🚀 Bitcoin's 4th Halving Buzz: Share insights, win big!

Hi, mooers!

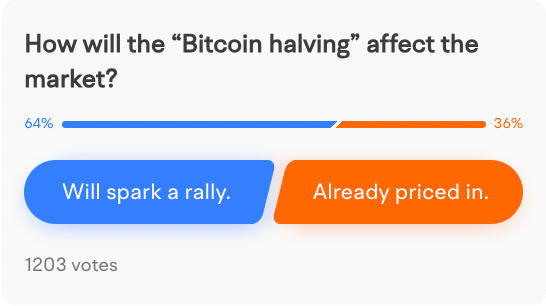

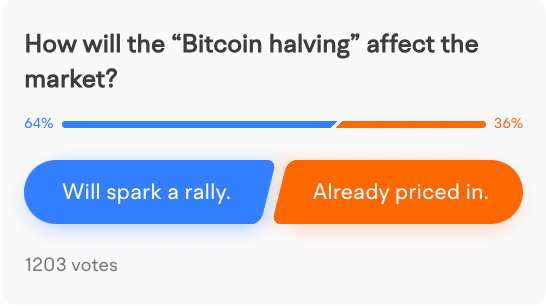

The crypto community is excited as the highly anticipated Bitcoin Halving has taken place on April 20. Historically, Bitcoin halvings have often led to substantial price increases due to reduced supply. Yet, some analysts contend that Bitcoin dominance is declining, indicating the beginning of a market rotation. The market's a mix of excitement and uncertainty, which could open the floodgates for investment. Our recent vote indicates a keen interest in Bitcoin, with the majority viewing the halving as having a bullish impact on the market.

It's time to share your thoughts on Bitcoin's trajectory. Whether you're a seasoned trader or a crypto novice, we would like your views on the Bitcoin market and its potential post-halving investment opportunity.

💡Here's how you can get involved:

-Mooer's Crypto Picks: Leave a comment under this post with your 1 to 3 most favored crypto-related tickers from Bitcoin spot ETFs, crypto trading platforms, Bitcoin holding companies, Bitcoin miners, or other Bitcoin-related ETFs.

-How your P/L looks: Share your crypto-related P/L orders and show us your trading performance. No matter winning or losing, lessons can be learned. Remember to share in the topic #Bitcoin's 4th halving done: A new rally or already priced in?

-Trading Wisdom: If you're keen on technicals or fundamentals, share your trading insights and experiences. Use your preferred analysis method to discuss your approach to the Bitcoin market, strategies, or what you've learned. Remember to share in the topic #Bitcoin's 4th halving done: A new rally or already priced in?

🏆Score Big Points

Earn points for your contributions:

-Crypto Picks: Comment with your favored crypto tickers for 10 points, and an additional 10 points will be given away if brief reasons are mentioned.

-P/L Share: Win 100 points for sharing your crypto-related P/L orders.

-Trading Insights: For sharing your trading wisdom and market analysis in more than 50 words, you'll receive 200 points.

-Top Posts: We will select the top 10 posts and reward them with extra 500 points.

*Top posts will be chosen for their authenticity, clarity, engagement, and informativeness

⏳ Event Timing

Mark your calendars! The event starts NOW, and will expire at 12 PM ET on May 3, 2024. Don't miss out on this opportunity to share, learn, and earn!

We appreciate your active participation and look forward to your insightful posts. Keep an eye on the latest Bitcoin discussions. Your voice is invaluable to our community, and together, we can ride the waves of this exciting halving event!

Ready to dive in? Let's see those posts rolling in! 🚀

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

look like a movie : I love $Coinbase (COIN.US)$ $Riot Platforms (RIOT.US)$ $ARK 21Shares Bitcoin ETF (ARKB.US)$

$Coinbase (COIN.US)$ $Riot Platforms (RIOT.US)$ $ARK 21Shares Bitcoin ETF (ARKB.US)$

mr_cashcow : Keeping my eyes on $Marathon Digital (MARA.US)$

With the bitcoin halving the here are some effects it have on related stocks:

1. Increased demand: As the amount of new Bitcoin introduced into the market decreases, demand for the existing supply increases, which can drive up the price of Bitcoin and related stocks.

2. Reduced mining profitability: As the block reward is cut in half, mining becomes less profitable, which can negatively impact the stock prices of mining companies.

3. Consolidation in the mining industry: As smaller mining operations become less profitable, they may be acquired by larger companies, leading to consolidation in the industry.

4. Increased focus on fundamentals: After the halving, investors may focus more on the fundamentals of mining companies, such as their ability to operate efficiently and effectively, which can impact their stock prices.

5. Volatility: The halving can lead to increased volatility in the price of Bitcoin and related stocks, as investors react to the event and its potential impact on the market.

6. Increased interest in Bitcoin ETFs: The halving can lead to increased interest in Bitcoin ETFs, which can provide investors with a way to gain exposure to Bitcoin without having to hold the underlying asset.

7. Potential for a "speculative bubble": The halving can trigger a "speculative bubble" in the price of Bitcoin and related stocks, as investors become more optimistic about the market and bid up prices.

hhhhhe : Keeping my eyes on $Marathon Digital (MARA.US)$

With the bitcoin halving the here are some effects it have on related stocks:

1. Increased demand: As the amount of new Bitcoin introduced into the market decreases, demand for the existing supply increases, which can drive up the price of Bitcoin and related stocks.

2. Reduced mining profitability: As the block reward is cut in half, mining becomes less profitable, which can negatively impact the stock prices of mining companies.

3. Consolidation in the mining industry: As smaller mining operations become less profitable, they may be acquired by larger companies, leading to consolidation in the industry.

4. Increased focus on fundamentals: After the halving, investors may focus more on the fundamentals of mining companies, such as their ability to operate efficiently and effectively, which can impact their stock prices.

5. Volatility: The halving can lead to increased volatility in the price of Bitcoin and related stocks, as investors react to the event and its potential impact on the market.

6. Increased interest in Bitcoin ETFs: The halving can lead to increased interest in Bitcoin ETFs, which can provide investors with a way to gain exposure to Bitcoin without having to hold the underlying asset.

7. Potential for a "speculative bubble": The halving can trigger a "speculative bubble" in the price of Bitcoin and related stocks, as investors become more optimistic about the market and bid up prices.

70981496 : I have many coins but the 2 best for me are FET and GRT. my strategy is to buy coins 1x per month, every month. it takes emotion and trying to time the market out of the picture. when everyone was selling crypto in 2022, I bought all the way down. it has paid off nicely

104298925 : why is moomoo until now still not offering crypto? disappointed with the progress.

104143906(ahyao) : Currently, my Ethereum is still earning Dogecoin, and it was cleared last month

Jafecheong : Bitcoin's halving will definitely drive a new round of gains, but Bitcoin's increase was limited. My opinion will definitely double again to around 140,000...

VTTO : The halving can lead to increased volatility in the price of Bitcoin and related stocks, as investors react to the event and its potential impact on the market.

Potential for a speculative bubble. The halving can trigger a speculative bubble in the price of Bitcoin and related stocks, as investors become more optimistic about the market and bid up prices.

wss fly to the moon : Euretheum is better.

Bitcoin is too expensive, halving allow more people to involve.

Willingnow : Who really is behind bitcoin? Do the research you might be surprised not everything you see is real.

View more comments...