Barney Tamminen

liked

CTOS digital Q1 net profit rose, and the stock price rose to a new high in nearly two months

Driven by higher sales of digital solutions, CTOS digital $CTOS(5301.MY$ Net profit for the first quarter of fiscal year 2024 increased 25.60% year over year to RM20.82 million, and a dividend of 0.64 cents was announced.

The company reported to the Malaysia Stock Exchange on Tuesday that its first-quarter turnover increased 20.11% a year to RM71.58 million.

On Wednesday, the stock surged 4.3% to RM1.46, a new high since early March.

The CTOS digital core net profit for the first quarter, accounting for 17.2% of the full-year forecast, is still considered to be in line with Societe Generale Investment Bank's research expectations, mainly seasonal weakness in the first quarter. In the past, it was only about 18% to 20% for the whole year.

However, thanks to increased sales of data systems reports and digital solutions, all divisions achieved steady double-digit revenue growth.

Management remains optimistic about CTOS's digital growth trajectory and believes that with strong channels and customer conversion, as well as upselling of international sector analytical services and other solutions, internal goals can be achieved.

The company anticipates that increased adoption of electronic customer verification service (eKYC) digital solutions, comprehensive portfolio reviews, and analytical products, as well as the influx of new customers, will be the driving force for growth in FY2024.

Management revealed that the appeal hearing date for the ongoing lawsuit is set for July 9.

Societe Generale Investment Bank research continues to be optimistic about the company as a leader...

Driven by higher sales of digital solutions, CTOS digital $CTOS(5301.MY$ Net profit for the first quarter of fiscal year 2024 increased 25.60% year over year to RM20.82 million, and a dividend of 0.64 cents was announced.

The company reported to the Malaysia Stock Exchange on Tuesday that its first-quarter turnover increased 20.11% a year to RM71.58 million.

On Wednesday, the stock surged 4.3% to RM1.46, a new high since early March.

The CTOS digital core net profit for the first quarter, accounting for 17.2% of the full-year forecast, is still considered to be in line with Societe Generale Investment Bank's research expectations, mainly seasonal weakness in the first quarter. In the past, it was only about 18% to 20% for the whole year.

However, thanks to increased sales of data systems reports and digital solutions, all divisions achieved steady double-digit revenue growth.

Management remains optimistic about CTOS's digital growth trajectory and believes that with strong channels and customer conversion, as well as upselling of international sector analytical services and other solutions, internal goals can be achieved.

The company anticipates that increased adoption of electronic customer verification service (eKYC) digital solutions, comprehensive portfolio reviews, and analytical products, as well as the influx of new customers, will be the driving force for growth in FY2024.

Management revealed that the appeal hearing date for the ongoing lawsuit is set for July 9.

Societe Generale Investment Bank research continues to be optimistic about the company as a leader...

Translated

17

Barney Tamminen

liked

8th May 2024 (Wed) Daily Market Outlook

Summary - What Is Happening In The Markets

US markets took a breather last night after a strong 3-consecutive days rally that started last Thursday. Price action was sluggish due to the lack of any significant news. S&P500 futures closed marginally higher by +0.13% while NASDAQ futures closed flat. Traders now turn their attention to the upcoming US 10-year Note auction that would...

Summary - What Is Happening In The Markets

US markets took a breather last night after a strong 3-consecutive days rally that started last Thursday. Price action was sluggish due to the lack of any significant news. S&P500 futures closed marginally higher by +0.13% while NASDAQ futures closed flat. Traders now turn their attention to the upcoming US 10-year Note auction that would...

+11

18

Barney Tamminen

liked

The Federal Open Market Committee has decided to keep interest rates unchanged once again. This was very much in line with market expectations and comes at a time when US stock indices are seeing increasing weakness across most sectors and only saved by the mega-caps.

While Jerome Powell was seemingly baited with hawkish-questions a couple of times at the post-FOMC meeting press conference, the US Fed chair made it clear th...

While Jerome Powell was seemingly baited with hawkish-questions a couple of times at the post-FOMC meeting press conference, the US Fed chair made it clear th...

27

Barney Tamminen

liked

$FTSE Bursa Malaysia KLCI Index(.KLSE.MY$

#2兆马币的大池塘才能滋养更多鱼儿

When we first entered the stock market 12 years ago, the total market value of Malaysian stocks at that time seemed to be RM1.6 trillion. After 12 years of waiting, I finally saw the word 2. Today, the market value reached RM2.00 trillion.

Malaysian Stock Market Capitalization = RM2,000,000,000,000

Moreover, the market capitalization broke through a two-year high of 1,605.68 points, mainly due to the promotion of money banks, TENAGA, and PMETAL.

$CIMB(1023.MY$

$MAYBANK(1155.MY$

$TENAGA(5347.MY$

I really hope that future horse stocks will bloom in full bloom, make this pond bigger and bigger, and nourish more fish 🐟 swim in the water. Mutual encouragement!

#2兆马币的大池塘才能滋养更多鱼儿

When we first entered the stock market 12 years ago, the total market value of Malaysian stocks at that time seemed to be RM1.6 trillion. After 12 years of waiting, I finally saw the word 2. Today, the market value reached RM2.00 trillion.

Malaysian Stock Market Capitalization = RM2,000,000,000,000

Moreover, the market capitalization broke through a two-year high of 1,605.68 points, mainly due to the promotion of money banks, TENAGA, and PMETAL.

$CIMB(1023.MY$

$MAYBANK(1155.MY$

$TENAGA(5347.MY$

I really hope that future horse stocks will bloom in full bloom, make this pond bigger and bigger, and nourish more fish 🐟 swim in the water. Mutual encouragement!

Translated

57

Barney Tamminen

liked

The strong performance of US technology stocks last night once again boosted the rise in the US stock market, although the stock market briefly declined due to the Treasury's increase in borrowing expectations for the second quarter. Tesla's stock price surged 15%, the biggest one-day increase in three years, while Apple also rose 2.5%. In contrast, Google and Nvidia experienced a period of fluctuation. Google fell by more than 3%, and Nvidia rebounded slightly after falling nearly 3% in the intraday period.

In the European market, the British stock market hit record highs for three consecutive days. Dutch Philips shares soared 29%, while Deutsche Bank fell nearly 9%. Furthermore, news of Tesla CEO Elon Musk's visit to China attracted market attention, particularly the expectation that fully automated driving technology (FSD) will soon be implemented in China.

The US Treasury unexpectedly raised borrowing expectations for the second quarter. This move did not take into account the possibility that the Federal Reserve might slow down its contraction. Meanwhile, the market continues to pay attention to the Fed's future interest rate policy. Despite expectations of interest rate cuts, the market generally believes that it will not return to the period of ultra-low interest rates.

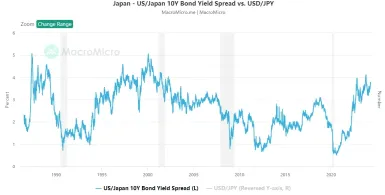

In the currency market, the yen fell sharply in the Asian market. At one point, it fell below 160 yen to 1 US dollar, a new low since 1990, but then surged 3.5% in the intraday period and once recovered to 155 yen. The US dollar index, on the other hand, turned down in the intraday period and was close to a two-week low. The cryptocurrency market is also quite volatile. Bitcoin's price once fell sharply, falling below the $62,000 mark.

The price of crude oil fell after rising for two consecutive days, and the price of US oil hit a new low in a month...

In the European market, the British stock market hit record highs for three consecutive days. Dutch Philips shares soared 29%, while Deutsche Bank fell nearly 9%. Furthermore, news of Tesla CEO Elon Musk's visit to China attracted market attention, particularly the expectation that fully automated driving technology (FSD) will soon be implemented in China.

The US Treasury unexpectedly raised borrowing expectations for the second quarter. This move did not take into account the possibility that the Federal Reserve might slow down its contraction. Meanwhile, the market continues to pay attention to the Fed's future interest rate policy. Despite expectations of interest rate cuts, the market generally believes that it will not return to the period of ultra-low interest rates.

In the currency market, the yen fell sharply in the Asian market. At one point, it fell below 160 yen to 1 US dollar, a new low since 1990, but then surged 3.5% in the intraday period and once recovered to 155 yen. The US dollar index, on the other hand, turned down in the intraday period and was close to a two-week low. The cryptocurrency market is also quite volatile. Bitcoin's price once fell sharply, falling below the $62,000 mark.

The price of crude oil fell after rising for two consecutive days, and the price of US oil hit a new low in a month...

Translated

13

1

Barney Tamminen

liked

Introduction

According to a Bloomberg report on April 10, Berkshire Hathaway, led by Warren Buffett, intends to issue yen-denominated bonds globally once again. A week later, on the 18th, Berkshire announced that the scale of this bond issuance amounted to 263.3 billion yen, marking the largest issuance of its yen bonds since their debut in 2019.

Of particular note, Berkshire's decision to borrow yen comes at a time when the currency is plung...

According to a Bloomberg report on April 10, Berkshire Hathaway, led by Warren Buffett, intends to issue yen-denominated bonds globally once again. A week later, on the 18th, Berkshire announced that the scale of this bond issuance amounted to 263.3 billion yen, marking the largest issuance of its yen bonds since their debut in 2019.

Of particular note, Berkshire's decision to borrow yen comes at a time when the currency is plung...

+2

31

3

Barney Tamminen

liked

Hello everyone and welcome back to moomoo![]() . I'm options explorer.

. I'm options explorer.

In the upcoming weeks, we are going to see a flurry of earnings reports in the U.S. stock market, including notable appearances from companies like $Coca-Cola(KO.US$, $Apple(AAPL.US$,and $Amazon(AMZN.US$.

After a company's earnings report, stock prices often experience high volatility.

For options traders, volatility often presents opportunities; hig...

In the upcoming weeks, we are going to see a flurry of earnings reports in the U.S. stock market, including notable appearances from companies like $Coca-Cola(KO.US$, $Apple(AAPL.US$,and $Amazon(AMZN.US$.

After a company's earnings report, stock prices often experience high volatility.

For options traders, volatility often presents opportunities; hig...

![[Options ABC] Three useful option strategies to consider during earnings season](https://ussnsimg.moomoo.com/sns_client_feed/77777077/20240507/1715073382828-6b5aab31a4.png/thumb?area=100&is_public=true)

![[Options ABC] Three useful option strategies to consider during earnings season](https://ussnsimg.moomoo.com/sns_client_feed/77777077/20240426/1714098015333-320ba84b8b.png/thumb?area=100&is_public=true)

![[Options ABC] Three useful option strategies to consider during earnings season](https://ussnsimg.moomoo.com/sns_client_feed/77777077/20240426/1714098015277-4cd56f1b92.png/thumb?area=100&is_public=true)

+12

95

19

Barney Tamminen

liked

As a value investor, I have been told not to watch prices daily. But given the general upbeat, you may miss the opportunity if you do not do this. Take Ternium as an example

Ternium and its subsidiaries manufacture, process, and sell various steel products mainly in South America. This is cyclical company that is fundamentally sound. It doubled its revenue over the past 12 years through organic growth and acquisitions. It achieved a growing ROE with corresponding imp...

Ternium and its subsidiaries manufacture, process, and sell various steel products mainly in South America. This is cyclical company that is fundamentally sound. It doubled its revenue over the past 12 years through organic growth and acquisitions. It achieved a growing ROE with corresponding imp...

16

Barney Tamminen

liked

As a global EV leader, China has far surpassed other countries in terms of both sales and export ratio, and the entire ecosystem is already very mature. More and more car manufacturers are seizing this piece of cake. The imbalance between supply and demand is getting bigger. The Chinese EV market is already facing a “never-ending” wave of price cuts

Among them, Tesla took the lead in announcing price cuts in 2022 in order to stabilize its market position, causing a chain effect of “price cuts”. As the biggest competitor, BYD also completely lowered prices soon after. Other major brands such as Ideal, SAIC, NIO, and Chery responded. This has triggered wave after wave of “price reduction waves”, forming the internal phenomenon seen so far

In order to stand out from the harsh competitive environment, the price cuts made by some car manufacturers are even more dumbfounded. With the attitude of “I would rather lose or not lose”, they quickly run out of breath when beating other peers. The entire field is already heating up, and everyone is leaving China one after another, so where will the next battleground be? Southeast Asia

Due to the impact of the price war, EVs of various brands are becoming more and more affordable, and consumers in emerging markets are becoming more and more accepting of EVs. For example, Thailand, Indonesia, the Philippines, and Malaysia have all “doubled” in the past few years. Not only dealers, but the supply chain required for the EV ecosystem, such as cables, electricity, distribution systems, charging piles, and battery replacement, will continue to benefit. With the help of the government actively promoting energy transformation, I believe more companies will seize this egg in the future...

Among them, Tesla took the lead in announcing price cuts in 2022 in order to stabilize its market position, causing a chain effect of “price cuts”. As the biggest competitor, BYD also completely lowered prices soon after. Other major brands such as Ideal, SAIC, NIO, and Chery responded. This has triggered wave after wave of “price reduction waves”, forming the internal phenomenon seen so far

In order to stand out from the harsh competitive environment, the price cuts made by some car manufacturers are even more dumbfounded. With the attitude of “I would rather lose or not lose”, they quickly run out of breath when beating other peers. The entire field is already heating up, and everyone is leaving China one after another, so where will the next battleground be? Southeast Asia

Due to the impact of the price war, EVs of various brands are becoming more and more affordable, and consumers in emerging markets are becoming more and more accepting of EVs. For example, Thailand, Indonesia, the Philippines, and Malaysia have all “doubled” in the past few years. Not only dealers, but the supply chain required for the EV ecosystem, such as cables, electricity, distribution systems, charging piles, and battery replacement, will continue to benefit. With the help of the government actively promoting energy transformation, I believe more companies will seize this egg in the future...

Translated

19

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)