养股人

voted

😊Hi, Malaysian mooers!

Malaysia Airports is estimated to release its next earnings report on May 30. How will the market react to the company's quarterly results? Vote your answer to participate!

🎁 Rewards

●👌 An equal share of 1,000 points: For mooers who correctly guess the price range of $AIRPORT(5014.MY$'s closing price on its earnings release date (e.g., If 50 mooers make a correct guess, each of them wil...

Malaysia Airports is estimated to release its next earnings report on May 30. How will the market react to the company's quarterly results? Vote your answer to participate!

🎁 Rewards

●👌 An equal share of 1,000 points: For mooers who correctly guess the price range of $AIRPORT(5014.MY$'s closing price on its earnings release date (e.g., If 50 mooers make a correct guess, each of them wil...

85

101

养股人

voted

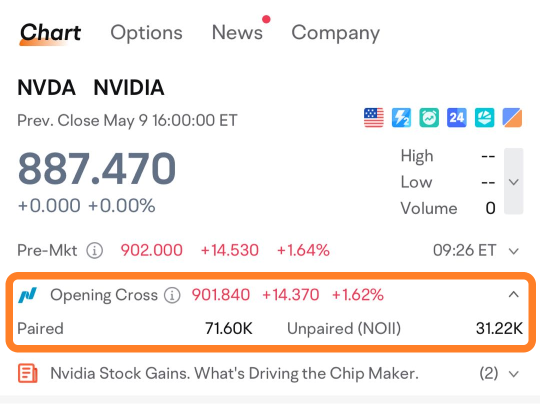

$NVIDIA(NVDA.US$ is releasing its Q1 earnings on May 22, after the U.S. stock market close. How will the whole market react to the AI giant's results? Vote your answer to participate!

Rewards

● An equal share of 10,000 points:

For mooers who correctly guess the price range of $NVIDIA(NVDA.US$'s opening price at 9:30 AM ET May 23 (e.g., If 50 mooers make a correct guess, they will get 200 points!)

(The vote will close ...

Rewards

● An equal share of 10,000 points:

For mooers who correctly guess the price range of $NVIDIA(NVDA.US$'s opening price at 9:30 AM ET May 23 (e.g., If 50 mooers make a correct guess, they will get 200 points!)

(The vote will close ...

152

348

It arrived in May of this year and held $KGB(0151.MY$ It's been almost three years. At first, it seemed that it was unique because it had a special industrial gas with a deep moat, especially high-purity gas (UHP) linked to semiconductors. It was also a highly profitable business for the company and contributed more than 60% of the company's turnover.

This kind of engineering subsistence company already has a cyclical weakness. Often, turnover is affected by the downturn in the industry, let alone companies linked to the semiconductor boom.

The wonderful thing is... The company started the liquefied carbon dioxide manufacturing field in 2019. The first factory was put into production in October of the same year, with an annual output of 50,000 tons. Currently, production is at full capacity.

Speaking of liquefied carbon dioxide (LCO2), it can be used for various purposes, especially in the food and beverage industry, to produce carbonated beverages and make dry ice for freezing food. Currently, more than 70% of the company's liquefied carbon dioxide is exported. This business can bring recurring income (Recurring Income) to the company, which is also shareholder's favorite business income, because it can be described as the company's “banknote capacity.” Currently, the profit from this business is around 30%.

The company's second new liquefied carbon dioxide plant was put into operation at the end of March this year, increasing total production from 50,000 tons to 120,000 tons. The company will have the potential to become the nation's largest supplier of liquefied carbon dioxide.

$KGB(0151.MY$ This year's first...

This kind of engineering subsistence company already has a cyclical weakness. Often, turnover is affected by the downturn in the industry, let alone companies linked to the semiconductor boom.

The wonderful thing is... The company started the liquefied carbon dioxide manufacturing field in 2019. The first factory was put into production in October of the same year, with an annual output of 50,000 tons. Currently, production is at full capacity.

Speaking of liquefied carbon dioxide (LCO2), it can be used for various purposes, especially in the food and beverage industry, to produce carbonated beverages and make dry ice for freezing food. Currently, more than 70% of the company's liquefied carbon dioxide is exported. This business can bring recurring income (Recurring Income) to the company, which is also shareholder's favorite business income, because it can be described as the company's “banknote capacity.” Currently, the profit from this business is around 30%.

The company's second new liquefied carbon dioxide plant was put into operation at the end of March this year, increasing total production from 50,000 tons to 120,000 tons. The company will have the potential to become the nation's largest supplier of liquefied carbon dioxide.

$KGB(0151.MY$ This year's first...

Translated

7

Highlight 1: ICT service revenue (cloud services and data centers) compared to the same quarter last year61% increase

Management stated in a statement that strong growth was due to cloud and data center services

Highlight 2: Cloud services will generate recurring revenue for the company, and management indicated plans to launch several data center services in the next few months

Highlight 3: New products will be unveiled this year (new growth engine)

Summary: Among these three highlights, shareholders value the most recurring revenue from cloud and data center services. Investors familiar with VSTECS know that the company's main business is PC agents and enterprise system services. Among them, the PC agency business, which accounts for the largest share of turnover, also has a very low profit margin.

Shareholders hope that cloud services and data center services can improve the company's low profit margins in the future and gradually become the company's main business. After all, businesses that can generate recurring revenue can provide stable cash flow, offsetting the company's cyclical influence on PC agents.

As for how the stock price will react tomorrow, let's leave it up to the market to decide. Will the overall decline in turnover give up last week's increase? Shareholders also have no ability to anticipate tomorrow. Shareholders only know that friends who persist in their time on the investment path “nurture” companies with growth value. What's left is to eat, drink, and wait patiently for long-term value to emerge.

$VSTECS(5162.MY$

Management stated in a statement that strong growth was due to cloud and data center services

Highlight 2: Cloud services will generate recurring revenue for the company, and management indicated plans to launch several data center services in the next few months

Highlight 3: New products will be unveiled this year (new growth engine)

Summary: Among these three highlights, shareholders value the most recurring revenue from cloud and data center services. Investors familiar with VSTECS know that the company's main business is PC agents and enterprise system services. Among them, the PC agency business, which accounts for the largest share of turnover, also has a very low profit margin.

Shareholders hope that cloud services and data center services can improve the company's low profit margins in the future and gradually become the company's main business. After all, businesses that can generate recurring revenue can provide stable cash flow, offsetting the company's cyclical influence on PC agents.

As for how the stock price will react tomorrow, let's leave it up to the market to decide. Will the overall decline in turnover give up last week's increase? Shareholders also have no ability to anticipate tomorrow. Shareholders only know that friends who persist in their time on the investment path “nurture” companies with growth value. What's left is to eat, drink, and wait patiently for long-term value to emerge.

$VSTECS(5162.MY$

Translated

+1

loading...

6

养股人

liked

PA is an aluminum product manufacturer with manufacturing capacity to produce aluminum billets and end product stamping. The major customer is First Solar from the US. There are also quite a few investors who worry that PA is too dependent on a single major customer. This is a potential risk. The situation is similar to MAGNI.

However, since getting First Solar in 2018, the company has extended it for the 3rd time, and each time it is bigger than the previous contract. In January of this year, the company obtained an extension of the FirstSolar contract for a period of 18 months of RM1,076 mils. Therefore, performance is expected to grow steadily over the next 5 to 6 quarters.

Since the company only earned RM239k in the same period last year, surrendering RM12.436 mils of profit in the latest quarter increased the company by 5,099.2%. Although there is a foreign exchange profit of RM2.9 mil, there are also RM1.8 mil ESOS expenses, and when deducted, there is also PAT of RM11.5 mil or more.

The company's new production capacity was upgraded in March, mainly to meet the record high contract obtained in January. It is expected that next quarter, with the contribution of new production capacity, turnover and profit will rise to the next level.

$PA(7225.MY$

The company's net cash reached a new high in the latest quarter, reaching RM88.8 mil. Mainly due to increased profits, reduced inventory, and the collection of accounts receivable.

Company shares...

However, since getting First Solar in 2018, the company has extended it for the 3rd time, and each time it is bigger than the previous contract. In January of this year, the company obtained an extension of the FirstSolar contract for a period of 18 months of RM1,076 mils. Therefore, performance is expected to grow steadily over the next 5 to 6 quarters.

Since the company only earned RM239k in the same period last year, surrendering RM12.436 mils of profit in the latest quarter increased the company by 5,099.2%. Although there is a foreign exchange profit of RM2.9 mil, there are also RM1.8 mil ESOS expenses, and when deducted, there is also PAT of RM11.5 mil or more.

The company's new production capacity was upgraded in March, mainly to meet the record high contract obtained in January. It is expected that next quarter, with the contribution of new production capacity, turnover and profit will rise to the next level.

$PA(7225.MY$

The company's net cash reached a new high in the latest quarter, reaching RM88.8 mil. Mainly due to increased profits, reduced inventory, and the collection of accounts receivable.

Company shares...

Translated

87

As the Malaysian KLCI Index rose, my overall portfolio also quietly reached a new high. Let's continue to ferment green positive energy next week![]() $FTSE Bursa Malaysia KLCI Index(.KLSE.MY$

$FTSE Bursa Malaysia KLCI Index(.KLSE.MY$

Translated

3

养股人

voted

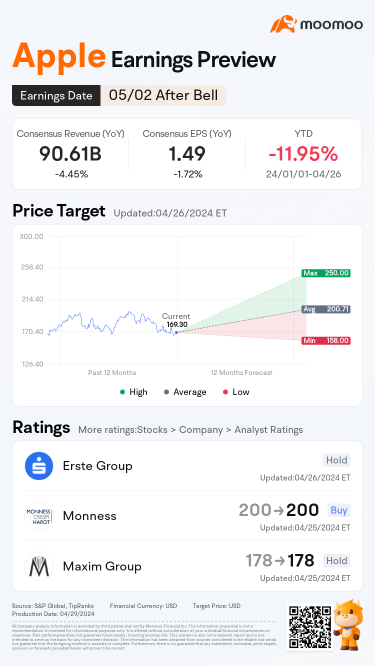

Apple is releasing its Q2 2024 earnings after the market closes on May 2.

Since its Q1 earnings release, shares of $Apple(AAPL.US$ have seen a decrease of 6%.![]() Its implied move on the earnings date is 4.2%. How will the market react to the upcoming results? Make your guess now!

Its implied move on the earnings date is 4.2%. How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $Apple(AAPL.US$'s opening price at 9:30 AM ET Ma...

Since its Q1 earnings release, shares of $Apple(AAPL.US$ have seen a decrease of 6%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $Apple(AAPL.US$'s opening price at 9:30 AM ET Ma...

116

222

养股人

voted

Every company's financials tell a unique story, revealing important information about its revenue, assets, liabilities, and cash flow.

By analyzing this data, investors can gain valuable insights into a company's performance and make informed decisions about where to put th...

+2

1590

1830

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)