Ei_888

liked

Asia stocks eye mixed open; Yields, dollar jumped

Asian stocks looked set for a mixed start Tuesday after Treasury yields and the dollar jumped as Jerome Powell's renomination to head the Federal Reserve fueled bets on quicker policy tightening.

Australian equities rose and futures for Hong Kong fell. Japan is closed for a holiday. U.S. futures nudged higher after the $S&P 500 Index(.SPX.US$ ended in the red and the $Nasdaq(NDAQ.US$ underperformed after a final-hour selloff in technology shares in the Wall Street session.

Wall Street breathes sigh of relief as Powell gets second Fed term

President Joe Biden announced Monday that he is renominating Jerome Powell for a second term as Federal Reserve chair and will put forth Fed Governor Lael Brainard as vice chairman. The move comes after weeks of speculation that Brainard might get the nod.

Selloff in highly priced tech stocks is pressuring hedge funds that piled in

Losses are picking up in very-high-priced technology stocks that had recently grown in popularity among hedge funds.

$Farfetch(FTCH.US$ and $Snowflake(SNOW.US$ fell, driving a basket of software and internet companies that have yet to earn any money down more than 5%, its biggest decline since March, data compiled by $Goldman Sachs(GS.US$ show. That's bad news for hedge funds who just boosted exposure to high-growth, high-valuation stocks to extreme levels.

Bitcoin is selling off while some smaller altcoins hang tough

The biggest cryptocurrencies have been mired in a selloff over the past week that's seen Bitcoin approaching a 20% correction from its recent record. Ether, the second-largest digital asset by market value, is down 8% from its Nov. 10 high.

While Z-Cash is up roughly 30% since the start of November. The Avalanche token also is holding up well, gaining about 50% over the past seven sessions, while the CRO has advanced enough to become the 13th-largest by market capitalization, which has ballooned to $18 billion.

Apple posts longest rally since July as tech broadly falls

$Apple(AAPL.US$ shares closed at a record high on Monday. The stock rose as much as 3.2% but pared much of that advance in afternoon trading, ending with a gain of 0.3%.

The company was an outlier among tech stocks, which opened broadly higher but subsequently turned negative, amid a widespread rotation out of high-valuation growth names. $Microsoft(MSFT.US$ hit an intraday record in early trading but closed down 1%. $NVIDIA(NVDA.US$ also opened in solidly positive territory but ended down 3.1%.

Zoom beats estimates even as revenue growth is poised to slow after pandemic

$Zoom Video Communications(ZM.US$ reported better-than-expected quarterly earnings on Monday, while warning investors of a revenue slowdown at the video-chat company as the pandemic comes to an end.

Revenue increased 35% from a year earlier in the quarter, which ended Oct. 31, slowing from 54% growth in the prior period. Net income jumped 71% to $340.3 million, according to a statement.

Cathie Wood's genomics fund is down 27% and outflows are growing

Investors appear to be losing patience with $ARK Genomic Revolution ETF(ARKG.US$.

It has seen roughly $520 million of outflows in November amid sinking returns. The fund is down 27% year-to-date as investors shun health-care stocks in favor for more cyclical names that perform well during an economic recovery. Even so, the ETF is faring far worse than the broader biotech sector, with the Nasdaq Biotechnology Index up 10.49% this year.

Walmart looks to grab consumers' attention with star-studded online shopping events

$Walmart(WMT.US$ will host more than 30 livestreaming events in November and December, including one with musician Jason Derulo that will kick off Cyber Week. Chief Marketing Officer William White said the shoppable events can help "shorten the distance between inspiration and purchase."

The big-box retailer could use the strategy to drive more online sales, especially as consumers return to stores.

Source: Bloomberg, CNBC

Asian stocks looked set for a mixed start Tuesday after Treasury yields and the dollar jumped as Jerome Powell's renomination to head the Federal Reserve fueled bets on quicker policy tightening.

Australian equities rose and futures for Hong Kong fell. Japan is closed for a holiday. U.S. futures nudged higher after the $S&P 500 Index(.SPX.US$ ended in the red and the $Nasdaq(NDAQ.US$ underperformed after a final-hour selloff in technology shares in the Wall Street session.

Wall Street breathes sigh of relief as Powell gets second Fed term

President Joe Biden announced Monday that he is renominating Jerome Powell for a second term as Federal Reserve chair and will put forth Fed Governor Lael Brainard as vice chairman. The move comes after weeks of speculation that Brainard might get the nod.

Selloff in highly priced tech stocks is pressuring hedge funds that piled in

Losses are picking up in very-high-priced technology stocks that had recently grown in popularity among hedge funds.

$Farfetch(FTCH.US$ and $Snowflake(SNOW.US$ fell, driving a basket of software and internet companies that have yet to earn any money down more than 5%, its biggest decline since March, data compiled by $Goldman Sachs(GS.US$ show. That's bad news for hedge funds who just boosted exposure to high-growth, high-valuation stocks to extreme levels.

Bitcoin is selling off while some smaller altcoins hang tough

The biggest cryptocurrencies have been mired in a selloff over the past week that's seen Bitcoin approaching a 20% correction from its recent record. Ether, the second-largest digital asset by market value, is down 8% from its Nov. 10 high.

While Z-Cash is up roughly 30% since the start of November. The Avalanche token also is holding up well, gaining about 50% over the past seven sessions, while the CRO has advanced enough to become the 13th-largest by market capitalization, which has ballooned to $18 billion.

Apple posts longest rally since July as tech broadly falls

$Apple(AAPL.US$ shares closed at a record high on Monday. The stock rose as much as 3.2% but pared much of that advance in afternoon trading, ending with a gain of 0.3%.

The company was an outlier among tech stocks, which opened broadly higher but subsequently turned negative, amid a widespread rotation out of high-valuation growth names. $Microsoft(MSFT.US$ hit an intraday record in early trading but closed down 1%. $NVIDIA(NVDA.US$ also opened in solidly positive territory but ended down 3.1%.

Zoom beats estimates even as revenue growth is poised to slow after pandemic

$Zoom Video Communications(ZM.US$ reported better-than-expected quarterly earnings on Monday, while warning investors of a revenue slowdown at the video-chat company as the pandemic comes to an end.

Revenue increased 35% from a year earlier in the quarter, which ended Oct. 31, slowing from 54% growth in the prior period. Net income jumped 71% to $340.3 million, according to a statement.

Cathie Wood's genomics fund is down 27% and outflows are growing

Investors appear to be losing patience with $ARK Genomic Revolution ETF(ARKG.US$.

It has seen roughly $520 million of outflows in November amid sinking returns. The fund is down 27% year-to-date as investors shun health-care stocks in favor for more cyclical names that perform well during an economic recovery. Even so, the ETF is faring far worse than the broader biotech sector, with the Nasdaq Biotechnology Index up 10.49% this year.

Walmart looks to grab consumers' attention with star-studded online shopping events

$Walmart(WMT.US$ will host more than 30 livestreaming events in November and December, including one with musician Jason Derulo that will kick off Cyber Week. Chief Marketing Officer William White said the shoppable events can help "shorten the distance between inspiration and purchase."

The big-box retailer could use the strategy to drive more online sales, especially as consumers return to stores.

Source: Bloomberg, CNBC

84

9

Ei_888

liked

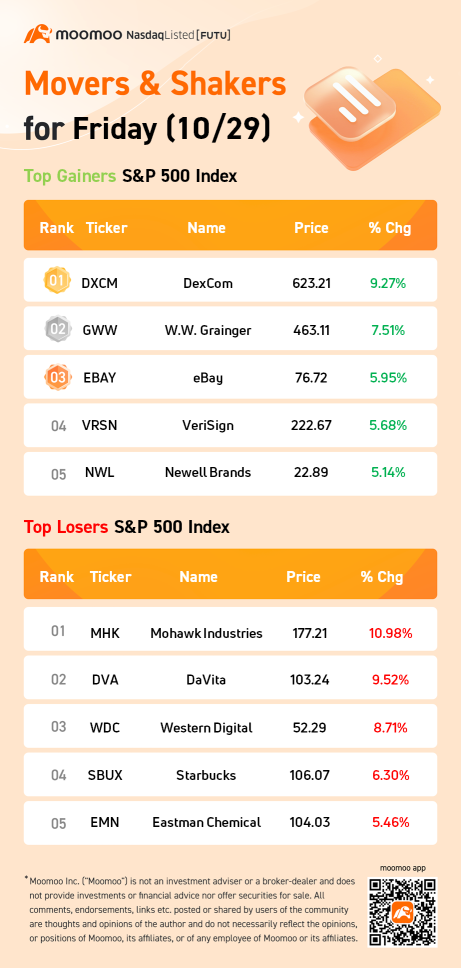

The U.S. stock market set another round of record highs on Friday as Wall Street looked past disappointing results from major companies to wrap up its best month of the year.

The $S&P 500 Index(.SPX.US$ rose 0.19% to close at 4,605.38 and the $Dow Jones Industrial Average(.DJI.US$ added 89.08 points, or 0.25%, to finish at 35,819.56. The $Nasdaq Composite Index(.IXIC.US$ rose 0.33% to close at 15,498.39. All three closed at record highs, and the S&P 500 and Nasdaq clinched their best months since November 2020.

The $S&P 500 Index(.SPX.US$ rose 0.19% to close at 4,605.38 and the $Dow Jones Industrial Average(.DJI.US$ added 89.08 points, or 0.25%, to finish at 35,819.56. The $Nasdaq Composite Index(.IXIC.US$ rose 0.33% to close at 15,498.39. All three closed at record highs, and the S&P 500 and Nasdaq clinched their best months since November 2020.

56

12

Ei_888

liked

By Danilo

Hey, mooers! Here are things you need to know before the opening bell:

- Stock futures slipped in early morning trading Friday as shares of major technology companies suffered following disappointing earnings reports.

- The social-media service Meta will retain the Facebook name even as the umbrella company readies billions of dollars in investments in its new mixed-reality platform.

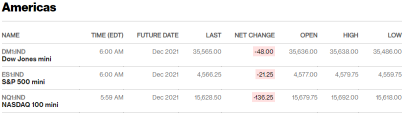

Market Snapshot

Stock futures slipped in early morning trading Friday as shares of major technology companies suffered following disappointing earnings reports.

Futures on the tech-heavy $NASDAQ 100 Index(.NDX.US$ futures dropped 0.8%. $S&P 500 Index(.SPX.US$ futures shed 0.5% and $Dow Jones Industrial Average(.DJI.US$ futures were 48 points lower.

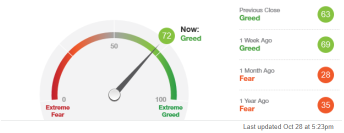

Market Temperature

Read More: Market Temperature (10/29)

Top News

Stocks end higher with earnings in focus

U.S. stocks climbed after a string of upbeat earnings reports.

Biden framework for social-climate package fails to ease passage of infrastructure bill

The White House's $1.85 trillion framework designed to show progress in the social-spending and climate talks fell short of persuading progressives to quickly approve the parallel, roughly $1 trillion infrastructure bill.

U.S. pending home sales unexpectedly fell in September

The number of houses going under contract in the U.S. declined in September by 2.3% after rising sharply in August, data from the National Association of Realtors showed. Economists were expecting a 1% rise.

Jobless claims fall to new pandemic low

Worker filings for unemployment benefits declined last week to their lowest level since the pandemic began, as employers competed for employees in a tightening labor market.

Apple warns of supply chain woes while Amazon faces increased labor costs

Investors remain watchful of how corporate leaders are managing disruptions as the pandemic's effects drag on. $Apple(AAPL.US$

Amazon earnings suffer as growth slows, costs rise

The company posted lower-than-expected third-quarter sales and signaled that a tight labor market and supply-chain disruptions would weigh on earnings. $Amazon(AMZN.US$

Facebook rebrands company as Meta in focus on metaverse

The social-media service will retain the Facebook name even as the umbrella company readies billions of dollars in investments in its new mixed-reality platform. $Meta Platforms(FB.US$

Read More

Traders bet Tesla stock's rally isn't over yet

'Squid Game' cryptocurrency is up nearly 2,400%, do you want to join the game?

Trump-tied SPAC fuels day trader return to blank-check stocks

In One Chart | Amazon earnings suffer as growth slows, costs rise

Amazon shares dip almost 5% in pre-market, as its earnings drop nearly 50% and holiday forecast disappoints

Key Events This Week

Source: CNBC, Dow Jones Newswires, Bloomberg

Hey, mooers! Here are things you need to know before the opening bell:

- Stock futures slipped in early morning trading Friday as shares of major technology companies suffered following disappointing earnings reports.

- The social-media service Meta will retain the Facebook name even as the umbrella company readies billions of dollars in investments in its new mixed-reality platform.

Market Snapshot

Stock futures slipped in early morning trading Friday as shares of major technology companies suffered following disappointing earnings reports.

Futures on the tech-heavy $NASDAQ 100 Index(.NDX.US$ futures dropped 0.8%. $S&P 500 Index(.SPX.US$ futures shed 0.5% and $Dow Jones Industrial Average(.DJI.US$ futures were 48 points lower.

Market Temperature

Read More: Market Temperature (10/29)

Top News

Stocks end higher with earnings in focus

U.S. stocks climbed after a string of upbeat earnings reports.

Biden framework for social-climate package fails to ease passage of infrastructure bill

The White House's $1.85 trillion framework designed to show progress in the social-spending and climate talks fell short of persuading progressives to quickly approve the parallel, roughly $1 trillion infrastructure bill.

U.S. pending home sales unexpectedly fell in September

The number of houses going under contract in the U.S. declined in September by 2.3% after rising sharply in August, data from the National Association of Realtors showed. Economists were expecting a 1% rise.

Jobless claims fall to new pandemic low

Worker filings for unemployment benefits declined last week to their lowest level since the pandemic began, as employers competed for employees in a tightening labor market.

Apple warns of supply chain woes while Amazon faces increased labor costs

Investors remain watchful of how corporate leaders are managing disruptions as the pandemic's effects drag on. $Apple(AAPL.US$

Amazon earnings suffer as growth slows, costs rise

The company posted lower-than-expected third-quarter sales and signaled that a tight labor market and supply-chain disruptions would weigh on earnings. $Amazon(AMZN.US$

Facebook rebrands company as Meta in focus on metaverse

The social-media service will retain the Facebook name even as the umbrella company readies billions of dollars in investments in its new mixed-reality platform. $Meta Platforms(FB.US$

Read More

Traders bet Tesla stock's rally isn't over yet

'Squid Game' cryptocurrency is up nearly 2,400%, do you want to join the game?

Trump-tied SPAC fuels day trader return to blank-check stocks

In One Chart | Amazon earnings suffer as growth slows, costs rise

Amazon shares dip almost 5% in pre-market, as its earnings drop nearly 50% and holiday forecast disappoints

Key Events This Week

Source: CNBC, Dow Jones Newswires, Bloomberg

+2

49

2

Ei_888

liked

According to a filing with the U.S. Securities and Exchange Commission, Chipmaker GlobalFoundries is marketing 33 million shares while Abu Dhabi’s Mubadala Investment Co., its major shareholder, plans to sell 22 million shares.

Mubadala currently owns 100% of the company and “continue to have substantial control after this offering.”

GlobalFoundries plans to list on the Nasdaq under the symbol GFS. It plans to raise as much as $2.6 billion in a U.S. initial public offering. At the top of that range,it would have a market value of $25 billionbased on the outstanding shares listed in its filing.

The offering is being led by Morgan Stanley, Bank of America, JPMorgan Chase, Citigroup and Credit Suisse.

Business Overview

$GlobalFoundries(GFS.US$is one of the world’s leading semiconductor foundries. The company was created by purchasing the manufacturing operations of Advanced Micro Devices Inc. in 2009 and later combining it with Singapore’s Chartered Semiconductor.

According to Gartner,in 2020, the company was the third largest foundry in the world based on external sales.

GlobalFoundries previously gave up on the kind of leading-edge production that would match the capabilities of Taiwan Semiconductor or Samsung.Instead,it's serving the market for less advanced chips, which are increasingly critical to carmakers and other industries.

GlobalFoundries has over50ecosystem partners spanning IP, electronic design automation, outsourced assembly and test and design services. Building on an existing library of more than4,000IP titles, it currently has more than950IP titles in active development across26process nodes and34IP partners.

The company has built deep strategic partnerships witha broad base of more than 200 customers as of December 31, 2020, many of whom are the global leaders in their field.

In the first six months of 2021, the top ten customers, based on wafer shipment volume, included Qualcomm, MediaTek, NXP Semiconductors, Qorvo, Cirrus Logic, Advanced Micro Devices (“AMD”), Skyworks Solutions, Murata Manufacturing, Samsung Electronics and Broadcom.

The company attracted a large share of single-sourced products and long-term supply agreements. As of the date of the company's prospectus,the aggregate lifetime revenue commitment reflected by these agreements amounted to more than $19.5 billion.

A key measure of GlobalFoundries's position as a strategic partner to the customers is the mix of wafer shipment volume attributable to single-sourced business (Single-sourced products are defined as those that can only be manufactured with GlobalFoundries's technology and cannot be manufactured elsewhere without significant customer redesigns).It represented approximately61% of wafer shipment volume in 2020, up from 47% in 2018.

Financial Performance

Revenue at GlobalFoundries dropped last year by 17% to $4.85 billion. GlobalFoundries said the reason is that it divested a business that brought in $391 million in 2019, and more broadly the company shifted contractual terms with most of its customers, changing how and when it recognizes revenue.

In the first half of 2021, revenue climbed by 13% from a year earlier to just over $3 billion.

Click to view the prospectus

Mubadala currently owns 100% of the company and “continue to have substantial control after this offering.”

GlobalFoundries plans to list on the Nasdaq under the symbol GFS. It plans to raise as much as $2.6 billion in a U.S. initial public offering. At the top of that range,it would have a market value of $25 billionbased on the outstanding shares listed in its filing.

The offering is being led by Morgan Stanley, Bank of America, JPMorgan Chase, Citigroup and Credit Suisse.

Business Overview

$GlobalFoundries(GFS.US$is one of the world’s leading semiconductor foundries. The company was created by purchasing the manufacturing operations of Advanced Micro Devices Inc. in 2009 and later combining it with Singapore’s Chartered Semiconductor.

According to Gartner,in 2020, the company was the third largest foundry in the world based on external sales.

GlobalFoundries previously gave up on the kind of leading-edge production that would match the capabilities of Taiwan Semiconductor or Samsung.Instead,it's serving the market for less advanced chips, which are increasingly critical to carmakers and other industries.

GlobalFoundries has over50ecosystem partners spanning IP, electronic design automation, outsourced assembly and test and design services. Building on an existing library of more than4,000IP titles, it currently has more than950IP titles in active development across26process nodes and34IP partners.

The company has built deep strategic partnerships witha broad base of more than 200 customers as of December 31, 2020, many of whom are the global leaders in their field.

In the first six months of 2021, the top ten customers, based on wafer shipment volume, included Qualcomm, MediaTek, NXP Semiconductors, Qorvo, Cirrus Logic, Advanced Micro Devices (“AMD”), Skyworks Solutions, Murata Manufacturing, Samsung Electronics and Broadcom.

The company attracted a large share of single-sourced products and long-term supply agreements. As of the date of the company's prospectus,the aggregate lifetime revenue commitment reflected by these agreements amounted to more than $19.5 billion.

A key measure of GlobalFoundries's position as a strategic partner to the customers is the mix of wafer shipment volume attributable to single-sourced business (Single-sourced products are defined as those that can only be manufactured with GlobalFoundries's technology and cannot be manufactured elsewhere without significant customer redesigns).It represented approximately61% of wafer shipment volume in 2020, up from 47% in 2018.

Financial Performance

Revenue at GlobalFoundries dropped last year by 17% to $4.85 billion. GlobalFoundries said the reason is that it divested a business that brought in $391 million in 2019, and more broadly the company shifted contractual terms with most of its customers, changing how and when it recognizes revenue.

In the first half of 2021, revenue climbed by 13% from a year earlier to just over $3 billion.

Click to view the prospectus

+2

82

22

Ei_888

liked

$AMC Entertainment(AMC.US$ they will take today as an opportunity to cover!

3

Ei_888

liked

Cathie Wood's tech-focused $ARK Innovation ETF(ARKK.US$ gained more than 150% in 2020. How crazy! You could never find another fund generating similar returns in one year! ![]()

![]()

![]()

But to be honest, I really don't know if she's a good fund manager. ARKK lost about 4% in 2021 and Cathie Wood seems to have a hard time. However, Buffett's value investing fund $Berkshire Hathaway-A(BRK.A.US$ gained 23% this year and has generated positive returns for 6 consecutive years.![]()

![]()

![]()

I think Cathie Wood was just lucky enough to catch the tech ride, or $Tesla(TSLA.US$'s ride, last year.![]()

![]()

Warren Buffett vs. Cathie Wood, who's the true guru?

Are you a value investor like Buffett? Are you a tech lover like Cathie Wood?![]()

![]()

![]()

Rewards calling! Comment to win rewards!

Moomoo news team and I hold the event together for a month! I will post discussions every day and Moomoo news team will support the event with reward points! We will pick the top 2 'liked' and top 3 'insightful' comments every weekday& top 10 'liked' and top 10 'insightful' comments every weekend to be the winners.

For more details, click here.

Follow me to join the latest discussion!

Write your own ideas: Plagiarism or cheating is not acceptable in any kind of community activity. Please "Report" the post if you see any. Once confirmed, the user committed shall be disqualified from the activity.

But to be honest, I really don't know if she's a good fund manager. ARKK lost about 4% in 2021 and Cathie Wood seems to have a hard time. However, Buffett's value investing fund $Berkshire Hathaway-A(BRK.A.US$ gained 23% this year and has generated positive returns for 6 consecutive years.

I think Cathie Wood was just lucky enough to catch the tech ride, or $Tesla(TSLA.US$'s ride, last year.

Warren Buffett vs. Cathie Wood, who's the true guru?

Are you a value investor like Buffett? Are you a tech lover like Cathie Wood?

Rewards calling! Comment to win rewards!

Moomoo news team and I hold the event together for a month! I will post discussions every day and Moomoo news team will support the event with reward points! We will pick the top 2 'liked' and top 3 'insightful' comments every weekday& top 10 'liked' and top 10 'insightful' comments every weekend to be the winners.

For more details, click here.

Follow me to join the latest discussion!

Write your own ideas: Plagiarism or cheating is not acceptable in any kind of community activity. Please "Report" the post if you see any. Once confirmed, the user committed shall be disqualified from the activity.

![[Rewards Calling] Value investing or tech innovation? Buffett or Cathie Wood?](https://ussnsimg.moomoo.com/4830957065967899878.png/thumb)

![[Rewards Calling] Value investing or tech innovation? Buffett or Cathie Wood?](https://ussnsimg.moomoo.com/5722423738357994721.jpg/thumb)

114

78

Ei_888

liked

Stocks set for mixed start amid inflation concerns

Asian stocks looked set for a mixed start Tuesday as investors continue to digest the prospect of tightening monetary policy to restrain a surge in inflation stoked partly by energy costs.

Futures rose in Japan and Hong Kong and fell in Australia. The $S&P 500 Index(.SPX.US$and $NASDAQ 100 Index(.NDX.US$gained overnight, aided by optimism about corporate earnings. U.S. contracts fluctuated.

JPMorgan's Kolanovic says market still misjudges reflation trade

The recent market jitters over stagflation are "misplaced" and the shift to bargain stocks and economically sensitive companies should continue, according to $JPMorgan(JPM.US$strategists led by Marko Kolanovic.

The economic expansion is likely to stay above trend levels as major central banks appear to prioritize sustaining the recovery over taming inflation, they wrote in a note to clients.

SEC says brokers enticed by payment for order flow are making trading into a game to lure investors

Wall Street's main regulator released its highly anticipated report on the GameStop mania on Monday. The SEC said online brokerages, enticed to increase revenue through payment for order flow, are turning stock-trading into a game in order to encourage activity from retail investors.

"Payment for order flow and the incentives it creates may cause broker-dealers to find novel ways to increase customer trading, including through the use of digital engagement practices," the agency said.

First bitcoin futures exchange-traded fund starts trading Tuesday

The first U.S. bitcoin futures exchange-traded fund launches on Tuesday, a milestone for the cryptocurrency industry. The ProShares ETF will provide exposure to bitcoin futures contracts — agreements to buy or sell the asset later for an agreed-upon price — rather than bitcoin itself. While there's strong demand for the new asset, financial advisors urge caution before adding bitcoin futures ETFs to portfolios.

Microsoft hits first record since August ahead of results

$Microsoft(MSFT.US$shares rose to their first all-time high in about two months on Monday, with the software company emerging as the first mega-cap stock to return to record levels after concerns over rising bond yields pressured the group in recent weeks. The stock rose 1% to $307.28, hitting its first intraday record since Aug. 20.

Rent the Runway targets valuation of up to $1.5 nillion in IPO

Rent the Runway Inc. is seeking a valuation of as much as $1.5 billion in its initial public offering next week, in what would cap a comeback for the clothing-rental business.

The New York company is aiming to sell shares at between $18 and $21 apiece for a fully diluted valuation of $1.24 billion to $1.46 billion, it said in a securities filing Monday. The roadshow for company management and their underwriters to pitch the shares to potential investors begins Tuesday and the shares are to start trading on the Nasdaq Stock Market next Wednesday.

State Street profit increases 29% on more assets, market gains

$State Street(STT.US$posted a better-than-expected quarterly profit, as market gains and new business wins lifted revenue. The custody bank’s shares were up 3% in midafternoon trading.

State Street's net income rose 29% to $714 million, or $1.96 a share, in the third quarter. Analysts polled by FactSet had predicted a $1.92 profit. Revenue climbed to $2.99 billion from $2.78 billion in the year-ago period. Analysts expected $2.96 billion.

No. 1 uranium miner backs physical fund in nod to robust demand

Kazatomprom, the world's largest uranium miner, is backing a new uranium fund that aims to invest in the radioactive metal used to power nuclear reactors.

Shares of uranium companies jumped Monday, lead by and $Cameco(CCJ.US$, based in Saskatoon, Saskatchewan, rose as much as 8.5% in Toronto trading, while $Lakewood Exploration Inc(LWD.CA$, Colorado-based Energy Fuels gained 9.1% in New York.

Source: Bloomberg, WSJ, CNBC

Asian stocks looked set for a mixed start Tuesday as investors continue to digest the prospect of tightening monetary policy to restrain a surge in inflation stoked partly by energy costs.

Futures rose in Japan and Hong Kong and fell in Australia. The $S&P 500 Index(.SPX.US$and $NASDAQ 100 Index(.NDX.US$gained overnight, aided by optimism about corporate earnings. U.S. contracts fluctuated.

JPMorgan's Kolanovic says market still misjudges reflation trade

The recent market jitters over stagflation are "misplaced" and the shift to bargain stocks and economically sensitive companies should continue, according to $JPMorgan(JPM.US$strategists led by Marko Kolanovic.

The economic expansion is likely to stay above trend levels as major central banks appear to prioritize sustaining the recovery over taming inflation, they wrote in a note to clients.

SEC says brokers enticed by payment for order flow are making trading into a game to lure investors

Wall Street's main regulator released its highly anticipated report on the GameStop mania on Monday. The SEC said online brokerages, enticed to increase revenue through payment for order flow, are turning stock-trading into a game in order to encourage activity from retail investors.

"Payment for order flow and the incentives it creates may cause broker-dealers to find novel ways to increase customer trading, including through the use of digital engagement practices," the agency said.

First bitcoin futures exchange-traded fund starts trading Tuesday

The first U.S. bitcoin futures exchange-traded fund launches on Tuesday, a milestone for the cryptocurrency industry. The ProShares ETF will provide exposure to bitcoin futures contracts — agreements to buy or sell the asset later for an agreed-upon price — rather than bitcoin itself. While there's strong demand for the new asset, financial advisors urge caution before adding bitcoin futures ETFs to portfolios.

Microsoft hits first record since August ahead of results

$Microsoft(MSFT.US$shares rose to their first all-time high in about two months on Monday, with the software company emerging as the first mega-cap stock to return to record levels after concerns over rising bond yields pressured the group in recent weeks. The stock rose 1% to $307.28, hitting its first intraday record since Aug. 20.

Rent the Runway targets valuation of up to $1.5 nillion in IPO

Rent the Runway Inc. is seeking a valuation of as much as $1.5 billion in its initial public offering next week, in what would cap a comeback for the clothing-rental business.

The New York company is aiming to sell shares at between $18 and $21 apiece for a fully diluted valuation of $1.24 billion to $1.46 billion, it said in a securities filing Monday. The roadshow for company management and their underwriters to pitch the shares to potential investors begins Tuesday and the shares are to start trading on the Nasdaq Stock Market next Wednesday.

State Street profit increases 29% on more assets, market gains

$State Street(STT.US$posted a better-than-expected quarterly profit, as market gains and new business wins lifted revenue. The custody bank’s shares were up 3% in midafternoon trading.

State Street's net income rose 29% to $714 million, or $1.96 a share, in the third quarter. Analysts polled by FactSet had predicted a $1.92 profit. Revenue climbed to $2.99 billion from $2.78 billion in the year-ago period. Analysts expected $2.96 billion.

No. 1 uranium miner backs physical fund in nod to robust demand

Kazatomprom, the world's largest uranium miner, is backing a new uranium fund that aims to invest in the radioactive metal used to power nuclear reactors.

Shares of uranium companies jumped Monday, lead by and $Cameco(CCJ.US$, based in Saskatoon, Saskatchewan, rose as much as 8.5% in Toronto trading, while $Lakewood Exploration Inc(LWD.CA$, Colorado-based Energy Fuels gained 9.1% in New York.

Source: Bloomberg, WSJ, CNBC

71

17

Ei_888

liked

$AMC Entertainment(AMC.US$ you are amazing!

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)