With the Rewards of Owning Stocks Over Bonds Evaporating, Should Investors Stay or Flee?

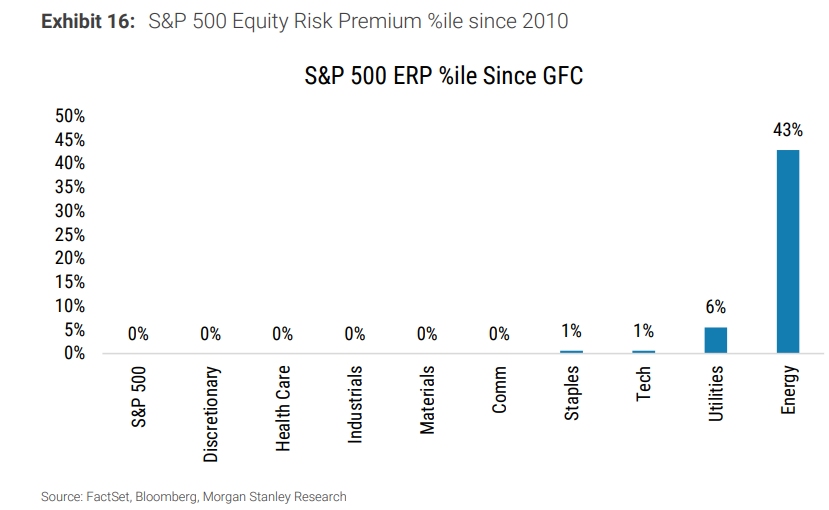

According to Morgan Stanley's latest research, the $S&P 500 Index(.SPX.US$ 's equity risk premium (ERP) has reached its lowest point since 2010 across virtually all sectors, with the exception of Energy. This suggests that sector level valuation appears particularly overextended when viewed through the lens of prevailing interest rates, implying that investors are being scantily rewarded for undertaking risks.

The equity risk premium (ERP) is the extra return that investors require for holding stocks over risk-free government bonds, usually the 10-year US Treasury yield. A higher ERP implies that investors are being offered a higher premium to invest in stocks and, therefore, stocks tend to be more appealing compared to bonds.

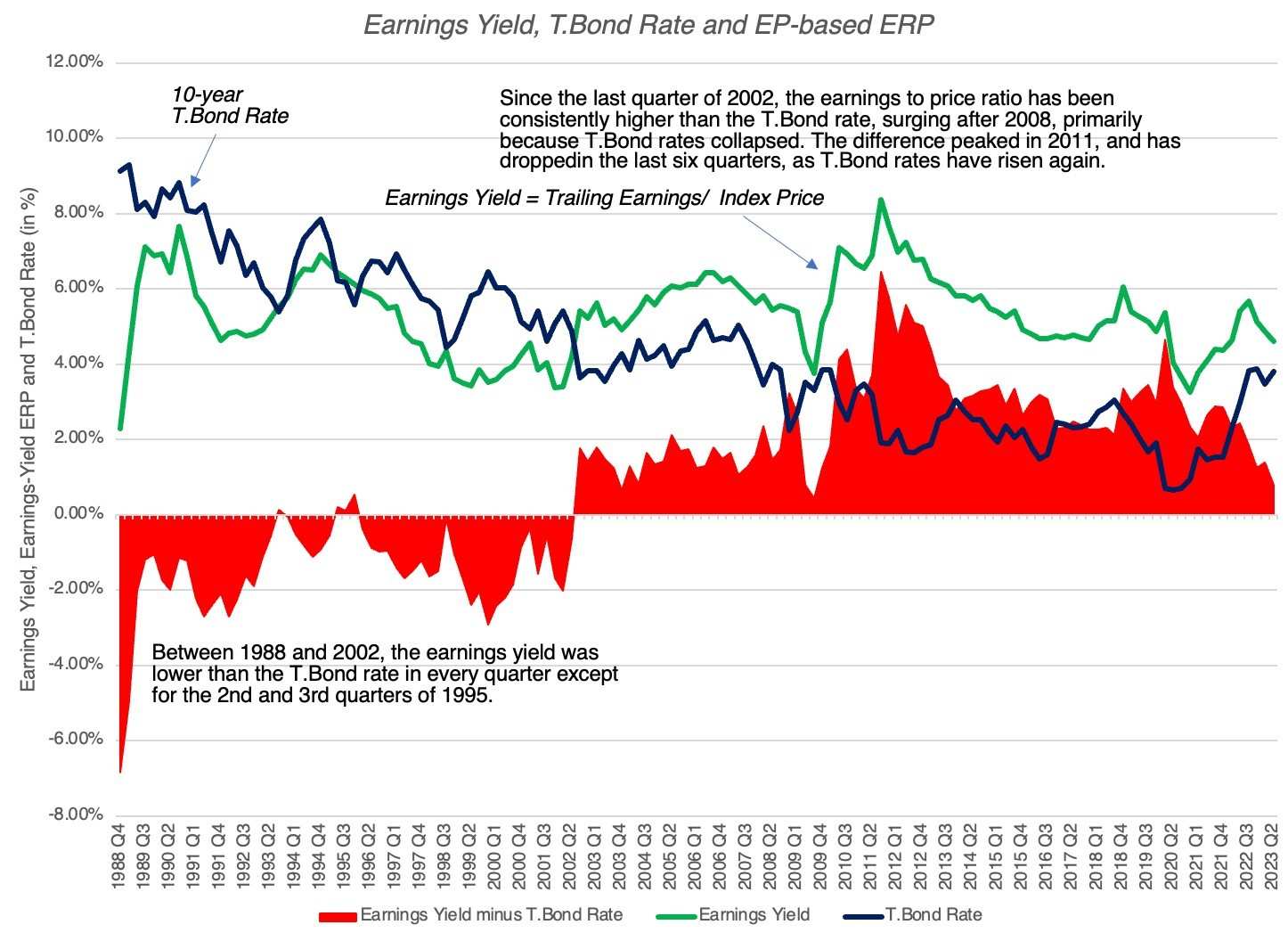

The rising U.S. bond yields and elevated U.S. stock valuations make equity risk-reward extremely low for investors today. According to a post shared by Aswath Damodaran, a professor at NYU Stern School of Business, the Equity Risk Premiums (ERP) have been declining since Q4 2021 and currently stand at approximately 1%. An article in the Wall Street Journal has further highlighted that “the gap between the earnings yield of the S&P 500 and the yield on the 10-year U.S. government bond dropped to its narrowest since 2002.” This indicates that the additional compensation for holding stocks instead of bonds has been decreasing persistently.

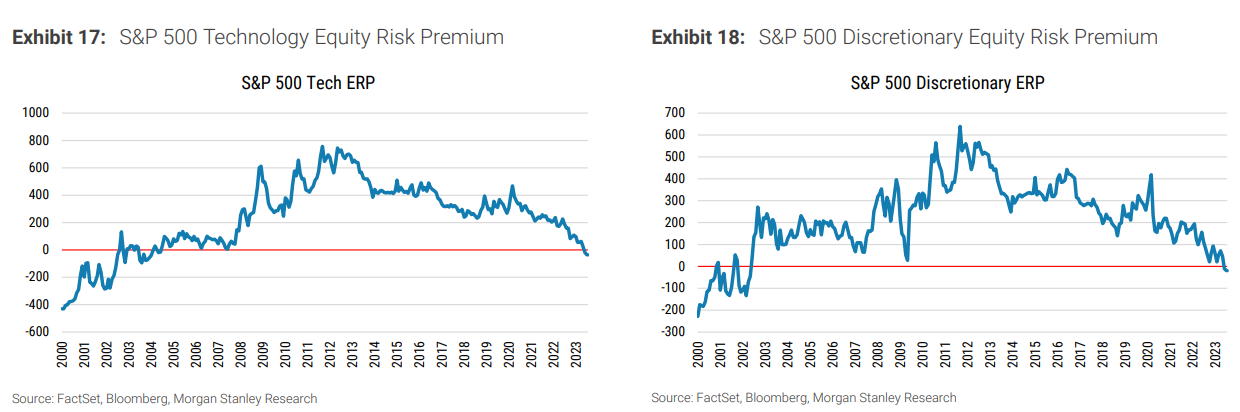

Specifically, according to Michael J Wilson at Morgan Stanley, the Technology and Consumer Discretionary sectors of the S&P 500 are currently experiencing negative equity risk premiums, which implies that their forward earnings yield is lower than the yield on the 10-year Treasury.

1. There is a general agreement on Wall Street that the equity risk premium cannot remain at such low levels indefinitely.

This implies that prices are expected to decline further before equity earnings become more appealing, or bond yields decrease further. The low returns for the risk-taking associated with owning stocks could limit further upside potential in the latter half of the year.

For share prices relative to earnings to be back to where they were at the start of the 2022 selloff “when interest rates are 2x, 3x higher than they were really doesn't add up,” commented Tim Urbanowicz, head of research and investment strategy at Innovator ETFs.

2. Some experts still believe that an ultralow risk premium does not necessarily imply the end of this year's stock rally.

According to Cliff Asness, the founder of AQR hedge fund, who proposed in 2000 that when comparing stocks and bonds, investors should consider not only their returns but also the relative risks, i.e., by introducing the stock-bond volatility ratio.

During periods when the market perceives higher uncertainty in equities, investors will demand a higher risk premium as compensation, leading to an increase in the stock-bond volatility ratio and a higher Equity Risk Premium (ERP) central tendency, and vice versa. Over the short term, if the volatility of US equities compared to US bonds is decreasing, the decrease in Equity Risk Premiums (ERPs) might appear somewhat justifiable to investors in US equities as the pivot has shifted downwards.

Source: Morgan Stanley, Wall Street Journal, Aswath Damodara

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

70918501 : stocks should have no risk at all if someone stepped in and stopped the shorting.

Seanblue : get up and get it done I own a lot of stocks how do I get funding to bank account

Moomoo Lily Seanblue: Hi, @Moomoo Buddy Please assist. Thanks!

Moomoo Buddy Seanblue: Hello, please submit your withdrawal request via: App - Accounts - Transfers - Withdraw - ACH or Wire. We'd like to know more about the issues and help sort out. Please contact our 24/7 live chat agents through the app via Me > Customer Service. If you prefer talking to someone, please call us at +18887210610 during regular trading days, 8.30 am - 4.30 pm eastern time(Closed on weekends and public holidays).

SpyderCall : good article

DudeThatsDerpy 70918501: That's not how the markets work...