Wall Street Today | Stocks Retreat as Investors Lock in Gains

RECAP

US Stocks Retreat After Rallying in 2023

US stocks pulled back on the first trading day of the year, locking gains posted in 2023, as the Magnificent Seven stocks retreated.

A Bloomberg gauge of the seven stocks declined 1.7%, weighing on the S&P 500 and the Nasdaq that are heavily weighted to the tech giants. The $Nasdaq Composite Index(.IXIC.US$ fell 1.6% to close at 14,765.94, its biggest daily decline since October. The $S&P 500 Index(.SPX.US$ slipped 0.6% to 4,742.83. The $Dow Jones Industrial Average(.DJI.US$ added 0.07%, to 37,715.04.

A Bloomberg gauge of the seven stocks declined 1.7%, weighing on the S&P 500 and the Nasdaq that are heavily weighted to the tech giants. The $Nasdaq Composite Index(.IXIC.US$ fell 1.6% to close at 14,765.94, its biggest daily decline since October. The $S&P 500 Index(.SPX.US$ slipped 0.6% to 4,742.83. The $Dow Jones Industrial Average(.DJI.US$ added 0.07%, to 37,715.04.

The day's decline is a "normal pattern" after investors sold equities that have been declining toward the end of the year to book the loss in their tax filings, CNBC quoted Infrastructure Capital Management CEO Jay Hatfield as saying. That pattern continues at the start of the new year, when investors tend to sell stocks that have previously rallied to lock in their gains, he said.

MACRO

Rate Cut Bets

Traders were pricing as many as seven 25 basis point cuts in interest rates by the US Federal Reserve by the end of 2024, according to the CME Fedwatch tool.

The market felt empowered to escalate its rate-cut expectations further, seeing as the meeting had the effect of expanding the outer limits from five cuts beginning midyear to at least seven cuts beginning March,” MarketWatch quoted former Fed governor Larry Meyer as saying. “Midyear onset still seems reasonable, but the risk is earlier and deeper cuts.”

SECTORS

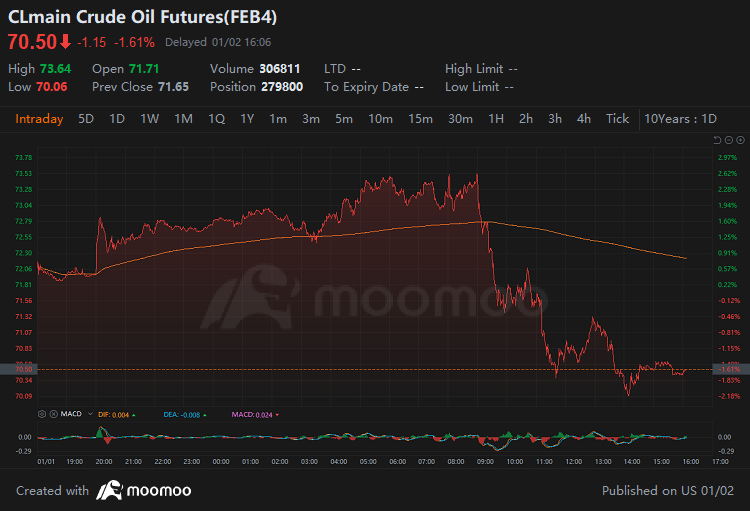

Stronger Dollar Hurt Gold, Oil

Crude oil and gold declined as the dollar strengthened, making commodities less attractive to holders of other currencies.

COMPANIES

Apple Price Target Cut

$Apple(AAPL.US$ shares slipped after reports that Barclays analyst Tim Long downgraded the stock and trimmed its price target on expectations of continued weakness in iPhone sales, particularly in China, CNBC reported.

Moderna Upgraded to Outperform

$Moderna(MRNA.US$ rose more than 13%, the best performer on the S&P 500 Tuesday, after Oppenheimer upgraded the vaccine giant to "Outperform" from a previous "Perform" rating. Oppenheimer also boosted its price target on the stock to $142. Rival $Pfizer(PFE.US$ gained 3.8%.

GoodRx Stock Price Target Cut

$GoodRx(GDRX.US$ shares slumped 16% after Bank of America Securities cut its price target on the stock to $4.50 from $8 and lowered its rating to underperform from buy.

Nvidia, AMD Slip

$NVIDIA(NVDA.US$ and its peer $Advanced Micro Devices(AMD.US$ fell after the Netherlands decided to block exports of certain lithography systems to China.

Rivian Deliveries Miss

$Rivian Automotive(RIVN.US$ shares slumped more than 10% after the company reported fourth quarter deliveries that missed estimates. The company said it delivered 13,972 vehicles in the fourth quarter, down from 15,564 in the third quarter. That missed the average estimate of analyst of 14,430 reported by Reuters.

Tesla Loses Crown as Top EV Maker

$Tesla(TSLA.US$ shares slipped after its Chinese rival BYD overtook the US-based electric vehicle giant in quarterly deliveries of fully electric vehicles for the first time. Tesla joined other Magnificent Seven stocks Apple, Nvidia, $Alphabet-A(GOOGL.US$, $Amazon(AMZN.US$, $Microsoft(MSFT.US$ and $Meta Platforms(META.US$ in retreating on the first trading day of the year after their meteoric rise in 2023. The decline overshadowed Tesla's

Cruise Operators Pull Back

Cruise operators pulled back after posting record yearly gains in 2023. $Norwegian Cruise(NCLH.US$'s stock fell 8.6%, the worst performer on the S&P 500. The stock had soared 63.7% in 2023, to break the previous record of 37.8% in 2019 by a wide margin. $Royal Caribbean(RCL.US$ declined 7.2% while $Carnival(CCL.US$ declined 6.7%.

Source: Bloomberg, Dow Jones, CNBC, Reuters

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

73035898 : yes that is how you do business

152258611 73035898: bro you n

know big heart faith and years of pain only way is up from the bottom love peace harmony goal to buy 3rd world country to save and feed