Metals & Mining Monitor | Strong Surge in Precious Metal Prices; BHP Mitsubishi Alliance Sells Coal Assets

Hello mooers! Welcome to Mining & Metals Monitor, your source for weekly insights into key commodities and fundamental changes in leading companies.

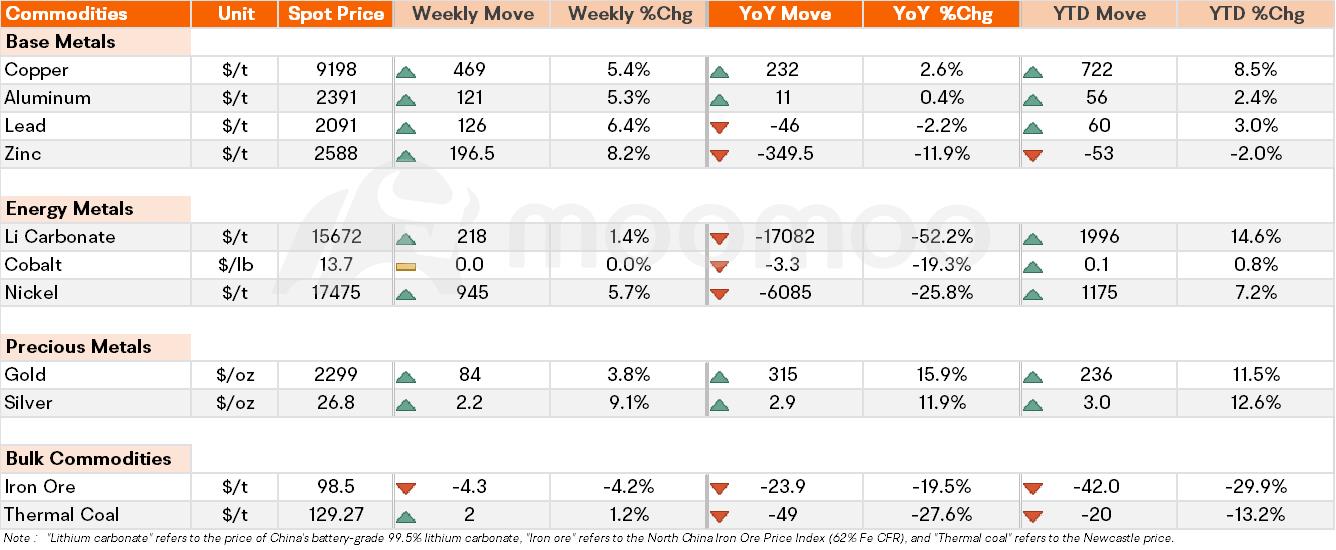

Spot Price Snapshot

Key Price Moves

Precious Metals: $Gold Futures(JUN4)(GCmain.US$ reached a new all-time high and $Silver Futures(JUL4)(SImain.US$ surpassed the US$27 level on Friday, despite an increase in the U.S. dollar and Treasury yields following the release of a better-than-expected jobs report and rising tensions in the Middle East. Iran threatened to retaliate after a military strike on its embassy in Syria killed high-ranking members of its Islamic Revolutionary Guard Corps on Monday.

Citi has raised its short-term price targets for gold and silver by 9% and 16%, respectively, to $US2400 an ounce and $US28 an ounce. Additionally, the brokerage firm increased the upper limit for its bullish scenario to $US3000 an ounce for gold and $US32 an ounce for silver.

Base Metals: The expected increase in demand has driven up prices for base metals. In March, China's official manufacturing PMI rose 1.7 percentage points to 50.8%, higher than expected at 49.9%, marking the first time it has risen above the boom-bust line since 2023. In addition, the Caixin China Manufacturing Purchasing Managers' Index (PMI) for March recorded 51.1, up 0.2 percentage points from February and has been in the expansion zone for five consecutive months, reaching a new high since March 2023, indicating that manufacturing production and business activities are accelerating. Meanwhile, the US ISM Manufacturing PMI for March was 50.3, significantly higher than the previous value of 47.8, rising above the boom-bust line for the first time in 16 months.

Against the backdrop of the global manufacturing demand recovery expectations, base metals rose across the board last week, with LME copper, aluminum, lead and zinc spot prices rising by 5.4%, 5.3%, 6.4% and 8.2% respectively.

$Copper Futures(JUL4)(HGmain.US$, the bellwether industrial metal, surged to a 14-month high due to increasing supply risks and hopes for a global recovery in demand. Major mine disruptions have resulted in historically high prices for mined ore, forcing smelters to pay steep prices. Furthermore, Chinese plants, which produce over half of the world's refined copper, are moving closer to implementing a joint output cut in response.

"Copper has broken above $8700/t for the first time since August as expectations for a large deficit have accelerated," Morgan Stanley said, "We stay bullish on copper, forecasting $10,200/t by the third quarter of 2024."

Uranmium: The recent climb in prices is primarily due to supply disruptions caused by flooding in Kazakhstan, the world's largest nuclear fuel producer. Spot uranium prices have risen by approximately 40% over the past year as Kazatomprom, the largest miner, has faced difficulties in increasing production, and the US is considering a ban on Russian supplies. These supply concerns have arisen as countries worldwide are turning to nuclear power as a means of reducing emissions. According to Goldman analyst Neil Mehta, global uranium demand could increase by up to 60% by 2040.

Top Company News

BHP Mitsubishi Alliance Sells Blackwater and Daunia Mines to Whitehaven Coal

On last Tuesday, $BHP Group Ltd(BHP.AU$ announced that its joint venture with Mitsubishi Development, which produces metallurgical coal, has successfully sold the Blackwater and Daunia mines in Queensland to $Whitehaven Coal Ltd(WHC.AU$ in a cash deal worth up to $4.1 billion.

Rio Tinto to Manage Rehabilitation of Closed Ranger Uranium Mine

$Rio Tinto Ltd(RIO.AU$ has announced that it will take over the rehabilitation of the Ranger uranium mine in Australia's Northern Territory from $Energy Resources of Australia Ltd(ERA.AU$ , which has faced significant cost overruns. Rio Tinto, which holds an 86.3% stake in ERA, stated that it will take approximately three months to complete the transition to full management of the mine's rehabilitation.

Vale Acquires Remaining 45% Stake in Alianca Energia for $541M

Brazilian mining company $Vale SA(VALE.US$ signed an agreement to purchase a 45% stake in Alianca Energia from Cemig GT, a subsidiary of energy firm Cemig, for 2.7 billion reais ($540.9 million). This acquisition will provide Vale with complete ownership of Alianca Energia, which holds seven hydroelectric plants and three wind units in its portfolio of assets.

Paladin and Boss Achieve Significant Uranium Milestones

Last week, two ASX-listed companies in the uranium sector made progress. $Paladin Energy Ltd(PDN.AU$achieved commercial production at its Langer Heinrich mine in Namibia, while $Boss Energy Ltd(BOE.AU$ passed the final technical milestone needed for the restart of its Honeymoon mine in Australia. With uranium prices now at levels that can support more mining operations, supply is beginning to increase. However, many believe that this will not be enough to meet the growing demand for nuclear power.

If you have any suggestions, please feel free to leave us a message. We welcome your feedback and ideas!

Source: moomoo, Trading Economics, Yahoo Finance, Wind

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment