Uranium on the Rise: A New Era for Nuclear Energy?

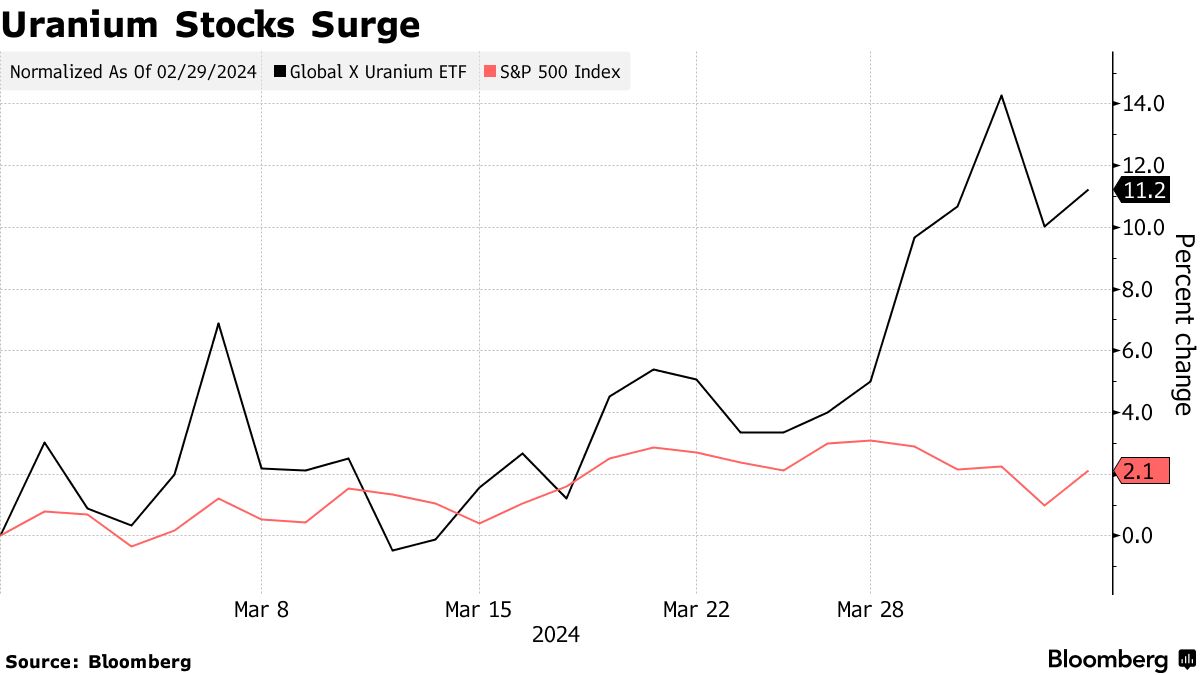

Over the past year, uranium prices have skyrocketed from under $50 per pound to over $100, currently stabilizing around the $90 mark. In late March, Kazakhstan, the largest uranium-producing nation, grappled with a once-in-a-century flood that sent ripples through the market. This event has significantly buoyed related stocks, with Australia's top uranium producer $Paladin Energy Ltd(PDN.AU$ surging 23% since March, North America's largest uranium miner $Cameco(CCJ.US$ climbing 20%, $NexGen Energy(NXE.US$ gaining 14%, and $Uranium Energy(UEC.US$ increasing by 12%.

What Are the Potential Catalysts in the Uranium Market?

Nuclear Power Gains Focus Amidst Energy Transition

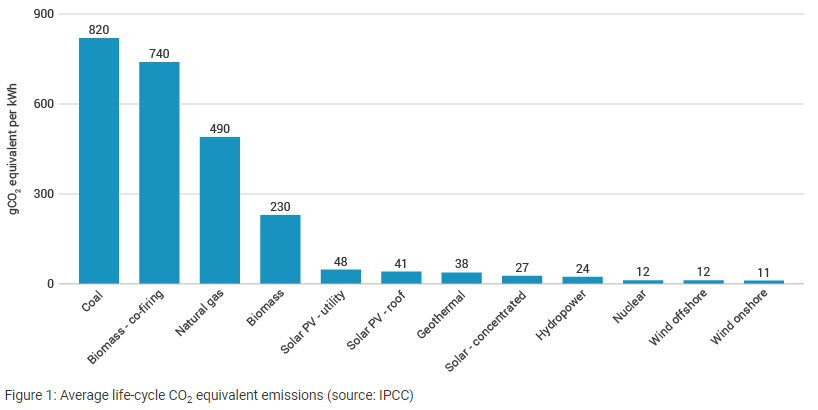

As the global demand for low-carbon, clean energy sources grows, numerous countries are seeking to reduce their reliance on fossil fuels. Nuclear power, recognized for its efficiency and stable base-load energy production, is increasingly regarded as a pivotal component in the transition to a low-carbon economy, drawing heightened attention.

Cameco has highlighted the significance of nuclear energy in combating climate change, stating on its fourth-quarter earnings call last month that the issue "remains top of mind, which truly puts nuclear in the spotlight." With the ability to generate electricity without emitting greenhouse gases, nuclear reactors have emerged as a compelling option in the fight against climate change.

Strong Demand for Nuclear Power Plant Construction

Uranium, primarily utilized in fuel production for nuclear power plants, accounts for over 99% of the total demand. Less than 1% of its uses include the production of medical isotopes and fuel for research reactors. During the COP28 climate change conference at the United Nations, the United States and 20 other countries pledged to triple their nuclear power capacity by 2050. In total, 22 countries committed to the ambitious target, viewing it as a crucial step in reaching their emissions reduction goals. These countries recognize that expanding nuclear energy capacity is likely the most viable path forward in the fight against climate change.

According to the World Nuclear Association (WNA), as of April, there are 16 countries with nuclear power programs. Moreover, approximately 60 reactors are currently being constructed worldwide, with an additional 90 power reactors planned, boasting a combined gross capacity of roughly 90 GWe. In addition, over 300 more reactors are being proposed. Furthermore, around 30 countries are contemplating, planning, or initiating nuclear power programs.

UxC, a leading global source of uranium data, reports that uranium demand is experiencing a significant surge. In fact, contracts signed by utilities for uranium supply reached 160 million pounds last year, marking the highest annual volume since 2012. Scott Melbye, executive vice president at Uranium Energy Corp, said,

The growing global acceptance of nuclear power in the green-energy transition has certainly returned the nuclear industry to a robust growth phase.

Geopolitical Dynamics Fuel Demand Increase

Russia holds approximately half of the global uranium enrichment capacity, making it a key supplier of both uranium and enriched uranium. Since 2022, the sudden escalation of geopolitical tensions has reawakened nuclear weapons demand that had lain dormant since the end of the Cold War 30 years ago. Existing and potential sanctions against the West have impacted Russia's uranium supply and disrupted the uranium route from Kazakhstan to Europe through Russia.

Meanwhile, Russia's halt in natural gas supplies to Europe has precipitated a severe energy crisis. In response, Germany has urgently halted its nuclear power plant decommissioning plans, Belgium has extended the service life of its nuclear reactors, and Italy is contemplating new nuclear energy projects. The brokerage firm PGM Global said: "...as Western governments try to diversify their uranium purchases away from Russia and Kazakhstan, many companies are signing contracts at premium prices."

In addition, the United States House of Representatives passed a bill last December to ban imports of Russian uranium, but it has not yet been passed by the Senate. The bill would prohibit imports 90 days after its enactment, unless the U.S. energy secretary determines that no alternative sources of supply are available or that imported shipments of the nuclear fuel are in the national interest.

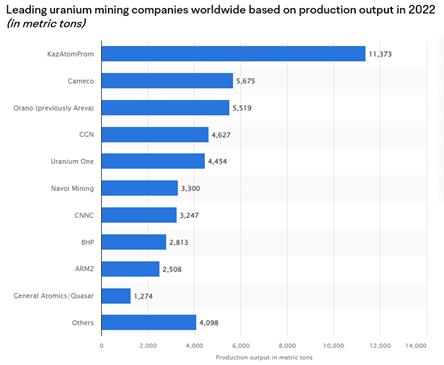

Uncertainty Looms on the Supply Side

According to WNA, Kazakhstan is the world's leading uranium producer, accounting for 43% of global uranium production in 2022. However, the country began reducing its annual production levels in 2018. The improving uranium market in 2022 prompted Kazatomprom, the country's top uranium-producing company, to temporarily reverse direction and announce a planned increase in production levels for 2023 and 2024. Nevertheless, in early February, Kazatomprom officially lowered its 2024 production guidance due to difficulties in obtaining sulfuric acid and development delays. The company now expects to produce 54 million to 58 million pounds of U3O8 for the year, down from its previous forecast of 65 million to 66 million pounds.

Niger ranks as the second-largest supplier of natural uranium to the European Union. Following a coup last year, Niger halted uranium exports, and it remains unclear when supply will resume.

Secondary Supply Could Rapidly Diminish

In recent years, as the dismantling of nuclear warheads from the post-World War II era (a process where countries like the United States and Russia dilute highly enriched uranium from nuclear weapons to industrial-grade standards to supplement nuclear fuel supply) has been winding down, the natural uranium market is losing an important secondary supply source. The potential sharp reduction in secondary uranium supply in the future could further exert pressure on the availability of uranium.

Anticipated Expansion of Supply-Demand Imbalance for Mid to Long-Term

Years of weak uranium prices have led to a decrease in the number of companies exploring for new uranium resources to bring to market. Major producers have also been forced to close mines and halt expansion projects. It typically takes 8-15 years for a uranium mine to begin production, making it challenging for supply to keep pace with demand.

Despite benefiting from the price increase since last year, which led some producers to announce the resumption of production from idle mines, the supply-demand gap is expected to widen from a medium to long-term perspective. According to WNA, the estimated global uranium demand for reactors in 2023 is about 65,650 tU, which is expected to double to nearly 130,000 tU by 2040. However, the supply of uranium from mines is projected to start declining in 2030-2031.

What Are Analysts' Perspectives?

BofA's metals and mining team predicts that the tightness in uranium markets could continue until at least 2025, implying that uranium prices may remain high throughout this year. The team of analysts has raised their uranium spot price targets to $105 per pound in 2024 and $115 per pound in 2025.

Despite capacity restarts, we forecast the uranium market to remain in a multi-year structural net deficit position, due to massive planned reactor build in China and the dual Western world agenda of decarbonization and energy independence.

Goldman analyst Neil Mehta said global uranium demand could grow by as much as 60% by 2040.

SP Angel mining analyst John Meyer noted that as mining costs rise and nuclear power plants look to build up inventories to cope with increasingly unstable supply issues, the market has been gradually pushing up prices.

We see prices rising year-on-year for the next 10-20 years or till the world finds another source for large scale uninterruptible baseload power with a low carbon footprint.

How to Invest Uranium in Australia?

Australia boasts the world's largest uranium reserves, accounting for a remarkable 27.7% of the global share. Key players in the Australian uranium mining sector include:

$Paladin Energy Ltd(PDN.AU$ is the largest uranium miner listed on the ASX and the fifth-largest uranium company globally by market capitalization. The company owns 75% of the Langer Heinrich mine in Namibia and has exploration projects in Canada and Australia. Due to the low uranium prices, Paladin suspended operations at Langer Heinrich in 2018 but resumed activities in 2022 and recently achieved commercial production. Paladin is also advancing its exploration program at the Michelin project in Canada.

$Boss Energy Ltd(BOE.AU$'s primary project is the Honeymoon mine in South Australia, which it acquired in December 2015. The company resumed mining operations in last mid-October and partnered with Coda Minerals Limited to obtain four exploration tenements in the Kinloch project, which is located 130 kilometers south of Honeymoon. The company recently achieved the final technical milestone necessary to restart its Honeymoon mine in Australia.

$Deep Yellow Ltd(DYL.AU$ has built a diverse portfolio of projects, including uranium exploration, early-stage, and advanced-stage projects in various geographical areas, such as Omahola and Tumas in Namibia, Mulga Rock in Western Australia, and Alligator in the Northern Territory. Deep Yellow recently updated its mineral resource estimate in February 2024 for the Ambassador and Princess deposits at Mulga Rock, resulting in an increase of approximately 26% in the total contained uranium.

$NexGen Energy Ltd(NXG.AU$, headquartered in Canada, is committed to becoming a leading provider of uranium for the world's current and future clean energy requirements in a responsible manner. The company is concentrating on projects in the Athabasca Basin, with its primary asset being Rook I, which includes several discoveries, such as Arrow and South Arrow. Additionally, NexGen holds a 50.1% stake in $IsoEnergy Ltd(ISO.CA$, an exploration-stage firm.

$BHP Group Ltd(BHP.AU$'s Olympic Dam mine in Australia is home to one of the largest uranium deposits globally, despite copper being the primary resource extracted from the mine. The asset holds uranium, gold, and silver reserves as well. BHP produced 3.4 million metric tons (MT) of uranium oxide concentrate from Olympic Dam in the 2023 fiscal year, marking an increase of 1.03 million MT from the previous year's output.

Source: WNA, IAEA, Barron's, Nasdaq, NEA, Paladin, Mirae Asset, Statista, Trading Economics

By Moomoo News Marina

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment