SGrobin

commented on

Have you ever wished you could lower the price you paid for a stock long after a transaction took place – I mean, without simply adding to the position at better prices to lower your average entry point?

This question is for everyone, but really, I aim this at the newer options traders and investors. If an investor learns to trade both stocks and stock options, he or she can use the two together to potentially lower a st...

This question is for everyone, but really, I aim this at the newer options traders and investors. If an investor learns to trade both stocks and stock options, he or she can use the two together to potentially lower a st...

79

17

SGrobin

liked

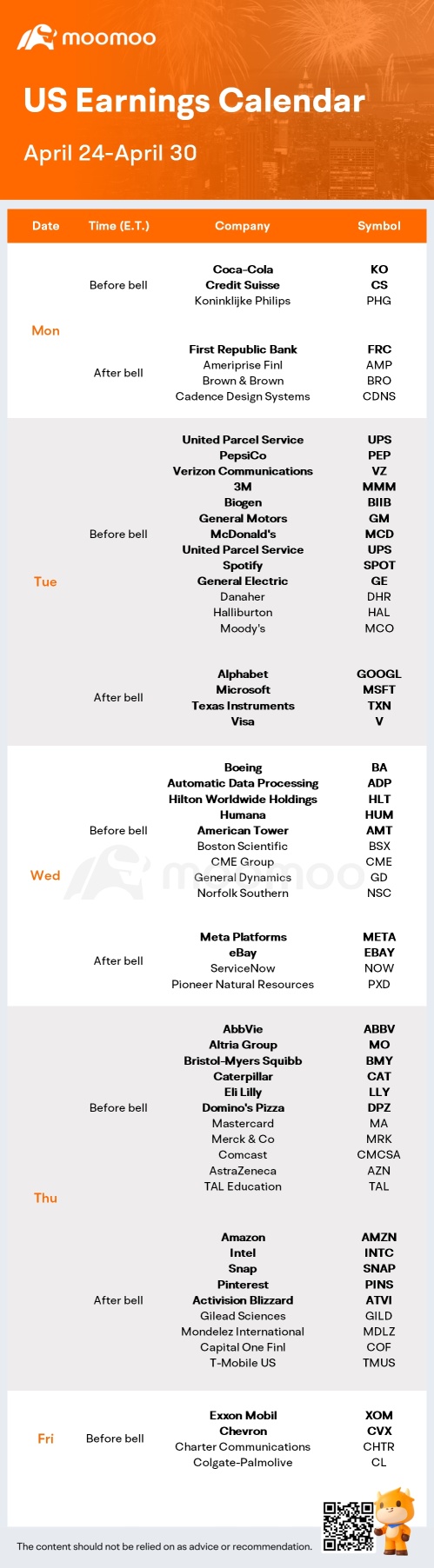

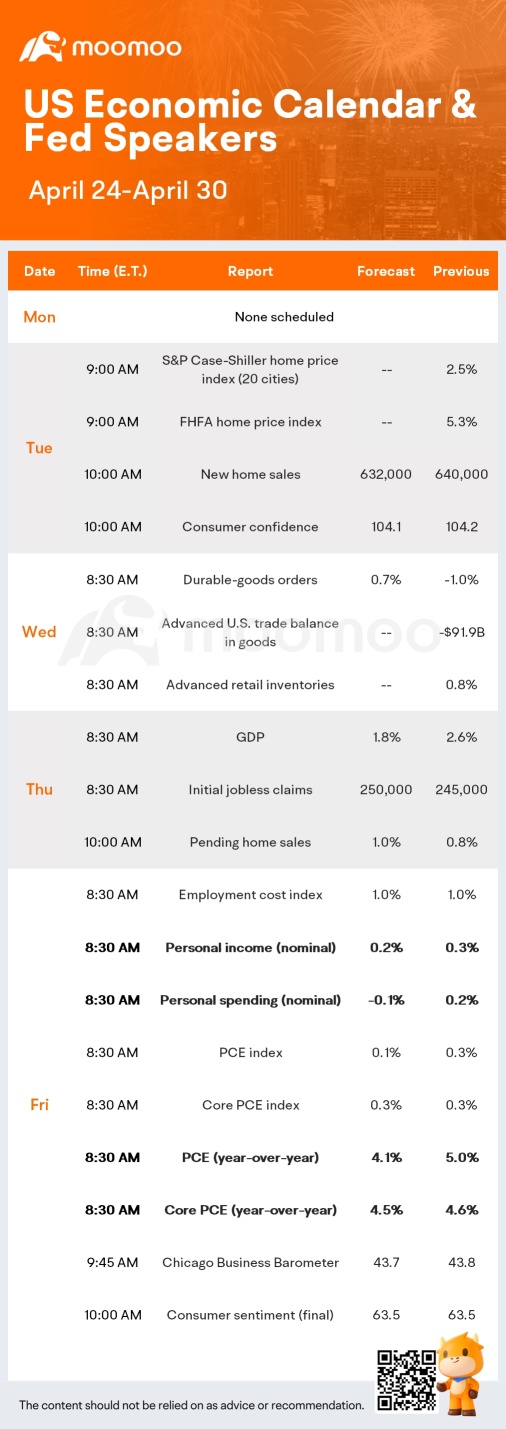

First-quarter earnings season ramps up this week, with some 170 S&P 500 firms scheduled to report, including many of the largest companies on the market. Economic releases will include data on business and consumer spending, plus an early look at first-quarter gross domestic product statistics.

$Coca-Cola(KO.US$ and $First Republic Bank(FRC.US$ will be Monday's earnings highlights, followed by a busy Tuesday: $3M(MMM.US$, ��������...

$Coca-Cola(KO.US$ and $First Republic Bank(FRC.US$ will be Monday's earnings highlights, followed by a busy Tuesday: $3M(MMM.US$, ��������...

+3

23

1

SGrobin

liked

Trading with the following in mind is crucial to being a successful day trader.

Understanding The Market Requires You To Understand Market Psychology

Stock market intraday patterns – all times are in Eastern Standard Time!

When day trading the US stock market you may notice certain patterns, based on the time of day, that occur more often than not. These patterns, or tendencies, happen often enough for professional day traders to base their trading around them.

9:30am: The stock market opens, and there is an initial push in one direction. Highly volatile!

9:45am: The initial push often sees a significant reversal or pullback. This is often just a short-term shift, and then the original trending direction re-asserts itself.

10:00am: If the trend that began at 9:30am is still happening, it will often be challenged around this time. This tends to be another time where there is a significant reversal or pullback.

11:15am-11:30am: The market is heading into lunch hour, and London is getting ready to close. This is when volatility will typically die out for a few hours, but often the daily high or low will be tested around this time. European traders will usually close out positions or accumulate a position before they finish for the day. Whether the highs or lows are tested or not, the markets tend to ‘drift’ for the next hour or more.

11:45am-1:30pm: This is lunch time in New York, plus a bit of a time buffer. Usually, this is the quietest time of the day, and often, day traders like to avoid it.

1:30pm-2:00pm: If the lunch hour was calm, then expect a breakout of the range established during lunch hour. Often, the market will try to move in the direction it was trading in before the lunch hour doldrums set in.

2:00pm-2:45pm: The close is getting closer, and many traders are trading with the trend thinking it will continue into close. That may happen, but expect some sharp reversals around this time, because on the flip side, man traders are quicker to take profits or move their trailing stop losses closer to the current price.

3:00pm-3:30pm: These are big “Shake-out” points, in that they will force many traders out of their positions. If a reversal of the prior trend occurs around this time, then the price is likely to move very strongly in the opposite direction. Even if the prior trend does sustain itself through these periods, expect some quick and sizable counter-trend moves.

As a day trader, its best to be nimble and not get tied into one position or direction. Many traders only trade the first hour and the last hour of every day, as these times are the most volatile.

3:30pm-4:00pm: The market closes at 4pm. After that, the liquidity dries up in nearly all stocks and ETFs, except for the very active ones. It’s common to close all positions a minute or more before the closing bell, unless you have orders placed to close your position on a closing auction or “cross”.

💰Wasnt sure where the “tips for day trading” event is or i wouldve posted this there. 🍻 @moomoo Event @moomoo Lily

Hope this provides some clarity to the workd of daytrading!

$Energy Focus(EFOI.US$

Understanding The Market Requires You To Understand Market Psychology

Stock market intraday patterns – all times are in Eastern Standard Time!

When day trading the US stock market you may notice certain patterns, based on the time of day, that occur more often than not. These patterns, or tendencies, happen often enough for professional day traders to base their trading around them.

9:30am: The stock market opens, and there is an initial push in one direction. Highly volatile!

9:45am: The initial push often sees a significant reversal or pullback. This is often just a short-term shift, and then the original trending direction re-asserts itself.

10:00am: If the trend that began at 9:30am is still happening, it will often be challenged around this time. This tends to be another time where there is a significant reversal or pullback.

11:15am-11:30am: The market is heading into lunch hour, and London is getting ready to close. This is when volatility will typically die out for a few hours, but often the daily high or low will be tested around this time. European traders will usually close out positions or accumulate a position before they finish for the day. Whether the highs or lows are tested or not, the markets tend to ‘drift’ for the next hour or more.

11:45am-1:30pm: This is lunch time in New York, plus a bit of a time buffer. Usually, this is the quietest time of the day, and often, day traders like to avoid it.

1:30pm-2:00pm: If the lunch hour was calm, then expect a breakout of the range established during lunch hour. Often, the market will try to move in the direction it was trading in before the lunch hour doldrums set in.

2:00pm-2:45pm: The close is getting closer, and many traders are trading with the trend thinking it will continue into close. That may happen, but expect some sharp reversals around this time, because on the flip side, man traders are quicker to take profits or move their trailing stop losses closer to the current price.

3:00pm-3:30pm: These are big “Shake-out” points, in that they will force many traders out of their positions. If a reversal of the prior trend occurs around this time, then the price is likely to move very strongly in the opposite direction. Even if the prior trend does sustain itself through these periods, expect some quick and sizable counter-trend moves.

As a day trader, its best to be nimble and not get tied into one position or direction. Many traders only trade the first hour and the last hour of every day, as these times are the most volatile.

3:30pm-4:00pm: The market closes at 4pm. After that, the liquidity dries up in nearly all stocks and ETFs, except for the very active ones. It’s common to close all positions a minute or more before the closing bell, unless you have orders placed to close your position on a closing auction or “cross”.

💰Wasnt sure where the “tips for day trading” event is or i wouldve posted this there. 🍻 @moomoo Event @moomoo Lily

Hope this provides some clarity to the workd of daytrading!

$Energy Focus(EFOI.US$

113

3

SGrobin

liked

$Ford Motor(F.US$ Ford Motor confirmed that the F150 Lightning, the first electric pickup truck, currently has close to 200,000 retail reservations. F-150 Lightning has been in trial production since September this year. According to the plan, it will be officially launched in the spring of 2022 and is expected to be delivered in the second half of 2022.

Earlier this year, Ford unveiled the F-150 Lightning, an all-electric version of the company’s best-selling pickup truck.

The vehicle has the potential to greatly accelerate electric vehicle adoption in the US since the F-150 is already the best-selling passenger vehicle in the market.

Earlier this year, Ford unveiled the F-150 Lightning, an all-electric version of the company’s best-selling pickup truck.

The vehicle has the potential to greatly accelerate electric vehicle adoption in the US since the F-150 is already the best-selling passenger vehicle in the market.

32

6

SGrobin

liked

$Tempest Therapeutics(TPST.US$ When will it be back to 40

Translated

2

SGrobin

liked

$Salesforce(CRM.US$ A few years ago, a company began forcing the grassroots to use Salesforce, more because of the internal needs of upward management rather than the consideration of improving corporate performance. The end result is that internal grassroots employees waste a lot of time entering “junk” information into Salesforce to deal with, and no one cares how many prospects turn into real customers. The Dow Jones Industrial Average really lacked foresight in incorporating CRM; it was a really good company $NVIDIA(NVDA.US$ $Advanced Micro Devices(AMD.US$ But it's not on the list.

Translated

13

SGrobin

liked

$WiMi Hologram Cloud(WIMI.US$ Metaverse, a trend,is coming. transitioned attention from the physical world to the virtual world. $Meta Platforms(FB.US$ $NVIDIA(NVDA.US$

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

SGrobin : Cover call