Value Outperforms Growth in Year's First Trading Day. Will the Market Reversal Continue to Remain?

The year commenced with a notable preference for value stocks, while growth stocks, especially in the technology sector, found themselves in negative territory. The S&P 500 Value Index ascended by 0.61%, whereas the tech heavy S&P 500 Growth Index experienced a decline of 1.59% on Tuesday.

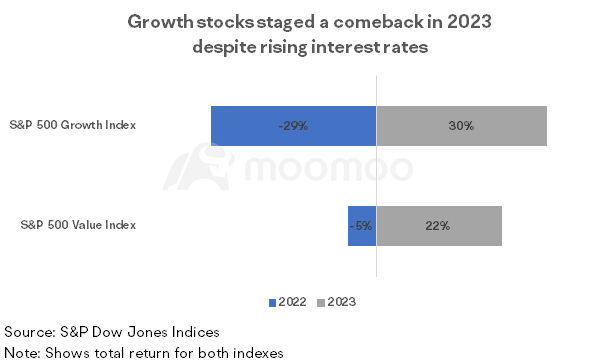

There are signs money may be flowing out of recent darling stocks and into cheap-looking laggards. This shift contrasts with 2023's trend, where the S&P 500 Growth Index surpassed the Value Index by 7.82 percentage points last year, including dividends, after trailing it badly in 2022.

A surprising reversal

Leading the gains were sectors such as consumer staples, utilities, and healthcare, which had previously underperformed in 2023. This trend reversal is evident in individual stock performances: $Moderna(MRNA.US$, a notable underperformer in the $S&P 500 Index(.SPX.US$ during 2023, surged 13.1%, bolstered by positive remarks from an Oppenheimer analyst. Similarly, $Pfizer(PFE.US$, another former laggard, saw a rise of 3.3% on Tuesday.

Conversely, technology megacaps faced a selloff. $Apple(AAPL.US$'s shares dipped following an analyst downgrade, contributing to the $NASDAQ 100 Index(.NDX.US$'s 1.7% fall, marking one of the worst starts to the year since the dot-com bust of 2001. $Amazon(AMZN.US$, $Uber Technologies(UBER.US$, and $Alphabet-C(GOOG.US$ also experienced declines.

The most common concern or belief we have heard from investors is that overbought conditions and euphoric sentiment will set up for a reversal to start 2024 in both bond yields and stocks," said Dennis DeBusschere, founder of 22V Research.

Historical performance backs value stocks

The day's market movements offered solace to investors favoring value, as these stocks often prevail over the long term due to lower valuations and higher dividend yields, regardless of the direction of interest rates. Historical patterns reveal that value stocks have outperformed growth in 10 of the 12 periods of rising rates, and in nine of 11 periods of falling rates.

Returns on stocks are generally derived from three sources: dividend yield, earnings growth, and changes in valuations. By definition, value stocks have lower valuations and higher dividend yields, so they have a built-in edge relative to growth in two of the three drivers of return. Historically, growth stocks have not provided sufficient earnings growth to surpass the inherent benefits of value, often because many fail to fulfill their projected potential.

Whether this emerging trend will persist is uncertain, and the initial day's performance offers limited insight into the market's direction for the remainder of 2024. Nevertheless, the retreat of growth stocks indicates a growing caution among investors who may be reluctant to continue the late rally from the previous quarter that elevated US equities.

Source: Bloomberg, MarketWatch, S&P Global

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Rexon Capital : An alternative perspective

Since Q4, institutional investors and fund managers who have lagged the S&P were FOMO and decided to chase the rally (going overweight). Given their huge underperformance, they had to hold on to these tech darlings for their annual shareholder’s letter as a “comfort point” to their investors that they are investing in these tech darlings. Once the year started, they quickly sell and to cash in and revert back to their original allocation.