Boss7777

commented on

Moomoo Courses is committed to providing high-quality content for investors. Learn first before trading, make investing easier and not alone.

Let’s take a look at what's new in Courses last week!![]()

【New Courses】

Are you still finding it hard to make money? Secure a better future for your family by starting investing. If you don't break the old way of thinking, it will be very hard to get you to start investing in the world.

![]() Easy Ways to Start Investing

Easy Ways to Start Investing

Here is a packaged how-to guide to solve your operation problems. How to access market news? How to track trading stocks? How to use stock screener? Come and enjoy it!

![]() Explore Investing Ideas

Explore Investing Ideas

The Federal Reserve could announce plans to cut economic support faster, and may signal 2022 rate increases, at its Dec. 14-15 meeting.

Why does the Federal funds rate matter to us? Follow moomoo Courses to see the updated news about Federal Funds Rate.

![]() The Federal Reserve

The Federal Reserve

【A Little Change】

Did you notice that moomoo Courses is quietly changing?

Our covers are all wordless. That's right!![]()

How about the simple and abstract cover art? Your voice will be forwarded to our designers.

For more investment knowledge and trends, welcome to Courses in the Community.

$S&P 500 Index(.SPX.US$ $Nasdaq Composite Index(.IXIC.US$ $Dow Jones Industrial Average(.DJI.US$

Let’s take a look at what's new in Courses last week!

【New Courses】

Are you still finding it hard to make money? Secure a better future for your family by starting investing. If you don't break the old way of thinking, it will be very hard to get you to start investing in the world.

Here is a packaged how-to guide to solve your operation problems. How to access market news? How to track trading stocks? How to use stock screener? Come and enjoy it!

The Federal Reserve could announce plans to cut economic support faster, and may signal 2022 rate increases, at its Dec. 14-15 meeting.

Why does the Federal funds rate matter to us? Follow moomoo Courses to see the updated news about Federal Funds Rate.

【A Little Change】

Did you notice that moomoo Courses is quietly changing?

Our covers are all wordless. That's right!

How about the simple and abstract cover art? Your voice will be forwarded to our designers.

For more investment knowledge and trends, welcome to Courses in the Community.

$S&P 500 Index(.SPX.US$ $Nasdaq Composite Index(.IXIC.US$ $Dow Jones Industrial Average(.DJI.US$

32

5

Boss7777

liked

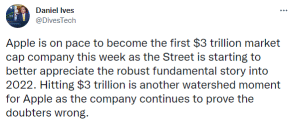

$Apple(AAPL.US$ rose 0.3% today. The company shares are on track to hit another milestone in terms of market capitalization, which is $3 trillion, according to Wedbush Securities.

...the Street is starting to better appreciate the robust fundamental story into 2022. Hitting $3 trillion is another watershed moment for Apple as the company continues to prove the doubters wrong."

—— Wedbush analyst Daniel Ives twetted eariler today.

On Dec. 2, Daniel Ives raised the firm's price target on Apple to $200 from $185 and keeps an Outperform rating on the shares. The analyst has increased confidence in the iPhone 13 growth cycle into 2022 following channel checks.

The checks "continue to be much stronger than expected" and Apple is now on pace to sell north of 40M iPhones during the holiday season despite the chip shortage headwinds, Ives tells investors in a research note. The analyst believes the underlying iPhone 13 demand story both domestically and in China "is trending well ahead of Street expectations." He estimates that in China alone there are roughly 15M iPhone 13 upgrades for the December quarter. Apple is on its way to three trillion dollar market cap during 2022 and is a "top tech name to own," contends Ives.

Besides Ives, Loup Ventures analyst Gene Munster also think Apple's $3T Milestone is a nod and its best days are to come. The analyst said in a note Sunday that the previous $200 target laid out by him was "too conservative." Munster said that in FY 23, Apple will earn $7 yields, which is a $250 share price — a 38% markup from the current levels.

Munster's optimism is riding on two new product categories — metaverse and autonomy.

According to Bloomberg, J.P.Morgan raises iPhone maker's Apple price target to $210 from $180, highest on Wall Street, meaning nearly 17% upside to stock's last close ($179.45/shares on Dec. 10th).

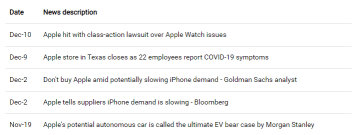

In the long run, Apple maybe one of the hottest stock to watch. But there are also bearish view on Apple once it hit $3T milestone.

Danil Sereda, an author from Seeking Alpha, suggested that Apple's upward movement becomes more and more fragile after the new high is reached because the rally looks overheated. He said that investors stopped paying due attention to the negative news about the company. Apple stock does not react in any way to negativity - the bulls just do not let it go down.

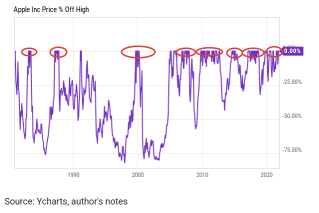

Meanwhile, Apple has been at its peak for too long with all the inputs described above. Historically, the longer the stock has been so close to its highs, the more it corrected (and not only during the Dot-com bubble and the Financial Crisis of 2008).

Mooers, do you think whether Apple's market cap will hit $3 trillion today?![]()

![]()

![]()

...the Street is starting to better appreciate the robust fundamental story into 2022. Hitting $3 trillion is another watershed moment for Apple as the company continues to prove the doubters wrong."

—— Wedbush analyst Daniel Ives twetted eariler today.

On Dec. 2, Daniel Ives raised the firm's price target on Apple to $200 from $185 and keeps an Outperform rating on the shares. The analyst has increased confidence in the iPhone 13 growth cycle into 2022 following channel checks.

The checks "continue to be much stronger than expected" and Apple is now on pace to sell north of 40M iPhones during the holiday season despite the chip shortage headwinds, Ives tells investors in a research note. The analyst believes the underlying iPhone 13 demand story both domestically and in China "is trending well ahead of Street expectations." He estimates that in China alone there are roughly 15M iPhone 13 upgrades for the December quarter. Apple is on its way to three trillion dollar market cap during 2022 and is a "top tech name to own," contends Ives.

Besides Ives, Loup Ventures analyst Gene Munster also think Apple's $3T Milestone is a nod and its best days are to come. The analyst said in a note Sunday that the previous $200 target laid out by him was "too conservative." Munster said that in FY 23, Apple will earn $7 yields, which is a $250 share price — a 38% markup from the current levels.

Munster's optimism is riding on two new product categories — metaverse and autonomy.

According to Bloomberg, J.P.Morgan raises iPhone maker's Apple price target to $210 from $180, highest on Wall Street, meaning nearly 17% upside to stock's last close ($179.45/shares on Dec. 10th).

In the long run, Apple maybe one of the hottest stock to watch. But there are also bearish view on Apple once it hit $3T milestone.

Danil Sereda, an author from Seeking Alpha, suggested that Apple's upward movement becomes more and more fragile after the new high is reached because the rally looks overheated. He said that investors stopped paying due attention to the negative news about the company. Apple stock does not react in any way to negativity - the bulls just do not let it go down.

Meanwhile, Apple has been at its peak for too long with all the inputs described above. Historically, the longer the stock has been so close to its highs, the more it corrected (and not only during the Dot-com bubble and the Financial Crisis of 2008).

Mooers, do you think whether Apple's market cap will hit $3 trillion today?

74

12

Boss7777

liked and commented on

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Boss7777 : Thanks