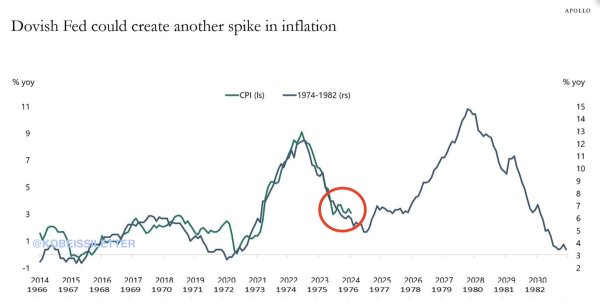

A Fed pivot could be devastating:

Since the Fed turned dovish in December, financial conditions have eased dramatically.

We have seen the S&P 500 make new all time highs, IPO activity is up, credit spreads have tightened and M&A is back.

Consumers have benefitted from a rise in asset prices and investors are piling into stocks.

Apollo says this is similar to what we saw in the 1970s when inflation rebounded to well over 10%.

If we are really on track for a "soft landing," why do we need lower ra...

Since the Fed turned dovish in December, financial conditions have eased dramatically.

We have seen the S&P 500 make new all time highs, IPO activity is up, credit spreads have tightened and M&A is back.

Consumers have benefitted from a rise in asset prices and investors are piling into stocks.

Apollo says this is similar to what we saw in the 1970s when inflation rebounded to well over 10%.

If we are really on track for a "soft landing," why do we need lower ra...

2

High-grade bond US issuers are on track to break first-quarter issuance records, with $27 billion issued this week and year-to-date volume reaching $466 billion. The $510 billion record for the first three months of a year is within reach if the current pace continues.

Despite higher Treasury yields, robust demand and favorable pricing conditions are driving corporate borrowers to tap the market before potential economic uncertainties arise. Is...

Despite higher Treasury yields, robust demand and favorable pricing conditions are driving corporate borrowers to tap the market before potential economic uncertainties arise. Is...

1

New York Community Bancorp (NYCB) late Monday said it closed a $1 billion equity investment from a group of firms led by former Treasury Secretary Steven Mnuchin's Liberty Capital.

The bank announced its intention to propose a one-for-three reverse stock split to shareholders.

Mnuchin and fellow investors Milton Berlinski and Allen Puwalski, as well as former Comptroller of the Currency Joseph Otting, joined the troubled lender's...

The bank announced its intention to propose a one-for-three reverse stock split to shareholders.

Mnuchin and fellow investors Milton Berlinski and Allen Puwalski, as well as former Comptroller of the Currency Joseph Otting, joined the troubled lender's...

3

💡3/12

$SPDR S&P 500 ETF(SPY.US$

After spy rejected 509/510 demand near open, spy perfectly touched 508 demand zone here it bounced but closed under 511.66. Now inside a fresh supply after hours.

📈above 514.18 ➡️ 528c 3/22 can work

📉below 509.82 ➡️ 506p 3/13 can work

$SPDR S&P 500 ETF(SPY.US$

After spy rejected 509/510 demand near open, spy perfectly touched 508 demand zone here it bounced but closed under 511.66. Now inside a fresh supply after hours.

📈above 514.18 ➡️ 528c 3/22 can work

📉below 509.82 ➡️ 506p 3/13 can work

1

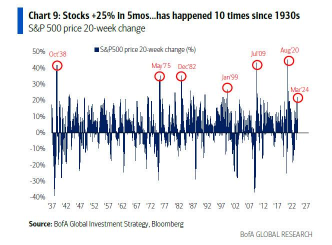

The S&P 500 is officially up 25%, adding 1,000 points, since its low in October 2023.

This has only happened 10 times dating back to 1930, according to Bank of America.

The last 3 times this happened?

August 2020, July 2009 and January 1999.

However, the Magnificent 7 are currently *only* up 149% since the run began in December 2022.

This percentage gain is lower than every "bubble" dating back to 1930 except for one.

History says the Magnificent 7 aren't done yet.

$S&P 500 Index(.SPX.US$ $Nasdaq Composite Index(.IXIC.US$ $Dow Jones Industrial Average(.DJI.US$ $SPDR S&P 500 ETF(SPY.US$ $Invesco QQQ Trust(QQQ.US$

This has only happened 10 times dating back to 1930, according to Bank of America.

The last 3 times this happened?

August 2020, July 2009 and January 1999.

However, the Magnificent 7 are currently *only* up 149% since the run began in December 2022.

This percentage gain is lower than every "bubble" dating back to 1930 except for one.

History says the Magnificent 7 aren't done yet.

$S&P 500 Index(.SPX.US$ $Nasdaq Composite Index(.IXIC.US$ $Dow Jones Industrial Average(.DJI.US$ $SPDR S&P 500 ETF(SPY.US$ $Invesco QQQ Trust(QQQ.US$

2

$Broadcom(AVGO.US$ | Broadcom Q1 Earnings Highlights:

🔹 EPS: $10.99 (Est. $10.40) 🟢

🔹 Revenue: $11.96B (Est. $11.79B) 🟢

🔹 Semiconductor Solutions Rev: $7.39B (Est. $7.7B) 🔴

FY'24 Business Outlook:

🔹 Revenue Guidance: ~$50.0B (Est. $50.21B) 🟡

🔹 Adjusted EBITDA Guidance: ~60% of projected revenue

Additional Insights:

🔸 Free cash flow, excluding restructuring in the quarter, was strong at $5.4B.

🔸 Fiscal Year 2024 includes the contribution from VMware, projecting an increase of 40% from the prior ...

🔹 EPS: $10.99 (Est. $10.40) 🟢

🔹 Revenue: $11.96B (Est. $11.79B) 🟢

🔹 Semiconductor Solutions Rev: $7.39B (Est. $7.7B) 🔴

FY'24 Business Outlook:

🔹 Revenue Guidance: ~$50.0B (Est. $50.21B) 🟡

🔹 Adjusted EBITDA Guidance: ~60% of projected revenue

Additional Insights:

🔸 Free cash flow, excluding restructuring in the quarter, was strong at $5.4B.

🔸 Fiscal Year 2024 includes the contribution from VMware, projecting an increase of 40% from the prior ...

1

6

$Domo Inc(DOMO.US$ | Domo Q4 Earnings Highlights:

🔹 EPS: ($0.05) (Est. ($0.07)) 🟢

🔹 Revenue: $80.2M (Est. $79.34M) 🟢

Q1'25 Guidance:

🔹 EPS: ($0.21)-($0.25) (Est. ($0.02)) 🔴

🔹 Revenue: $79M-$80M (Est. $82.09M) 🔴

FY'25 Guidance:

🔹 EPS: ($0.36)-($0.46) (Est. ($0.15)) 🔴

🔹 Revenue: $315M-$323M (Est. $323.7M) 🔴

Other Q4 Metrics:

🔹 Subscription Revenue: $71.9M (+2% YoY) 🟢

🔹 Billings: $105.4M (+1% y/y)

🔹 Net Cash Provided by Operating Activities: $5.4M

🔸 CEO Josh James' Commentary: "The strategic inve...

🔹 EPS: ($0.05) (Est. ($0.07)) 🟢

🔹 Revenue: $80.2M (Est. $79.34M) 🟢

Q1'25 Guidance:

🔹 EPS: ($0.21)-($0.25) (Est. ($0.02)) 🔴

🔹 Revenue: $79M-$80M (Est. $82.09M) 🔴

FY'25 Guidance:

🔹 EPS: ($0.36)-($0.46) (Est. ($0.15)) 🔴

🔹 Revenue: $315M-$323M (Est. $323.7M) 🔴

Other Q4 Metrics:

🔹 Subscription Revenue: $71.9M (+2% YoY) 🟢

🔹 Billings: $105.4M (+1% y/y)

🔹 Net Cash Provided by Operating Activities: $5.4M

🔸 CEO Josh James' Commentary: "The strategic inve...

We don't top out until the frequent top callers tap out!

People are so delusional, that we are printing ATH after ATH for the past two months on $S&P 500 Index(.SPX.US$ , we are in Price Discovery and they call this "a bearmarket".

People are so delusional, that we are printing ATH after ATH for the past two months on $S&P 500 Index(.SPX.US$ , we are in Price Discovery and they call this "a bearmarket".

Markets are currently in a state of anticipation, with all eyes on the upcoming Federal Reserve policy announcement. Traders are pricing in a 50% chance of a US interest rate cut in March, a sentiment reinforced by the expected slowdown in the PCE deflator gauge. The focus is now on Fed Chair Jerome Powell's post-meeting speech for indications of a dovish pivot, which could ignite market expectations for rapid rate cuts. The pressure is on the Fed to signal a depar...

1

Value today of $10,000 invested in Nvidia:

1 year ago: $29,969

5 years ago: $152,425

10 years ago: $1,568,920

15 years ago: $3,162,228

25 years ago: $14,885,610

$NVIDIA(NVDA.US$

1 year ago: $29,969

5 years ago: $152,425

10 years ago: $1,568,920

15 years ago: $3,162,228

25 years ago: $14,885,610

$NVIDIA(NVDA.US$

2

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)