101764215Moi

voted

Morning mooers! It is Wednesday May 22, the market is cautiously flat, awaiting Nvidia earnings after market closes.

My name is Kevin Travers, and here are the stories moving on Wall Street Today:

$Target (TGT.US)$'s fiscal first-quarter earnings missed Wall Street's estimates by 3C, and were 1% below last year's $2.05. Shares in the firm fell 8% in early trading, the lowest decline on the S&P 500.

The largest gainer on the S&P 50...

My name is Kevin Travers, and here are the stories moving on Wall Street Today:

$Target (TGT.US)$'s fiscal first-quarter earnings missed Wall Street's estimates by 3C, and were 1% below last year's $2.05. Shares in the firm fell 8% in early trading, the lowest decline on the S&P 500.

The largest gainer on the S&P 50...

46

4

101764215Moi

voted

In a CNBC interview, billionaire investor Stanley Druckenmiller revealed that he trimmed his exposure to $NVIDIA(NVDA.US$ stock earlier this year. “We did cut that and a lot of other positions in late March. I just need a break. We’ve had a hell of a run. A lot of what we recognized has become recognized by the marketplace now,” said Druckenmiller.

Specifically, Druckenmiller took some profits off the table when “the stock went from $150 to ...

Specifically, Druckenmiller took some profits off the table when “the stock went from $150 to ...

6

1

101764215Moi

commented on

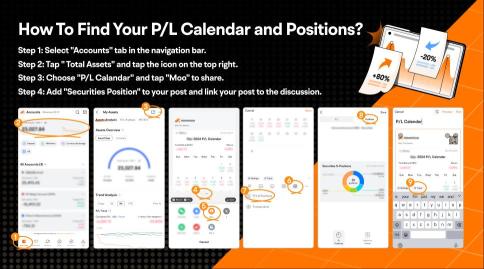

Hey mooers! We have held a Share Your Today's Profit/Loss (April Challenge). Many mooers participated in this activity and shared their P/L and trading experience. Thank you for your active participation!

👏 Without further ado, it's time to announce the winners for April.

💬 Don't be shy, leave a congratulatory message for the winning users in the comment section!

👏 Congratulations to the following mooers for winning 50...

👏 Without further ado, it's time to announce the winners for April.

💬 Don't be shy, leave a congratulatory message for the winning users in the comment section!

👏 Congratulations to the following mooers for winning 50...

49

19

101764215Moi

commented on

Hey, mooers!

With April's market swings and the excitement of Q1 2024 earnings, it's time to reflect. How did your portfolio react? Any adjustments worth noting? Which companies led to your success? Looking forward, what's on your investment horizon for May?

❤ We'd love to hear:

● Profit surprises: Which stocks delivered better-than-expected earnings?

● Market catalysts: What factors impacted your investment outcomes?

● May's inv...

With April's market swings and the excitement of Q1 2024 earnings, it's time to reflect. How did your portfolio react? Any adjustments worth noting? Which companies led to your success? Looking forward, what's on your investment horizon for May?

❤ We'd love to hear:

● Profit surprises: Which stocks delivered better-than-expected earnings?

● Market catalysts: What factors impacted your investment outcomes?

● May's inv...

+1

77

45

101764215Moi

voted

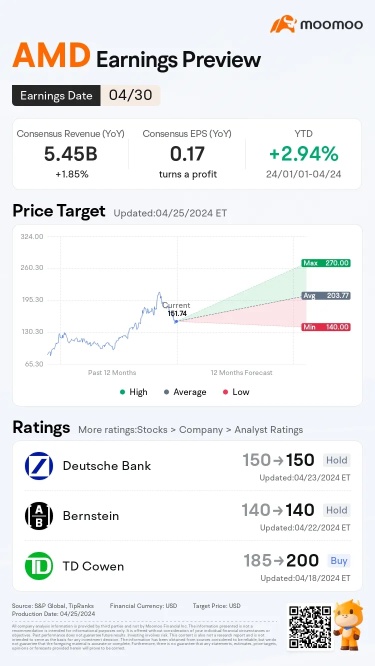

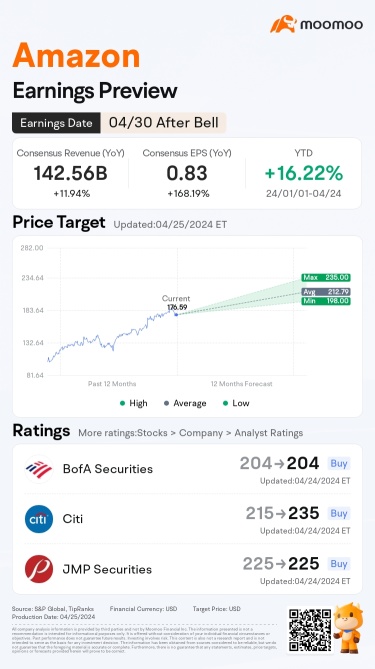

AMD and Amazon are releasing their Q1 earnings after the market closes on April 30. Who will please the market more, the e-commerce giant or the AI darling? Make your prediction to grab point rewards!

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the winner who makes the biggest gains in Wednesday's intraday trading (e.g., If 50 mooers make a correct guess, each of them will get 100 points.)

(Vote will close at 9:3...

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the winner who makes the biggest gains in Wednesday's intraday trading (e.g., If 50 mooers make a correct guess, each of them will get 100 points.)

(Vote will close at 9:3...

54

48

101764215Moi

voted

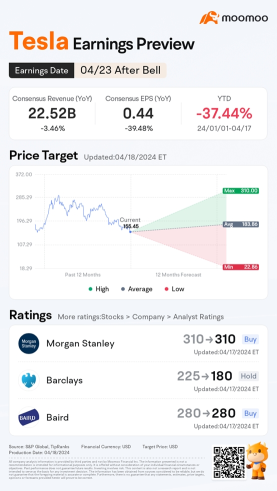

Tesla is releasing its Q1 2024 earnings after the market closes on April 23.

Since its Q4 earnings release, shares of $Tesla(TSLA.US$ have seen a decrease of 29%.![]() Overall earnings estimates have been revised lower since the company's last earnings release. How will the market react to the upcoming results? Make your guess now!

Overall earnings estimates have been revised lower since the company's last earnings release. How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range ...

Since its Q4 earnings release, shares of $Tesla(TSLA.US$ have seen a decrease of 29%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range ...

133

370

101764215Moi

reacted to and voted

Netflix is releasing its Q1 2024 earnings after the market closes on April 18.

Since its Q4 earnings release, shares of $Netflix(NFLX.US$ have seen an increase of 25%.![]() Its implied move on the earnings date is 8.8%. How will the market react to the upcoming results? Make your guess now!

Its implied move on the earnings date is 8.8%. How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $Netflix(NFLX.US$'s opening price at ...

Since its Q4 earnings release, shares of $Netflix(NFLX.US$ have seen an increase of 25%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $Netflix(NFLX.US$'s opening price at ...

55

103

101764215Moi

liked

i find the daily statement somewhat difficult to read. it can be reformatted to make it easier for users to digest.

1

1

101764215Moi

liked

Was initially attracted to Moomoo due to its user-friendly interface and robust research tools. The ease of trading and the extensive investment options available were also major factors that led me to join Moomoo. I became a part of the Moomoo community approximately six months ago, and I have been pleased with the platform's performance and the support I've received.

Currently, my main investments on Moomoo revolve around a diversified portfolio of stocks, ETFs, and a few opti...

Currently, my main investments on Moomoo revolve around a diversified portfolio of stocks, ETFs, and a few opti...

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)