$Sea(SE.US$ tiktok is selling e-commerce business to tokopedia in exchange for equity, better known as cooperation. This is the effect of one plus one less than two. Can it also plummet?

Translated

5

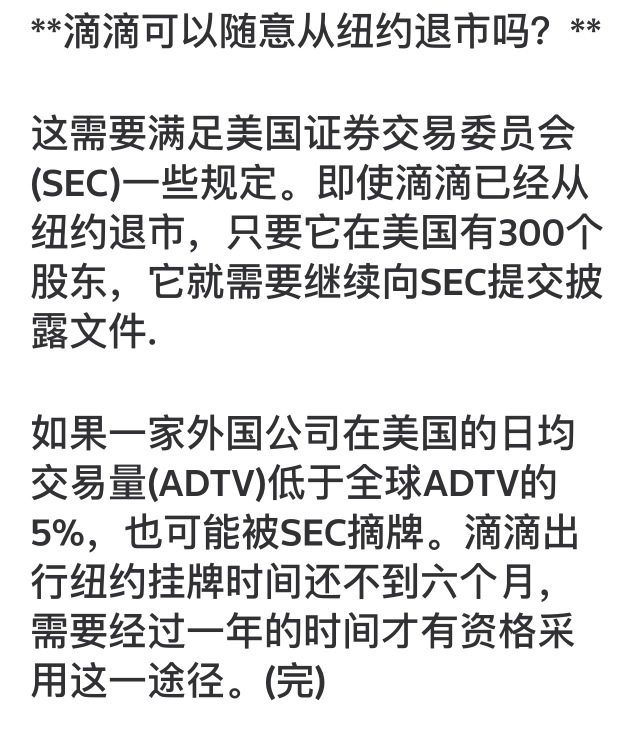

$DiDi Global (Delisted)(DIDI.US$ Also, I saw that it was retail investors who are starting to say they are selling, whether this means that if the organization doesn't leave, it won't collapse. Then it was also said that as long as there are 300 shareholders, Didi must submit disclosure documents. Does this mean that retail US stock investors can use this to become investors?

It would be nice if you could forget your Futu password, and maybe you'll get rich after a few years to log in... the more you operate, the more you benefit.

https://mobile.reuters.com/article/amp/idCNKBS2IM045

It would be nice if you could forget your Futu password, and maybe you'll get rich after a few years to log in... the more you operate, the more you benefit.

https://mobile.reuters.com/article/amp/idCNKBS2IM045

Translated

2

$DiDi Global (Delisted)(DIDI.US$ not sure how it work if Didi converts US ADS to HK stock. As what I see from alibaba, its US stock value is synced with the HK one, the conversion rate is same as the currency in Futu. if it works the same for Didi, when Didi list ok HK stock with a solid price, the US one will react accordingly. it does not matter how Low it’s now due to the market reaction, the final price will depends on the value at the point when Didi list on HK. Correct me if I am wrong, thank you.

6

$DiDi Global (Delisted)(DIDI.US$ I hope the Chinese government will put more pressure on Didi to pay more to complete privatization and reduce the losses of chives 🤦♂️

Translated

1

5

$DiDi Global (Delisted)(DIDI.US$ I understand that delisting is just not traded on the NASDAQ market, but the stocks in hand are still valuable and will be related to Didi's performance and valuation. However, after getting seriously injured this time, Didi climbed up and then went public in Hong Kong. It is estimated that it will be difficult to bring the valuation back to its original height; even if it works, it will be a long time. It should be unlikely that it will become super cheap; after all, it didn't go down. Most likely, it's still been a long time to crawl back to a price below the listed price, and if you can't wait, they will resolutely leave the market to invest in another one. The best case scenario is privatization. Didi buys back the stock at a reasonable price, but the chances are not great; it depends on whether the shareholders of Didi have the patience to exchange their capital for their conscience.

The above is just my personal opinion of Xiaobai. In this special period, I hope everyone can speak and comment responsibly to avoid causing others to buy or sell irrationally. Investing is serious business.

The above is just my personal opinion of Xiaobai. In this special period, I hope everyone can speak and comment responsibly to avoid causing others to buy or sell irrationally. Investing is serious business.

Translated

5

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)