US Bond Funds Saw Record Inflows as Rate-Cut Prospects Fuel Investor Optimism

Boosted by a combination of softer manufacturing figures and accommodating dovish comments from Federal Reserve officials, US bond funds racked up large inflows in the seven days to March 6 as expectations raised for interest rate cuts later this year.

Investment data from the London Stock Exchange Group revealed significant interest in US bond funds, with the most notable investments being directed toward US short/intermediate investment-grade funds, which drew $4.21 billion—their highest attraction since March 24, 2021. General domestic taxable fixed income and government bond funds also experienced substantial inflows, receiving $4.65 billion and $1.35 billion, respectively.

In sync with these developments, the yield on the $U.S. 2-Year Treasury Notes Yield(US2Y.BD$ —a benchmark closely associated with interest rate forecasts, which typically moves inversely to bond prices—saw a sharp decrease last week, dropping 15.7 basis points, its most significant decline in a six-week period.

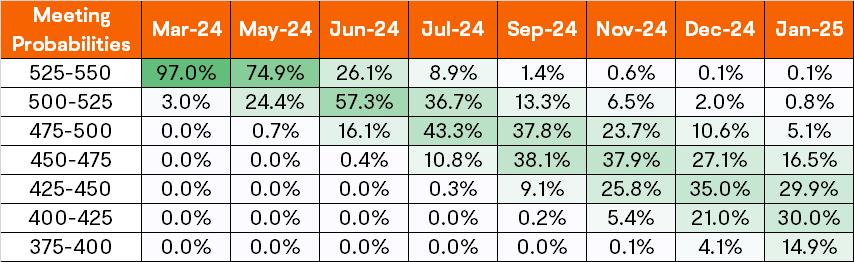

Fed-fund futures put just 26.1% odds of interest rates holding steady through June, down from 25.8% on Sunday, according to the CME FedWatch Tool. Odds of a 25 basis point cut through June were up to 57.3%. Odds, the headline interest rate is 50 basis points lower through the June meeting, holding around 16.1%. A basis point is a hundredth of a percentage point.

Equity funds in the US also enjoyed a second consecutive week of net inflows, securing around $1.2 billion. This followed a prior week's net purchasing amount of $171 million.

The real estate and consumer discretionary sectors, in particular, stood out with robust investment interest. Real estate sector funds attracted $1.11 billion, while consumer discretionary sector funds drew $777 million, representing the most substantial inflows across sector-specific funds.

The real estate and consumer discretionary sectors are generally more sensitive to rate cuts because lower interest rates can lead to reduced borrowing costs for consumers and businesses. In the real estate sector, this can result in increased demand for property as mortgages become more affordable, potentially driving up property values and benefiting real estate investments. For the consumer discretionary sector, lower interest rates often lead to higher consumer spending on non-essential items and services, as individuals have more disposable income due to lower interest payments. This increased spending can boost revenues for companies within the consumer discretionary space.

Money market funds are custodians to a significant amount of capital from investors who will actively seek higher returns.

About $19 billion flowed into US money-market funds in the week through March 6, according to Investment Company Institute data. Total assets rose to $6.08 trillion from $6.06 trillion the week prior.

During periods of interest rate cuts, the size of money market funds may diminish as yields on the short-term debt securities they invest in, such as US Treasury bills and commercial paper, tend to fall, making them less appealing to income-seeking investors. Consequently, individuals and institutional investors alike might shift their capital to investment vehicles with higher potential returns, such as stocks or bonds, in pursuit of better yields. This behavior is driven by the increased opportunity cost of holding cash equivalents, as well as concerns that the low returns on money market funds may not keep pace with inflation, eroding the real value of their earnings. As these investors withdraw funds in search of more lucrative opportunities, the overall assets under management in money market funds can decrease.

Source: Bloomberg, Reuters

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

70650636 : technology will play a role in trading if there happens to be a big boom tech. advancement.