This is a recent tweet from Mark Minervini on Twitter 👇

Since the day after the contraction was the quarterly earnings report, we have no way of knowing whether Mark traded this stock, but we can do it according to $Blueprint Medicines(BPMC.US$The chart shows some telltale signs of why Mark is paying attention to this stock.

First, take a look at the IBD chart. The two recent sharp declines have produced a bullish divergence from the RS line 👇

Some other important metrics 👇

Back to the MOOMOO chart:

The figure uses purple lines to connect the high and low points of the finishing area, as follows:

101,84.81

97, 84.33

94.67, 88.46

94.98, 90.745

The difference is obtained by subtracting before and after:

16.19

12.67

6.21

4.235

High and low point gap%:

16%

13.06%

6.56% (met the conditions)

4.46% (conditions met)

Finally, a white line is drawn to break through the buying point, and the recent low uses a red line to indicate a stop loss.

Next, we use a $100,000.00 account as an account model. Swing trading corresponds to a reasonable stop loss range of 1% to 0.25% of the account

1% account stop loss = $1,000.00. You can buy 236 shares with a price difference stop loss corresponding to 4.235. The amount used: $22,427.00...

Since the day after the contraction was the quarterly earnings report, we have no way of knowing whether Mark traded this stock, but we can do it according to $Blueprint Medicines(BPMC.US$The chart shows some telltale signs of why Mark is paying attention to this stock.

First, take a look at the IBD chart. The two recent sharp declines have produced a bullish divergence from the RS line 👇

Some other important metrics 👇

Back to the MOOMOO chart:

The figure uses purple lines to connect the high and low points of the finishing area, as follows:

101,84.81

97, 84.33

94.67, 88.46

94.98, 90.745

The difference is obtained by subtracting before and after:

16.19

12.67

6.21

4.235

High and low point gap%:

16%

13.06%

6.56% (met the conditions)

4.46% (conditions met)

Finally, a white line is drawn to break through the buying point, and the recent low uses a red line to indicate a stop loss.

Next, we use a $100,000.00 account as an account model. Swing trading corresponds to a reasonable stop loss range of 1% to 0.25% of the account

1% account stop loss = $1,000.00. You can buy 236 shares with a price difference stop loss corresponding to 4.235. The amount used: $22,427.00...

Translated

+3

12

Last week in review 👉🏻Market Review+Core Position Analysis (29/04-03/05 2024)

“Trade like a gecko, usually lying motionless on a wall. Once mosquitoes appear, they quickly eat them, then calm down and wait for the next opportunity.” -Jim.Simons (R.I.P)

A quick review of this week's market behavior:

$NASDAQ 100 Index(.NDX.US$ Tuesday disagreement;

$S&P 500 Index(.SPX.US$ Tuesday disagreement;

$Dow Jones Industrial Average(.DJI.US$ Divided on Tuesday, attracted funds on Thursday.

dji>spx>ndx

A week where trading volume was drastically reduced, there was almost no supply. The SPX Follow-up Day (FTD) still hasn't appeared, but there is very good price behavior, and the breadth is getting better day by day. A large number of swing traders and position traders on Twitter are extremely excited, and the vast majority have already participated...

Will the large upward gap in the daily chart last Friday be made up (the correction is normal; it does not mean that the upward trend is not valid; failure to make up indicates that the upward trend is extremely strong)? Another important observation point for the next two weeks;

The market currently has not given enough information to give me confidence to enter. The situation is likely to gradually become clear in the next two weeks. It just so happens that SPX's historical average low in May was on May 23. There is no need to predict, just wait patiently for the market...

“Trade like a gecko, usually lying motionless on a wall. Once mosquitoes appear, they quickly eat them, then calm down and wait for the next opportunity.” -Jim.Simons (R.I.P)

A quick review of this week's market behavior:

$NASDAQ 100 Index(.NDX.US$ Tuesday disagreement;

$S&P 500 Index(.SPX.US$ Tuesday disagreement;

$Dow Jones Industrial Average(.DJI.US$ Divided on Tuesday, attracted funds on Thursday.

dji>spx>ndx

A week where trading volume was drastically reduced, there was almost no supply. The SPX Follow-up Day (FTD) still hasn't appeared, but there is very good price behavior, and the breadth is getting better day by day. A large number of swing traders and position traders on Twitter are extremely excited, and the vast majority have already participated...

Will the large upward gap in the daily chart last Friday be made up (the correction is normal; it does not mean that the upward trend is not valid; failure to make up indicates that the upward trend is extremely strong)? Another important observation point for the next two weeks;

The market currently has not given enough information to give me confidence to enter. The situation is likely to gradually become clear in the next two weeks. It just so happens that SPX's historical average low in May was on May 23. There is no need to predict, just wait patiently for the market...

Translated

+11

12

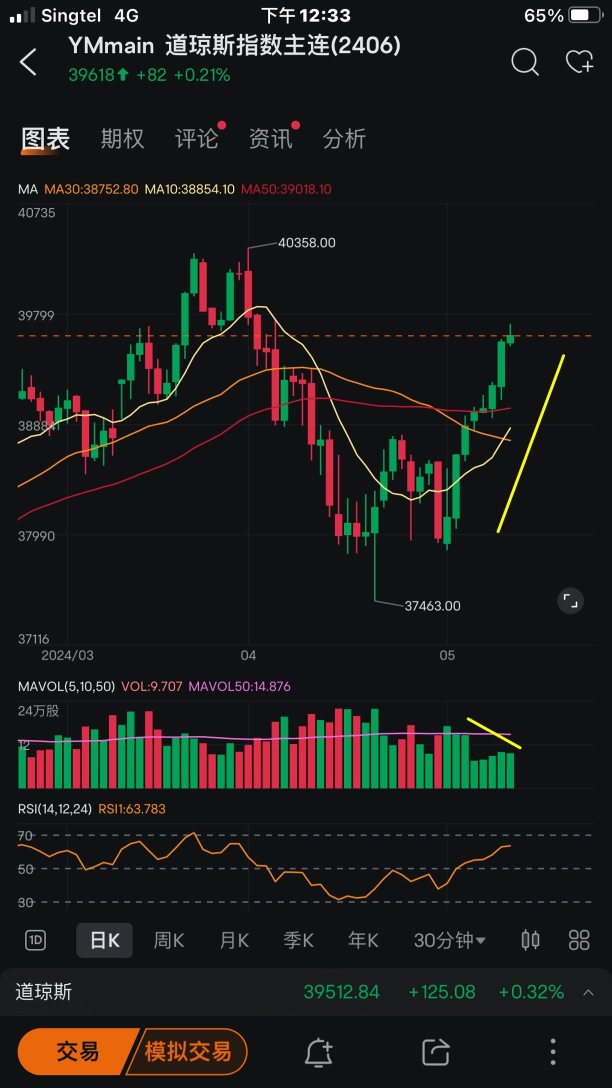

Major Index futures 👇

Key Indices 👇

The market, where trading volume and price were uniformly diverged in the initial stage, is still very unconvincing;

Complements every SPX Follow-up Day (FTD) since October 2022 👇

In terms of individual stocks, most of the surviving leader stocks and emerging leader stocks are:

Excessive expansion of high opening after financial reports;

the left half of the settings;

I'm just half way through the setup;

Continue to wait patiently as planned 🚴🏻

Key Indices 👇

The market, where trading volume and price were uniformly diverged in the initial stage, is still very unconvincing;

Complements every SPX Follow-up Day (FTD) since October 2022 👇

In terms of individual stocks, most of the surviving leader stocks and emerging leader stocks are:

Excessive expansion of high opening after financial reports;

the left half of the settings;

I'm just half way through the setup;

Continue to wait patiently as planned 🚴🏻

Translated

+10

7

Natural gas $Henry Hub Natural Gas Futures(JUN4)(NGmain.US$ The foundation has been established for a long time since the last trading volume release bottomed out, and the recent huge trading volume has shown upward strength 👇

Translated

2

Crude oil futures $Crude Oil Futures(JUL4)(CLmain.US$ The corresponding changes in price and trading volume indicate that the trend is likely to reverse here 👇

Translated

4

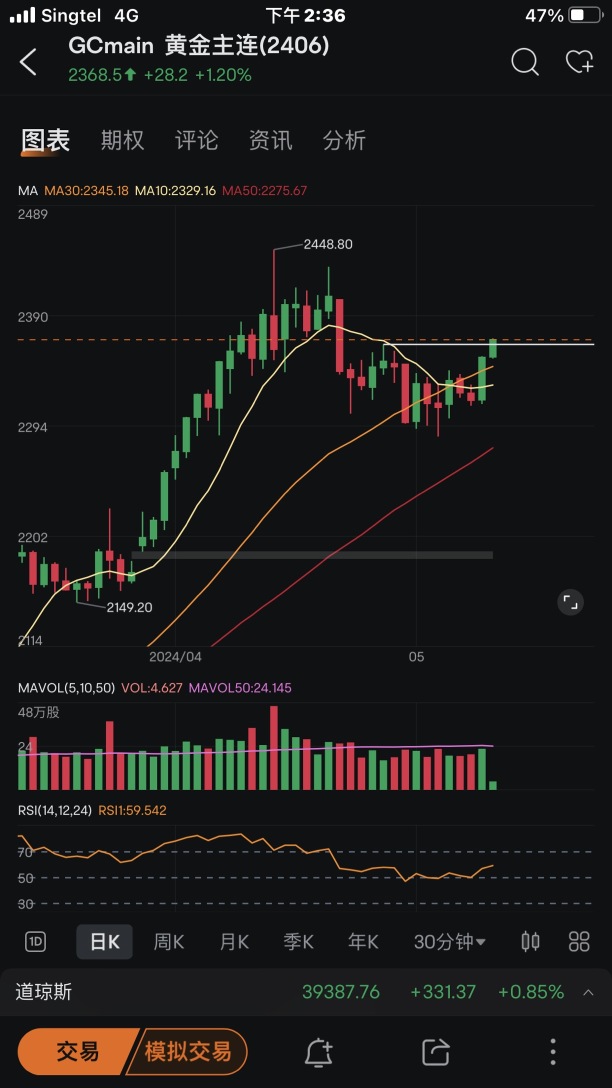

futures action is implying that the first break after a major cycle break is nearing completion 👇

$Gold Futures(JUN4)(GCmain.US$ $SPDR Gold ETF(GLD.US$ $VanEck Gold Miners Equity ETF(GDX.US$

$Gold Futures(JUN4)(GCmain.US$ $SPDR Gold ETF(GLD.US$ $VanEck Gold Miners Equity ETF(GDX.US$

Translated

5

This is the yield curve of the trader's own account.

If you repeatedly summarize and study your past yield curve, you will see your unique strengths and weaknesses; and with the following questions 👇

Is it possible to basically identify the most basic characteristics of the upward trend and adjustment period in the market?

Were you fully involved in trading during the main upward trend?

Were transactions drastically reduced or not traded during periods of market adjustment?

Are there still problems with stock selection?

Is the position the right size?

Is it possible to cut weed in positions too slowly or sell too early/late to big winners?

The most important question after the research isn't to ask yourself “Can I do a better account yield curve?”

Instead, ask “What can I do to have a better account yield curve?”

Below are yield curves for the last two major uptrends, where you can always find areas for improvement to do better in the next uptrend. 🚴🏻

June-July 2023:

November 2023 to March 2024:

Research your past transactions over and over again, learn from them and find improvement plans, and confirm implementing this plan when you make your next transaction. 🚴🏻

Finally: Keep reading 🚴🏻 (The human body needs timely nutritional supplementation; mental and spiritual needs are equally necessary)

If you repeatedly summarize and study your past yield curve, you will see your unique strengths and weaknesses; and with the following questions 👇

Is it possible to basically identify the most basic characteristics of the upward trend and adjustment period in the market?

Were you fully involved in trading during the main upward trend?

Were transactions drastically reduced or not traded during periods of market adjustment?

Are there still problems with stock selection?

Is the position the right size?

Is it possible to cut weed in positions too slowly or sell too early/late to big winners?

The most important question after the research isn't to ask yourself “Can I do a better account yield curve?”

Instead, ask “What can I do to have a better account yield curve?”

Below are yield curves for the last two major uptrends, where you can always find areas for improvement to do better in the next uptrend. 🚴🏻

June-July 2023:

November 2023 to March 2024:

Research your past transactions over and over again, learn from them and find improvement plans, and confirm implementing this plan when you make your next transaction. 🚴🏻

Finally: Keep reading 🚴🏻 (The human body needs timely nutritional supplementation; mental and spiritual needs are equally necessary)

Translated

+2

9

Last week in review 👉🏻Market Review+Core Position Analysis (22/04-26/04 2024)

“I've made as many mistakes in stock trading as many times as I was right, which has helped me grow both my career and my personal wealth. The key is asymmetric leverage; you make more money when you make a profit than when you lose, and you always get a return. This is the Holy Grail!” (All transactions only serve the profit curve of your account, nothing more) -Mark.Minervini

A quick review of this week's markets:

$NASDAQ 100 Index(.NDX.US$ Distributed on Tuesday and attracted funds on Friday;

$S&P 500 Index(.SPX.US$ Dispatched on Tuesday and Wednesday;

$Dow Jones Industrial Average(.DJI.US$ Distributed on Tuesday, divided on Friday.

NDX>DJI>SPX

The first 4 days of decline this week. The market opened sharply higher with the support of APPL earnings on Thursday and very good pre-market inflation data on Friday, but with the support of such superior external factors, SPX still failed to complete the “Follow-up Day (FTD)”, and was almost all blocked below 50MA and the intensive trading zone above. From a trading psychology analysis, this position has a great advantage for traders to go short: the distance from the 50MA above and the “sky pool” is extremely short, that is, the stop-loss cost (risk) is extremely small...

“I've made as many mistakes in stock trading as many times as I was right, which has helped me grow both my career and my personal wealth. The key is asymmetric leverage; you make more money when you make a profit than when you lose, and you always get a return. This is the Holy Grail!” (All transactions only serve the profit curve of your account, nothing more) -Mark.Minervini

A quick review of this week's markets:

$NASDAQ 100 Index(.NDX.US$ Distributed on Tuesday and attracted funds on Friday;

$S&P 500 Index(.SPX.US$ Dispatched on Tuesday and Wednesday;

$Dow Jones Industrial Average(.DJI.US$ Distributed on Tuesday, divided on Friday.

NDX>DJI>SPX

The first 4 days of decline this week. The market opened sharply higher with the support of APPL earnings on Thursday and very good pre-market inflation data on Friday, but with the support of such superior external factors, SPX still failed to complete the “Follow-up Day (FTD)”, and was almost all blocked below 50MA and the intensive trading zone above. From a trading psychology analysis, this position has a great advantage for traders to go short: the distance from the 50MA above and the “sky pool” is extremely short, that is, the stop-loss cost (risk) is extremely small...

Translated

+16

10

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)