Energy Stocks Are Lagging Behind Oil Prices. How to Ride the Trend?

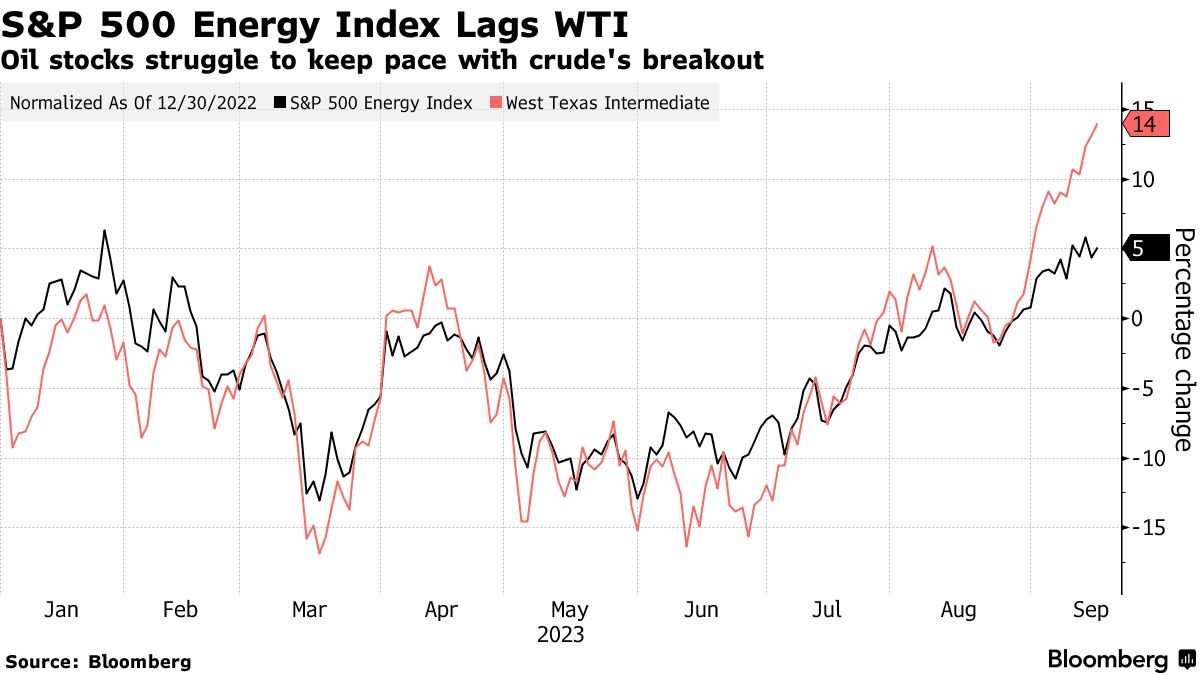

Energy equities have struggled to keep pace with soaring oil price. The S&P 500 Energy Index has increased by about 14% since late June, but it has not kept up with the surge in oil prices, which have risen by about 30% during the same period to reach over $93 a barrel.

The correlation between the S&P 500 Energy index and WTI has dropped from over 70% in June to roughly 28% for much of September, indicating that investors are uncertain about the sustainability of the oil rally given concerns about the economy. "Rather than chasing the rally in energy stocks, retail investors are currently exhibiting caution," Vanda Research analysts led by senior vice-president Marco Iachini wrote.

Wall Street Remains Bullish

Luckily for the oil and gas bulls, FactSet has reported that Wall Street analysts were most upbeat about the energy sector, which has the highest percentage of "buy" ratings, at 64%.

How to Take Advantage

Some investors see an imbalance in the market, between the U.S. major oil companies and some companies with slightly lower valuations.

Institutional investors who are still interested in oil stocks have gravitated to the major oil companies since the pandemic. When oil prices fell in 2020, the majors were the only stocks that were big enough for institutions to invest in without causing an outsize market impact.

"The much cheaper oil and gas shares are trading at much lower stock prices at comparable oil prices because they are still too tiny for the larger pools of money to consider," Bill Smead, chief investment officer of Smead Capital Management, wrote in a note this week.

He says the big oil companies might have to buy the smaller ones to capitalize on this disparity, and argues that investors can take advantage by buying the undervalued stocks now.

Source: Bloomberg, Barron's, MarketWatch

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment