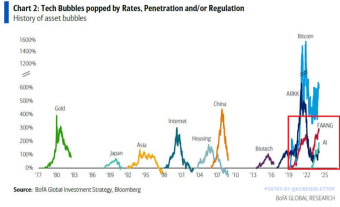

AI-related stocks have rallied more than 200% since ChatGPT was released in November 2022, largely driven by Nvidia, $NVIDIA(NVDA.US$ , gains.

Moreover, FAANG stocks, Meta, $Meta Platforms(META.US$ , Apple, $Apple(AAPL.US$ , Amazon, $Amazon(AMZN.US$ , Netflix, $Netflix(NFLX.US$ , and Google, $Alphabet-A(GOOGL.US$ , are up ~300% over the last 5 years.

By comparison, during the 1990s Dot-Com frenzy, Internet-related stocks rallied ~300%...

Moreover, FAANG stocks, Meta, $Meta Platforms(META.US$ , Apple, $Apple(AAPL.US$ , Amazon, $Amazon(AMZN.US$ , Netflix, $Netflix(NFLX.US$ , and Google, $Alphabet-A(GOOGL.US$ , are up ~300% over the last 5 years.

By comparison, during the 1990s Dot-Com frenzy, Internet-related stocks rallied ~300%...

6

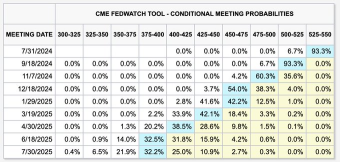

Markets now have a BASE CASE of 6 interest rate cuts over the next year.

The base case shows rate cuts at every meeting remaining in 2024 starting in September.

Discussions of a 50 basis point interest rate cut have even begun to emerge.

This feels a lot like January 2024 when the market went from pricing-in 3 rate cuts in 2024 to 7 in a matter of weeks.

The only way rate expectations can get more dovish this year is if the Fed starts cutting rates by 50 basis points.

What happens if CPI in...

The base case shows rate cuts at every meeting remaining in 2024 starting in September.

Discussions of a 50 basis point interest rate cut have even begun to emerge.

This feels a lot like January 2024 when the market went from pricing-in 3 rate cuts in 2024 to 7 in a matter of weeks.

The only way rate expectations can get more dovish this year is if the Fed starts cutting rates by 50 basis points.

What happens if CPI in...

3

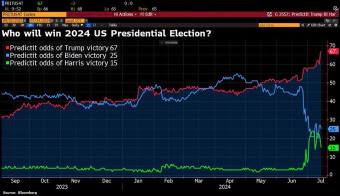

$Trump Media & Technology(DJT.US$ Very similar to what happened during the Reagan election in 1981.

67% odds after the shooting.

67% odds after the shooting.

3

What is happening with regional bank stocks?

So far in 2024, the KBW Regional Bank Index is down ~12%, massively underperforming larger banks.

In comparison, $Bank of America(BAC.US$ , $JPMorgan(JPM.US$ , $Citigroup(C.US$ , and $Wells Fargo & Co(WFC.US$ are up ~20% YTD.

This marks the largest gap in the performance between small and large banks since the 2008 Financial Crisis.

Even as the headlines have disappeared, many small banks are still feeling the pain of the regional bank crisis....

So far in 2024, the KBW Regional Bank Index is down ~12%, massively underperforming larger banks.

In comparison, $Bank of America(BAC.US$ , $JPMorgan(JPM.US$ , $Citigroup(C.US$ , and $Wells Fargo & Co(WFC.US$ are up ~20% YTD.

This marks the largest gap in the performance between small and large banks since the 2008 Financial Crisis.

Even as the headlines have disappeared, many small banks are still feeling the pain of the regional bank crisis....

4

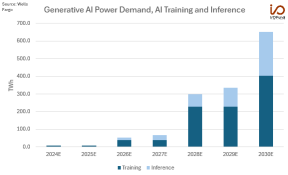

Wells Fargo is projecting AI power demand to surge 8,050% by 2030, from 8 TWh this year to 652 TWh.

AI training is expected to drive the bulk of this demand, at 40 TWh in 2026 and 402 TWh by 2030, with inference’s power demand accelerating at the end of the decade.

$NVIDIA(NVDA.US$ $Advanced Micro Devices(AMD.US$ $Broadcom(AVGO.US$ $Alphabet-C(GOOG.US$ $Microsoft(MSFT.US$ $Amazon(AMZN.US$

AI training is expected to drive the bulk of this demand, at 40 TWh in 2026 and 402 TWh by 2030, with inference’s power demand accelerating at the end of the decade.

$NVIDIA(NVDA.US$ $Advanced Micro Devices(AMD.US$ $Broadcom(AVGO.US$ $Alphabet-C(GOOG.US$ $Microsoft(MSFT.US$ $Amazon(AMZN.US$

2

Weight of the top 10 stocks in the S&P 500 has spiked to ~34%, the most in the entire history.

At the same time the weight of the LARGEST stock of the $S&P 500 Index(.SPX.US$ relative to the 75th percentile stock is 770x!

This is even higher than in the 1920s.

$Apple(AAPL.US$ $Microsoft(MSFT.US$ $NVIDIA(NVDA.US$ $Tesla(TSLA.US$ $Amazon(AMZN.US$

At the same time the weight of the LARGEST stock of the $S&P 500 Index(.SPX.US$ relative to the 75th percentile stock is 770x!

This is even higher than in the 1920s.

$Apple(AAPL.US$ $Microsoft(MSFT.US$ $NVIDIA(NVDA.US$ $Tesla(TSLA.US$ $Amazon(AMZN.US$

4

$Apple(AAPL.US$ ’s announcement to buy back $110B in shares marks the largest share buyback program in US history. Over the last 30 years, Apple has bought back over half a trillion dollars worth of shares.

3

This is interesting:

Hedge funds have been selling US tech stocks at the fastest pace in at least 7 years this month, according to Goldman Sachs.

Semiconductor stocks have been the most heavily sold, followed by software and internet stocks.

This comes after Nasdaq 100 has rallied 18% year-to-date and 40% since October 2023.

At the same time, the Semiconductor Index, $PHLX Semiconductor Index(.SOX.US$ , has skyrocketed by 30% and 70%, respectively.

As a result, $PHLX Semiconductor Index(.SOX.US$ relative ...

Hedge funds have been selling US tech stocks at the fastest pace in at least 7 years this month, according to Goldman Sachs.

Semiconductor stocks have been the most heavily sold, followed by software and internet stocks.

This comes after Nasdaq 100 has rallied 18% year-to-date and 40% since October 2023.

At the same time, the Semiconductor Index, $PHLX Semiconductor Index(.SOX.US$ , has skyrocketed by 30% and 70%, respectively.

As a result, $PHLX Semiconductor Index(.SOX.US$ relative ...

2

This is insane.

$Goldman Sachs(GS.US$ just reported that hedge funds are aggressively offloading tech stocks at a rapid rate we haven't seen in years

June is already a record month

$Apple(AAPL.US$ $NVIDIA(NVDA.US$ $Microsoft(MSFT.US$ $Tesla(TSLA.US$ $Amazon(AMZN.US$

$Goldman Sachs(GS.US$ just reported that hedge funds are aggressively offloading tech stocks at a rapid rate we haven't seen in years

June is already a record month

$Apple(AAPL.US$ $NVIDIA(NVDA.US$ $Microsoft(MSFT.US$ $Tesla(TSLA.US$ $Amazon(AMZN.US$

3

3

Citigroup raises price target on $NVIDIA(NVDA.US$ to $250

Rosenblatt upgrades $Apple(AAPL.US$ to buy, raises price target to $260

Bank of America reiterates buy on $Amazon(AMZN.US$ , raises price target to $220

Jeffries reiterates buy on $Alphabet-C(GOOG.US$ , raises price target to $215

Rosenblatt upgrades $Apple(AAPL.US$ to buy, raises price target to $260

Bank of America reiterates buy on $Amazon(AMZN.US$ , raises price target to $220

Jeffries reiterates buy on $Alphabet-C(GOOG.US$ , raises price target to $215

3

8

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)