Heavy selling hit late yesterday but S&P 500 futures higher, erasing the drop

S&P 500 futures are up 25 points in a move that will erase the drop in the final hour of trading yesterday. Notably, there have been two late-day drops in the past two days. That could be an indication of rebalancing flows into quarter end. I'll be keeping an eye out for the same today.

$Dow Jones Industrial Average(.DJI.US$ $Nasdaq Composite Index(.IXIC.US$ $S&P 500 Index(.SPX.US$

S&P 500 futures are up 25 points in a move that will erase the drop in the final hour of trading yesterday. Notably, there have been two late-day drops in the past two days. That could be an indication of rebalancing flows into quarter end. I'll be keeping an eye out for the same today.

$Dow Jones Industrial Average(.DJI.US$ $Nasdaq Composite Index(.IXIC.US$ $S&P 500 Index(.SPX.US$

1

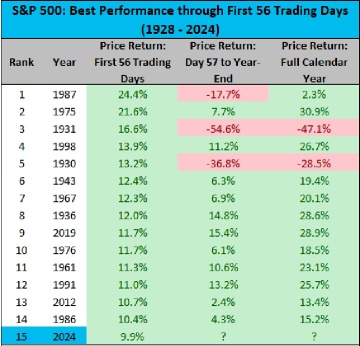

S&P 500 is up 9.9% in the first 56 trading days of 2024, the 15th best start to a year going back to 1928. $S&P 500 Index(.SPX.US$

4

Nvidia $NVIDIA(NVDA.US$ will hit a minimum $10 Trillion Market Cap by 2030 says Beth Kindig, lead tech analyst at the I/O Fund

5

4

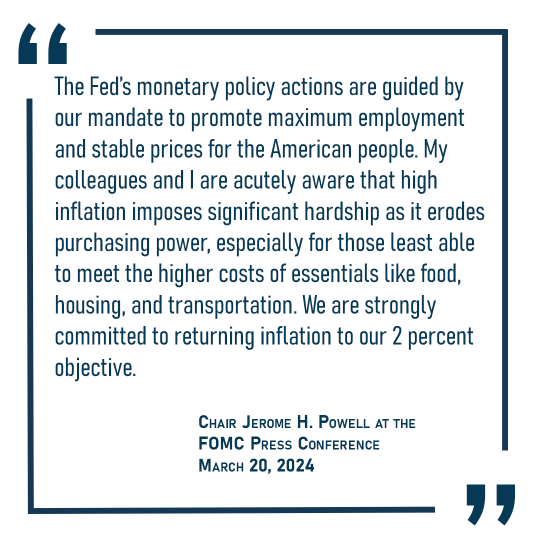

Read Chair Powell's full opening statement from the #FOMC press conference:

$SPDR S&P 500 ETF(SPY.US$ $Invesco QQQ Trust(QQQ.US$

$SPDR S&P 500 ETF(SPY.US$ $Invesco QQQ Trust(QQQ.US$

1

$SPDR S&P 500 ETF(SPY.US$ holding support still on trendline and sitting above 20SMA.

(Thursday and Friday could be big set-up for explosion to the upside)

(Thursday and Friday could be big set-up for explosion to the upside)

1

The likelihood of US 2-year yields moving back towards 5% is increasing, as the Federal Reserve's March dot plot may suggest only two 25bps interest rate cuts this year instead of three. This shift comes after US CPI data revealed a slowdown in inflation, indicating that rates may need to remain higher for longer.

The split within the Fed between those projecting two rate reductions and those indicating three is close, with potential for a more haw...

The split within the Fed between those projecting two rate reductions and those indicating three is close, with potential for a more haw...

3

$SPDR S&P 500 ETF(SPY.US$ | BofA RAISES its 2024 S&P 500 earnings estimates to $250 from $235, citing AI's 'virtuous cycle' and marking the highest Wall Street forecast with a 12% YoY upside.

"Companies delivered another STRONG beat in 4Q and our economists RAISED their 2024 GDP forecast to +2.7% YoY (vs. +1.4% in November)," note strategists.

This GDP increase is expected to boost EPS growth by 5ppt.

Despite a 3ppt shortfall in expected EPS growth in 2023, BofA anticipates a REBOUND in 2024,...

"Companies delivered another STRONG beat in 4Q and our economists RAISED their 2024 GDP forecast to +2.7% YoY (vs. +1.4% in November)," note strategists.

This GDP increase is expected to boost EPS growth by 5ppt.

Despite a 3ppt shortfall in expected EPS growth in 2023, BofA anticipates a REBOUND in 2024,...

2

In a speech on Friday, Biden “bet” that the Fed would be cutting interest rates soon.

It is extremely rare for a President not named Trump to comment on Federal Reserve policy. This comes after a climax run in $NVIDIA(NVDA.US$ stock and a volatile week that had the market on the cusp of a much needed pause or pullback.

Yet now, if market participants take this comment seriously and believe Biden has inside information about Powell’s plan, ...

It is extremely rare for a President not named Trump to comment on Federal Reserve policy. This comes after a climax run in $NVIDIA(NVDA.US$ stock and a volatile week that had the market on the cusp of a much needed pause or pullback.

Yet now, if market participants take this comment seriously and believe Biden has inside information about Powell’s plan, ...

5

4

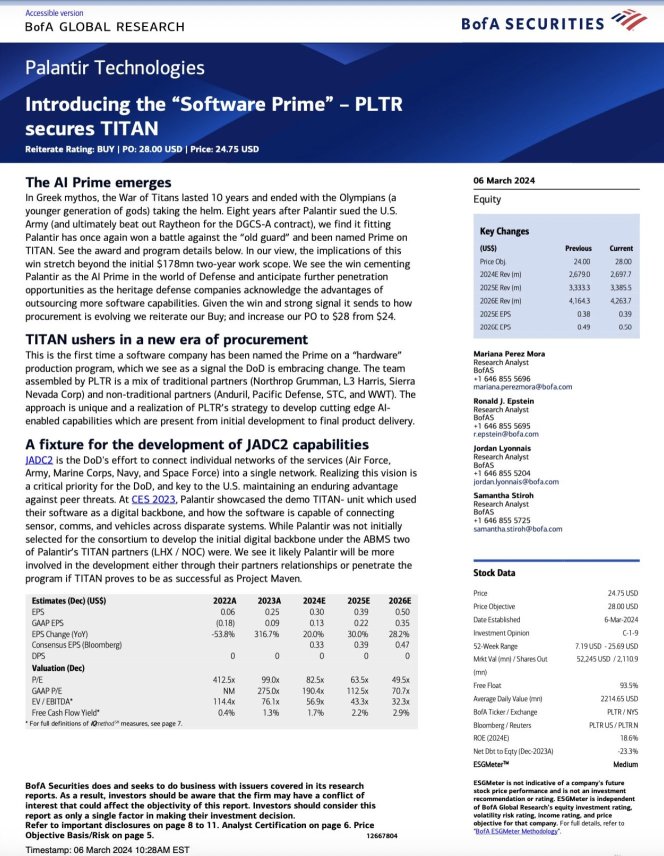

$Palantir(PLTR.US$ BANK OF AMERICA ANALYST MARIANA RAISES PALANTIR PRICE TARGET UPGRADE TO $28

$SPDR S&P 500 ETF(SPY.US$ $Invesco QQQ Trust(QQQ.US$

$SPDR S&P 500 ETF(SPY.US$ $Invesco QQQ Trust(QQQ.US$

6

US yields are trending higher as the March dot plot from the Federal Reserve may signal only two 25bps interest rate cuts this year, down from the previously expected three reductions. The core PCE's monthly growth rate hitting a one-year high in January indicates that inflation remains a concern, supporting the Fed's stance on keeping interest rates elevated.

The split between Fed members projecting two vs. three rate cuts was close, with a shift f...

The split between Fed members projecting two vs. three rate cuts was close, with a shift f...

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)