iris of the lambs

liked

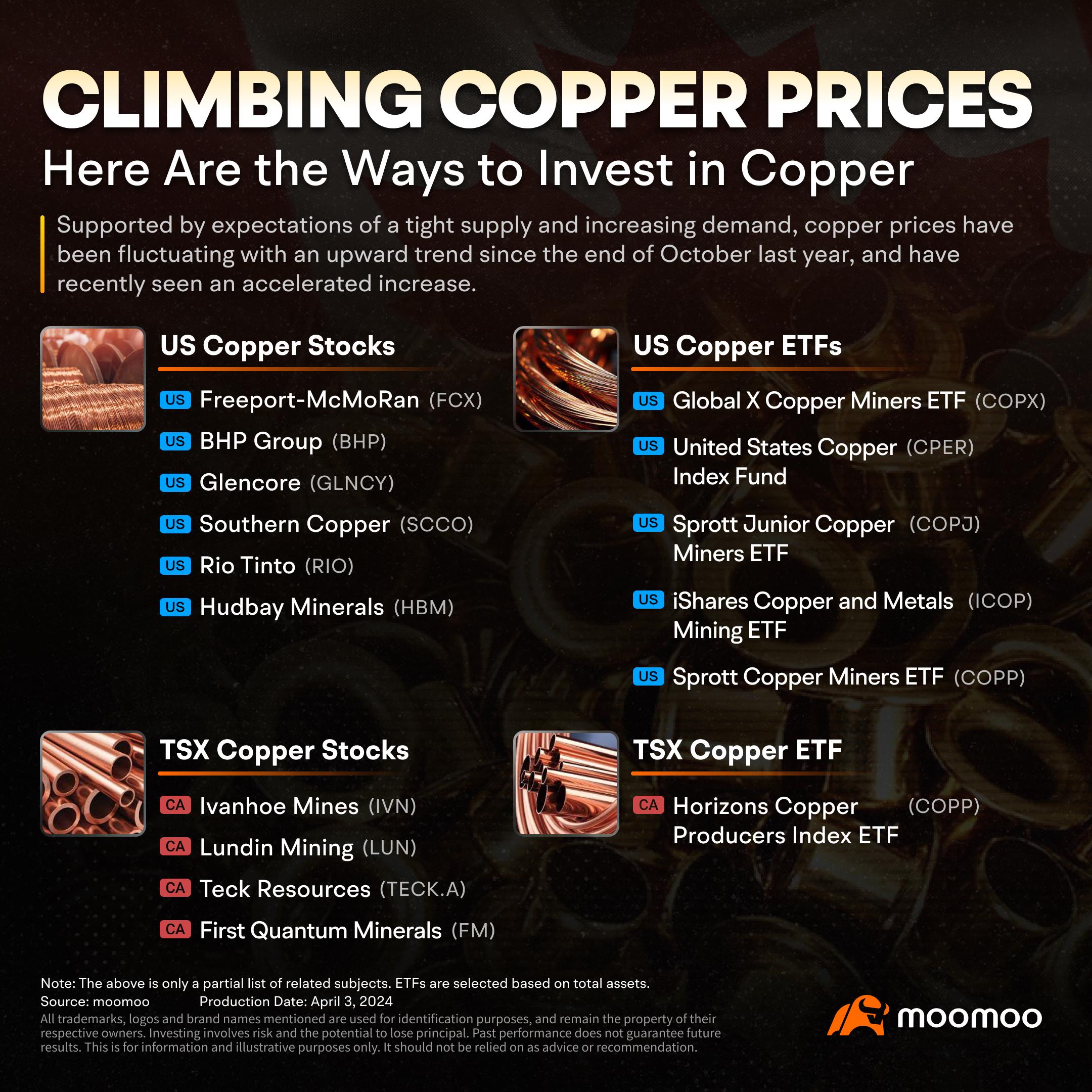

The copper market is currently experiencing a robust upswing, propelled by a confluence of factors, including supply challenges and cyclical improvements in the global economy. LME's copper futures have surged above the psychological mark of US$10,000 per metric ton and are heading toward US$15,000.

What are the driving forces behind this surge, and how can you effectively tap into this metal's potential through dive...

What are the driving forces behind this surge, and how can you effectively tap into this metal's potential through dive...

30

iris of the lambs

liked

$SCABLE(5170.MY$

PN17's Sarawak Cable (SCABLE, 5170, Motherboard Industrial Co., Ltd.) was unable to reach an agreement with White Samurai, and the rescue plan came to an end. The stock price once fell by nearly 26%, but at the end of the day it ushered in a major reversal, rising 3.23%.

Perhaps investors are happy to see the agreement come to an end, which may attract better white warriors and cause everyone to enter the tray.

Or maybe large investors intend to sell off stocks and buy large sums of money at the end of the day to get out of the way. This is unknown.

The company announced yesterday on the Malaysian Exchange that it was unable to agree with White Warrior Serendib Capital on the exclusive corporate relationship stipulated by the two parties at the end of 2023.

Earlier, Sarawak Cable confirmed that the British investment agency Serendib Capital will be the white samurai to save the company and inject RM250 million to get the company back on track.

The news of the rescue once caused the stock to soar to a maximum of 48 cents, but since then, amid intense fluctuations, the stock price has already slipped.

Source: Nanyang Siang Pao

Disclaimer: This content is for informational and educational purposes only, and does not constitute any specific investment, investment strategy, or recommendation endorsement. The reader shall bear any risk and responsibility arising from reliance on this content. Always conduct your own independent research and evaluation and consult professional advice if necessary before making any investment decisions. The author and related participants are not responsible for any loss or damage resulting from the use or reliance on the information contained in this article.

PN17's Sarawak Cable (SCABLE, 5170, Motherboard Industrial Co., Ltd.) was unable to reach an agreement with White Samurai, and the rescue plan came to an end. The stock price once fell by nearly 26%, but at the end of the day it ushered in a major reversal, rising 3.23%.

Perhaps investors are happy to see the agreement come to an end, which may attract better white warriors and cause everyone to enter the tray.

Or maybe large investors intend to sell off stocks and buy large sums of money at the end of the day to get out of the way. This is unknown.

The company announced yesterday on the Malaysian Exchange that it was unable to agree with White Warrior Serendib Capital on the exclusive corporate relationship stipulated by the two parties at the end of 2023.

Earlier, Sarawak Cable confirmed that the British investment agency Serendib Capital will be the white samurai to save the company and inject RM250 million to get the company back on track.

The news of the rescue once caused the stock to soar to a maximum of 48 cents, but since then, amid intense fluctuations, the stock price has already slipped.

Source: Nanyang Siang Pao

Disclaimer: This content is for informational and educational purposes only, and does not constitute any specific investment, investment strategy, or recommendation endorsement. The reader shall bear any risk and responsibility arising from reliance on this content. Always conduct your own independent research and evaluation and consult professional advice if necessary before making any investment decisions. The author and related participants are not responsible for any loss or damage resulting from the use or reliance on the information contained in this article.

Translated

16

iris of the lambs

liked

May Arbitrage Exit Spell Expired? Summarize the brave move towards 1610 points

Report: @Jungle lee

Investors are currently filled with excitement, not only driving up the trend of Malaysian stocks, but also driving the FTSE Composite Index $FTSE Bursa Malaysia KLCI Index(.KLSE.MY$ Does breaking through 1,600 points mean that the “sell in May and go away” (sell in May and go away) spell is no longer suitable to be applied to horse stocks?

“May arbitrage leaves the market” is actually a common phrase on Wall Street in the US, because all major US companies will announce their performance during the April period, and specific economic data will also be released during that period, and investors may make profits one after another and leave the market, which in turn puts selling pressure on the stock market.

Incidentally, in the Oriental Stock Market, there is also a saying “the five poor, six, seven out of seven.”

Although the East and West have different understandings about when the market will resume its bull market — the East thinks it can turn around in July, while the West thinks it will be necessary to wait until after Halloween (that is, November); one thing the two sides have in common is that the bear market began in May.

However, if you look at the current trend, that is, the four-day trading day starting May 2 was a situation where Malaysian stocks soared sharply. It seems that the relevant proverb cannot be applied to the trend of Malaysian stocks in May this year.

Judging from today's trend, the composite index was at the level of 1,600 points at the beginning, and now it has taken a leap forward. 1...

Report: @Jungle lee

Investors are currently filled with excitement, not only driving up the trend of Malaysian stocks, but also driving the FTSE Composite Index $FTSE Bursa Malaysia KLCI Index(.KLSE.MY$ Does breaking through 1,600 points mean that the “sell in May and go away” (sell in May and go away) spell is no longer suitable to be applied to horse stocks?

“May arbitrage leaves the market” is actually a common phrase on Wall Street in the US, because all major US companies will announce their performance during the April period, and specific economic data will also be released during that period, and investors may make profits one after another and leave the market, which in turn puts selling pressure on the stock market.

Incidentally, in the Oriental Stock Market, there is also a saying “the five poor, six, seven out of seven.”

Although the East and West have different understandings about when the market will resume its bull market — the East thinks it can turn around in July, while the West thinks it will be necessary to wait until after Halloween (that is, November); one thing the two sides have in common is that the bear market began in May.

However, if you look at the current trend, that is, the four-day trading day starting May 2 was a situation where Malaysian stocks soared sharply. It seems that the relevant proverb cannot be applied to the trend of Malaysian stocks in May this year.

Judging from today's trend, the composite index was at the level of 1,600 points at the beginning, and now it has taken a leap forward. 1...

Translated

From YouTube

25

iris of the lambs

liked

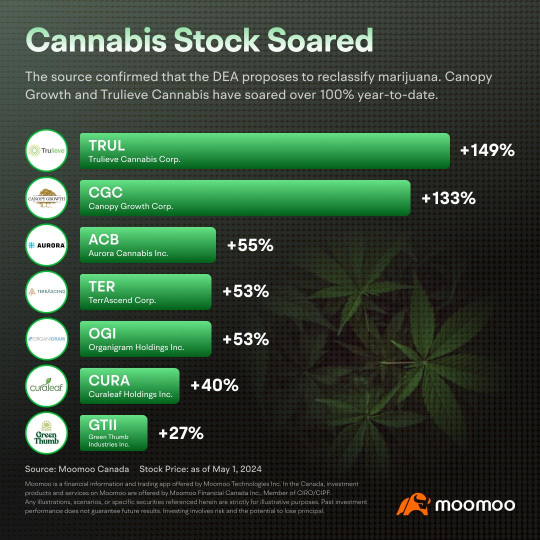

Last week marked a historic day for the cannabis industry as the U.S. Drug Enforcement Administration (DEA) unveiled plans to reevaluate marijuana's classification as a less dangerous drug. In response to this significant development, cannabis stocks surged. What impacts will this have on the industry? What new avenues for investment and risks are poised to emerge?

What happened?

Marijuana has been classified as her...

What happened?

Marijuana has been classified as her...

48

iris of the lambs

liked

$YTL(4677.MY$ & $YTLPOWR(6742.MY$ both companies hit another record high yesterday. Both companies are also among the top gainers of KLCI component stocks since YTD. On top of strong fundamental base, I dig into their charting to identify where is the next resistance level, and is there any potential short term correction signal for me to enter at cheaper price.

$YTL(4677.MY$ Daily Chart

There is a strong support from buyers as (1) multiple higher...

$YTL(4677.MY$ Daily Chart

There is a strong support from buyers as (1) multiple higher...

27

4

iris of the lambs

liked

Due to repeated optimism from brokerage firms, Yang Zhongli's institutional stock price has broken a new high

$YTL(4677.MY$Driven by its three major businesses, utilities, construction, and ash, analysts are optimistic that its stock price still has plenty of room to rise, and the reasonable price has been raised sharply to RM3.33.

Following the release of Hong Leong Investment Bank's optimistic report, Yang Zhongli's agency received incentives today and its stock price broke a new high. The stock price rose 6 cents or 2.21% throughout the day, and the closing report was RM2.77.

An analyst at Fenglong Investment Bank pointed out that Yang Zhongli's three major businesses are $YTLPOWR(6742.MY$Mainly utilities, as well as construction and ash, are important drivers of its strong profit potential.

“In particular, Yang Zhongli Electric Power, Yang Zhongli's agency will rely heavily on this 55.6% subsidiary to achieve outstanding results.”

Yang Zhongli's electricity is still strong

He said that Yang Zhongli Electric Power delivered strong profit performance in the past few quarters, thanks to the contribution of Singaporean subsidiary SerayaPower.

“SerayaPower and the Jordanian affiliate Attarat power plant are expected to maintain a steady profit contribution.”

Meanwhile, analysts said that its British water subsidiary, WessexWater, is expected to turn a loss into a profit starting at the end of the current fiscal year, which will further boost the future profit performance of Yang Zhongli's utilities.

The newly emerging data center business is also viewed by analysts as one of Yang Zhongli's future growth drivers.

“500 megawatts...

$YTL(4677.MY$Driven by its three major businesses, utilities, construction, and ash, analysts are optimistic that its stock price still has plenty of room to rise, and the reasonable price has been raised sharply to RM3.33.

Following the release of Hong Leong Investment Bank's optimistic report, Yang Zhongli's agency received incentives today and its stock price broke a new high. The stock price rose 6 cents or 2.21% throughout the day, and the closing report was RM2.77.

An analyst at Fenglong Investment Bank pointed out that Yang Zhongli's three major businesses are $YTLPOWR(6742.MY$Mainly utilities, as well as construction and ash, are important drivers of its strong profit potential.

“In particular, Yang Zhongli Electric Power, Yang Zhongli's agency will rely heavily on this 55.6% subsidiary to achieve outstanding results.”

Yang Zhongli's electricity is still strong

He said that Yang Zhongli Electric Power delivered strong profit performance in the past few quarters, thanks to the contribution of Singaporean subsidiary SerayaPower.

“SerayaPower and the Jordanian affiliate Attarat power plant are expected to maintain a steady profit contribution.”

Meanwhile, analysts said that its British water subsidiary, WessexWater, is expected to turn a loss into a profit starting at the end of the current fiscal year, which will further boost the future profit performance of Yang Zhongli's utilities.

The newly emerging data center business is also viewed by analysts as one of Yang Zhongli's future growth drivers.

“500 megawatts...

Translated

26

3

iris of the lambs

liked

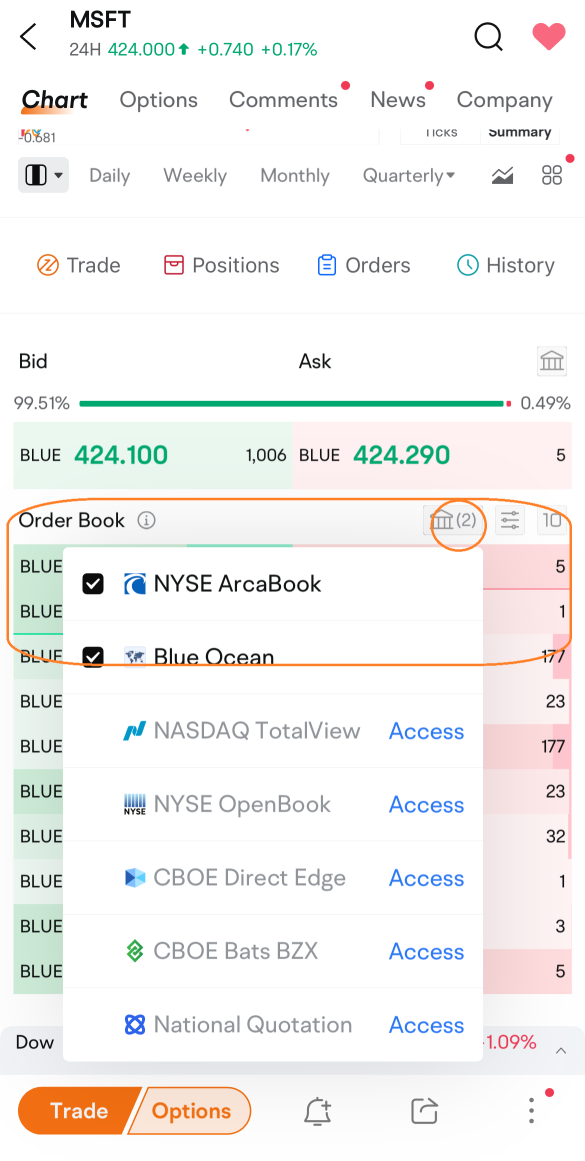

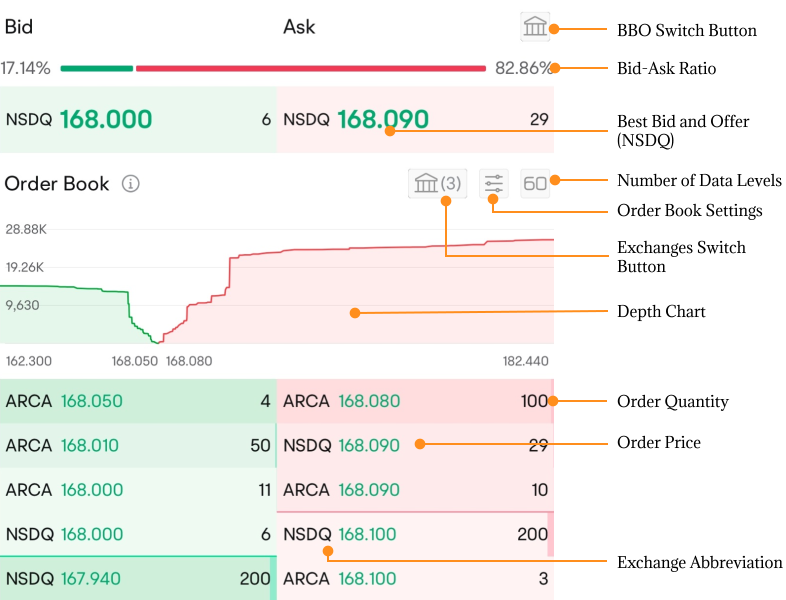

Moomoo is thrilled to announce a global strategic partnership with Nasdaq. This collaboration unlocks an exclusive opportunity for our users: a limited-time offer to access up to 3 months of Nasdaq TotalView Level 2 real-time streaming quotes for free*.

Claim now>>>https://j.moomoo.com/00RI2z

Images provided are not current and any securities are shown for illustrative purposes only and is not a rec...

Claim now>>>https://j.moomoo.com/00RI2z

Images provided are not current and any securities are shown for illustrative purposes only and is not a rec...

+2

61

9

iris of the lambs

liked

Good morning mooers! Here are things you need to know about today's market:

● S&P/TSX 60 Index Standard Futures are trading at 1,318.40, up 0.05%.

● Financial experts see lower recession risk, slower rate cuts: BoC survey

● Higher US LNG deliveries, easing geopolitical tensions to put pressure on EU natural gas prices, Commerzbank says

● Canada aims to attract Honda and ...

● S&P/TSX 60 Index Standard Futures are trading at 1,318.40, up 0.05%.

● Financial experts see lower recession risk, slower rate cuts: BoC survey

● Higher US LNG deliveries, easing geopolitical tensions to put pressure on EU natural gas prices, Commerzbank says

● Canada aims to attract Honda and ...

32

iris of the lambs

liked

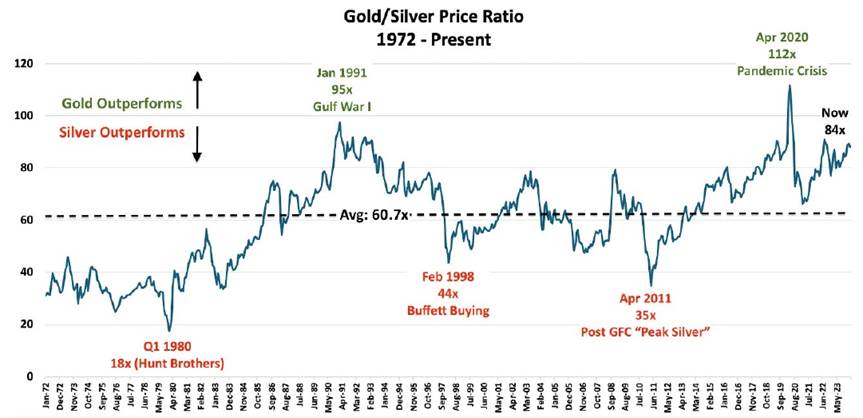

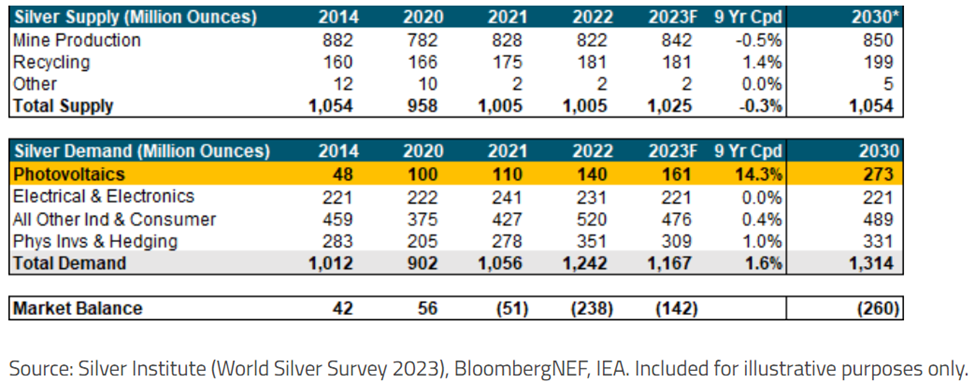

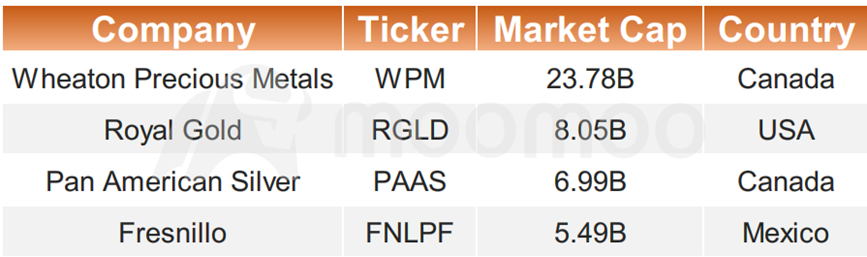

Gold prices have risen more than 15.6% this year. For investors who missed gold, silver is likely an alternative investment with the potential to catch up for the gains.

Although gold is considered a better safe-haven asset, silver offers several compelling reasons for consideration. The silver market is smaller and more volatile than gold, which means it has the potential for higher percentage gains.

Moreov...

Although gold is considered a better safe-haven asset, silver offers several compelling reasons for consideration. The silver market is smaller and more volatile than gold, which means it has the potential for higher percentage gains.

Moreov...

64

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)