Biotechmaster

liked

$Cheetah Net Supply Chain Service(CTNT.US$ $GameStop(GME.US$ $Faraday Future Intelligent Electric Inc.(FFIE.US$

ctnt is at a massive discount at 0.72. it is heavily sold and shorted at a 52w low. 52w high is 14. opportunity here and dydd

ctnt is at a massive discount at 0.72. it is heavily sold and shorted at a 52w low. 52w high is 14. opportunity here and dydd

5

Biotechmaster

liked

Translated

4

Biotechmaster

liked

$Quest Diagnostics(DGX.US$ PathAI + Invigorate + stable finance + qualified management team + decent PE.

Will it dominate pathology and cancer diagnosis with AI in the future? Worth noting.

Will it dominate pathology and cancer diagnosis with AI in the future? Worth noting.

4

Biotechmaster

liked

$JPY/USD(JPYUSD.FX$

The yen is weaker than the level that previously triggered the latest round of suspected intervention by Japan, highlighting the limited impact of intervention in the foreign exchange market.

The yen once hit a four-week low of 157.71 against the US dollar, then recovered some of its losses. The level of exchange rate fluctuation is currently close to the much-watched 157.52 mark. The yen strengthened sharply after hitting this level on May 1.

Continued weakness reflects the large yield gap between Japan and other major economies, which has prompted capital to withdraw from the yen and to potentially higher-return assets. Although the yield on Japanese treasury bonds hit a ten-year high, the pressure on the yen has not abated.

Masaaki Omori, chief trading strategist at Mizuho Securities, said that Japanese yen arbitrage is still too attractive, and fast money investors continue to short the yen. Unless speculations surrounding the Fed will cut interest rates drastically or the Bank of Japan will raise interest rates drastically, the strong momentum of the dollar against the yen is unlikely to change.

The yield on Japan's 10-year treasury bonds once rose 2.5 basis points to 1.1%, the highest level since July 2011.

After the Bank of Japan withdrew from the negative interest rate policy in March, market speculation that interest rates will be further raised this year has heated up, and the benchmark yield has been rising.

“Even if the yield on Japanese treasury bonds rises slightly, it doesn't matter,” said Masateru Omori. The market is still focused on higher-yielding currencies.

Risk of intervention

Not only is the yen depreciating against the US dollar, but it is also weakening against European currencies. The yen is close to its lowest level against the pound since 2008...

The yen is weaker than the level that previously triggered the latest round of suspected intervention by Japan, highlighting the limited impact of intervention in the foreign exchange market.

The yen once hit a four-week low of 157.71 against the US dollar, then recovered some of its losses. The level of exchange rate fluctuation is currently close to the much-watched 157.52 mark. The yen strengthened sharply after hitting this level on May 1.

Continued weakness reflects the large yield gap between Japan and other major economies, which has prompted capital to withdraw from the yen and to potentially higher-return assets. Although the yield on Japanese treasury bonds hit a ten-year high, the pressure on the yen has not abated.

Masaaki Omori, chief trading strategist at Mizuho Securities, said that Japanese yen arbitrage is still too attractive, and fast money investors continue to short the yen. Unless speculations surrounding the Fed will cut interest rates drastically or the Bank of Japan will raise interest rates drastically, the strong momentum of the dollar against the yen is unlikely to change.

The yield on Japan's 10-year treasury bonds once rose 2.5 basis points to 1.1%, the highest level since July 2011.

After the Bank of Japan withdrew from the negative interest rate policy in March, market speculation that interest rates will be further raised this year has heated up, and the benchmark yield has been rising.

“Even if the yield on Japanese treasury bonds rises slightly, it doesn't matter,” said Masateru Omori. The market is still focused on higher-yielding currencies.

Risk of intervention

Not only is the yen depreciating against the US dollar, but it is also weakening against European currencies. The yen is close to its lowest level against the pound since 2008...

Translated

19

Biotechmaster

liked

$SIMEPROP(5288.MY$

Google confirmed the news of its investment in Malaysia, driving the relevant data center concept stock Morinami Industries and $GAMUDA(5398.MY$Jinmudai's stock price soared!

Today, Google promised to invest 2 billion US dollars (approximately RM9.4 billion) in Malaysia to develop Google's first data center and cloud area in Malaysia at the Elmina (Elmina) Business Park in Shah Alam, Selangor, a subsidiary of Senami Industries.

Morinami Industries opened at RM1.19 in early trading today. Inspired by favorable news, the stock price once rose to a maximum of RM1.28.

When the market closed, Morinami Industries closed at RM1.24, up 4 cents or 3.33% throughout the day, with a trading volume of 60.96 million shares.

At the same time, Jinwu University earlier received two giant data center related engineering contracts related to the Morinami industry through its subsidiary, with a total value of RM1,743 million, so it is also highly sought after today.

The project is expected to have two main stages, with a contract value of RM815 million for the construction phase and RM928.6 million for the mechanical commissioning phase.

When the market closed, Financial Services reported RM6.15, up 7 cents or 1.15%, and the trading volume reached 8.81 million shares.

Source: Nanyang Siang Pao

Disclaimer: This content is for informational and educational purposes only, and does not constitute any specific investment, investment strategy, or recommendation endorsement. Readers shall bear any risk and responsibility arising from reliance on this content...

Google confirmed the news of its investment in Malaysia, driving the relevant data center concept stock Morinami Industries and $GAMUDA(5398.MY$Jinmudai's stock price soared!

Today, Google promised to invest 2 billion US dollars (approximately RM9.4 billion) in Malaysia to develop Google's first data center and cloud area in Malaysia at the Elmina (Elmina) Business Park in Shah Alam, Selangor, a subsidiary of Senami Industries.

Morinami Industries opened at RM1.19 in early trading today. Inspired by favorable news, the stock price once rose to a maximum of RM1.28.

When the market closed, Morinami Industries closed at RM1.24, up 4 cents or 3.33% throughout the day, with a trading volume of 60.96 million shares.

At the same time, Jinwu University earlier received two giant data center related engineering contracts related to the Morinami industry through its subsidiary, with a total value of RM1,743 million, so it is also highly sought after today.

The project is expected to have two main stages, with a contract value of RM815 million for the construction phase and RM928.6 million for the mechanical commissioning phase.

When the market closed, Financial Services reported RM6.15, up 7 cents or 1.15%, and the trading volume reached 8.81 million shares.

Source: Nanyang Siang Pao

Disclaimer: This content is for informational and educational purposes only, and does not constitute any specific investment, investment strategy, or recommendation endorsement. Readers shall bear any risk and responsibility arising from reliance on this content...

Translated

17

3

Biotechmaster

liked

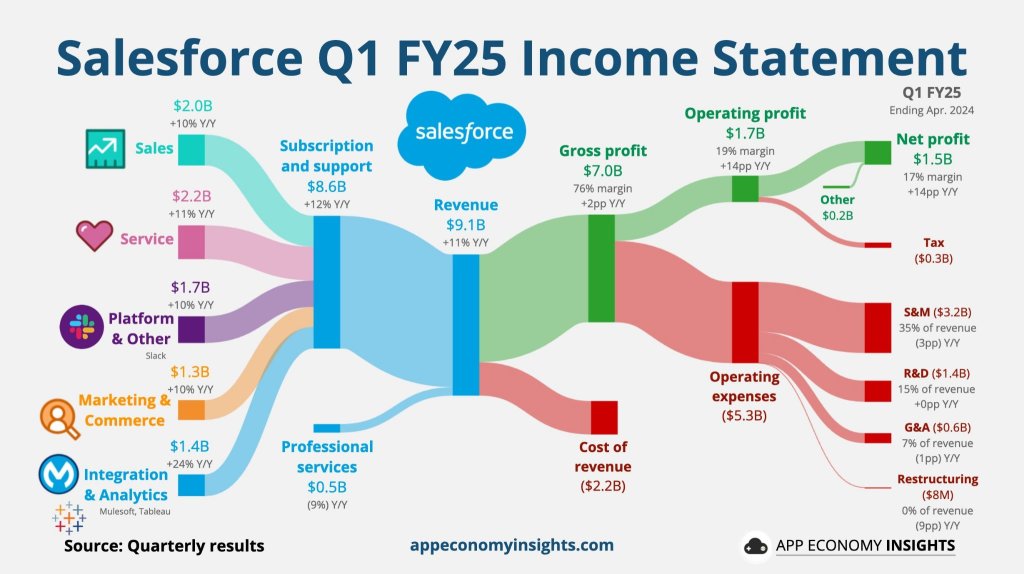

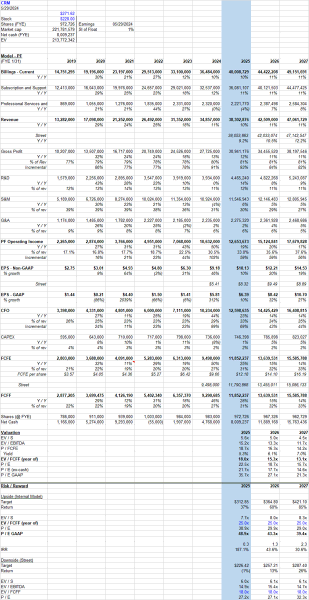

$Salesforce(CRM.US$ Per usual, not much color beyond blaming it on a soft macro and beginning-of-year sales adjustments. Definitely some egg on face as CEO was mega-bullish on last qtr’s call, and CFO said the following at last public conference: “I’m a lawyer and never said this but never been more excited for Salesforce”.

It’s very early in enterprise AI product development / pricing so story moving sideways for now as are numbers (top line and...

It’s very early in enterprise AI product development / pricing so story moving sideways for now as are numbers (top line and...

26

6

Biotechmaster

liked

Hey, mooers!

May has been an exciting month for the market, meme stocks jumped, Dow Jones record high and Nvidia topped $1000 a share after Q1 earnings. Did your portfolio enjoy the heat? Share your investment approach now!

❤️ We'd love to hear:

● Pleasant surprises: How was your monthly performance? Any better-than-expected profit or trading?

● June's investment tactics: Are there any investment plan updates on the horizon?

Event...

May has been an exciting month for the market, meme stocks jumped, Dow Jones record high and Nvidia topped $1000 a share after Q1 earnings. Did your portfolio enjoy the heat? Share your investment approach now!

❤️ We'd love to hear:

● Pleasant surprises: How was your monthly performance? Any better-than-expected profit or trading?

● June's investment tactics: Are there any investment plan updates on the horizon?

Event...

79

64

Biotechmaster

liked

$Sharps Technology(STSS.US$ Over $1 because this thing is good for everyone. Otherwise, we'll have to face the prisoner's dilemma![]() Let the bears roll short a few times

Let the bears roll short a few times![]() Protecting your property is simple, keep it all the time. Until the bears pay you the profit you deserve

Protecting your property is simple, keep it all the time. Until the bears pay you the profit you deserve![]()

Translated

3

Biotechmaster

liked

When I first saw the Reddit IPO a few months back, I did a bit of a deep dive into their financials. Simply put, the outlook was as a grim as I expected.

More traffic on Reddit = More profit from ads and other data partnerships.

A few other things to consider:

When coming up with the estimated EPS data for the Reddit IPO, experts COULDN’T have projected this boost in traffic (it didn’t exist at the time)

Reddit entered into a contract to ...

More traffic on Reddit = More profit from ads and other data partnerships.

A few other things to consider:

When coming up with the estimated EPS data for the Reddit IPO, experts COULDN’T have projected this boost in traffic (it didn’t exist at the time)

Reddit entered into a contract to ...

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)