar Airways.

The move by Public Services and Procurement Canada means $Lockheed Martin(LMT.US$ F-35 stealth fighter and Saab's Gripen are the only two aircraft still in contention.

The Super Hornet and F-35 were viewed by some observers as the only real competition because of Canada's relationship with the U.S., which includes using fighter jets together to defend North American air space, while Sweden - Saab's home - is not a member of NATO or NORAD.

Boeing saysit is "working with the U.S. and Canadian governments to better understand the decision and looking for the earliest date to request a debrief to then determine our path forward."

According to a report yesterday, Boeing is in the lead to win an order for nearly 50 freighter planes from Qatar Airways.

21

8

Sze How Ng

liked

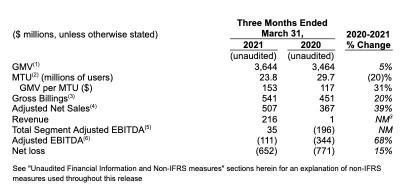

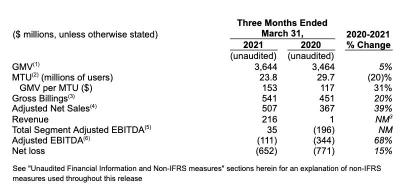

$Altimeter Growth Corp(AGC.US$ $Grab Holdings(GRAB.US$ Grab's earnings report puts a lot of emphasis on Adjusted Net Sales where Adjusted Net Sales = Revenue + consumer incentives and excess driver/merchant incentives. This will mislead investors and exaggerate the company's actual performance. Firstly, incentives-fueled growth is not sustainable due to cash burns and reliance on subsidies from external parties. Secondly, according to Grab:

Grab presents Adjusted Net Sales as a metric to compare, and to enable investors to compare, its aggregate operating results in the absence of excess incentives, which are intended to be temporary drivers of growth, and which Grab plans to reduce in the future. Grab’s management believes Adjusted Net Sales captures significant trends in its business over time.

Therefore, incentives should be removed from any form of Grab's performance analysis. Unfortunately, Grab's performance after removing incentives doesn't look optimistic. Grab's revenue decreased by 16% quarter over quarter, despite an increase in adjusted net sales of 8%. This suggests that incentives fueled the bulk of its expansion. According to the numbers, Grab upped its incentives by 27% quarter over quarter. However, the 27 percent increase in incentives resulted in just a 3.78 percent rise in monthly transacting users (MTU) and a 2.6 percent increase in GMV per MTU. This has several consequences. To begin, the considerable increase of incentives but just a modest increase in growth indicates an aging market.

On the other hand, with Uber as comps, Grab's valuation of $60bn implies a (revised) CAGR of 35% + a full recovery of its ride-hailing business to pre-pandemic levels. This causes a discrepancy between its valuation and growth expectations. A bear-case scenario will see Grab's share price mirror $Zoom Video Communications(ZM.US$ decline after reporting slowing growth.

Let's examine whether Q3 performance can turn things around for Grab.

Figure 1: Grab's 2021Q1 Quarterly Performance

Figure 2: Grab's 2021Q2 Quarterly Performance

Grab presents Adjusted Net Sales as a metric to compare, and to enable investors to compare, its aggregate operating results in the absence of excess incentives, which are intended to be temporary drivers of growth, and which Grab plans to reduce in the future. Grab’s management believes Adjusted Net Sales captures significant trends in its business over time.

Therefore, incentives should be removed from any form of Grab's performance analysis. Unfortunately, Grab's performance after removing incentives doesn't look optimistic. Grab's revenue decreased by 16% quarter over quarter, despite an increase in adjusted net sales of 8%. This suggests that incentives fueled the bulk of its expansion. According to the numbers, Grab upped its incentives by 27% quarter over quarter. However, the 27 percent increase in incentives resulted in just a 3.78 percent rise in monthly transacting users (MTU) and a 2.6 percent increase in GMV per MTU. This has several consequences. To begin, the considerable increase of incentives but just a modest increase in growth indicates an aging market.

On the other hand, with Uber as comps, Grab's valuation of $60bn implies a (revised) CAGR of 35% + a full recovery of its ride-hailing business to pre-pandemic levels. This causes a discrepancy between its valuation and growth expectations. A bear-case scenario will see Grab's share price mirror $Zoom Video Communications(ZM.US$ decline after reporting slowing growth.

Let's examine whether Q3 performance can turn things around for Grab.

Figure 1: Grab's 2021Q1 Quarterly Performance

Figure 2: Grab's 2021Q2 Quarterly Performance

16

Sze How Ng

liked and commented on

$MasterCard(MA.US$ Seems like they went with a smaller than usual div increase but larger buyback. Makes sense, I hope they increase the pace of buybacks as the current $4.4B outstanding means they bought back around $800m in q4 so far. Should be far more at these prices.

20

5

Sze How Ng

liked

$Crude Oil Futures(JUN4)(CLmain.US$ $Tesla(TSLA.US$ I use about 300-400 gallons of gas a year. So let me sell my car, and buy a $45k car to save about $1k a year. My ROI is only forever. It would take me 3.3 years just to make up on the sales tax.

19

6

Sze How Ng

liked and commented on

An ugly day for the stock market was especially rough on $AT&T(T.US$, which slipped 4.4% on the day to seal its worst month in a year and a half - and reach its lowest point since the Global Financial Crisis, more than a decade ago.

That came as a presentation from Communications chief Jeff McElfresh raised new concerns about user growth in the wireless industry.

Speaking at a Wells Fargo conference, McElfresh worked to highlight momentum in mobility, saying over the past five quarters AT&T has delivered its best subscriber results in a decade (including nearly 4 million postpaid phone net additions, and 1.4 million fiber net adds).

"Total tonnage of EBITDA in the third quarter of '21 was a high-water mark for us," he says, noting Wireless raised its EBITDA by nearly 3.6%.

He added that the company's "three key elements" - simplified plans and targeted sub-segment approach, improved customer experience and network performance - are leading to lower churn and increased customer lifetime value.

He reiterated, though, that the outlook for 2022 and beyond doesn't assume a continuation of the outsized trends in net adds that we've seen.

"There's no doubt that the stimulus programs have put some extra cash in household budgets" this year, he says. "And so we're not expecting that level of activity to continue into 2022 and beyond. In fact, in a three-player market with the integration between Sprint and T-Mobile, we suspect the activity level for postpaid in 2022 is probably going to subside." AT&T does expect to take "more than our fair share," however, and he adds their guidance doesn't depend on outsized postpaid growth.

Expectations that average revenue per user on postpaid phones will stabilize next year means the company expects higher service revenues from the growing base, he says. Fewer than a quarter of gross adds and upgrades in Q3 traded in newer devices for premium promotional offers, and only about 20% of the company's postpaid smartphones are on Unlimited Elite, its highest-ARPU and fastest growing rate plan.

McElfresh's comments about dwindling industry user growth ahead did no favors for AT&T's wireless rivals today. $T-Mobile US(TMUS.US$fell 4.1% (again, also amid a marketwide sell-off), and $Verizon(VZ.US$fell 2.7%. $Dish Network(DISH.US$, set to become the fourth national player in wireless over time, tumbled 5.7% today.

That came as a presentation from Communications chief Jeff McElfresh raised new concerns about user growth in the wireless industry.

Speaking at a Wells Fargo conference, McElfresh worked to highlight momentum in mobility, saying over the past five quarters AT&T has delivered its best subscriber results in a decade (including nearly 4 million postpaid phone net additions, and 1.4 million fiber net adds).

"Total tonnage of EBITDA in the third quarter of '21 was a high-water mark for us," he says, noting Wireless raised its EBITDA by nearly 3.6%.

He added that the company's "three key elements" - simplified plans and targeted sub-segment approach, improved customer experience and network performance - are leading to lower churn and increased customer lifetime value.

He reiterated, though, that the outlook for 2022 and beyond doesn't assume a continuation of the outsized trends in net adds that we've seen.

"There's no doubt that the stimulus programs have put some extra cash in household budgets" this year, he says. "And so we're not expecting that level of activity to continue into 2022 and beyond. In fact, in a three-player market with the integration between Sprint and T-Mobile, we suspect the activity level for postpaid in 2022 is probably going to subside." AT&T does expect to take "more than our fair share," however, and he adds their guidance doesn't depend on outsized postpaid growth.

Expectations that average revenue per user on postpaid phones will stabilize next year means the company expects higher service revenues from the growing base, he says. Fewer than a quarter of gross adds and upgrades in Q3 traded in newer devices for premium promotional offers, and only about 20% of the company's postpaid smartphones are on Unlimited Elite, its highest-ARPU and fastest growing rate plan.

McElfresh's comments about dwindling industry user growth ahead did no favors for AT&T's wireless rivals today. $T-Mobile US(TMUS.US$fell 4.1% (again, also amid a marketwide sell-off), and $Verizon(VZ.US$fell 2.7%. $Dish Network(DISH.US$, set to become the fourth national player in wireless over time, tumbled 5.7% today.

24

10

Sze How Ng

liked and commented on

$Rivian Automotive(RIVN.US$ Looking eight years ahead Rivian is currently grossly undervalued.

18

4

Sze How Ng

liked and commented on

$Pfizer(PFE.US$ nature seems to have provided us with a TRUE "vaccine" with the milder cases. if everyone simply caught the mild case and stayed at home, drank water got

vitamin D, stopped eating JUNK food for a couple of weeks and got plenty of rest, we would have the sought after "herd immunity"...oops, this the US we are talking about. so few are willing to live "healthy".....and cigarettes are "ok" with the FDA!!!

vitamin D, stopped eating JUNK food for a couple of weeks and got plenty of rest, we would have the sought after "herd immunity"...oops, this the US we are talking about. so few are willing to live "healthy".....and cigarettes are "ok" with the FDA!!!

12

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Sze How Ng : What happens when the November CPI and PPI are released and they are running hotter than October CPI and PPI…?

How does Powell react to those data points?