Happy O Man

liked and commented on

Good morning mooers! Here are things you need to know about today's Singapore:

●Singapore shares opened lower on Monday; STI down 1.01%

●Commodities face tough week as Fed angst builds

●Stocks and REITs to watch: Singtel, SPH Reit, Aspen

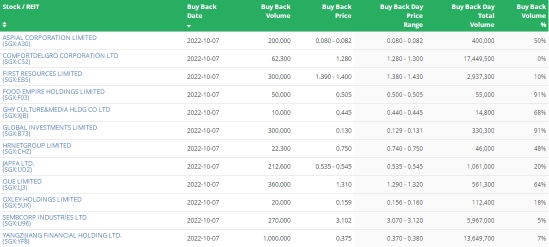

●Latest share buy back transactions

-moomoo News SG

Market Trend

Singapore shares opened lower on Monday. The $FTSE Singapore Straits Time Index(.STI.SG$ decreased 1.01 per cent to 3,114.16 ...

●Singapore shares opened lower on Monday; STI down 1.01%

●Commodities face tough week as Fed angst builds

●Stocks and REITs to watch: Singtel, SPH Reit, Aspen

●Latest share buy back transactions

-moomoo News SG

Market Trend

Singapore shares opened lower on Monday. The $FTSE Singapore Straits Time Index(.STI.SG$ decreased 1.01 per cent to 3,114.16 ...

1443

1387

Happy O Man

commented on

$DiDi Global (Delisted)(DIDI.US$ what’s happening suddenly 🚀🚀🚀

2

Happy O Man

liked

UBS Asset Management recently launched its year-ahead outlook titled, ‘Panorama: Investing in 2022,’ which describes why we believe that investing in 2022 will require a different playbook than investors have used to navigate the past decade.![]()

Barry Gill, Head of Investments at UBS Asset Management, said, “As the economy re-normalizes after the shock of COVID, investors need to prepare for a very different investment landscape to that of the last decade. They need a new playbook to help them asses the risks from possible structural inflation, a slowdown in monetary stimulus and the decline in Chinese growth prospects. There are also reasons to be optimistic; growth in developed markets is strong and most investors are starting this economic cycle in a much better position than coming out of the global financial crisis.”

We identify six key considerations for investors:

1.Better starting points

Many obstacles faced by households and businesses in the early stages of the last cycle are not present this time around. In the aftermath of the pandemic-induced recession, the nation’s aggregate paycheck in the US is already 6.7% above where it stood in February 2020. Unprecedented fiscal and monetary accommodation also limited insolvencies and promoted a faster rebound in earnings. The result is that ratios of debt to enterprise value for global equities recovered quickly, and all-in borrowing costs for US investment grade companies are near record lows. That is a much better set of initial conditions for hiring and investment than prevailed in the opening phase of the long-lived, pre-pandemic expansion. UBS AM predicts that this has laid the foundation for a period of above trend activity led by the private sector.

2.A higher fiscal floor

An important difference in this cycle compared to the last one is that fiscal policymakers are taking more of a prolonged “do no harm” approach, and without a quick pivot to severe austerity in the cards. Measures of the fiscal stance that adjust for economic slack imply that the developed-market fiscal policy will stay easier through 2023 than at any time since 2010.

3.Supply chain induced inflation

The shortages connected to supply chain snarls have been material contributors to above-trend inflation around the world. These elevated price pressures, which stand in stark contrast to the largely disinflationary past decade, have some negative implications for economic activity. However, there are some silver linings, too: broad-based inflation is also a symptom of an economy that is maximizing its productive capacity. Ultimately, UBS AM concludes, the combination of increased capacity to alleviate bottlenecks and strong growth in labor income will outweigh the effects of higher prices, resulting in demand delayed, not demand destroyed in 2022

4.Stronger investment expectations

The aforementioned supply constraints are, in some instances, consumers’ way of telling corporations to increase capital expenditures. The response from corporations: we are, and there’s more to come. The recovery in capital goods shipments, a proxy for business investment, has been much stronger in the 15 months since April 2020 than the same period following June 2009. Banks are easing access to credit for corporations who want to borrow, and the demand for commercial and industrial loans is picking up. Since capex is currently impeded by supply chain snarls, there is little reason to think momentum does not continue.

5.Less monetary support

The surge in short-term rates since mid-September, which has since partially retraced, suggests that rate hikes across many advanced economies are likely to begin in 2022 – if not sooner. For the Federal Reserve, this would mean a much quicker pivot to tightening policy compared to the more than six-year lag between the end of the 2009 recession and ensuing lift off. The removal of central bank stimulus is, on the surface, a seeming negative for risk assets. However, investors must bear in mind that this withdrawal of support is linked to positive economic outcomes. In 2022, UBS AM predicts it will be clear that the removal of monetary accommodation is a function of not just the stickiness of price pressures, but also the strength of growth and progress towards full employment.

6.China

Notwithstanding the structural trend, there are a series of catalysts over the short term that point to the stabilization and perhaps modest pickup in Chinese activity. Robust demand from the US and European Union are driving the Chinese trade surplus to a record, underpinning domestic production. A turn in the credit impulse before the year is out should put another floor under activity. UBS AM forecasts that a more comprehensive recovery in Chinese mobility will be in the offing following the Winter Olympics, supporting efforts to rebalance growth towards consumption.

Nicole Goldberger, Head of Growth Multi-Asset Portfolios at UBS Asset Management, said: “Equity market indicators and sovereign bond yields suggest that investors are underestimating the runway for above-trend economic growth. We realize that such periods have been fleeting in recent history, which helps explain the market skepticism. Nevertheless, market pricing suggests a consensus in the return to mediocre growth. While the Omicron variant is likely to weigh on activity in the very near term, we do not anticipate it will cause a deeper or more prolonged drag on growth compared to previous waves of the virus. Ultimately, we believe much of the economic momentum that was building prior to this development will be retained.”

She continues: “Against this backdrop, we believe that risk assets most levered to cyclical strength are well positioned to outperform in a world of upside growth surprises that should propel bond yields higher. Investors should also consider exposure to commodities, both directly and through energy equities, to help offset the risks that inflation proves to be disruptive to both stocks and bonds.”

Barry Gill, Head of Investments at UBS Asset Management, said, “As the economy re-normalizes after the shock of COVID, investors need to prepare for a very different investment landscape to that of the last decade. They need a new playbook to help them asses the risks from possible structural inflation, a slowdown in monetary stimulus and the decline in Chinese growth prospects. There are also reasons to be optimistic; growth in developed markets is strong and most investors are starting this economic cycle in a much better position than coming out of the global financial crisis.”

We identify six key considerations for investors:

1.Better starting points

Many obstacles faced by households and businesses in the early stages of the last cycle are not present this time around. In the aftermath of the pandemic-induced recession, the nation’s aggregate paycheck in the US is already 6.7% above where it stood in February 2020. Unprecedented fiscal and monetary accommodation also limited insolvencies and promoted a faster rebound in earnings. The result is that ratios of debt to enterprise value for global equities recovered quickly, and all-in borrowing costs for US investment grade companies are near record lows. That is a much better set of initial conditions for hiring and investment than prevailed in the opening phase of the long-lived, pre-pandemic expansion. UBS AM predicts that this has laid the foundation for a period of above trend activity led by the private sector.

2.A higher fiscal floor

An important difference in this cycle compared to the last one is that fiscal policymakers are taking more of a prolonged “do no harm” approach, and without a quick pivot to severe austerity in the cards. Measures of the fiscal stance that adjust for economic slack imply that the developed-market fiscal policy will stay easier through 2023 than at any time since 2010.

3.Supply chain induced inflation

The shortages connected to supply chain snarls have been material contributors to above-trend inflation around the world. These elevated price pressures, which stand in stark contrast to the largely disinflationary past decade, have some negative implications for economic activity. However, there are some silver linings, too: broad-based inflation is also a symptom of an economy that is maximizing its productive capacity. Ultimately, UBS AM concludes, the combination of increased capacity to alleviate bottlenecks and strong growth in labor income will outweigh the effects of higher prices, resulting in demand delayed, not demand destroyed in 2022

4.Stronger investment expectations

The aforementioned supply constraints are, in some instances, consumers’ way of telling corporations to increase capital expenditures. The response from corporations: we are, and there’s more to come. The recovery in capital goods shipments, a proxy for business investment, has been much stronger in the 15 months since April 2020 than the same period following June 2009. Banks are easing access to credit for corporations who want to borrow, and the demand for commercial and industrial loans is picking up. Since capex is currently impeded by supply chain snarls, there is little reason to think momentum does not continue.

5.Less monetary support

The surge in short-term rates since mid-September, which has since partially retraced, suggests that rate hikes across many advanced economies are likely to begin in 2022 – if not sooner. For the Federal Reserve, this would mean a much quicker pivot to tightening policy compared to the more than six-year lag between the end of the 2009 recession and ensuing lift off. The removal of central bank stimulus is, on the surface, a seeming negative for risk assets. However, investors must bear in mind that this withdrawal of support is linked to positive economic outcomes. In 2022, UBS AM predicts it will be clear that the removal of monetary accommodation is a function of not just the stickiness of price pressures, but also the strength of growth and progress towards full employment.

6.China

Notwithstanding the structural trend, there are a series of catalysts over the short term that point to the stabilization and perhaps modest pickup in Chinese activity. Robust demand from the US and European Union are driving the Chinese trade surplus to a record, underpinning domestic production. A turn in the credit impulse before the year is out should put another floor under activity. UBS AM forecasts that a more comprehensive recovery in Chinese mobility will be in the offing following the Winter Olympics, supporting efforts to rebalance growth towards consumption.

Nicole Goldberger, Head of Growth Multi-Asset Portfolios at UBS Asset Management, said: “Equity market indicators and sovereign bond yields suggest that investors are underestimating the runway for above-trend economic growth. We realize that such periods have been fleeting in recent history, which helps explain the market skepticism. Nevertheless, market pricing suggests a consensus in the return to mediocre growth. While the Omicron variant is likely to weigh on activity in the very near term, we do not anticipate it will cause a deeper or more prolonged drag on growth compared to previous waves of the virus. Ultimately, we believe much of the economic momentum that was building prior to this development will be retained.”

She continues: “Against this backdrop, we believe that risk assets most levered to cyclical strength are well positioned to outperform in a world of upside growth surprises that should propel bond yields higher. Investors should also consider exposure to commodities, both directly and through energy equities, to help offset the risks that inflation proves to be disruptive to both stocks and bonds.”

33

2

Happy O Man

reacted to

This week I hit for the cycle on $Progenity(PROG.US$ , while it seems most of the world has been caught up in phoney enticements ( $Phunware(PHUN.US$ $Digital World Acquisition Corp(DWAC.US$ ) for the chance at some quick easy money. Round FIVE will put prog right up there with $AMC Entertainment(AMC.US$ & $GameStop(GME.US$ for me. And I think thats pretty damn good, I just have to be PATIENT.

In case someone has been lying to you:

There.Is.No.Easy.Money.

So please, stop being distracted! T-stocks are Wall Street Bet Stocks version 2.0,

the only difference is NOW they have attached political emotions to your already bad investing habits. and it seems that you all are unwittingly taking sides (fuck trump, go amc type of shit), which absolutely disgust me. And you are all making it too easy for them to continue to divide us. You ARE ALL MY ALLIES, regardless of your investment choices, politics, religions, colors, sex, or anything else!

I say we start learning and adapting to their constantly evolving illegal games (media manipulation, PFOF, CB’s) together. Then we will all figure out how to take that cheese - without getting TRAPPED. It only requires a bit of teamwork and fortification. As far as I can tell theres two places we still hold great power in - and thats in PARTICIPTION & CONSUMPTION.

What would happen if we all decided to stop participating at once? Nothing in the law that states we must participate. so what if the rigged market crashes… it benefits only them anyway. Then its easy, because with none of us fish left in the pond to catch, their game will quickly end. Demand real and transparent changes until we even THINK ABOUT EVER touching the stock market again. OR AM I ONLY DREAMING? Let me know where you stand. And if you dont have one, TAKE ONE! Don’t be a chump.

Whatever we finally come up with (that was just one idea, i have many), i hope we can get our collective shit together and do it fast. Before more Noobs and paper chasers lose they faces off. Tired of watching this play out daily.

Finally, its my opinion that You would all do BETTER by switching over to crypto. they have only just begun trying to implement their instruments of manipultion there, and its still VERY EARLY. Plus my crazy % returned there can’t lie to you. 10x used to be a pipedream, now its the expectation. In crypto you just set it and forget it. The hardest part is just leaving it alone.

Or, you can continue chasing those PR driven momentum bags to hold onto. Personally I don’t like them very much, ESPECIALLY IF I DIDNT HONESTLY EARN THEM!

*not financial advice*…but DO have a THINK about it, will ya?

In case someone has been lying to you:

There.Is.No.Easy.Money.

So please, stop being distracted! T-stocks are Wall Street Bet Stocks version 2.0,

the only difference is NOW they have attached political emotions to your already bad investing habits. and it seems that you all are unwittingly taking sides (fuck trump, go amc type of shit), which absolutely disgust me. And you are all making it too easy for them to continue to divide us. You ARE ALL MY ALLIES, regardless of your investment choices, politics, religions, colors, sex, or anything else!

I say we start learning and adapting to their constantly evolving illegal games (media manipulation, PFOF, CB’s) together. Then we will all figure out how to take that cheese - without getting TRAPPED. It only requires a bit of teamwork and fortification. As far as I can tell theres two places we still hold great power in - and thats in PARTICIPTION & CONSUMPTION.

What would happen if we all decided to stop participating at once? Nothing in the law that states we must participate. so what if the rigged market crashes… it benefits only them anyway. Then its easy, because with none of us fish left in the pond to catch, their game will quickly end. Demand real and transparent changes until we even THINK ABOUT EVER touching the stock market again. OR AM I ONLY DREAMING? Let me know where you stand. And if you dont have one, TAKE ONE! Don’t be a chump.

Whatever we finally come up with (that was just one idea, i have many), i hope we can get our collective shit together and do it fast. Before more Noobs and paper chasers lose they faces off. Tired of watching this play out daily.

Finally, its my opinion that You would all do BETTER by switching over to crypto. they have only just begun trying to implement their instruments of manipultion there, and its still VERY EARLY. Plus my crazy % returned there can’t lie to you. 10x used to be a pipedream, now its the expectation. In crypto you just set it and forget it. The hardest part is just leaving it alone.

Or, you can continue chasing those PR driven momentum bags to hold onto. Personally I don’t like them very much, ESPECIALLY IF I DIDNT HONESTLY EARN THEM!

*not financial advice*…but DO have a THINK about it, will ya?

11

12

Happy O Man

liked

$Metaverse(LIST2567.US$ $FOUNT METAVERSE ETF(MTVR.US$ Recently I’ve been looking into how to invest in the Metaverse. It didn’t look promising to me but ever since Facebook started gambling it’s entire future on it, I’ve been looking for reasons to invest in the etf.

4

Happy O Man

liked

$JD.com(JD.US$ JD cannot overtake Alibaba because $Alibaba(BABA.US$ bussines covered the whole world.

20

1

Happy O Man

liked

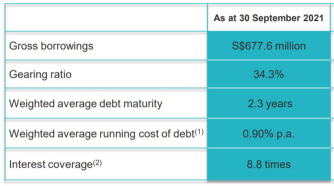

$Lendlease Reit(JYEU.SG$

You are not hearing it wrong, when you hear that Lendlease Reit's cost of debt is only 0.9%.

This is because they have access to EU loans, which have low interest rates even pre-covid.

As a result, LL has very strong and stable finances.

$LION-PHILLIP S-REIT(CLR.SG$ $SGX(S68.SG$ $FTSE Singapore Straits Time Index(.STI.SG$ $First Trust Ftse Epra/Nareit Global Real Estate Index Fund(FFR.US$

You are not hearing it wrong, when you hear that Lendlease Reit's cost of debt is only 0.9%.

This is because they have access to EU loans, which have low interest rates even pre-covid.

As a result, LL has very strong and stable finances.

$LION-PHILLIP S-REIT(CLR.SG$ $SGX(S68.SG$ $FTSE Singapore Straits Time Index(.STI.SG$ $First Trust Ftse Epra/Nareit Global Real Estate Index Fund(FFR.US$

28

2

Happy O Man

liked

$DigiCore Reit USD(DCRU.SG$

big fish don't mind buying above IPO price of 0.88 USD

big fish don't mind buying above IPO price of 0.88 USD

8

1

Happy O Man

liked

$BYD ELECTRONIC(00285.HK$ many people thinking that byd elec only making vape. please read the summary la hahahah

20

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Happy O Man : K