kong光

voted

$GENTING(3182.MY$

As the domestic tourism industry continues to recover, Hong Leong Investment Bank believes that Genting, which is currently undervalued, is one of the main beneficiaries and deserves investors' attention.

Hong Leong Investment Bank analysts pointed out that they are in Genting Malaysia, respectively $GENM(4715.MY$and Genting Singapore $Genting Sing(G13.SG$Genting, which has a strategic stake, can benefit from the recovery of tourism in Malaysia and New Zealand.

The following are the company's range buying points, short-term upward targets, and stop-loss points.

$GENTING(3182.MY$

Source: Nanyang Siang Pao

Disclaimer: This content is for informational and educational purposes only, and does not constitute any specific investment, investment strategy, or recommendation endorsement. The reader shall bear any risk and responsibility arising from reliance on this content. Always conduct your own independent research and evaluation and consult professional advice if necessary before making any investment decisions. The author and related participants are not responsible for any loss or damage resulting from the use or reliance on the information contained in this article.

As the domestic tourism industry continues to recover, Hong Leong Investment Bank believes that Genting, which is currently undervalued, is one of the main beneficiaries and deserves investors' attention.

Hong Leong Investment Bank analysts pointed out that they are in Genting Malaysia, respectively $GENM(4715.MY$and Genting Singapore $Genting Sing(G13.SG$Genting, which has a strategic stake, can benefit from the recovery of tourism in Malaysia and New Zealand.

The following are the company's range buying points, short-term upward targets, and stop-loss points.

$GENTING(3182.MY$

Source: Nanyang Siang Pao

Disclaimer: This content is for informational and educational purposes only, and does not constitute any specific investment, investment strategy, or recommendation endorsement. The reader shall bear any risk and responsibility arising from reliance on this content. Always conduct your own independent research and evaluation and consult professional advice if necessary before making any investment decisions. The author and related participants are not responsible for any loss or damage resulting from the use or reliance on the information contained in this article.

Translated

17

3

kong光

liked

ColumnsRiverstone's turnover surpassed a 6-quarter high and distributed a 4-point Interim Dividend (RM)

$Riverstone(AP4.SG$

Today, RIVERSTONE, which is listed in Singapore 🇸🇬, announced its latest results, with net profit growing 54.3% year-on-year. The chart below shows RIVERSTONE's turnover and net profit over the past few years:

The latest quarterly turnover was RM249.5 mil, and management said that the supply relationship had returned to normal. It is expected that the next few quarters will be very good with the recovery of semiconductors and consumer electronics products. Therefore, FY2024's annual turnover is likely to exceed RM1,000 mil and is expected to grow by more than 10%.

Since RiverStone focuses on cleanroom gloves, it is a relatively niche market. After this pandemic, the company's net profit margin was even scarier than before the pandemic, reaching 28.9%. One reason is due to the sharp increase in cash and the environment of high interest rates. In the case of RM947.64 mil cash and 0 bank loans, the company can earn higher interest income.

The company has a positive outlook, with supply and hope to return to normal, with major customer sectors recovering in semiconductors and consumer electronics. In addition, the company is expected to pay a 4-point dividend (RM) in Q1, which is equivalent to a payout ratio of 82.1%. In an environment where profits are returning to growth, Riverst...

Today, RIVERSTONE, which is listed in Singapore 🇸🇬, announced its latest results, with net profit growing 54.3% year-on-year. The chart below shows RIVERSTONE's turnover and net profit over the past few years:

The latest quarterly turnover was RM249.5 mil, and management said that the supply relationship had returned to normal. It is expected that the next few quarters will be very good with the recovery of semiconductors and consumer electronics products. Therefore, FY2024's annual turnover is likely to exceed RM1,000 mil and is expected to grow by more than 10%.

Since RiverStone focuses on cleanroom gloves, it is a relatively niche market. After this pandemic, the company's net profit margin was even scarier than before the pandemic, reaching 28.9%. One reason is due to the sharp increase in cash and the environment of high interest rates. In the case of RM947.64 mil cash and 0 bank loans, the company can earn higher interest income.

The company has a positive outlook, with supply and hope to return to normal, with major customer sectors recovering in semiconductors and consumer electronics. In addition, the company is expected to pay a 4-point dividend (RM) in Q1, which is equivalent to a payout ratio of 82.1%. In an environment where profits are returning to growth, Riverst...

Translated

64

4

kong光

liked

$KENANGA(6483.MY$ lets go 🚀🚀….nice 8% gain in 3 days from pivot bo…peeling some gain into strength to finance risk

1

kong光

liked

Market Cap : MYR 815 million

Debt : 0

Cash Level : MYR 451 million

Enterprise Value : MYR 364 million

FPI should be able to generate Profit After Tax of MYR 117 million.

PE : 8, EV/PAT : 3, DY : 7%.

A safe investment choice with strong cash position, moderate growth, low valuation and high Dividend Yield

Debt : 0

Cash Level : MYR 451 million

Enterprise Value : MYR 364 million

FPI should be able to generate Profit After Tax of MYR 117 million.

PE : 8, EV/PAT : 3, DY : 7%.

A safe investment choice with strong cash position, moderate growth, low valuation and high Dividend Yield

3

kong光

commented on

News Highlights

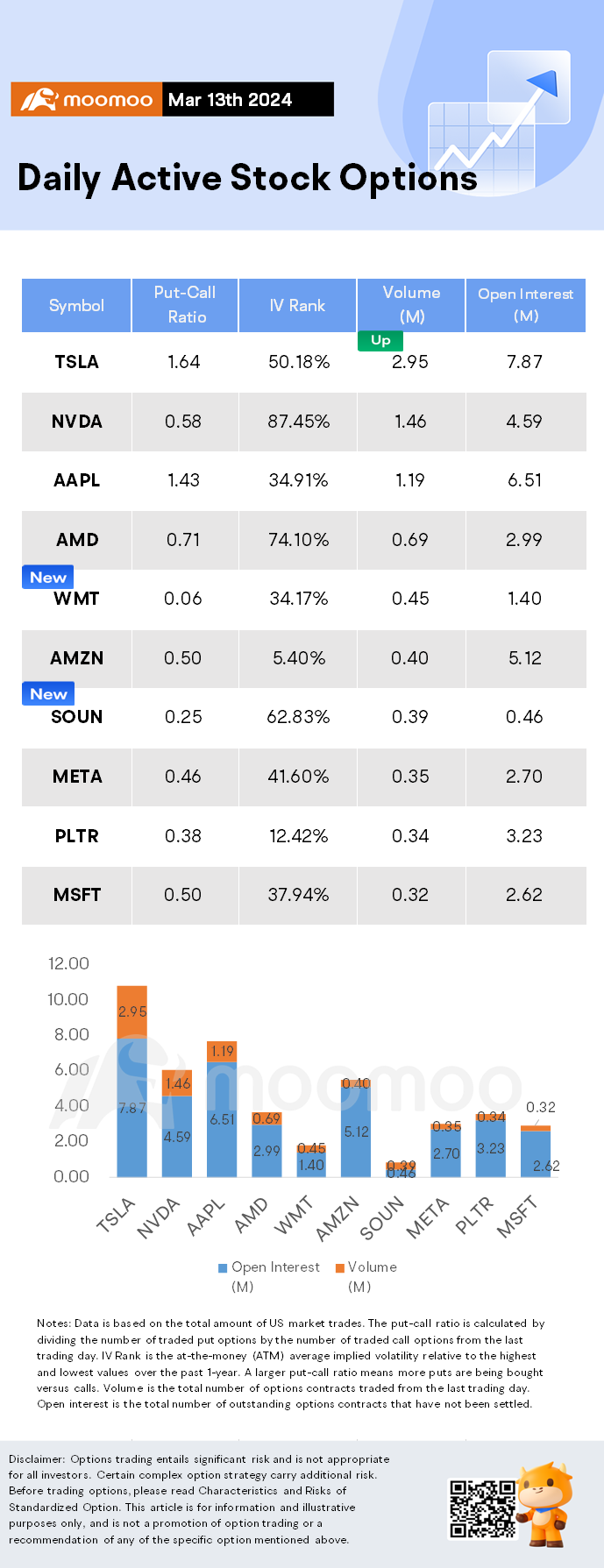

$Tesla(TSLA.US$ shares lowered by 4.54%, closing at $169.48. Its options trading volume was 2.95 million. Call contracts account for 37.9% of the total trading volume. The most traded calls are contracts of $175 strike price that expire on Mar 15th. The total volume reaches 123,035 with an open interest of 16,043. The most traded puts are contracts of a...

$Tesla(TSLA.US$ shares lowered by 4.54%, closing at $169.48. Its options trading volume was 2.95 million. Call contracts account for 37.9% of the total trading volume. The most traded calls are contracts of $175 strike price that expire on Mar 15th. The total volume reaches 123,035 with an open interest of 16,043. The most traded puts are contracts of a...

34

6

kong光

commented on

$GENTING(3182.MY$ Will medicine for the elderly work tonight?

Translated

2

1

kong光

commented on

$GENTING(3182.MY$ tmr RM5 for sure because Taurx

4

kong光

commented on

Hi everyone,

Finally moomoo has landed in malaysia! Malaysia market I would always go for the bluechips like Cimb and Maybank. Looking forward to it!

Finally moomoo has landed in malaysia! Malaysia market I would always go for the bluechips like Cimb and Maybank. Looking forward to it!

9

1

kong光

commented on

[Brief description] Malaysia's semiconductor stocks will decouple from the US technology sector in 2023. The main reason is that demand has not recovered, and they have not directly benefited from Nvidia and the AI chip industry chain.

After entering 2024, many semiconductor companies said that the inventory removal cycle has come to an end. With the exception of automotive semiconductors, all other semiconductor types have seen a recovery trend.

In February 2024, as MPI handed over better-than-expected financial reports and a positive outlook, another giant, INARI, was also highly anticipated by the market, and the results will be released on February 26.

Judging from the current market capital flow, it seems that the revolving theme of baseball has spread to the foot of the technology sector.

On the auspicious day of 28/2/2024, let's listen to Zeff's in-depth sharing of INARI's performance report and more industry updates! Promise you!

[Mentor] Zeff Tan, Chief Mentor at SHARIX Malaysia, Stock Market Researcher [Join us] Tailored for moomoo users! See you on February 28th at 8:00pm! Want to know the latest developments in the semiconductor industry? Hurry up and invite the shareholders around you to learn together!

[Disclaimer] All opinions expressed in the live stream and video are the independent opinions of SHARIX. moomoo and its affiliates are not responsible for their content and opinions

After entering 2024, many semiconductor companies said that the inventory removal cycle has come to an end. With the exception of automotive semiconductors, all other semiconductor types have seen a recovery trend.

In February 2024, as MPI handed over better-than-expected financial reports and a positive outlook, another giant, INARI, was also highly anticipated by the market, and the results will be released on February 26.

Judging from the current market capital flow, it seems that the revolving theme of baseball has spread to the foot of the technology sector.

On the auspicious day of 28/2/2024, let's listen to Zeff's in-depth sharing of INARI's performance report and more industry updates! Promise you!

[Mentor] Zeff Tan, Chief Mentor at SHARIX Malaysia, Stock Market Researcher [Join us] Tailored for moomoo users! See you on February 28th at 8:00pm! Want to know the latest developments in the semiconductor industry? Hurry up and invite the shareholders around you to learn together!

[Disclaimer] All opinions expressed in the live stream and video are the independent opinions of SHARIX. moomoo and its affiliates are not responsible for their content and opinions

Translated

419

75

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)