Wall Street Banks Warn: Nvidia & AI Surge Echoes 1999 Bubble in 2024

Just five years back, $NVIDIA(NVDA.US$'s market worth hovered around $100 billion. Now in 2024, it has ascended to the ranks of the world's third most valuable company with a market cap of an astonishing $2.3 trillion, and its stock is on a trajectory toward the $1,000 milestone. This marks a twentyfold increase in Nvidia's stock value, primarily driven by the burgeoning generative AI technology sector.

Nevertheless, Nvidia's rapid ascent and the AI industry's expansion have led investors and analysts to wonder if this is indicative of a market bubble, casting doubt on the longevity of such high valuations for tech giants like Nvidia.

Apollo Says AI Bubble Surpasses 1990s Tech Frenzy

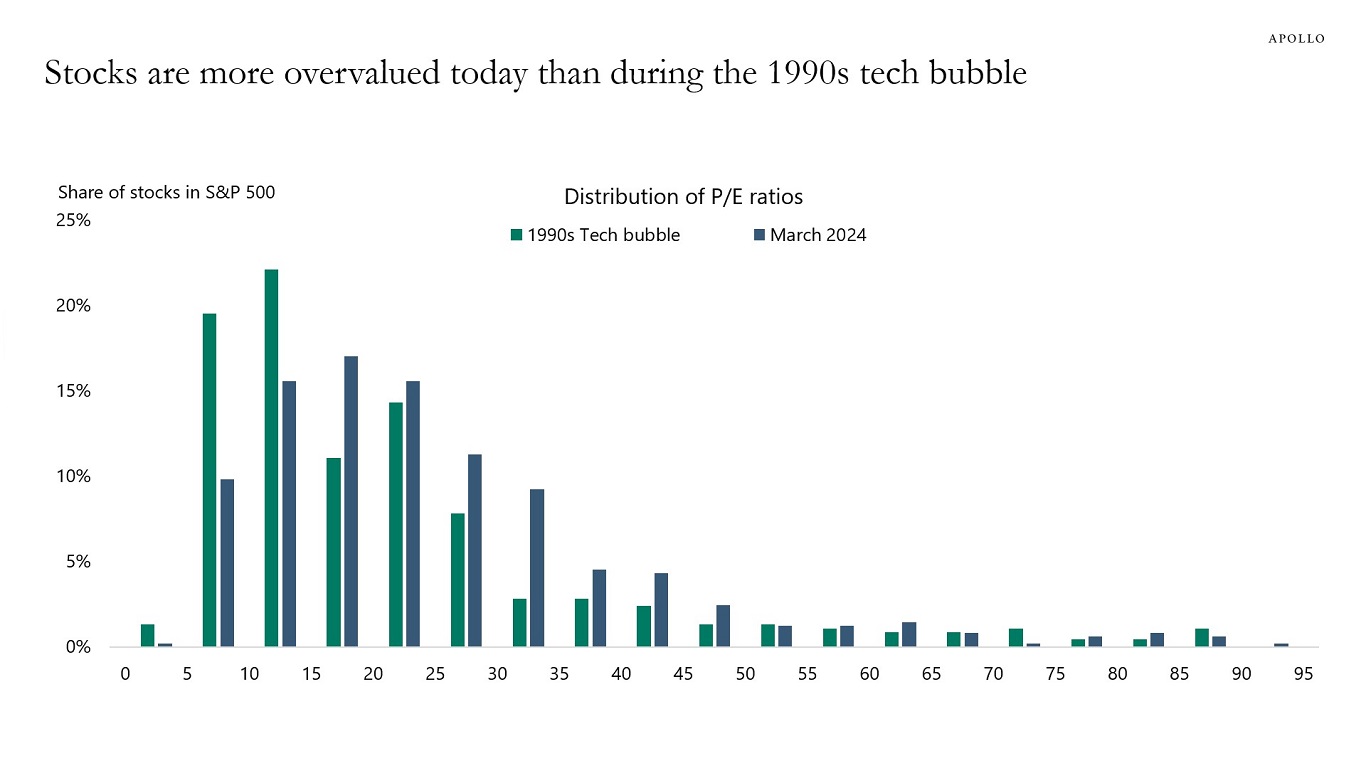

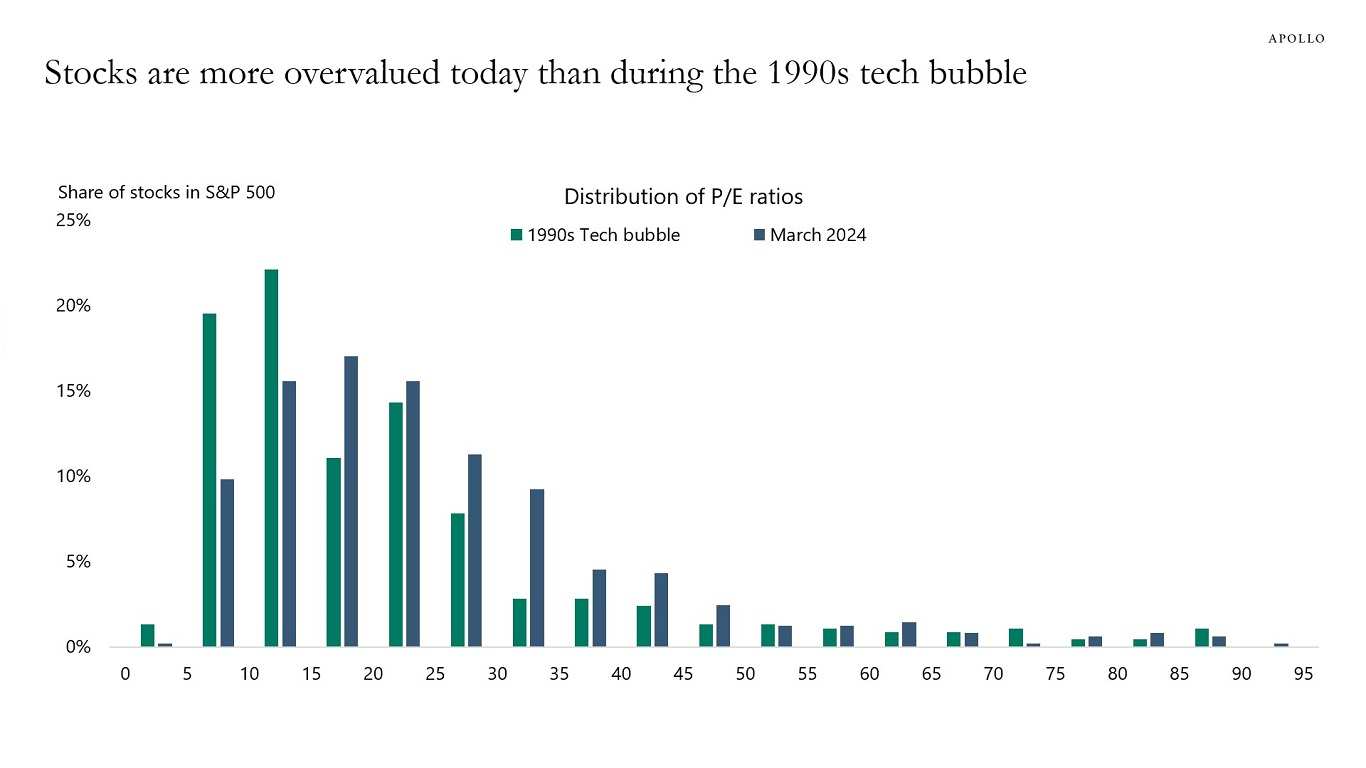

Torsten Slok, Chief Economist at Apollo Global Management, released a compelling report on Sunday, summarized in one graphic, that offered insightful information challenging the widespread Wall Street analysts' forecasts of AI driving stock prices to new highs.

Torsten Slok's report presented a bar chart comparing the median price-to-earnings (P/E) ratios of the ten most valuable U.S. companies from 1990 to 2020 and in late February 2024, alongside the overall S&P 500 figures and those excluding the top ten. The headline stated that the current AI bubble surpasses the 1990s tech bubble. The data indicated that the current top 10 P/E multiple is around 40, significantly higher than the 23 to 26 range seen during the build-up and peak of the dotcom era. Slok suggests that this means today's top S&P 500 companies are more overvalued than they were during the tech bubble.

The report inspired further scrutiny into how the stocks with high valuations in 2000, particularly those still in the top ten today, have performed over time. A different approach was adopted by considering the combined P/E of these top companies as if they were one entity, assessing the potential returns for investors who held a market-cap-weighted collection of these firms. This analysis was aimed at understanding the potential outcomes for current investors backing Nvidia and other major tech stocks heavily invested in AI, amidst the strong market enthusiasm driven by both Wall Street and Main Street.

Citi Predicts 2024 May Mirror 1999's Market Scenario

Citi strategists have weighed in on the debate, suggesting that the situation in 2024 is unique yet reminiscent of the market conditions in 1999. Citi analyst Christopher Danely acknowledges the possibility of an AI bubble but suggests that it could persist until 2025.

We would note that these bubbles can last a year or longer, similar to what happened in 1999 with the tech bubble. This has happened before in 1999 and while it ended badly (and this will likely end badly as well), valuations can remain frothy for over a year, as long as estimates keep going up rapidly."

Danely noted that it wasn't until late 2000 that valuations began to collapse.

BofA Cites AI and Crypto Fervor as Signs of a Market Bubble

Michael Hartnett, Chief Investment Strategist at Bank of America, has expressed concerns that the intense excitement surrounding AI and cryptocurrencies is indicative of a bubble.

In an interview with Bloomberg, Hartnett pointed out that the current market euphoria is being driven by expectations of the Federal Reserve's interest rate cuts, leading investors to preemptively invest in various assets like gold, cryptocurrencies, equities, and bonds. He observed that the combination of unexpectedly persistent inflation and moderate growth, along with the continued strength of riskier assets, suggests a bubble mentality is at play in the markets.

Hartnett underscored that signs of a bubble can be detected through certain characteristics, including the patterns and velocity of price changes, overall valuations, and the breadth of market participation.

Source: APOLLO, FORTUNE, Investing.com, CNN BUSINESS

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

AbdulK : FOMO

AbdulK : FUD

10baggerbamm : here's where I disagree with Tom and every other figure head that is nothing more than a parrot regurgitating somebody else's storyline because it got some traction and views. I started in 1988 I had a broker dealer I sat behind a trading desk as a market maker I have a little bit of experience. 1998 everyday there was another company going public there were companies going public with zero revenue back then and in the early days of 1980 they were called blind pools they were the most risky investments fast forward covid now they're called spacs. most are junk companies most would never be able to go public in the traditional method because a lack of revenue lack of product lack of direction lack of market share.. back in 1998 in addition to a constant stream of companies going public the valuation of these companies they were trading at 30 to 50 times 2 to 3 year forward projected revenues. Nvidia is trading at 32 PE. in 98-99 the vast majority of these companies did not have the denominator and e to even have an a price to earnings ratio they were forward projected revenues that the stocks were traded on. that's not happening today so we don't have the IPO stream we don't have the egregious valuation of forward revenues and with people on the TV saying this is the new normal which is what they were doing back in 98 and 99. in 9899 all the company had to do is say we're starting a website and the stock would go up by 30 to 50%. we did have slight exuberance call it with companies saying we're utilizing AI in our business and it would gain traction and momentum investors would come in that's about the only correlation that does exist. (pt 1 of 2)

WolfOfWallStreet : Butt you all banks own it too

10baggerbamm 10baggerbamm: pt 2. back in 9899 the bubble was being created because of the use of margin virtually every person that had an account with us and my friends companies were leveraged on margin buying everything they could every com that was going public every time it would uptick they're stretching their buying power down to 40 and 30% you see back then there were no designated securities they're required to hire maintenance or you couldn't borrow against like exist today. the use of margin is what created that bubble and compounded the sell-offs because every Friday we had Forced liquidations. that's not happening today either. Nvidia is a cash generating monster they're making billions of dollars in profits in 1998-99 there was not a single company making even working those numbers backwards anything close to what Nvidia is generating right now in true cash profits or revenue (inflation adjusted for 98-99. ) Amazon was still selling books they had not even pivoted to selling any other products it was speculated by Jeff bezos that they would begin selling other consumer goods at some point but that's how early in the infancy and they were reporting losses hand over fist back then by the way. if you have not fallen asleep by now then you'll understand these talking heads writing for these periodicals these journals that are on TV they're there for self promotion and self enrichment of their own mutual funds of their newsletters many did not live through the bubble of the coms they're just regurgitating what others are saying because they want the attention. this is not to say Nvidia can't come down to its moving average $500 it could but two years from today 4 years today 5 years today as long as Nvidia is the key leader an amb and this Canadian company don't have a chip that is five times faster at half the price than Nvidia is still going to be the 800 lb gorilla in the room.

UnitZero142857 : Empty machines are losing money like crazy. They keep talking about bubbles. Anyway, they are chasing big dragons to buy at bargain prices.

jasonsouza77 : wow the comments here are better than

104723145 :

Nidia_Girl : The problem with AI it needs so much funding and so much research , their has been a period iñ time when we we had technology advancing because of the competition that existed . Today with 20 different ideas needing funding for basic concept , funding will stop flowing when investors lose patience

Wealthy George : Wall Street has never lacked highly educated idiots who only study. These idiots who work on Wall Street don't invest themselves; they only get paid. Wall Street is also recruiting these idiots to get them to work and make mentally retarded remarks at critical moments to drive the public to throw out their chips.

View more comments...