ETluvinvestment

liked

$Visa(V.US$ they need to bring down their fees and match the competitors. Don't be too cocky ![]() . Price should go back up then.

. Price should go back up then.

9

ETluvinvestment

liked and commented on

Asian stocks set to dip as traders weigh earnings

Asian stocks looked set to dip Wednesday as traders weighed the latest U.S. earnings reports amid lingering concerns about growth risks from elevated inflation.

Futures fell in Japan and Hong Kong and were little changed in Australia. The $S&P 500 Index(.SPX.US$ eked out a record high, with $United Parcel Service(UPS.US$ and $GE Aerospace(GE.US$ up on strong results. U.S. contracts fluctuated in early Asian trading.

Oil holds gains after industry data shows cushing supply decline

Oil clung to gains after an industry-funded report showed another stockpile decline at the Cushing, Oklahoma, storage hub, with supply levels already at the lowest since 2018.

U.S. crude futures rose 1.1% on Tuesday, holding at the highest since 2014. The industry-funded American Petroleum Institute reported crude supplies at Cushing fell 3.73 million barrels last week, according to people familiar with the data. That would be the largest decline since January if confirmed by U.S. government data on Wednesday.

Microsoft beats revenue expectations, reporting 22% growth

Microsoft's Azure revenue growth slowed slightly in the quarter, although on a constant-currency basis it accelerated from the prior quarter. PC supply constraints cut into sales of Windows to device makers.

$Microsoft(MSFT.US$ shares edged 2% higher in extended trading Tuesday.

Robinhood shares tank as revenue falls way short of expectations on lighter crypto trading

Third-quarter transaction-based revenue totaled $267 million, with only $51 million coming from cryptocurrency trading. Revenue from crypto trading totaled $233 million in the second quarter. $Robinhood(HOOD.US$ said that, barring any change in the market environment, the headwinds that dragged down last quarter will persist into the end of the year. Shares tanked by 8% after the bell.

AMD sales rise 54% on strong demand for chips for servers and game consoles

$Advanced Micro Devices(AMD.US$ shares were up 1% in extended trading. AMD has benefitted from a surge in electronics sales as its central processors and graphics processors power PCs, servers, and game consoles. AMD earnings and revenue beat analyst expectations, and the company issued a strong forecast for the fourth quarter.

Stocks linked to Trump — DWAC and Phunware — sink after ex-president touts social media plans

Two stocks linked to Donald Trump dropped shortly after the ex-president detailed plans for one of the companies, and the other firm said it would sell additional shares to raise capital. The big pullbacks for the SPAC $Digital World Acquisition Corp(DWAC.US$ and $Phunware(PHUN.US$ came after both companies saw massive gains in their stock values last week.

Alphabet reports better-than-expected quarterly profit and revenue

$Alphabet-A(GOOGL.US$ topped analysts expectations on the top and bottom lines. The company's shares were down about 2% after the report.

Google's advertising revenue rose 43% to $53.13 billion, up from $37.1 billion the same time last year and slightly higher than the prior quarter. YouTube ads rose to $7.21 billion, up from $5.04 billion a year ago.

Twitter shares rise after company says Apple privacy changes had less of an impact than expected on third-quarter results

$Twitter (Delisted)(TWTR.US$ reported revenue growth of 37% in the third quarter to $1.284 billion. The company said $Apple(AAPL.US$'s privacy changes to iOS 14 had less of an impact than expected. Twitter said fourth-quarter revenue will be $1.5 billion to $1.6 billion, while analysts were predicting sales for the quarter of $1.58 billion.

Source: Bloomberg, WSJ, CNBC

Asian stocks looked set to dip Wednesday as traders weighed the latest U.S. earnings reports amid lingering concerns about growth risks from elevated inflation.

Futures fell in Japan and Hong Kong and were little changed in Australia. The $S&P 500 Index(.SPX.US$ eked out a record high, with $United Parcel Service(UPS.US$ and $GE Aerospace(GE.US$ up on strong results. U.S. contracts fluctuated in early Asian trading.

Oil holds gains after industry data shows cushing supply decline

Oil clung to gains after an industry-funded report showed another stockpile decline at the Cushing, Oklahoma, storage hub, with supply levels already at the lowest since 2018.

U.S. crude futures rose 1.1% on Tuesday, holding at the highest since 2014. The industry-funded American Petroleum Institute reported crude supplies at Cushing fell 3.73 million barrels last week, according to people familiar with the data. That would be the largest decline since January if confirmed by U.S. government data on Wednesday.

Microsoft beats revenue expectations, reporting 22% growth

Microsoft's Azure revenue growth slowed slightly in the quarter, although on a constant-currency basis it accelerated from the prior quarter. PC supply constraints cut into sales of Windows to device makers.

$Microsoft(MSFT.US$ shares edged 2% higher in extended trading Tuesday.

Robinhood shares tank as revenue falls way short of expectations on lighter crypto trading

Third-quarter transaction-based revenue totaled $267 million, with only $51 million coming from cryptocurrency trading. Revenue from crypto trading totaled $233 million in the second quarter. $Robinhood(HOOD.US$ said that, barring any change in the market environment, the headwinds that dragged down last quarter will persist into the end of the year. Shares tanked by 8% after the bell.

AMD sales rise 54% on strong demand for chips for servers and game consoles

$Advanced Micro Devices(AMD.US$ shares were up 1% in extended trading. AMD has benefitted from a surge in electronics sales as its central processors and graphics processors power PCs, servers, and game consoles. AMD earnings and revenue beat analyst expectations, and the company issued a strong forecast for the fourth quarter.

Stocks linked to Trump — DWAC and Phunware — sink after ex-president touts social media plans

Two stocks linked to Donald Trump dropped shortly after the ex-president detailed plans for one of the companies, and the other firm said it would sell additional shares to raise capital. The big pullbacks for the SPAC $Digital World Acquisition Corp(DWAC.US$ and $Phunware(PHUN.US$ came after both companies saw massive gains in their stock values last week.

Alphabet reports better-than-expected quarterly profit and revenue

$Alphabet-A(GOOGL.US$ topped analysts expectations on the top and bottom lines. The company's shares were down about 2% after the report.

Google's advertising revenue rose 43% to $53.13 billion, up from $37.1 billion the same time last year and slightly higher than the prior quarter. YouTube ads rose to $7.21 billion, up from $5.04 billion a year ago.

Twitter shares rise after company says Apple privacy changes had less of an impact than expected on third-quarter results

$Twitter (Delisted)(TWTR.US$ reported revenue growth of 37% in the third quarter to $1.284 billion. The company said $Apple(AAPL.US$'s privacy changes to iOS 14 had less of an impact than expected. Twitter said fourth-quarter revenue will be $1.5 billion to $1.6 billion, while analysts were predicting sales for the quarter of $1.58 billion.

Source: Bloomberg, WSJ, CNBC

64

5

ETluvinvestment

liked

According to a filing with the U.S. Securities and Exchange Commission, Chipmaker GlobalFoundries is marketing 33 million shares while Abu Dhabi’s Mubadala Investment Co., its major shareholder, plans to sell 22 million shares.

Mubadala currently owns 100% of the company and “continue to have substantial control after this offering.”

GlobalFoundries plans to list on the Nasdaq under the symbol GFS. It plans to raise as much as $2.6 billion in a U.S. initial public offering. At the top of that range,it would have a market value of $25 billionbased on the outstanding shares listed in its filing.

The offering is being led by Morgan Stanley, Bank of America, JPMorgan Chase, Citigroup and Credit Suisse.

Business Overview

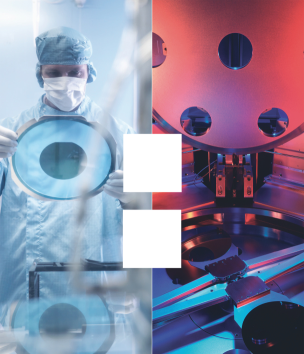

$GlobalFoundries(GFS.US$is one of the world’s leading semiconductor foundries. The company was created by purchasing the manufacturing operations of Advanced Micro Devices Inc. in 2009 and later combining it with Singapore’s Chartered Semiconductor.

According to Gartner,in 2020, the company was the third largest foundry in the world based on external sales.

GlobalFoundries previously gave up on the kind of leading-edge production that would match the capabilities of Taiwan Semiconductor or Samsung.Instead,it's serving the market for less advanced chips, which are increasingly critical to carmakers and other industries.

GlobalFoundries has over50ecosystem partners spanning IP, electronic design automation, outsourced assembly and test and design services. Building on an existing library of more than4,000IP titles, it currently has more than950IP titles in active development across26process nodes and34IP partners.

The company has built deep strategic partnerships witha broad base of more than 200 customers as of December 31, 2020, many of whom are the global leaders in their field.

In the first six months of 2021, the top ten customers, based on wafer shipment volume, included Qualcomm, MediaTek, NXP Semiconductors, Qorvo, Cirrus Logic, Advanced Micro Devices (“AMD”), Skyworks Solutions, Murata Manufacturing, Samsung Electronics and Broadcom.

The company attracted a large share of single-sourced products and long-term supply agreements. As of the date of the company's prospectus,the aggregate lifetime revenue commitment reflected by these agreements amounted to more than $19.5 billion.

A key measure of GlobalFoundries's position as a strategic partner to the customers is the mix of wafer shipment volume attributable to single-sourced business (Single-sourced products are defined as those that can only be manufactured with GlobalFoundries's technology and cannot be manufactured elsewhere without significant customer redesigns).It represented approximately61% of wafer shipment volume in 2020, up from 47% in 2018.

Financial Performance

Revenue at GlobalFoundries dropped last year by 17% to $4.85 billion. GlobalFoundries said the reason is that it divested a business that brought in $391 million in 2019, and more broadly the company shifted contractual terms with most of its customers, changing how and when it recognizes revenue.

In the first half of 2021, revenue climbed by 13% from a year earlier to just over $3 billion.

Click to view the prospectus

Mubadala currently owns 100% of the company and “continue to have substantial control after this offering.”

GlobalFoundries plans to list on the Nasdaq under the symbol GFS. It plans to raise as much as $2.6 billion in a U.S. initial public offering. At the top of that range,it would have a market value of $25 billionbased on the outstanding shares listed in its filing.

The offering is being led by Morgan Stanley, Bank of America, JPMorgan Chase, Citigroup and Credit Suisse.

Business Overview

$GlobalFoundries(GFS.US$is one of the world’s leading semiconductor foundries. The company was created by purchasing the manufacturing operations of Advanced Micro Devices Inc. in 2009 and later combining it with Singapore’s Chartered Semiconductor.

According to Gartner,in 2020, the company was the third largest foundry in the world based on external sales.

GlobalFoundries previously gave up on the kind of leading-edge production that would match the capabilities of Taiwan Semiconductor or Samsung.Instead,it's serving the market for less advanced chips, which are increasingly critical to carmakers and other industries.

GlobalFoundries has over50ecosystem partners spanning IP, electronic design automation, outsourced assembly and test and design services. Building on an existing library of more than4,000IP titles, it currently has more than950IP titles in active development across26process nodes and34IP partners.

The company has built deep strategic partnerships witha broad base of more than 200 customers as of December 31, 2020, many of whom are the global leaders in their field.

In the first six months of 2021, the top ten customers, based on wafer shipment volume, included Qualcomm, MediaTek, NXP Semiconductors, Qorvo, Cirrus Logic, Advanced Micro Devices (“AMD”), Skyworks Solutions, Murata Manufacturing, Samsung Electronics and Broadcom.

The company attracted a large share of single-sourced products and long-term supply agreements. As of the date of the company's prospectus,the aggregate lifetime revenue commitment reflected by these agreements amounted to more than $19.5 billion.

A key measure of GlobalFoundries's position as a strategic partner to the customers is the mix of wafer shipment volume attributable to single-sourced business (Single-sourced products are defined as those that can only be manufactured with GlobalFoundries's technology and cannot be manufactured elsewhere without significant customer redesigns).It represented approximately61% of wafer shipment volume in 2020, up from 47% in 2018.

Financial Performance

Revenue at GlobalFoundries dropped last year by 17% to $4.85 billion. GlobalFoundries said the reason is that it divested a business that brought in $391 million in 2019, and more broadly the company shifted contractual terms with most of its customers, changing how and when it recognizes revenue.

In the first half of 2021, revenue climbed by 13% from a year earlier to just over $3 billion.

Click to view the prospectus

+2

82

22

ETluvinvestment

liked

Master @Tupack H McsnacksWhat's you view on $Naked Brand Group (NAKD.US$ , $Zomedica(ZOM.US$ and $Advanced Micro Devices(AMD.US$ ? Will NAKD delisted on 25/10, how about our shares after delisted? Thanks

20

3

ETluvinvestment

commented on and voted

$Gitlab(GTLB.US$ shares jumped 35% in their first day of trading on Thursday after it sold shares well above its expected range in its IPO.

$Gitlab(GTLB.US$ is a cloud-based depository of software. The platform allows developers to share and contribute to each other’s work.

Since its founding almost a decade ago, GitLab has been chasing down GitHub in the source repository market, which also includes Atlassian’s Bitbucket. $Microsoft(MSFT.US$ acquired GitHub in 2018 for $7.5 billion, and since that time GitLab has grown rapidly as the only big independent player in the market.

Revenue in the second quarter jumped 69% from a year earlier to $58.1 million. However, because GitLab spends the equivalent of three-quarters of its revenue on sales and marketing, largely to build its developer user base, the company recorded a net loss of $40.2 million in the latest quarter.

GitLab raised close to $650 million in the offering, and investors purchased over $150 million of additional stock from an entity affiliated with GitLab CEO Sid Sijbrandij.

Despite having an outstanding beginning, Gitlab is still facing severe competition. Github, Red Hat, Bitbucket, Atlassian, etc. are all its strong competitors. Github poses the greatest threat, it is currently the world's largest code hosting platform, used by more than 50 million developers. The top three customers are $Microsoft(MSFT.US$ , $Facebook(FB.US$ , and $Alphabet-C(GOOG.US$ .

Will Gitlab overcome all the obstacles and thrive? Will you bet on it? Vote and comment to tell mooers about your thoughts.

Source:

GitLab jumps 35% in its Nasdaq debut after code-sharing company priced IPO above expected range

$Gitlab(GTLB.US$ is a cloud-based depository of software. The platform allows developers to share and contribute to each other’s work.

Since its founding almost a decade ago, GitLab has been chasing down GitHub in the source repository market, which also includes Atlassian’s Bitbucket. $Microsoft(MSFT.US$ acquired GitHub in 2018 for $7.5 billion, and since that time GitLab has grown rapidly as the only big independent player in the market.

Revenue in the second quarter jumped 69% from a year earlier to $58.1 million. However, because GitLab spends the equivalent of three-quarters of its revenue on sales and marketing, largely to build its developer user base, the company recorded a net loss of $40.2 million in the latest quarter.

GitLab raised close to $650 million in the offering, and investors purchased over $150 million of additional stock from an entity affiliated with GitLab CEO Sid Sijbrandij.

Despite having an outstanding beginning, Gitlab is still facing severe competition. Github, Red Hat, Bitbucket, Atlassian, etc. are all its strong competitors. Github poses the greatest threat, it is currently the world's largest code hosting platform, used by more than 50 million developers. The top three customers are $Microsoft(MSFT.US$ , $Facebook(FB.US$ , and $Alphabet-C(GOOG.US$ .

Will Gitlab overcome all the obstacles and thrive? Will you bet on it? Vote and comment to tell mooers about your thoughts.

Source:

GitLab jumps 35% in its Nasdaq debut after code-sharing company priced IPO above expected range

39

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)