KHINHSUHLAING

liked and commented on

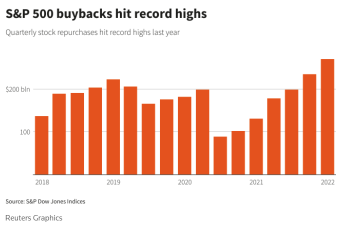

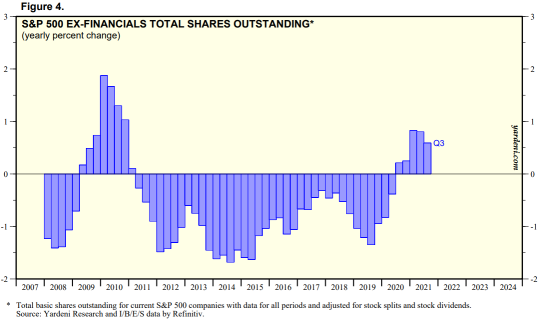

- US buybacks hit record levels

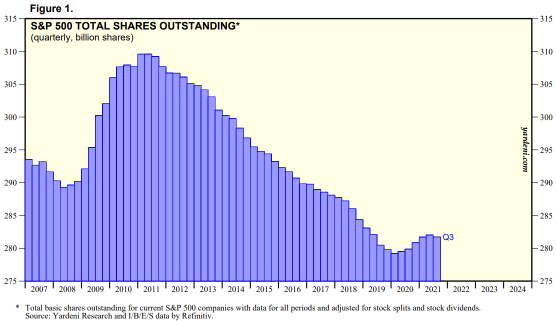

US companies announced more than $300 billion in new buybacks in the first quarter, with March seeing a robust year-over-year increase, suggesting buyback activities have sustained resilience in recent weeks, according to financial data firms EPFR and Informa Financial Intelligence.

New buybacks announced in March reached about $74 billion, up from $54 billion in March 2021, Informa Financial Intelli...

US companies announced more than $300 billion in new buybacks in the first quarter, with March seeing a robust year-over-year increase, suggesting buyback activities have sustained resilience in recent weeks, according to financial data firms EPFR and Informa Financial Intelligence.

New buybacks announced in March reached about $74 billion, up from $54 billion in March 2021, Informa Financial Intelli...

48

6

KHINHSUHLAING

liked and commented on

Recent weeks have been featuring a stock-buyback spree. Alibaba shares clinched an 11% increment after the e-commerce juggernaut announced its $25 billion stock buyback program. Amazon jumped up 5% after approving $10 billion buybacks. General Electric also enjoyed the favor of its $3 billion buyback program, up 3.5% during the day. There are more to come: Tencent, Xiaomi ……

When geopolitical issues and rampant inflation curb on the s...

When geopolitical issues and rampant inflation curb on the s...

+1

120

14

KHINHSUHLAING

liked and commented on

According to a filing with the U.S. Securities and Exchange Commission, Chipmaker GlobalFoundries is marketing 33 million shares while Abu Dhabi’s Mubadala Investment Co., its major shareholder, plans to sell 22 million shares.

Mubadala currently owns 100% of the company and “continue to have substantial control after this offering.”

GlobalFoundries plans to list on the Nasdaq under the symbol GFS. It plans to raise as much as $2.6 billion in a U.S. initial public offering. At the top of that range,it would have a market value of $25 billionbased on the outstanding shares listed in its filing.

The offering is being led by Morgan Stanley, Bank of America, JPMorgan Chase, Citigroup and Credit Suisse.

Business Overview

$GlobalFoundries(GFS.US$is one of the world’s leading semiconductor foundries. The company was created by purchasing the manufacturing operations of Advanced Micro Devices Inc. in 2009 and later combining it with Singapore’s Chartered Semiconductor.

According to Gartner,in 2020, the company was the third largest foundry in the world based on external sales.

GlobalFoundries previously gave up on the kind of leading-edge production that would match the capabilities of Taiwan Semiconductor or Samsung.Instead,it's serving the market for less advanced chips, which are increasingly critical to carmakers and other industries.

GlobalFoundries has over50ecosystem partners spanning IP, electronic design automation, outsourced assembly and test and design services. Building on an existing library of more than4,000IP titles, it currently has more than950IP titles in active development across26process nodes and34IP partners.

The company has built deep strategic partnerships witha broad base of more than 200 customers as of December 31, 2020, many of whom are the global leaders in their field.

In the first six months of 2021, the top ten customers, based on wafer shipment volume, included Qualcomm, MediaTek, NXP Semiconductors, Qorvo, Cirrus Logic, Advanced Micro Devices (“AMD”), Skyworks Solutions, Murata Manufacturing, Samsung Electronics and Broadcom.

The company attracted a large share of single-sourced products and long-term supply agreements. As of the date of the company's prospectus,the aggregate lifetime revenue commitment reflected by these agreements amounted to more than $19.5 billion.

A key measure of GlobalFoundries's position as a strategic partner to the customers is the mix of wafer shipment volume attributable to single-sourced business (Single-sourced products are defined as those that can only be manufactured with GlobalFoundries's technology and cannot be manufactured elsewhere without significant customer redesigns).It represented approximately61% of wafer shipment volume in 2020, up from 47% in 2018.

Financial Performance

Revenue at GlobalFoundries dropped last year by 17% to $4.85 billion. GlobalFoundries said the reason is that it divested a business that brought in $391 million in 2019, and more broadly the company shifted contractual terms with most of its customers, changing how and when it recognizes revenue.

In the first half of 2021, revenue climbed by 13% from a year earlier to just over $3 billion.

Click to view the prospectus

Mubadala currently owns 100% of the company and “continue to have substantial control after this offering.”

GlobalFoundries plans to list on the Nasdaq under the symbol GFS. It plans to raise as much as $2.6 billion in a U.S. initial public offering. At the top of that range,it would have a market value of $25 billionbased on the outstanding shares listed in its filing.

The offering is being led by Morgan Stanley, Bank of America, JPMorgan Chase, Citigroup and Credit Suisse.

Business Overview

$GlobalFoundries(GFS.US$is one of the world’s leading semiconductor foundries. The company was created by purchasing the manufacturing operations of Advanced Micro Devices Inc. in 2009 and later combining it with Singapore’s Chartered Semiconductor.

According to Gartner,in 2020, the company was the third largest foundry in the world based on external sales.

GlobalFoundries previously gave up on the kind of leading-edge production that would match the capabilities of Taiwan Semiconductor or Samsung.Instead,it's serving the market for less advanced chips, which are increasingly critical to carmakers and other industries.

GlobalFoundries has over50ecosystem partners spanning IP, electronic design automation, outsourced assembly and test and design services. Building on an existing library of more than4,000IP titles, it currently has more than950IP titles in active development across26process nodes and34IP partners.

The company has built deep strategic partnerships witha broad base of more than 200 customers as of December 31, 2020, many of whom are the global leaders in their field.

In the first six months of 2021, the top ten customers, based on wafer shipment volume, included Qualcomm, MediaTek, NXP Semiconductors, Qorvo, Cirrus Logic, Advanced Micro Devices (“AMD”), Skyworks Solutions, Murata Manufacturing, Samsung Electronics and Broadcom.

The company attracted a large share of single-sourced products and long-term supply agreements. As of the date of the company's prospectus,the aggregate lifetime revenue commitment reflected by these agreements amounted to more than $19.5 billion.

A key measure of GlobalFoundries's position as a strategic partner to the customers is the mix of wafer shipment volume attributable to single-sourced business (Single-sourced products are defined as those that can only be manufactured with GlobalFoundries's technology and cannot be manufactured elsewhere without significant customer redesigns).It represented approximately61% of wafer shipment volume in 2020, up from 47% in 2018.

Financial Performance

Revenue at GlobalFoundries dropped last year by 17% to $4.85 billion. GlobalFoundries said the reason is that it divested a business that brought in $391 million in 2019, and more broadly the company shifted contractual terms with most of its customers, changing how and when it recognizes revenue.

In the first half of 2021, revenue climbed by 13% from a year earlier to just over $3 billion.

Click to view the prospectus

+2

82

22

KHINHSUHLAING

liked

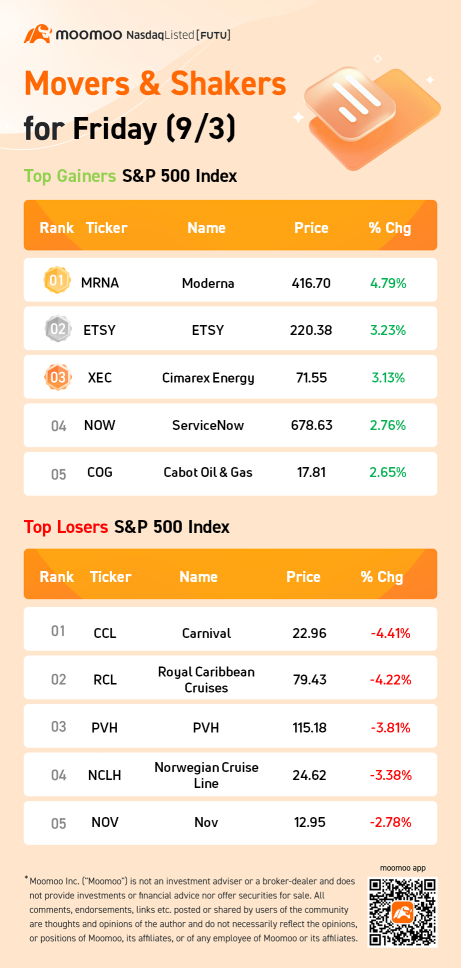

Asian stocks set for steady open; Bond yields jump

Asian stocks looked set for a steady open Friday after U.S. shares rallied and sovereign bond yields surged on economic optimism.

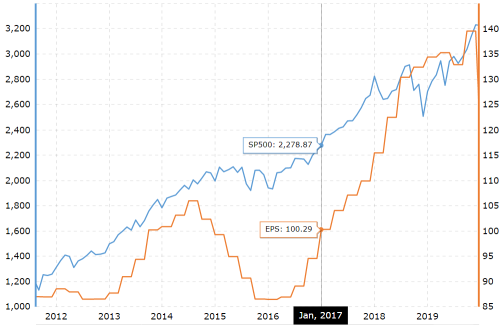

Futures rose in Japan, were little changed in Australia and dipped in Hong Kong. The $S&P 500 Index(.SPX.US$posted its biggest two-day gain since July, led by economically-sensitive sectors like energy and financials, as investors embraced the view that a looming reduction in Federal Reserve stimulus affirms the recovery from the pandemic. U.S equity contracts fluctuated.

Stock-bond divergence mystery eases, signaling belief in growth

An enduring mystery of 2021 markets showed signs of unwinding Thursday, with divergent signals on economic growth in stocks and bonds beginning to harmonize.

Struggling DraftKings finds buyers in Wood's ARK, retail traders

Cathie Wood and buy-the-dip retail traders are snapping up shares of $DraftKings(DKNG.US$and boosting the stock after it got hammered this week over its move to U.K. gambling company Entain.

Wood's Ark bought roughly 770,000 shares of Boston-based DraftKings on Wednesday across two exchange-traded funds. Those buys follow a rush of retail investors who snatched up $44 million worth of shares on Tuesday and added another $11 million Wednesday. DraftKings shares surged as much as 2.3% out of the gate Thursday.

Costco sales rose 17% in latest quarter

$Costco(COST.US$sales increased in its latest quarter but inflationary pressures continued to build. The wholesale retail chain estimated overall price inflation on its products were in the 3.5% to 4.5% range, up from its earlier estimate of 2.5% to 3.5% in the previous quarter.

Dell plans buybacks, provides post-spinoff outlook

$Dell Technologies(DELL.US$is planning a $5 billion share-repurchase program and projected revenue growth of up to 4% annually through fiscal 2026 as it nears the spinoff of its majority stake in $VMware Inc(VMW.US$in November.

The company also plans to start paying dividends to shareholders in the fiscal quarter that will run through April 2022. Dell is targeting dividends of about $1 billion a year, it said Thursday.

Salesforce boosts sales outlook as pandemic continues to lift demand

$Salesforce(CRM.US$, the market leader in sales software, raised its revenue guidance for the fiscal year that ends Jan. 31 to a range between $26.25 billion and $26.35 billion, a jump from its previous estimate of $26.2 billion to $26.3 billion.

The company expects the growth to continue the following year. It predicts revenue between $31.65 billion and $31.8 billion for the fiscal year ending January 2023. The company's shares Thursday rose close to 7% on the news.

Nike shares fall as supply chain havoc leads retailer to slash revenue forecast

$Nike(NKE.US$said that global supply chain congestion is hurting the business more than it previously anticipated. The sneaker giant lowered its fiscal 2022 outlook to account for longer transit times, labor shortages and prolonged production shutdowns in Vietnam.

Nike now expects full-year sales to increase mid-single digits, compared with a prior outlook of low-double digit growth. Shares dropped more than 3% in extended trading Thursday.

JPMorgan says flows show the buy-the-dip mantra is at risk

Flow measures for the S&P 500 Index signal that the psychology of buying the dip in U.S. equities is fraying, according to JPMorgan Chase & Co. strategists.

An outflow of $11 billion from equity exchange-traded funds on Sept. 20 -- the biggest on a down day this year outside of quarterly options and futures expirations -- is "rather concerning" because it's inconsistent with the buy-the-dip behavior that's helped propel equities higher for months, JPMorgan strategists led by Nikolaos Panigirtzoglou wrote in a note Wednesday.

Source: Bloomberg, WSJ,CNBC

Asian stocks looked set for a steady open Friday after U.S. shares rallied and sovereign bond yields surged on economic optimism.

Futures rose in Japan, were little changed in Australia and dipped in Hong Kong. The $S&P 500 Index(.SPX.US$posted its biggest two-day gain since July, led by economically-sensitive sectors like energy and financials, as investors embraced the view that a looming reduction in Federal Reserve stimulus affirms the recovery from the pandemic. U.S equity contracts fluctuated.

Stock-bond divergence mystery eases, signaling belief in growth

An enduring mystery of 2021 markets showed signs of unwinding Thursday, with divergent signals on economic growth in stocks and bonds beginning to harmonize.

Struggling DraftKings finds buyers in Wood's ARK, retail traders

Cathie Wood and buy-the-dip retail traders are snapping up shares of $DraftKings(DKNG.US$and boosting the stock after it got hammered this week over its move to U.K. gambling company Entain.

Wood's Ark bought roughly 770,000 shares of Boston-based DraftKings on Wednesday across two exchange-traded funds. Those buys follow a rush of retail investors who snatched up $44 million worth of shares on Tuesday and added another $11 million Wednesday. DraftKings shares surged as much as 2.3% out of the gate Thursday.

Costco sales rose 17% in latest quarter

$Costco(COST.US$sales increased in its latest quarter but inflationary pressures continued to build. The wholesale retail chain estimated overall price inflation on its products were in the 3.5% to 4.5% range, up from its earlier estimate of 2.5% to 3.5% in the previous quarter.

Dell plans buybacks, provides post-spinoff outlook

$Dell Technologies(DELL.US$is planning a $5 billion share-repurchase program and projected revenue growth of up to 4% annually through fiscal 2026 as it nears the spinoff of its majority stake in $VMware Inc(VMW.US$in November.

The company also plans to start paying dividends to shareholders in the fiscal quarter that will run through April 2022. Dell is targeting dividends of about $1 billion a year, it said Thursday.

Salesforce boosts sales outlook as pandemic continues to lift demand

$Salesforce(CRM.US$, the market leader in sales software, raised its revenue guidance for the fiscal year that ends Jan. 31 to a range between $26.25 billion and $26.35 billion, a jump from its previous estimate of $26.2 billion to $26.3 billion.

The company expects the growth to continue the following year. It predicts revenue between $31.65 billion and $31.8 billion for the fiscal year ending January 2023. The company's shares Thursday rose close to 7% on the news.

Nike shares fall as supply chain havoc leads retailer to slash revenue forecast

$Nike(NKE.US$said that global supply chain congestion is hurting the business more than it previously anticipated. The sneaker giant lowered its fiscal 2022 outlook to account for longer transit times, labor shortages and prolonged production shutdowns in Vietnam.

Nike now expects full-year sales to increase mid-single digits, compared with a prior outlook of low-double digit growth. Shares dropped more than 3% in extended trading Thursday.

JPMorgan says flows show the buy-the-dip mantra is at risk

Flow measures for the S&P 500 Index signal that the psychology of buying the dip in U.S. equities is fraying, according to JPMorgan Chase & Co. strategists.

An outflow of $11 billion from equity exchange-traded funds on Sept. 20 -- the biggest on a down day this year outside of quarterly options and futures expirations -- is "rather concerning" because it's inconsistent with the buy-the-dip behavior that's helped propel equities higher for months, JPMorgan strategists led by Nikolaos Panigirtzoglou wrote in a note Wednesday.

Source: Bloomberg, WSJ,CNBC

50

9

KHINHSUHLAING

liked

In 2021, Futu turns 9 years old. Having accompanied millions of users for 9 years.

As we celebrate our 9th birthday, we look back into the past and try to uncover memorable moments, and found that every unforgettable moment was spent with you—our dear users:

In 2012, Futu embarked on an exciting journey with you.

In 2019, we were listed on the Nasdaq.

In 2020, we onboarded our 10 millionth user.

In 2021, we advanced into more markets across the globe, welcoming more than 15.5 million users from over 200 countries and regions…

As we celebrate our 9th birthday, we feel ever more motivated by our founding vision: “make investing easier and not alone”. It is the millions of users in our community that make investing “not alone”. These 9 years with you are the best time that we have ever spent.

As we celebrate our 9th birthday, we would like you to know: We wish to continue accompanying you on your investing journey ahead, for the next 9 years or even 90 years.

As we celebrate our 9th birthday, we sincerely want to invite you - our dear users - to share your moomoo stories in the past years.

[About the Event]

We wish to invite our users to share their moomoo stories and 9 representative users will be selected. If you are interested, please send your moomoo story or your self-introduction to the official email address: futupr@futunn.com.

The email should include: (ideally 300-500 words, the more the better)

-Your name, moomoo ID, Nationality, Occupation

-Your moomoo story: When you started using Futu services and products via moomoo; what you want to share with us and fellow users

-A casual photo of yourself or a photo of you with a moomoo figurine (optional, less than 5M)

[What to Do If I Am Selected as a Representative User?]

① You should be willing to take an interview themed "My moomoo Story", which will be disseminated via global and Futu/moomoo official media channels in the form of image and text.

② You should be willing to take a photo against a pure-colored background or a photo that presents your daily life. The photo will be used for the poster of "Futu 9th Anniversary—Representative Users", which will be disseminated globally.

③ You should be willing to participate in a video filming. The video will be used for the video of "Futu 9th Anniversary—Representative Users", which will be disseminated globally.

*Detailed information on the specifications of the photos and videos will be further discussed with you by our staff.

[Application Period]

September 16 – September 22

[Gift Package for Selected Users]

If you are selected as a representative user, share your Futu story, and participate in the photo taking and video filming, you will receive a US$999 stock card*, and a lucky bag containing exquisite moomoo merchandise.

[Gift Package for Event Participants]

User that actively participated in the Event but are not selected will receive 999 points* as a thank you gift.

*T&Cs apply:

Singapore Users: tap to read full T&Cs

U.S. Users: tap to read full T&Cs

As we celebrate our 9th birthday, we look back into the past and try to uncover memorable moments, and found that every unforgettable moment was spent with you—our dear users:

In 2012, Futu embarked on an exciting journey with you.

In 2019, we were listed on the Nasdaq.

In 2020, we onboarded our 10 millionth user.

In 2021, we advanced into more markets across the globe, welcoming more than 15.5 million users from over 200 countries and regions…

As we celebrate our 9th birthday, we feel ever more motivated by our founding vision: “make investing easier and not alone”. It is the millions of users in our community that make investing “not alone”. These 9 years with you are the best time that we have ever spent.

As we celebrate our 9th birthday, we would like you to know: We wish to continue accompanying you on your investing journey ahead, for the next 9 years or even 90 years.

As we celebrate our 9th birthday, we sincerely want to invite you - our dear users - to share your moomoo stories in the past years.

[About the Event]

We wish to invite our users to share their moomoo stories and 9 representative users will be selected. If you are interested, please send your moomoo story or your self-introduction to the official email address: futupr@futunn.com.

The email should include: (ideally 300-500 words, the more the better)

-Your name, moomoo ID, Nationality, Occupation

-Your moomoo story: When you started using Futu services and products via moomoo; what you want to share with us and fellow users

-A casual photo of yourself or a photo of you with a moomoo figurine (optional, less than 5M)

[What to Do If I Am Selected as a Representative User?]

① You should be willing to take an interview themed "My moomoo Story", which will be disseminated via global and Futu/moomoo official media channels in the form of image and text.

② You should be willing to take a photo against a pure-colored background or a photo that presents your daily life. The photo will be used for the poster of "Futu 9th Anniversary—Representative Users", which will be disseminated globally.

③ You should be willing to participate in a video filming. The video will be used for the video of "Futu 9th Anniversary—Representative Users", which will be disseminated globally.

*Detailed information on the specifications of the photos and videos will be further discussed with you by our staff.

[Application Period]

September 16 – September 22

[Gift Package for Selected Users]

If you are selected as a representative user, share your Futu story, and participate in the photo taking and video filming, you will receive a US$999 stock card*, and a lucky bag containing exquisite moomoo merchandise.

[Gift Package for Event Participants]

User that actively participated in the Event but are not selected will receive 999 points* as a thank you gift.

*T&Cs apply:

Singapore Users: tap to read full T&Cs

U.S. Users: tap to read full T&Cs

![[Call for Stories] Futu Turns 9 and You Are Invited to Share Your “moomoo Stories”!](https://ussnsimg.moomoo.com/1631868222118-77777004-android-org.jpg/thumb)

904

1077

KHINHSUHLAING

liked

Stocks are likely to look beyond Friday's surprisingly soft August jobs report and latch onto the latest data on labor and inflation in the coming week's jobless claims and producer price index.

Stocks were mixed in the past week ahead of the long Labor Day weekend, with the $Nasdaq Composite Index(.IXIC.US$ outperforming, the $S&P 500 Index(.SPX.US$ rising slightly and the $Dow Jones Industrial Average(.DJI.US$ flat. The best-performing sectors were on the defensive side, led by real estate investment trusts, utilities, consumer staples and health care.

...

Stocks were mixed in the past week ahead of the long Labor Day weekend, with the $Nasdaq Composite Index(.IXIC.US$ outperforming, the $S&P 500 Index(.SPX.US$ rising slightly and the $Dow Jones Industrial Average(.DJI.US$ flat. The best-performing sectors were on the defensive side, led by real estate investment trusts, utilities, consumer staples and health care.

...

76

22

KHINHSUHLAING

liked

Want to redeem the privileged moomoo coupons or figures?![]()

![]()

Need more moomoo points?![]()

![]()

The long-awaited event is finally coming!

We’re giving away 14K+ Points to help you achieve your goals.![]()

![]()

Don’t miss the new lessons on Courses this week. Video version, you are gonna love it!

![]() How to join this event?

How to join this event?

Only two steps needed.

1. Learn the new lessons:

Where to attend:

🔗 https://live.moomoo.com/course/36078

2. Comment on THIS post

Share you...

Need more moomoo points?

The long-awaited event is finally coming!

We’re giving away 14K+ Points to help you achieve your goals.

Don’t miss the new lessons on Courses this week. Video version, you are gonna love it!

Only two steps needed.

1. Learn the new lessons:

Where to attend:

🔗 https://live.moomoo.com/course/36078

2. Comment on THIS post

Share you...

![[Free Gifts] Back to Courses. Learn new lessons for 999 points!](https://ussnsimg.moomoo.com/2021090100001230362694db9a5.png/thumb)

![[Free Gifts] Back to Courses. Learn new lessons for 999 points!](https://ussnsimg.moomoo.com/2021090100001232132f0dbedaa.png/thumb)

![[Free Gifts] Back to Courses. Learn new lessons for 999 points!](https://ussnsimg.moomoo.com/20210901000012339353586e4a7.png/thumb)

281

344

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

KHINHSUHLAING :