Weekly Buzz | All-Time Highs During Cold Weather Week

Happy Friday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of this week! Answer the Weekly Topic question for a chance to win an award next week!

Make Your Choice

Weekly Buzz | All-Time Highs During Cold Weather

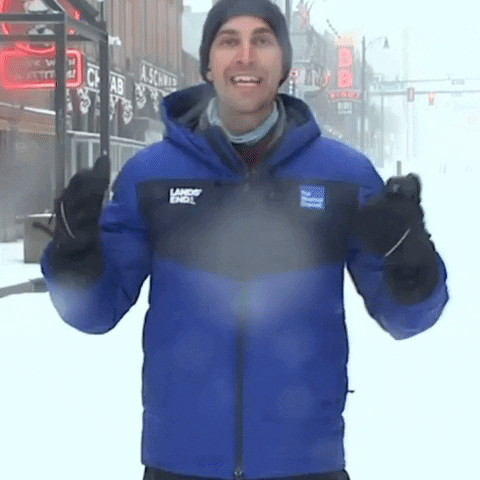

While snow fell in Jersey City, outside the moomoo office, U.S. Equities hit all-time highs.

Friday ended on a high note, as the S&P 500 and Dow Jones Industrial Average topped all-time high records when the market closed. Reporters attributed the rise to hopes for rate cuts in the new year and early quarterly reports showing AI and Semiconductor companies outshining even the largest financial institutions in earnings.

Large-cap benchmark $S&P 500 Index(.SPX.US$ gained 1.2% to close at 4,839.81. The Dow gained 1.1% to 37,863.8, while the tech-heavy $纳斯达克综合指数(.IXIC.US)$ advanced 1.7% to finish at 15,310.97.

$Meta Platforms(META.US)$, one of the seven tech giants, also surpassed its previous peak, ending Friday at $383.45 after founder and Chief Executive Officer Mark Zuckerberg said his company is "building massive compute infrastructure" to support his long-term vision for general intelligence. Its supplier $英伟达(NVDA.US)$, another stock from that magnificent group, advanced, boosting its gains over the past year to more than 250%.

Oil prices fell down close to $70 a barrel at the beginning of the year and have remained tethered despite rising conflict in the Red Sea.

"Oil prices remain violently rangebound to start the year," said Michael Tran, commodity analyst at RBC Capital Markets, in a note. "While this sentence sounds like an oxymoron, keen market observers have become numb or achieved a degree of analysis paralysis to start the year given the confluence of escalating geopolitical risk enveloped in a market that remains reasonably well supplied."

Pakistan and Iran traded military strikes this week, and U.S. forces launched new strikes against Iran-backed Houthi militants who have continued to target Red Sea shipping with missile and drone attacks.

Let's dive into the weekly buzzing stock list this week:

Tesla pointed toward a bear market this week, down about 24% from its high of $299 over the summer, while CEO Elon Musk said he wanted more stock to help guide AI innovation at the company. CNBC's "Mad Money" host Jim Cramer made a prediction that Tesla would be the first to leave the "Magnificent Seven" stocks on Wednesday.

"To me, it's looking a little like Tesla would be the first to fall," Cramer said. "We have a CEO [who's] getting a little petulant...again, talking about needing to control 25% to innovate."

@Rexon Capital: If ever you doubt yourself, remember that you thought Tesla would keep going down.

AMC dropped like a rock for six days before reversing on Thursday and Friday. The movie theater stock hit an all-time low at $4.08 a share Wednesday.

@Dumb Money Space Ape: bought at the bottom of the dip.

Super Micro Computer hit a record high after releasing guidance so good it yanked up semiconductor and AI stocks. Nvidia is up nearly 20% for the year, bouncing higher on every news story of an AI-focused company gaining ground.

@huang002339: 2024 dec 1000$?

Apple rose on the week from good news about it's VR headset Vision Pro release, and upgrades from analysts.

Wednesday, Nio joined Tesla's global price cuts on EV models to encourage sales. The company announced up to $5,500 off on select models. The EV stock has tracked downward all year, down about 33%.

Mullen Auto fell more than 30% in the past week after announcing it lost $1 billion in the quarter that ended Sept. 30 on $366,000 in revenue after delivering 35 vehicles in 2023. On Friday, the company sank more than 15% intraday Friday as the EV start-up continued a long-time tumble that’s seen it sink more than 99.9% since going public in 2021.

User said: I know they have reversed split before. But this ath is more then all the stock market put together or is it not?

AMD has felt the force of the AI craze in a delayed reaction, jumping 60% in the past three months. This week the company enjoyed a Strong Buy rating from Raymond James Analysts.

Alibaba felt a positive trading session Friday after a rough week, after multiple analysts maintained high price targets.

Singapore Airlines enjoyed stronger data from December this week, reporting traffic rose 15%.

@Teck Wang Pang: Airline review: This cabin crew makes you feel good about flying economy.

Thursday, MT Newswires quoted BoA Securities saying that Microsoft's revenue growth is expected to accelerate to solid high teens from the current mid-teens level as the tech giant benefits from the continued strength of its cloud business Azure and M365.

@Brianjh: The competition to build the iPhone of artificial intelligence is heating up

Thanks for reading!

All comments, links, and content posted or shared by users of the community are the opinion of the respective authors only and do not reflect the opinions, views, or positions of Moomoo Financial Inc., Moomoo Technologies, any affiliates, or any employees of MFI, MTI or its affiliates. Please consult a qualified financial professional for your financial planning and tax situations.

Awards

Congrats to the following mooers whose comments were selected as the top comments last week!

Notice:

A reward will be sent to you this week. Please feel free to contact us if there is an issue.

Weekly Topic

The S&P 500 and Dow Jones Industrial Average hit all-time highs this week. Do you think this is a sign this year will follow January's lead, or is this a jump before a plunge? What do you do when prices break records?

Comment below and share your ideas! We will select up to 15 TOP COMMENTS for a reward next week. Winners will get 200 points by next week, with which you can exchange gifts at Reward Club.

Disclaimer:

Any app images provided are not current, and any securities are shown for illustrative purposes only.

This presentation is for information and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. See this link for more information.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102362254 : The S&P 500 and DJI hit all-time highs this week, but is it a boom or a bust? There is no clear answer, as different factors affect the market. Some are optimistic, citing the economic recovery, fiscal stimulus, strong earnings (TSM/TRV) and low interest rates. Others are pessimistic, warning of overvaluation, inflation, speculation, bubbles, and instability. I don't try to time the market, but follow some principles: diversify, DCA, learn from mistakes, and focus on long-term trends. The key is to be disciplined and patient, and play the market smart.

HuatEver : What an auspicious way to start my 2024 investment journey with the S&P 500 and the Dow Jones Industrial Average to hit all-time highs this week.

. I am eager to diversify my portfolio and buy more shares of excellent companies that will give me peace of mind and many peaceful nights.

. I am eager to diversify my portfolio and buy more shares of excellent companies that will give me peace of mind and many peaceful nights.

ZnWC : Actually the lead started in December last year until now. The causes for the uptrend are complex but can be attributed to 3 reasons : First inflation is cooling and Fed paused rate hike. Investors looking forward for a rate cut is also another contributing factor. Second US economy avoided a recession and entering a soft landing stop short a recovery. Third artificial intelligence charm continues to provide the catalyst.

I don't foresee a huge plunge but may encounter price correction because there are 3 uncertainties. First new geopolitical tension may escalate into conflict or trade war. Second oil price surge may cause inflation to return and trigger fed for more rate hike. Third China's economy slipped into recession and trigger a global fall in demand.

When price break record, I'll trade based on the trend and do the followings:

1. Sell the stocks which have meet the profit goals

2. Invest in a new industry where there is room to grow but not necessarily growth stocks. If there's no clear trend, trade options to protect the holding stock downtrend risk.

3. Invest in value stocks which give good dividend when the price dip

To prepare for any black swan event, I'll also need to avoid fomo buy (greed) and catching a falling knife. As always gather sufficient data (FA, TA, analyst ratings, financial report etc) or dyodd before entering into a trade.

HuatLady : Many investors are very delighted by the recent S&P 500 Index n $Dow Jones Industrial Average (.DJI.US)$ soar as they use these indexes to track the bull or bear markets. Personally, I am not much affected by these short-term changes, because I follow a long-term investing strategy. I focus on the fundamentals and growth potential of the companies I invest in, rather than the daily market movements.

momo98 : I think that the ATH is the ceiling, and a 10% correction is imminent. That will be healthy for the stock market to continue it's bull market trend

小trader : The recent all-time highs in the S&P 500 and Dow Jones Industrial Average have fueled discussions about the market's future trajectory. Opinions differ, with optimists highlighting factors such as an economic recovery, fiscal stimulus, robust earnings, and low interest rates. Pessimists caution against overvaluation, inflation, speculation, bubbles, and instability. The current uptrend is complex, linked to factors like cooled inflation and a paused Fed rate hike, yet uncertainties such as geopolitical tensions, oil price surges, or a Chinese economic recession could lead to corrections.

Personally, I believe in the time in the market over timing the market and I do not bet against the market. I believe that in the long run, the stock markets will always improve. Hence, I prioritize the fundamentals and growth potential of the companies I invest in over daily market movements.