102554695 Tweety

liked

$Alcoa(AA.US$Today's standing at 49, and the next battle is at 53... Good stocks really don't disappoint those who have faith in it

Translated

1

102554695 Tweety

liked

$Apple(AAPL.US$ Still can buy now ?

20

102554695 Tweety

liked

The iPhone maker $Apple(AAPL.US$ generates large revenues and free cash flows and will most certainly continue to do so for the foreseeable future. This, however, could already be priced in the company's stock, which makes it susceptible to a price consolidation or slight correction in the short term. This is even more so due to the post-pandemic hefty 2021 revenue increases, which the company is unlikely to sustain in the next year or two.

I have compiled some data from the company's past annual reports. I will go quickly through the existing financial situation of the company and then move on to more fun stuff.

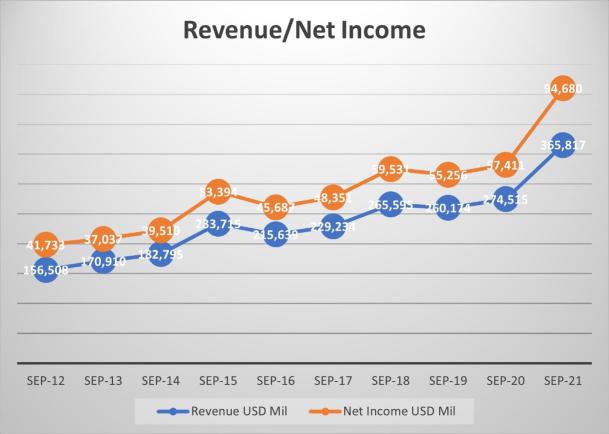

Revenue and Net Income

Apple generates revenues from multiple flagship products and services, including iPhone and iPad sales, App Store, Apple Care services, and cloud storage, to name a few. iPhone sales are the major contributor to revenues, but recently the Other Products category, which includes such items as Apple Watch, Home Air Pods, Home accessories and other wearables, has picked up quite nicely. Apple product users are pretty much locked into the iOS ecosystem and unwilling to part with such products anytime soon. Short of the company successively releasing a few subquality devices, it is not likely Apple's loyal customers will abandon the company anytime soon. This, in turn, will ensure Apple's consistent revenue generation for many more years to come.

The operating margin is good at over 25%, considering the fierce competition in the tech sector, where margins are always being tested in order to gain market share.

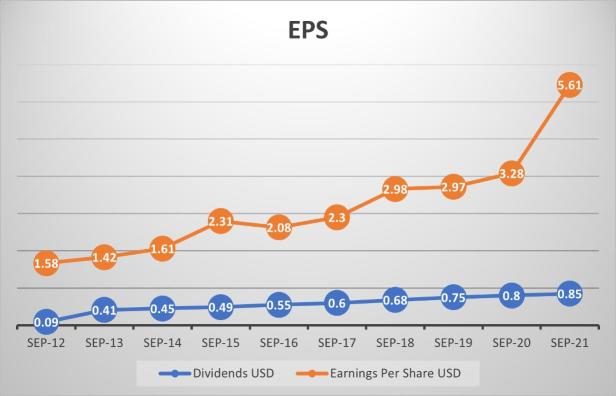

Earnings have seen a sharp increase in 2021 after modest gains over the previous years. The earnings will likely pull back a bit, in line with the trend leading up to the pandemic. The dividend yield is relatively low when compared to many other tech giants.

Return on Equity, Return on Invested Capital, and Return on Assets

The same can be observed with the return on equity, invested capital, and assets. All these three metrics have seen a jump in the last year, with the return in equity being the highest.

The free cash flow per share is illustrated in the chart below. The growth is steady as the company can generate a lot of cash due to the popularity of its products.

Financial Health

Apple's debt to equity ratio is 1.73, which is a bit high. The company will need to make principal payments at an average of $10 billion annually until 2026 and over $64 billion annually after that. The total term debt value is $118 billion.

The current and quick ratios have been declining in the last two years, correlated with the increase in liabilities. The quick ratio is slightly concerning due to having a value below 1, and the current ratio is not healthy either.

Free Cash Flow Yield

The chart below shows the relationship between the price and the FCF yield trend. This is another important metric in that it provides a measurement of the stock valuation. The stock price trending upwards while the yields are heading lower indicates an unsustainable trend and a likely correction in the short term.

Share buybacks

Conclusion

I think Apple is a great company that will handsomely reward its shareholders in the long run, but it would probably be wise to apply a wait-and-see approach in the short term. Any dip in the range of $125-130 would be a good entry position. If, after a correction, it breaks above $160, that would be my signal to increase my position to take advantage of the next bull run. Until then, I will be on the sidelines waiting patiently.

Thank you for reading.

I have compiled some data from the company's past annual reports. I will go quickly through the existing financial situation of the company and then move on to more fun stuff.

Revenue and Net Income

Apple generates revenues from multiple flagship products and services, including iPhone and iPad sales, App Store, Apple Care services, and cloud storage, to name a few. iPhone sales are the major contributor to revenues, but recently the Other Products category, which includes such items as Apple Watch, Home Air Pods, Home accessories and other wearables, has picked up quite nicely. Apple product users are pretty much locked into the iOS ecosystem and unwilling to part with such products anytime soon. Short of the company successively releasing a few subquality devices, it is not likely Apple's loyal customers will abandon the company anytime soon. This, in turn, will ensure Apple's consistent revenue generation for many more years to come.

The operating margin is good at over 25%, considering the fierce competition in the tech sector, where margins are always being tested in order to gain market share.

Earnings have seen a sharp increase in 2021 after modest gains over the previous years. The earnings will likely pull back a bit, in line with the trend leading up to the pandemic. The dividend yield is relatively low when compared to many other tech giants.

Return on Equity, Return on Invested Capital, and Return on Assets

The same can be observed with the return on equity, invested capital, and assets. All these three metrics have seen a jump in the last year, with the return in equity being the highest.

The free cash flow per share is illustrated in the chart below. The growth is steady as the company can generate a lot of cash due to the popularity of its products.

Financial Health

Apple's debt to equity ratio is 1.73, which is a bit high. The company will need to make principal payments at an average of $10 billion annually until 2026 and over $64 billion annually after that. The total term debt value is $118 billion.

The current and quick ratios have been declining in the last two years, correlated with the increase in liabilities. The quick ratio is slightly concerning due to having a value below 1, and the current ratio is not healthy either.

Free Cash Flow Yield

The chart below shows the relationship between the price and the FCF yield trend. This is another important metric in that it provides a measurement of the stock valuation. The stock price trending upwards while the yields are heading lower indicates an unsustainable trend and a likely correction in the short term.

Share buybacks

Conclusion

I think Apple is a great company that will handsomely reward its shareholders in the long run, but it would probably be wise to apply a wait-and-see approach in the short term. Any dip in the range of $125-130 would be a good entry position. If, after a correction, it breaks above $160, that would be my signal to increase my position to take advantage of the next bull run. Until then, I will be on the sidelines waiting patiently.

Thank you for reading.

+6

72

2

102554695 Tweety

commented on

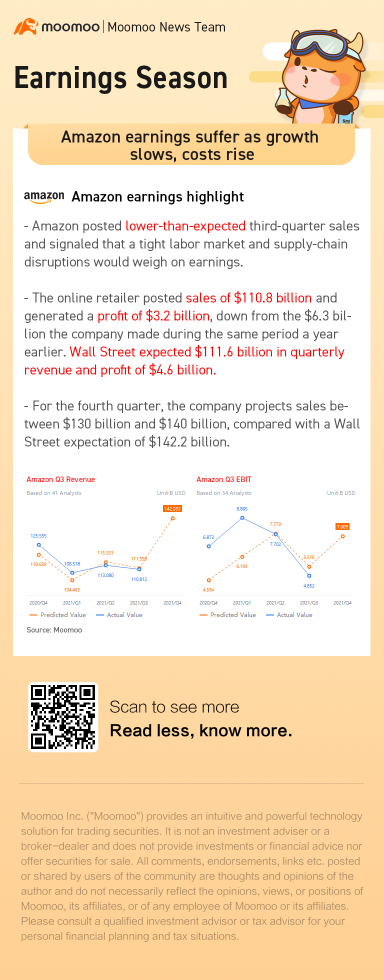

$Amazon(AMZN.US$shares, which closed up 1.59% in Thursday trading, fell 4.78% at $3446.57 per share at pre-market trading.

Expand

Expand 33

5

102554695 Tweety

liked

Translated

5

102554695 Tweety

commented on

In 2021, Futu turns 9 years old. Having accompanied millions of users for 9 years.

As we celebrate our 9th birthday, we look back into the past and try to uncover memorable moments, and found that every unforgettable moment was spent with you—our dear users:

In 2012, Futu embarked on an exciting journey with you.

In 2019, we were listed on the Nasdaq.

In 2020, we onboarded our 10 millionth user.

In 2021, we advanced into more markets across the globe, welcoming more than 15.5 million users from over 200 countries and regions…

As we celebrate our 9th birthday, we feel ever more motivated by our founding vision: “make investing easier and not alone”. It is the millions of users in our community that make investing “not alone”. These 9 years with you are the best time that we have ever spent.

As we celebrate our 9th birthday, we would like you to know: We wish to continue accompanying you on your investing journey ahead, for the next 9 years or even 90 years.

As we celebrate our 9th birthday, we sincerely want to invite you - our dear users - to share your moomoo stories in the past years.

[About the Event]

We wish to invite our users to share their moomoo stories and 9 representative users will be selected. If you are interested, please send your moomoo story or your self-introduction to the official email address: futupr@futunn.com.

The email should include: (ideally 300-500 words, the more the better)

-Your name, moomoo ID, Nationality, Occupation

-Your moomoo story: When you started using Futu services and products via moomoo; what you want to share with us and fellow users

-A casual photo of yourself or a photo of you with a moomoo figurine (optional, less than 5M)

[What to Do If I Am Selected as a Representative User?]

① You should be willing to take an interview themed "My moomoo Story", which will be disseminated via global and Futu/moomoo official media channels in the form of image and text.

② You should be willing to take a photo against a pure-colored background or a photo that presents your daily life. The photo will be used for the poster of "Futu 9th Anniversary—Representative Users", which will be disseminated globally.

③ You should be willing to participate in a video filming. The video will be used for the video of "Futu 9th Anniversary—Representative Users", which will be disseminated globally.

*Detailed information on the specifications of the photos and videos will be further discussed with you by our staff.

[Application Period]

September 16 – September 22

[Gift Package for Selected Users]

If you are selected as a representative user, share your Futu story, and participate in the photo taking and video filming, you will receive a US$999 stock card*, and a lucky bag containing exquisite moomoo merchandise.

[Gift Package for Event Participants]

User that actively participated in the Event but are not selected will receive 999 points* as a thank you gift.

*T&Cs apply:

Singapore Users: tap to read full T&Cs

U.S. Users: tap to read full T&Cs

As we celebrate our 9th birthday, we look back into the past and try to uncover memorable moments, and found that every unforgettable moment was spent with you—our dear users:

In 2012, Futu embarked on an exciting journey with you.

In 2019, we were listed on the Nasdaq.

In 2020, we onboarded our 10 millionth user.

In 2021, we advanced into more markets across the globe, welcoming more than 15.5 million users from over 200 countries and regions…

As we celebrate our 9th birthday, we feel ever more motivated by our founding vision: “make investing easier and not alone”. It is the millions of users in our community that make investing “not alone”. These 9 years with you are the best time that we have ever spent.

As we celebrate our 9th birthday, we would like you to know: We wish to continue accompanying you on your investing journey ahead, for the next 9 years or even 90 years.

As we celebrate our 9th birthday, we sincerely want to invite you - our dear users - to share your moomoo stories in the past years.

[About the Event]

We wish to invite our users to share their moomoo stories and 9 representative users will be selected. If you are interested, please send your moomoo story or your self-introduction to the official email address: futupr@futunn.com.

The email should include: (ideally 300-500 words, the more the better)

-Your name, moomoo ID, Nationality, Occupation

-Your moomoo story: When you started using Futu services and products via moomoo; what you want to share with us and fellow users

-A casual photo of yourself or a photo of you with a moomoo figurine (optional, less than 5M)

[What to Do If I Am Selected as a Representative User?]

① You should be willing to take an interview themed "My moomoo Story", which will be disseminated via global and Futu/moomoo official media channels in the form of image and text.

② You should be willing to take a photo against a pure-colored background or a photo that presents your daily life. The photo will be used for the poster of "Futu 9th Anniversary—Representative Users", which will be disseminated globally.

③ You should be willing to participate in a video filming. The video will be used for the video of "Futu 9th Anniversary—Representative Users", which will be disseminated globally.

*Detailed information on the specifications of the photos and videos will be further discussed with you by our staff.

[Application Period]

September 16 – September 22

[Gift Package for Selected Users]

If you are selected as a representative user, share your Futu story, and participate in the photo taking and video filming, you will receive a US$999 stock card*, and a lucky bag containing exquisite moomoo merchandise.

[Gift Package for Event Participants]

User that actively participated in the Event but are not selected will receive 999 points* as a thank you gift.

*T&Cs apply:

Singapore Users: tap to read full T&Cs

U.S. Users: tap to read full T&Cs

![[Call for Stories] Futu Turns 9 and You Are Invited to Share Your “moomoo Stories”!](https://ussnsimg.moomoo.com/1631868222118-77777004-android-org.jpg/thumb)

904

1077

102554695 Tweety

liked

Hii mooers!

The US Stock Paper Trading Competition Season 3 is now arrived!

![]() Tap here to register

Tap here to register ![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() Do you like our cutie moomoo figurines but lack ponits to redeem?

Do you like our cutie moomoo figurines but lack ponits to redeem?

![]() Are you looking for a chance to get our cutie themed gifts without saving up points for a long time?

Are you looking for a chance to get our cutie themed gifts without saving up points for a long time?

You can get limited-edition moomoo Figurines by simply guessing of this week's highest total profit/loss percentageon the leaderboard.

...

The US Stock Paper Trading Competition Season 3 is now arrived!

You can get limited-edition moomoo Figurines by simply guessing of this week's highest total profit/loss percentageon the leaderboard.

...

![[S3 W1 US Stock Paper Trading] Make your guess of the highest Total P/L to win!](https://ussnsimg.moomoo.com/2339315773675467647.jpg/thumb)

![[S3 W1 US Stock Paper Trading] Make your guess of the highest Total P/L to win!](https://ussnsimg.moomoo.com/3104839985507150523.jpg/thumb)

![[S3 W1 US Stock Paper Trading] Make your guess of the highest Total P/L to win!](https://ussnsimg.moomoo.com/921399588460037604.gif/thumb)

48

93

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)