We should do what we can, focus on investing in a few stocks we understand, don't be greedy, throw fishing nets everywhere, want to embrace left and right, and make all the money in the stock market.

A stock portfolio that is too fragmented cannot bring high returns. We should focus on investing in no more than five ⭐ stocks, preferably from different industries, to reduce risk.

You must read the QR and AR reports carefully when they come out.

✨ One minute of cultivation, one point of harvest ✨

Pies don't fall from the sky for no reason. If you want to invest and get rich, you have to work hard to do your homework. You must never think that the tips given by others are accurate, and rely on them to develop.

If you have the right mindset and work hard to study the fundamentals of the enterprise, you will definitely be richly rewarded.

✨ Invest and get rich, don't be impetuous, have whimsical dreams and become rich overnight ✨

There are no shortcuts to investing and becoming rich; you must step by step. Over time, you will definitely reach the end.

Don't use a gambling mentality to invest in stocks. You may be blessed for a moment, speculate successfully, expand yourself, and bad luck later, and it will be easy to throw back everything you've earned.

✨ Flowers don't have a hundred days of red, people don't have a thousand days of good ✨

Good luck cannot last a lifetime; if you don't wake up in time, you will fall sooner or later.

There are no shortcuts to investing; getting rich overnight is a fantasy. Don't believe in secrets that can be developed in the short term; instead, you should follow the steps and slowly accumulate wealth.

✨ BUY LOW, SELL HIGH ✨

Real value investors welcome the arrival of a bear market, provided they have plenty of cash, because at this point they can drop to the ground without much effort...

A stock portfolio that is too fragmented cannot bring high returns. We should focus on investing in no more than five ⭐ stocks, preferably from different industries, to reduce risk.

You must read the QR and AR reports carefully when they come out.

✨ One minute of cultivation, one point of harvest ✨

Pies don't fall from the sky for no reason. If you want to invest and get rich, you have to work hard to do your homework. You must never think that the tips given by others are accurate, and rely on them to develop.

If you have the right mindset and work hard to study the fundamentals of the enterprise, you will definitely be richly rewarded.

✨ Invest and get rich, don't be impetuous, have whimsical dreams and become rich overnight ✨

There are no shortcuts to investing and becoming rich; you must step by step. Over time, you will definitely reach the end.

Don't use a gambling mentality to invest in stocks. You may be blessed for a moment, speculate successfully, expand yourself, and bad luck later, and it will be easy to throw back everything you've earned.

✨ Flowers don't have a hundred days of red, people don't have a thousand days of good ✨

Good luck cannot last a lifetime; if you don't wake up in time, you will fall sooner or later.

There are no shortcuts to investing; getting rich overnight is a fantasy. Don't believe in secrets that can be developed in the short term; instead, you should follow the steps and slowly accumulate wealth.

✨ BUY LOW, SELL HIGH ✨

Real value investors welcome the arrival of a bear market, provided they have plenty of cash, because at this point they can drop to the ground without much effort...

Translated

4

✨ Invest not to become rich overnight, but to slowly accumulate wealth ✨

We should think backwards and not go with the crowd and go with the flow. When everyone agreed on the stocks we bought, in fact, the stocks we bought were probably overvalued and no longer cheap and beautiful.

When the stock market is bustling and people are flocking to buy in for fear of missing out on opportunities, we must rationally sell stocks and leave the market.

When a bear market hits, everyone is afraid to sell. We should keep up the deal, boldly buy undervalued high-quality stocks, and then hold them for a long time.

✨ Never let greed and fear influence investment decisions ✨

Long-term investment is not about holding for a long time; from a business perspective, we only need to buy a few 5-star companies that we can understand, have stable growth in performance, and have moats.

If the stock price overreflects the value of the company now/in the next few years, or if the company has deteriorated, you should sell/stop losing.

✨ Rome wasn't built in a day; I want to go to heaven one step at a time ✨

Investors usually seldom trade, but once they take action, they all return home with a full load.

We should think backwards and not go with the crowd and go with the flow. When everyone agreed on the stocks we bought, in fact, the stocks we bought were probably overvalued and no longer cheap and beautiful.

When the stock market is bustling and people are flocking to buy in for fear of missing out on opportunities, we must rationally sell stocks and leave the market.

When a bear market hits, everyone is afraid to sell. We should keep up the deal, boldly buy undervalued high-quality stocks, and then hold them for a long time.

✨ Never let greed and fear influence investment decisions ✨

Long-term investment is not about holding for a long time; from a business perspective, we only need to buy a few 5-star companies that we can understand, have stable growth in performance, and have moats.

If the stock price overreflects the value of the company now/in the next few years, or if the company has deteriorated, you should sell/stop losing.

✨ Rome wasn't built in a day; I want to go to heaven one step at a time ✨

Investors usually seldom trade, but once they take action, they all return home with a full load.

Translated

3

The benefit of value investing is that it lasts a long time. Famous investment masters all live longer than 90 years.

The main reason is that value investment focuses on patience, and investment results take a long time to prepare, so these investment gurus have peace of mind on a daily basis, have few ups and downs, and have no pressure, which indirectly brings the benefits of longevity.

As you build up your wealth, you also have plenty of time to do your favorite activities, such as reading, exercising, spending time with your family, etc.

If they are short-term speculators, they need to bear the pressure brought about by rising and falling stock prices, and the stress is very harmful to health.

Stock investing is a joint venture with others. We must take it seriously. We must be interested in investing. If we have the mentality of making quick money, it is difficult to earn huge wealth in the investment field.

You can only become rich by investing for a long time

![]() Buy when undervalued, sell when overvalued

Buy when undervalued, sell when overvalued![]()

The main reason is that value investment focuses on patience, and investment results take a long time to prepare, so these investment gurus have peace of mind on a daily basis, have few ups and downs, and have no pressure, which indirectly brings the benefits of longevity.

As you build up your wealth, you also have plenty of time to do your favorite activities, such as reading, exercising, spending time with your family, etc.

If they are short-term speculators, they need to bear the pressure brought about by rising and falling stock prices, and the stress is very harmful to health.

Stock investing is a joint venture with others. We must take it seriously. We must be interested in investing. If we have the mentality of making quick money, it is difficult to earn huge wealth in the investment field.

You can only become rich by investing for a long time

Translated

Many shareholders are eager to develop as soon as possible, so when they are young, they use aggressive short-term investment methods, thinking that being young is the capital, and even if they fall, they still have plenty of time to stand up.

If you want to get rich, you must follow the steps, stick to aggressive long-term investment principles, and fantasize about getting to heaven one step at a time

If you are an older investor, capital protection is more important. The ideal way to invest is to buy blue-chip stocks that pay generous dividends year after year

If you want to get rich, you must follow the steps, stick to aggressive long-term investment principles, and fantasize about getting to heaven one step at a time

If you are an older investor, capital protection is more important. The ideal way to invest is to buy blue-chip stocks that pay generous dividends year after year

Translated

In the world of stock investing, being overconfident is a fatal taboo.

We have to be in awe of the market, especially when we are most confident.

Some shareholders emptied everything when they earned their first pot of money with good luck. They felt that they were so powerful that they could continue the myth.

Strong soldiers are bound to defeat. When one is too confident, it is easy to overlook details, make mistakes, easily return to the original form, and lose hard-earned wealth.

For smart investors, success is a continuous process of exploration.

Don't blame others for making investment mistakes, let alone try to recoup your previous losses.

The right mindset is to review your mistakes to find out why you failed and avoid repeating them.

To ensure that our wealth continues to grow, we must learn new knowledge with an open mind, and we need to read all the time to absorb new knowledge.

We have to be in awe of the market, especially when we are most confident.

Some shareholders emptied everything when they earned their first pot of money with good luck. They felt that they were so powerful that they could continue the myth.

Strong soldiers are bound to defeat. When one is too confident, it is easy to overlook details, make mistakes, easily return to the original form, and lose hard-earned wealth.

For smart investors, success is a continuous process of exploration.

Don't blame others for making investment mistakes, let alone try to recoup your previous losses.

The right mindset is to review your mistakes to find out why you failed and avoid repeating them.

To ensure that our wealth continues to grow, we must learn new knowledge with an open mind, and we need to read all the time to absorb new knowledge.

Translated

康庄大道

commented on

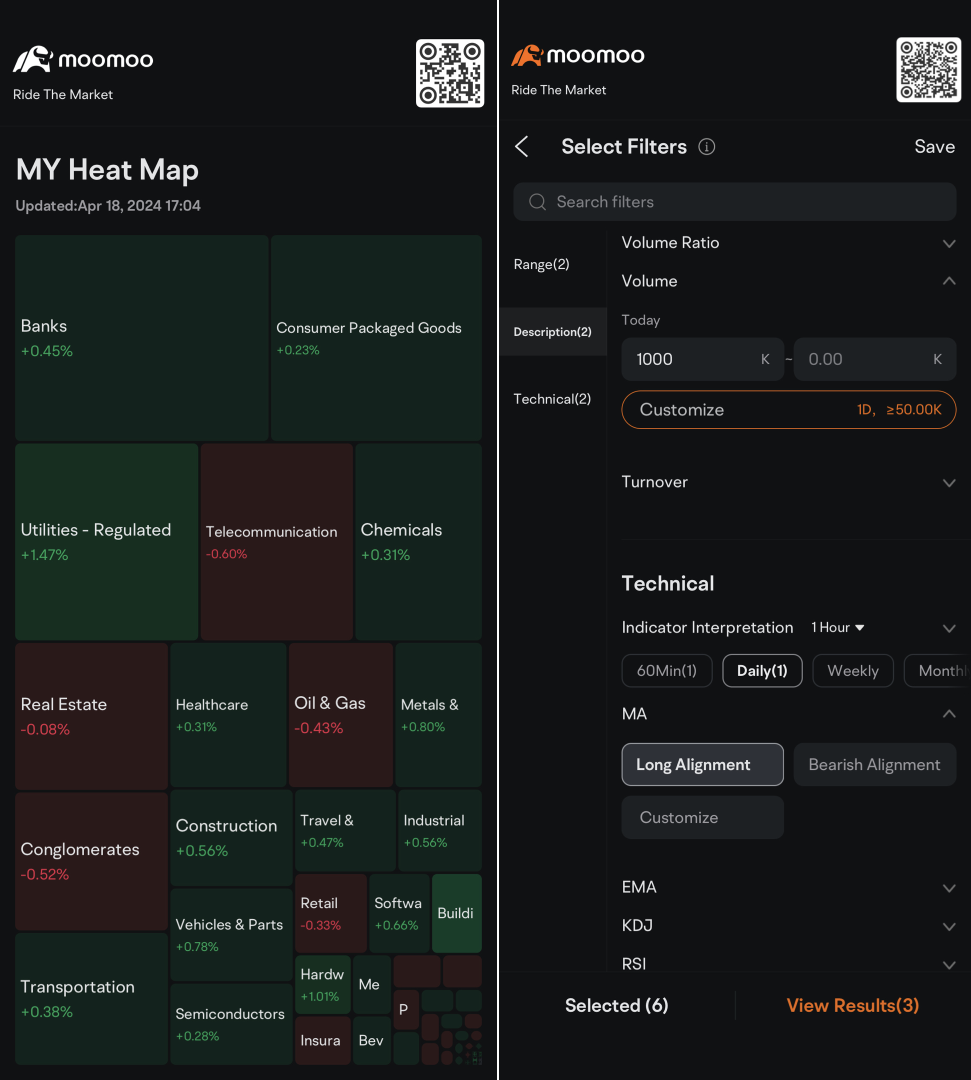

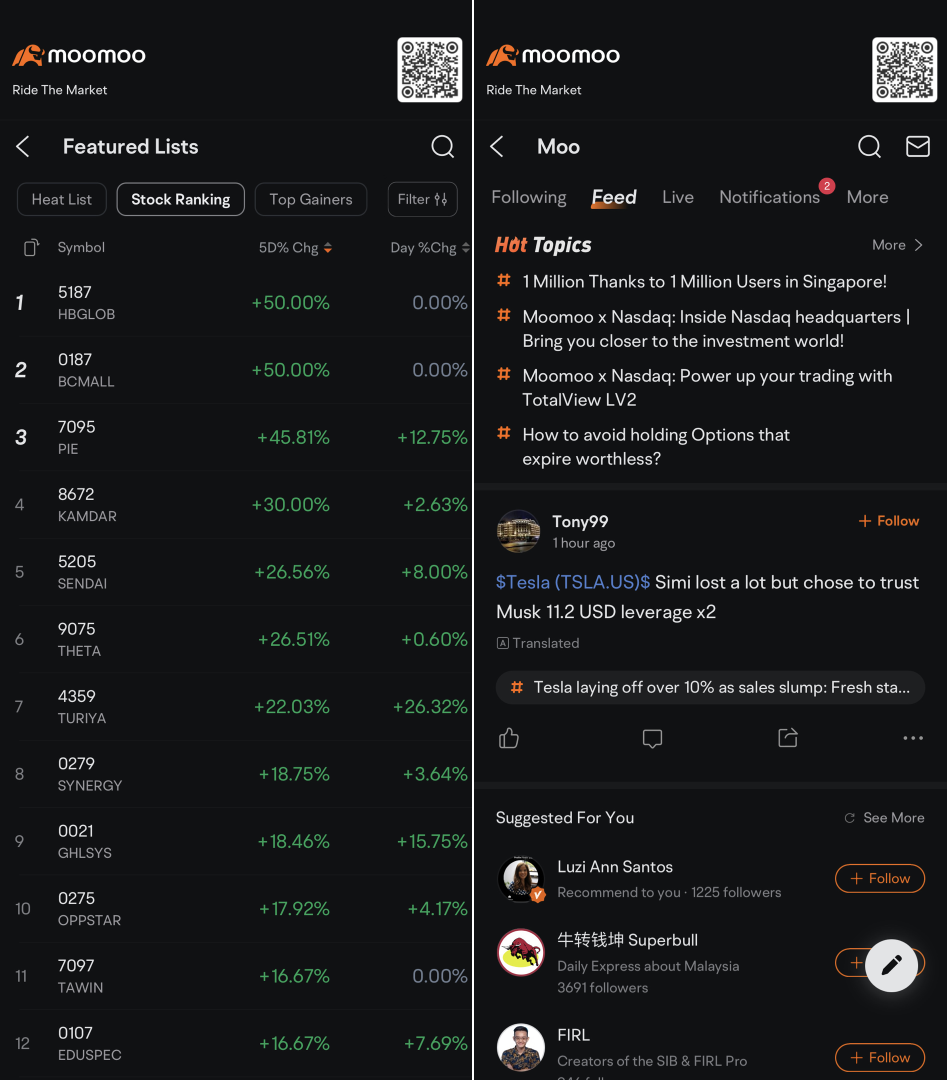

Hey all, Cici receives a lot of feedback from mates stating that moomoo has a lot of features that they simply don't know about without digging in, and newbies can get lost.🗺️

In fact, moomoo has always been committed to creating a professional investment platform with “rich markets,” “fast transactions,” and “perfect analytical tools” for investors, so there are lots of tools and information that investors may no...

In fact, moomoo has always been committed to creating a professional investment platform with “rich markets,” “fast transactions,” and “perfect analytical tools” for investors, so there are lots of tools and information that investors may no...

+6

242

103

康庄大道

Set a live reminder

[Brief description] More stable investors prefer to invest in dividends from banks, infrastructure, REIT, etc., because of the stable performance of this type of business, dividends are also quite generous. As a REIT writer, I'm certainly no exception. However, in addition to the above projects, there are other shares with generous dividends, one of which is preference shares (preference shares).

This type of stock has steady characteristics, and dividends are guaranteed, and declines are rare.

Regarding the characteristics of preferred stocks, I will explain the benefits of investing in preferred stocks on the upcoming live broadcast.

[Speaker] Yan Yue, a Malaysian financial writer, published “Buying an Industry Starting at RM100: How to Invest in Reits”, “Buying Stocks Starting at RM100: Making Money Automatically Come to the Door”, and “Malaysian Stocks Are Easy to Understand: Stock News”.

[Join us] Tailored for moomoo users! See you on March 24th at 8.00pm! Do you want to generate a steady passive income? Let's get to know it together!

[Disclaimer] All opinions expressed in the live broadcast and video are based on the independent opinions of the presenter (Yan Yue). Moomoo and its affiliates are not responsible for their content or opinions.

This type of stock has steady characteristics, and dividends are guaranteed, and declines are rare.

Regarding the characteristics of preferred stocks, I will explain the benefits of investing in preferred stocks on the upcoming live broadcast.

[Speaker] Yan Yue, a Malaysian financial writer, published “Buying an Industry Starting at RM100: How to Invest in Reits”, “Buying Stocks Starting at RM100: Making Money Automatically Come to the Door”, and “Malaysian Stocks Are Easy to Understand: Stock News”.

[Join us] Tailored for moomoo users! See you on March 24th at 8.00pm! Do you want to generate a steady passive income? Let's get to know it together!

[Disclaimer] All opinions expressed in the live broadcast and video are based on the independent opinions of the presenter (Yan Yue). Moomoo and its affiliates are not responsible for their content or opinions.

Translated

270

67

The last addition of Sarawak Ash was a failure

Translated

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)