May FOMC Preview: Sticky Inflation Likely Forces Fed to Turn More Hawkish

Investors are closely watching the Federal Open Market Committee meeting to be held from April 30 to May 1. The Committee is widely anticipated to maintain the current range of its federal funds rate target between 5.25% and 5.5%.

The statement from the FOMC is expected to be released at 2 pm Eastern Time on Wednesday, after the end of their two-day meeting, followed by a press conference with Chair Jerome Powell scheduled for 2:30 pm ET.

The May FOMC meeting comes at a delicate time for the Fed, with disinflationary progress remaining substantially slower than the Committee would desire, as the labor market remains tight.

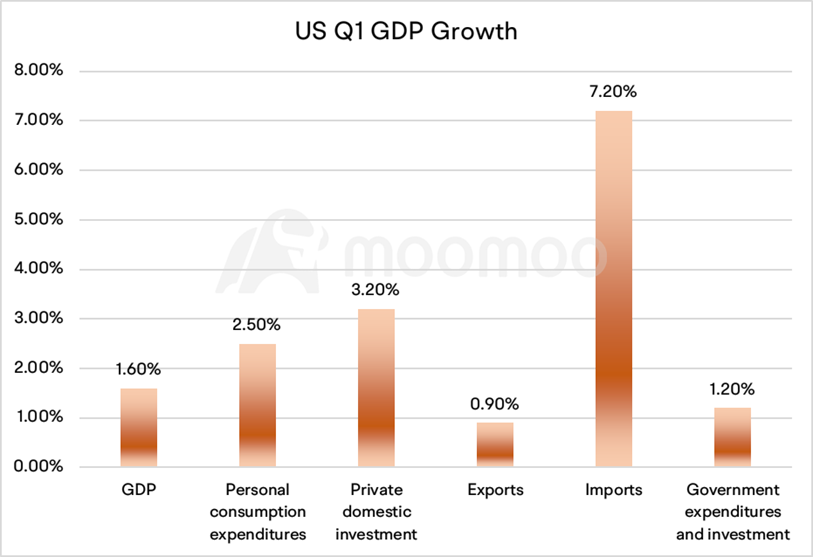

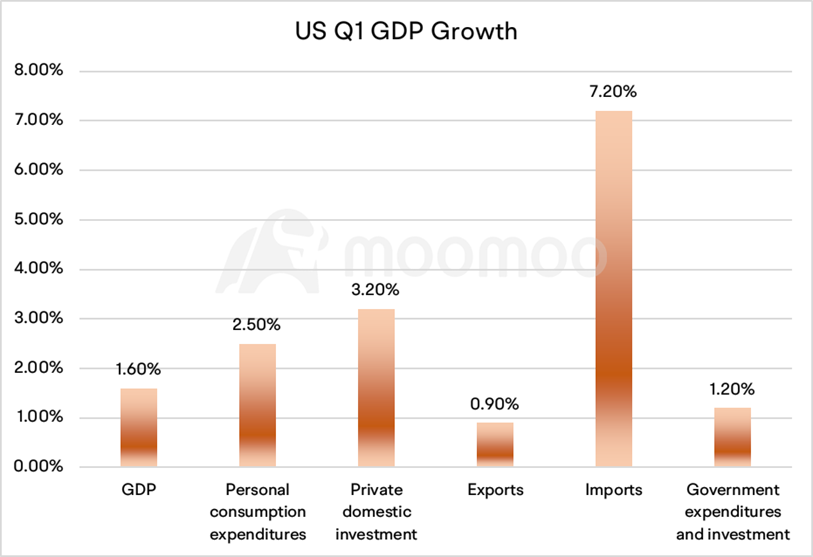

■ Q1 GDP shows mixed signals

Bureau of Economic Analysis reported in its preliminary estimate last Thursday that the GDP grew at an annualized rate of 1.6% in the first quarter. This figure falls short of the 2.4% growth rate economists surveyed by Reuters had predicted, following a 3.4% expansion in the fourth quarter.

Brian Jacobsen, Chief Economist of Annex Wealth Management, noted that “GDP growth was a miss, but the details were deja vu all over again when it comes to consumption spending. Services were up, but goods were down. Final sales to private domestic purchasers increased 3.1% annualized, so domestic spending by households is still healthy despite the headline weakness. Unfortunately, it looks like spending on things like insurance and healthcare is beginning to squeeze out spending on other things.”

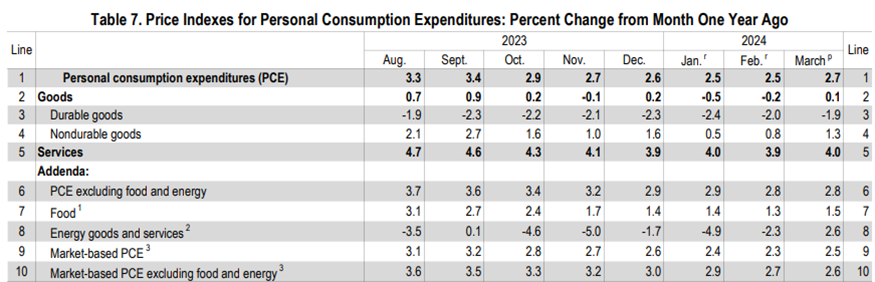

■ PCE data shows that the disinflation process slowed

Inflation has been volatile in the past few months, and progress has clearly slowed from the encouraging pace late last year. The US core PCE price index, the Federal Reserve's preferred gauge to measure inflation, rose by 2.8% from the previous year. Figures came above market forecasts of 2.6%.

Meanwhile, the Fed's preferred wage gauge – the Employment Cost Index (ECI), due on the first day of the meeting, is likely to come in hot after nearly half of US states raised their minimum wages in the first quarter.

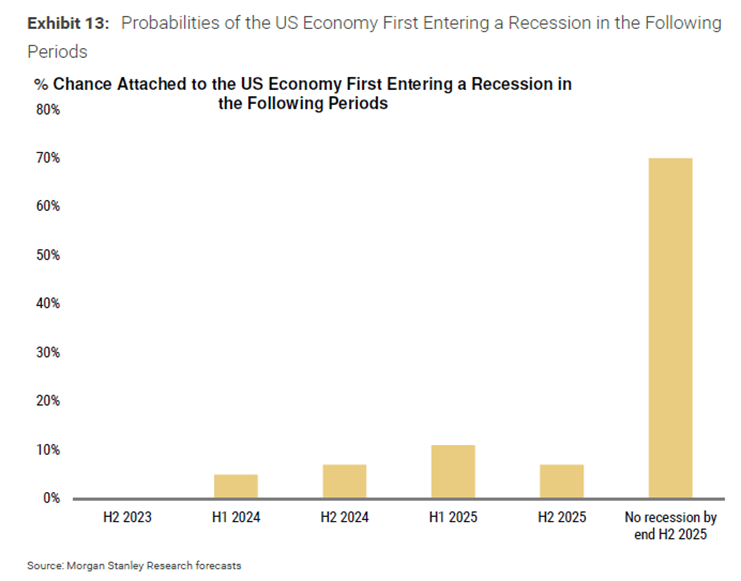

The lack of progress has stripped away Chair Powell's appetite to get started as early as June. Morgan Stanley's economist Ellen Zentner has pushed out the timing of the first cut to July.

■ The Fed is expected to turn more hawkish

Fedspeak since the March 20 decision has trended more hawkish, reversing a dovish trend. The most telling sign of an impending hawkish pivot in recent Fed communications came from Chicago Fed President Austan Goolsbee – notably, in comments released during the Fed blackout period — who said a string of hot inflation prints show “progress on inflation has stalled” and the Fed needs to “recalibrate.”

“If the most dovish member of the FOMC says that, you know a hawkish pivot is coming.” Bloomberg chief economist Anna Wong noted in her latest report. She pointed out that, at the minimum, Powell will likely indicate the median FOMC participant now expects “less” cuts this year; in a more hawkish direction, he could hint at a chance of no cuts — or even suggest a hike might be on the table, though not the current baseline.

A more hawkish stance may be reflected in the statement and Powell's post-meeting remarks.

■ What message will Powell deliver at the press conference?

Chair Powell will likely stress that it's appropriate to give restrictive policy further time to work. He's fresh off his appearance at the IMF-WB Spring Meetings, where he expressed his latest views on monetary policy - it is unlikely his message deviates far from the views he expressed.

During his appearance at the meeting, he commented that recent data have not bolstered confidence in the process of disinflation; rather, they imply that it may take more time to reach a state of assured price stability. Nonetheless, he mentioned that the current policy framework is suitably equipped to manage these risks. Should inflation remain persistently high, the Federal Reserve is prepared to sustain the present degree of monetary restriction for an extended period. Conversely, if there is an unforeseen downturn in the labor market, the Fed has the flexibility to implement more accommodative measures.

l■ Will the Fed release a signal on tapering QT at this meeting?

The Committee held an in-depth discussion at the March meeting and was looking to slow the pace of run-off "fairly soon." Zentner sees the Fed announcing the parameters of a taper to QT in May and initiating the taper in June. QT ends around February 2025, but could go on for longer. Zentner noted the Fed would likely cut the pace of QT in half for Treasuries to $30bn/month, but leave MBS to run off with prepayments.

■ Will the Fed's hawkish stance shake the market?

The U.S. 10-year Treasury yield reached 4.66% on Friday, significantly higher than the 3.86% in December last year, and quite close to the highest level in October last year. Various signs of reflation intensify investors' selling of Treasuries. The bond market has already reacted early to the Fed's hawkish turn. That makes Powell's dovish turn late last year seem futile.

CME FedWatch shows markets have begun pricing in Fed rate cuts most likely starting in September,meaning rate cut expectations are being pushed back again and again.

If the Fed becomes more hawkish, as expected, stock market volatility is likely to increase. Still, Markets are affected by many forces. As the earnings season has arrived, investors’ focus this week is more on the financial results of large technology stocks. In 2023, investors continued to witness the "higher for longer" narrative being reinforced, but the stock market still performed well. Similarly, the key point is whether the company's profit growth rate this year can withstand the rise in risk-free interest rates.

Wall Street analysts are expecting positive S&P 500 growth numbers as first-quarter earnings season ramps up in the coming weeks. Analysts are projecting S&P 500 earnings growth of 0.9% in the first quarter compared to a year ago, the third consecutive quarter of positive earnings growth.

Michael Brown, an analyst from Australian forex trading company Pepperstone, said, “The FOMC should be more hawkish than its G10 peers, most of which are likely to cut rates by June. And when the 'Fed puts' are in place again, investors should continue to feel comfortable moving further away from the risk curve, thus maintaining the path of least resistance for stock market gains.”

Source: Bloomberg, Morgan Stanley

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

SpyderCall : Good read.

Scapey T Goat : "Unfortunately, it looks like spending on things like insurance and healthcare is beginning to squeeze out spending on other things.”

translation: people need to spend money to survive and not on Netflix and avocado toast.