Why Better-Than-Expected Earnings Results Are Hard for Investors to Buy into Anymore

As the Q2 earnings season draws to a close, companies have surpassed analysts' estimates by a higher proportion than usual. According to FactSet data, approximately 90% of $S&P 500 Index(.SPX.US$ firms have reported their Q2 results up to this point, with 79% beating analyst estimates, surpassing both the ten-year and five-year averages of 73% and 77%, respectively. Data from Refinitiv IBES indicates that, as a whole, these firms reported earnings that exceeded estimates by 7.7%, surpassing the long-term average of 4.1%.

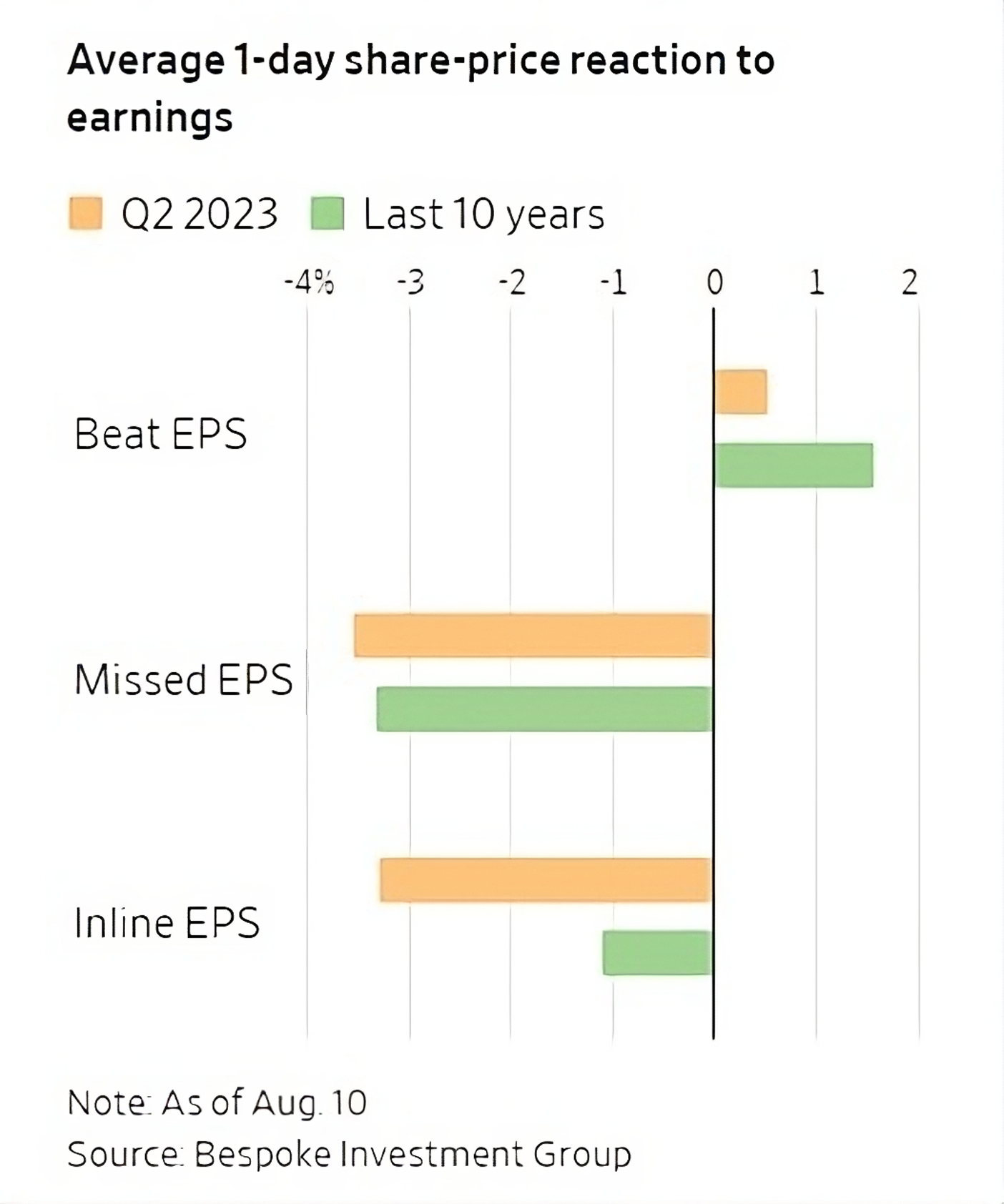

However, Investors aren't buying into the better-than-expected earnings season. Bespoke Investment Group's analysis shows that, during this earnings season, companies beating earnings expectations saw an average stock price increase of 0.5% in the post-announcement trading period, which is significantly lower than the ten-year average of 1.6%. Moreover, companies that missed or were in line with earnings expectations experienced more drastic stock price declines after reporting their results compared to usual.

1. A lower threshold for profit expectations undermines the significance of earnings beat for some investors. At the beginning of this earnings season, Wall Street had lowered its earnings estimates for S&P 500 firms to a decline of approximately 7%, compared to a less than 1% decline at the end of last year. FactSet's aggregate data for companies that reported results indicates that profits actually decreased by about 6%.

Seth Cohan, vice president and executive director of the Wealth Alliance:“The earnings that we saw were mostly based on lowered expectations to begin with.”

2. Beyond revenues and net profits, additional evidence is required to substantiate a company's profitability and future growth prospects. Investors today are increasingly cautious and seek a more comprehensive view of a company's performance, beyond solely quarterly or annual financial reports. They consider a range of factors, such as the firm's strategic planning, position in the industry chain, and adaptability to future economic conditions. In this context, investors scrutinize full-year guidance adjustments, gross margin trends, and market performance of core products, among other factors, to assess a company's long-term growth prospects and competitiveness. Without sufficient information to validate its long-term growth potential, even a company that releases outstanding financial data may face skepticism from investors.

3. Higher valuations require a stronger performance to be justified.

After an impressive rally in the market this year, current stock valuations appear to be very expensive. According to FactSet, the S&P 500's next 12-month expected PE ratio stood at around 19 times, surpassing the five-year average of 18.6 times. Meanwhile, Credit Suisse research indicates that 86% of the S&P 500's year-to-date return can be attributed to valuation expansion, with only a small portion resulting from positive changes in earnings expectations. Perhaps the market requires stronger performance to justify pursuing higher valuations.

Amanda Agati, the chief investment officer for PNC Asset Management Group regards earnings season as a reality check for investors.“This has been a very delusional market rally; At some point, the fundamentals have to matter,” Agati said.

Anthony Saglimbene, chief market strategist at Ameriprise Financial:“At this point, valuations have run ahead of the fundamentals and so companies now have to prove that they can generate earnings growth.”

O’Keefe, head of Logan Capital’s dividend-growth strategy:“We’ve watched valuation creep up here. Investors are concerned that the market has run a little bit ahead of itself.”

Compared to earnings results, investors appear to be more focused on macroeconomic data and Federal Reserve announcements these days. 1) Federal Reserve Chair Jerome Powell has indicated that the central bank will adopt a data-dependent approach to future interest rate hikes. Any data that results in a shift in the Fed's assessment of the September decision could impact the market. 2) While investors are generally more optimistic about the economic outlook, some remain worried that the delayed impact of interest rate hikes could lead to a recession, which would impact corporate earnings. 3) Also, the increase in bond yields continues to pose a risk to risky assets such as equities.

John Lynch, chief investment officer for Comerica Wealth Management:“There is optimism, but I still wonder going into next year, are we too optimistic, from a consensus standpoint; Just because we didn’t have a recession this year, that yield curve continues to point to one.”

This week, investors will also be monitoring earnings reports from major retailers, including Home Depot, Target, and Walmart, to gain insight into the state of the American consumer and the U.S. economy.

Source: The Wall Street Journal, Fxexplained, Refinitiv IBES, Bespoke Investment Group

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment