Investor84

liked

$Netflix(NFLX.US$

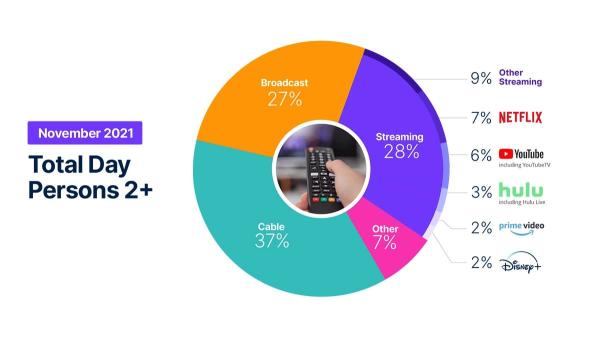

Broadcast television used the fall season to grow its share of total television viewing for the past couple of months, pulling even with streaming. But while a holiday month meant more TV time in general, it also meant lots of students spending time at home - and more time playing games.

Broadcast TV shed a point of share in November, and that point went to the "Other" usage category that includes videogames, according to "The Gauge" from Nielsen, its monthly macro look at TV delivery platforms.

Streaming had been tied with broadcast at 28% share, but broadcast drops back to 27%, and "Other" (including uses like watching video discs along with gaming) moves up to 7%. Cable share remained flat at 37%:

Broadcast television used the fall season to grow its share of total television viewing for the past couple of months, pulling even with streaming. But while a holiday month meant more TV time in general, it also meant lots of students spending time at home - and more time playing games.

Broadcast TV shed a point of share in November, and that point went to the "Other" usage category that includes videogames, according to "The Gauge" from Nielsen, its monthly macro look at TV delivery platforms.

Streaming had been tied with broadcast at 28% share, but broadcast drops back to 27%, and "Other" (including uses like watching video discs along with gaming) moves up to 7%. Cable share remained flat at 37%:

41

Investor84

liked

HONG KONG, December 17, 2021 -- Futu Holdings Limited (“Futu” or the “Company”) (Nasdaq:FUTU), a leading tech-driven online brokerage and wealth management platform, today responds to the media speculations regarding potential PRC regulatory policies that may have a material adverse impact on the Company’s business operation. As a Nasdaq-listed company, Futu is committed to timely disclose recent developments that may have a material adverse impact on the Company’s business operation, including regulatory developments.

Futu always maintains active communication with different competent PRC regulatory authorities in its ordinary course of business.To date, the Company has not received (nor is it aware of) any notice, guidance or order from any PRC regulatory authorities which is expected to have a material adverse impact on its business operation or financial conditions. The Company has been operating steadily and will continue to serve existing and new clients.

In terms of serving the PRC clients, Futu has been a biding by the same rules and regulations and adopting the similar industry practices and business models as other brokers who hold the same type of licenses in Hong Kong. No further innovations or breakthroughs have been made by Futu with respect to the business model. There is no such “internet broker-dealer”category or definition under relevant legal framework and nowadays almost all broker-dealers are using internet (through App and/or website) to serve their clients. Futu will keep monitoring regulatory developments and continue to fully cooperate with relevant regulatory authorities.

During the recent period, the Company noticed that some individuals and institutions have been spreading false or fake information about Futu on social media with the purpose of profiting from short-selling. We have gathered relevant information and further reported to relevant regulators. We also reserve our right to take legal action.

We believe that the regulatory authorities in mainland China and Hong Kong have always attached great importance to protecting investors, maintaining a healthy and stable financial market, and prudently formulating policies and guiding the industry. We caution the media and the public to distinguish false and fake information and avoid being taken advantage of.

About Futu Holdings Limited

Futu Holdings Limited (Nasdaq: FUTU) is an advanced technology company transforming the investing experience by offering a fully digitized brokerage and wealth management platform. The Company primarily serves the emerging affluent population, pursuing a massive opportunity tofacilitate a once-in-a-generation shift in the wealth management industry and build a digital gateway into broader financial services. The Company provides investing services through its proprietary digital platform, Futubull and moomoo, each a highly integrated application accessible through anymobile device, tablet or desktop. The Company's primary fee-generating services include trade execution and margin financing which allow its clients to trade securities, such as stocks, warrants, options, futures and exchange-tradedfunds, or ETFs, across different markets. Futu has also embedded social media tools to create a network centered around its users and provide connectivity tousers, investors, companies, analysts, media and key opinion leaders.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the "safe harbor"provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as"will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar statements. Among otherthings, the quotations from the management team of the Company, contain forward-looking statements. Futu may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Futu's beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors couldcause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: Futu's goal and strategies; Futu's expansion plans; Futu's future business development, financial condition and results of operations; Futu's expectations regarding demand for, and market acceptance of, its credit products; Futu's expectations regarding keeping and strengthening its relationships with borrowers, institutional funding partners, merchandise suppliers and other parties it collaborate with; general economic and business conditions; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Futu's filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release, and Futu does not undertake any obligation toupdate any forward-looking statement, except as required under applicable law.

For investor inquiries, please contact:

Investor Relations

Futu Holdings Limited

ir@futuholdings.com

Futu always maintains active communication with different competent PRC regulatory authorities in its ordinary course of business.To date, the Company has not received (nor is it aware of) any notice, guidance or order from any PRC regulatory authorities which is expected to have a material adverse impact on its business operation or financial conditions. The Company has been operating steadily and will continue to serve existing and new clients.

In terms of serving the PRC clients, Futu has been a biding by the same rules and regulations and adopting the similar industry practices and business models as other brokers who hold the same type of licenses in Hong Kong. No further innovations or breakthroughs have been made by Futu with respect to the business model. There is no such “internet broker-dealer”category or definition under relevant legal framework and nowadays almost all broker-dealers are using internet (through App and/or website) to serve their clients. Futu will keep monitoring regulatory developments and continue to fully cooperate with relevant regulatory authorities.

During the recent period, the Company noticed that some individuals and institutions have been spreading false or fake information about Futu on social media with the purpose of profiting from short-selling. We have gathered relevant information and further reported to relevant regulators. We also reserve our right to take legal action.

We believe that the regulatory authorities in mainland China and Hong Kong have always attached great importance to protecting investors, maintaining a healthy and stable financial market, and prudently formulating policies and guiding the industry. We caution the media and the public to distinguish false and fake information and avoid being taken advantage of.

About Futu Holdings Limited

Futu Holdings Limited (Nasdaq: FUTU) is an advanced technology company transforming the investing experience by offering a fully digitized brokerage and wealth management platform. The Company primarily serves the emerging affluent population, pursuing a massive opportunity tofacilitate a once-in-a-generation shift in the wealth management industry and build a digital gateway into broader financial services. The Company provides investing services through its proprietary digital platform, Futubull and moomoo, each a highly integrated application accessible through anymobile device, tablet or desktop. The Company's primary fee-generating services include trade execution and margin financing which allow its clients to trade securities, such as stocks, warrants, options, futures and exchange-tradedfunds, or ETFs, across different markets. Futu has also embedded social media tools to create a network centered around its users and provide connectivity tousers, investors, companies, analysts, media and key opinion leaders.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the "safe harbor"provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as"will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar statements. Among otherthings, the quotations from the management team of the Company, contain forward-looking statements. Futu may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Futu's beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors couldcause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: Futu's goal and strategies; Futu's expansion plans; Futu's future business development, financial condition and results of operations; Futu's expectations regarding demand for, and market acceptance of, its credit products; Futu's expectations regarding keeping and strengthening its relationships with borrowers, institutional funding partners, merchandise suppliers and other parties it collaborate with; general economic and business conditions; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Futu's filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release, and Futu does not undertake any obligation toupdate any forward-looking statement, except as required under applicable law.

For investor inquiries, please contact:

Investor Relations

Futu Holdings Limited

ir@futuholdings.com

62

11

Investor84

liked

$Meta Platforms(FB.US$ Meta going up and down. What should you be expecting this week? Do you know your entry and exit points for meta?

Knowing entry points help you maximise profits and minimise losses. 80% retail traders lose money because they don't kno the right entry and exit points.

Do take some time to watch my video if you missed it yesterday and know the support and resistance levels!

As always trade safe and invest wise!

Knowing entry points help you maximise profits and minimise losses. 80% retail traders lose money because they don't kno the right entry and exit points.

Do take some time to watch my video if you missed it yesterday and know the support and resistance levels!

As always trade safe and invest wise!

17

1

Investor84

liked and commented on

Investor84

reacted to

$Futu Holdings Ltd(FUTU.US$ y red again noooo now my kids have no money for dinner anymore

21

Investor84

liked

$BABA-SW(09988.HK$ if this falls below $120 today, look out for massive China stock sell off in US market tonight

21

7

Investor84

liked

Insiders have greater and earlier access to information and news, which is why insider trades are closely watched. The following are some of the companies whose CEOs have cashed out their stocks this year $NVIDIA(NVDA.US$ $AMC Entertainment(AMC.US$ $Microsoft(MSFT.US$ $Amazon(AMZN.US$ $Tesla(TSLA.US$ $Meta Platforms(FB.US$ $Walmart(WMT.US$ $Alphabet-C(GOOG.US$ $Alphabet-A(GOOGL.US$ $DBS Group Holdings(D05.SG$ When CEOs sell their stock, is it a bad thing? The short answer is it depends.

CEOs get stock options as part of their remuneration package and it is reasonable for CEOs to cash out some of their holdings from time to time to fund their personal or investment needs. For instance, Bezos needed funds for his Bezos Earth Fund. In the US, the sale may be part of a predetermined plan under Rule 10b5-1 to avoid contravening insider trading laws. Despite this, some may argue that the CEO can influence the date of release of news that would be positive or negative for the stock, as could be seen in the speculations generated when the CEO of $Pfizer(PFE.US$ sold $5.6 million of stock on the day of vaccine announcement.

On the other hand, significant sell-offs may indicate the stock is over-valued and/or an expectation that the stock price will become bearish. Even if it were not the case, the market may perceive it to be bad and start selling off in fear, setting off a price fall.

The factors I would consider when assessing whether a sell off is negative are:

1) The percentage of shares the CEO still owns after the sale. If the CEO still has many shares remaining, chances are he believes in the company‘s prospects and his interests are still closely aligned with the company‘s.

2) The fundamentals of the company. If the company is a market leader, I would not be too worried.

3) The greater operating environment (prospects of the economy and sector, signs of regulatory changes etc).

4) Any rumours. This is not dependable unfortunately as rumours can turn out to be false.

In conclusion, a sell off by the CEO may not be a signal to sell. One needs to consider a variety of factors.

Disclaimer: The above is my personal opinion. It is not financial advice or a recommendation to invest. Please consult a financial advisor before making any investment decision.

If you find this article useful, please click![]() below or share your thoughts in the comments. Thanks!

below or share your thoughts in the comments. Thanks!

Making the Most of Star Institutions’ Positions https://www.moomoo.com/community/feed/107411341443078?lang_code=2

CEOs get stock options as part of their remuneration package and it is reasonable for CEOs to cash out some of their holdings from time to time to fund their personal or investment needs. For instance, Bezos needed funds for his Bezos Earth Fund. In the US, the sale may be part of a predetermined plan under Rule 10b5-1 to avoid contravening insider trading laws. Despite this, some may argue that the CEO can influence the date of release of news that would be positive or negative for the stock, as could be seen in the speculations generated when the CEO of $Pfizer(PFE.US$ sold $5.6 million of stock on the day of vaccine announcement.

On the other hand, significant sell-offs may indicate the stock is over-valued and/or an expectation that the stock price will become bearish. Even if it were not the case, the market may perceive it to be bad and start selling off in fear, setting off a price fall.

The factors I would consider when assessing whether a sell off is negative are:

1) The percentage of shares the CEO still owns after the sale. If the CEO still has many shares remaining, chances are he believes in the company‘s prospects and his interests are still closely aligned with the company‘s.

2) The fundamentals of the company. If the company is a market leader, I would not be too worried.

3) The greater operating environment (prospects of the economy and sector, signs of regulatory changes etc).

4) Any rumours. This is not dependable unfortunately as rumours can turn out to be false.

In conclusion, a sell off by the CEO may not be a signal to sell. One needs to consider a variety of factors.

Disclaimer: The above is my personal opinion. It is not financial advice or a recommendation to invest. Please consult a financial advisor before making any investment decision.

If you find this article useful, please click

Making the Most of Star Institutions’ Positions https://www.moomoo.com/community/feed/107411341443078?lang_code=2

38

8

Investor84

reacted to

$Futu Holdings Ltd(FUTU.US$

Hope this umbrella help us to fend off Omicron and may all our counters shoot like rocket soon

Hope this umbrella help us to fend off Omicron and may all our counters shoot like rocket soon

51

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)