Berkshire Hathaway Earnings Preview: How Could the Financial Giant's Broad Business Presence Benefit from Resilient US Economy

$Berkshire Hathaway-A(BRK.A.US$ is estimated to announce earnings this weekend. Although $Apple(AAPL.US$, Berkshire Hathaway's largest holding, fell 8.4% in the second quarter, which would drag down its investment income, the company's extensive business portfolio may benefit from the steady economic recovery.

1) Insurance Underwriting

The conglomerate's insurance and reinsurance business activities are conducted through numerous domestic and foreign-based insurance subsidiaries. Its insurance underwriting operations include the following groups: (1) GEICO, (2) Berkshire Hathaway Primary Group and (3) Berkshire Hathaway Reinsurance Group.

GEICO, which writes private passenger automobile insurance, accounts for half of all Berkshire Hathaway's underwriting revenue. GEICO's pre-tax underwriting earnings could benefit from higher average premiums per auto policy, lower claims frequencies, reductions in prior accident years' claims estimates, and a reduction in advertising costs. Although average claims severities rose in 2023 due to higher auto repair parts prices, labor costs and medical inflation, GEICO sought rate increases in numerous states in 2022 and 2023 in response to accelerating claims costs. GEICO also significantly reduced advertising expenditures in 2022 and 2023.

The Berkshire Hathaway Reinsurance Group ("BHRG") offers excess-of-loss and quota-share reinsurance coverages on property and casualty risks to insurers and reinsurers. As one of the fastest-growing businesses in Buffett's insurance empire, the company could benefit from net increases in new property business and higher rates.

2) Retail Segment

Berkshire's service businesses provide grocery and food service distribution, professional aviation training programs, etc. The largest company in the segment is the supply chain management firm McLane, which Warren Buffett acquired. McLane's major customers during 2023 included Walmart (approximately 17.0% of revenues), 7-Eleven (approximately 14.0% of revenues), and Yum! Brands (approximately 12.3% of revenues). Buffett said McLane's business model is based on a high volume of sales, rapid inventory turnover and stringent expense controls.

Its earnings outlook is closely related to the prosperity of the US retail industry. The US Redbook Same-Store Sales index showed the retail industry is gradually emerging from the downward trend of the past two years.

3) Railway Segment

Berkshire Hathaway's railroad business suffered a decline last year, but is expected to recover this year.

The sector’s revenues declined 6.9% in 2023 compared to 2022, reflecting a volume decrease and lower average revenue per car/unit. The volume decrease was primarily due to lower intermodal shipments resulting from reduced West Coast imports, the loss of an intermodal customer and competition from lower spot rates in the trucking market, which has impacted its domestic intermodal demand. However, U.S. trade balance data shows that imports have continued to recover this year.

As for the first quarter of 2024, Berkshire Hathaway's railway business might be squeezed by rising fuel costs, but demand due to the resilience of the U.S. economy and rising transportation costs may offset the rise in costs.

4) Energy Division

In 2023, the division was negatively affected by an increase in energy operating expenses, higher interest expense, and lower electric utility margin.

Buffett said one of the most severe earnings disappointments last year occurred at BHE. Although most of its large electric-utility businesses, as well as its extensive gas pipelines, performed about as expected, the regulatory climate in a few states has raised the specter of zero profitability or even bankruptcy (an actual outcome at California’s largest utility and a current threat in Hawaii).

However, the electric-utility business is expected to turn around. According to the latest statistics from the EIA, U.S. sales of electricity exceeded 4% in the first two months of 2024, showing strong power demand, possibly driven by the electric transformation of autos and AI computing power.

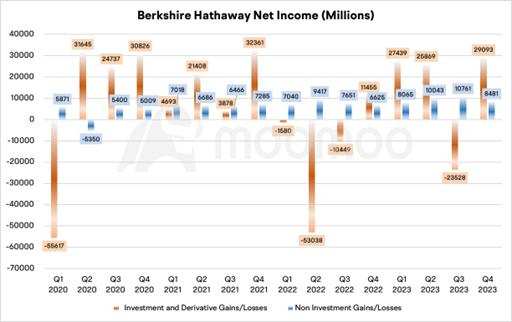

5) Investment Income

Buffett's holdings in some key public companies remain the focus of investors' attention. Occidental Petroleum, its sixth-largest holding, is up more than 14% this year. Buffett praised its vast oil and gas holdings in the United States, as well as its leadership in carbon-capture initiative. He said, "Under Vicki Hollub's leadership, Occidental is doing the right things for both its country and its owners. No one knows what oil prices will do over the next month, year, or decade. But Vicki does know how to separate oil from rock, and that's an uncommon talent."

Buffett also emphasized the importance of American Express to his company earlier this year, although it only accounts for 4-5% of Berkshire's GAAP net worth. He believes AMEX is on track to increase its dividend by 16% this year, and says the company illustrates his thought processes.

Berkshire Hathaway's investment income comes not only from the appreciation of stocks and dividend income, but also from interest on Treasury bonds. The company's holding cash and cash equivalents reached $121.8 billion. It also holds $10.3 billion in the U.S. Treasury.

Other earnings included after-tax foreign exchange rate gains related to the non-U.S. Dollar denominated debt issued by Berkshire and its finance subsidiary, Berkshire Hathaway Finance Corporation (“BHFC”). Buffett denied he could forecast market prices of major currencies. Still, Berkshire has financed most of its Japanese position with the proceeds from ¥1.3 trillion of bonds. The weakened yen has produced a $1.9 billion gain for Berkshire over the 2020-23 period.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment