Today's Pre-Market Stock Movers And Top Ratings: TGT, COIN, TJX, CVX, and More

Pre-Market Stock Movers

Gapping up

(Target shares popped nearly 8% before the market opened even as the retailer slashed its full-year forecast and posted revenue for the recent quarter that fell short of Wall Street’s expectations. The company posted earnings of $1.80 a share, versus the $1.39 expected by analysts polled by Refinitiv. Revenue came in at $24.77 billion, lighter than the $25.16 billion that was estimated.)

(Shares of the Mediterranean fast-casual chain jumped more than 9% after posting a profit in its first quarterly report following its initial public offering. Revenue surged 62% in the latest quarter to nearly $173 million as Cava opened new stores.)

(Shares of the U.S. cryptocurrency exchange rose about 4% before the bell after the National Futures Association, a CFTC-designated self-regulatory organization, cleared the company to operate a futures trading service alongside its existing spot crypto trading offering.)

(The off-price retailer's stock rose 3% on stronger-than-expected quarterly results. TJX posted adjusted earnings of 85 cents per share on $12.76 billion in revenue. That came in ahead of the 77 cents and $12.45 billion expected by analysts, per Refinitiv.)

(The beverage stock rose about 1.4% after UBS upgraded Keurig Dr Pepper to a buy from a neutral rating, citing its cheap valuation relative to peers and its historical average.)

(The tax preparer’s stock jumped more than 4% after topping fiscal fourth-quarter earnings expectations and hiking its dividend by 10%. H&R Block earned $2.05 adjusted per share on revenues of $1.03 billion. Analysts polled by Refinitiv had estimated $1.88 in earnings and $1.01 billion in revenue.)

Gapping down

(The electric vehicle stock lost more than 2% premarket on news that it cut prices on existing Model S and Model X inventories in China.)

(Coherent plunged more than 23% before the bell after posting weaker-than-expected guidance for the fiscal first quarter and full year. The company attributed the disappointing outlook to expectations for “no meaningful improvement” in the macroeconomic environment, including China.)

(The Vietnamese electric vehicle stock shed more than 12% in the premarket, one day after its debut on the Nasdaq via a SPAC merger. Shares more than doubled in Tuesday’s session.)

(U.S.-listed shares of JD.com dropped 5% even after the China-based e-commerce company surpassed expectations for the recent quarter on the top and bottom lines.)

(Shares lost 2.5% in the premarket after the laboratory technology company cut its full-year guidance, citing a softer macroenvironment. Agilent topped its third-quarter revenue and EPS expectations, posting adjusted earnings of $1.43 a share on $1.67 billion in revenue.)

(Jack Henry & Associates dropped 6.3% in the premarket. The financial tech company issued full-year earnings guidance for June 2024 that was weaker than expected; it forecast per-share earnings in the range of $4.92 to $4.99, while analysts polled by FactSet expected $5.35. Otherwise, it beat analysts’ expectations in its most recent quarter. Jack Henry reported fiscal fourth-quarter earnings of $1.34 per share, better than the consensus estimate of $1.19 per share, while revenue of $534.6 million topped analysts’ $512.8 million estimate.)

(The aerospace technology stock fell about 11% in premarket trading after fiscal fourth-quarter results came in short of analyst expectations. Mercury reported 11 cents of adjusted earnings per share on $253.2 million of revenue. Analysts surveyed by FactSet’s StreetAccount were expecting 52 cents per share on $278.8 million of revenue. Guidance for the 2024 fiscal year also missed estimates on several metrics, as the company said it was entering a “transition year.”)

Source: CNBC

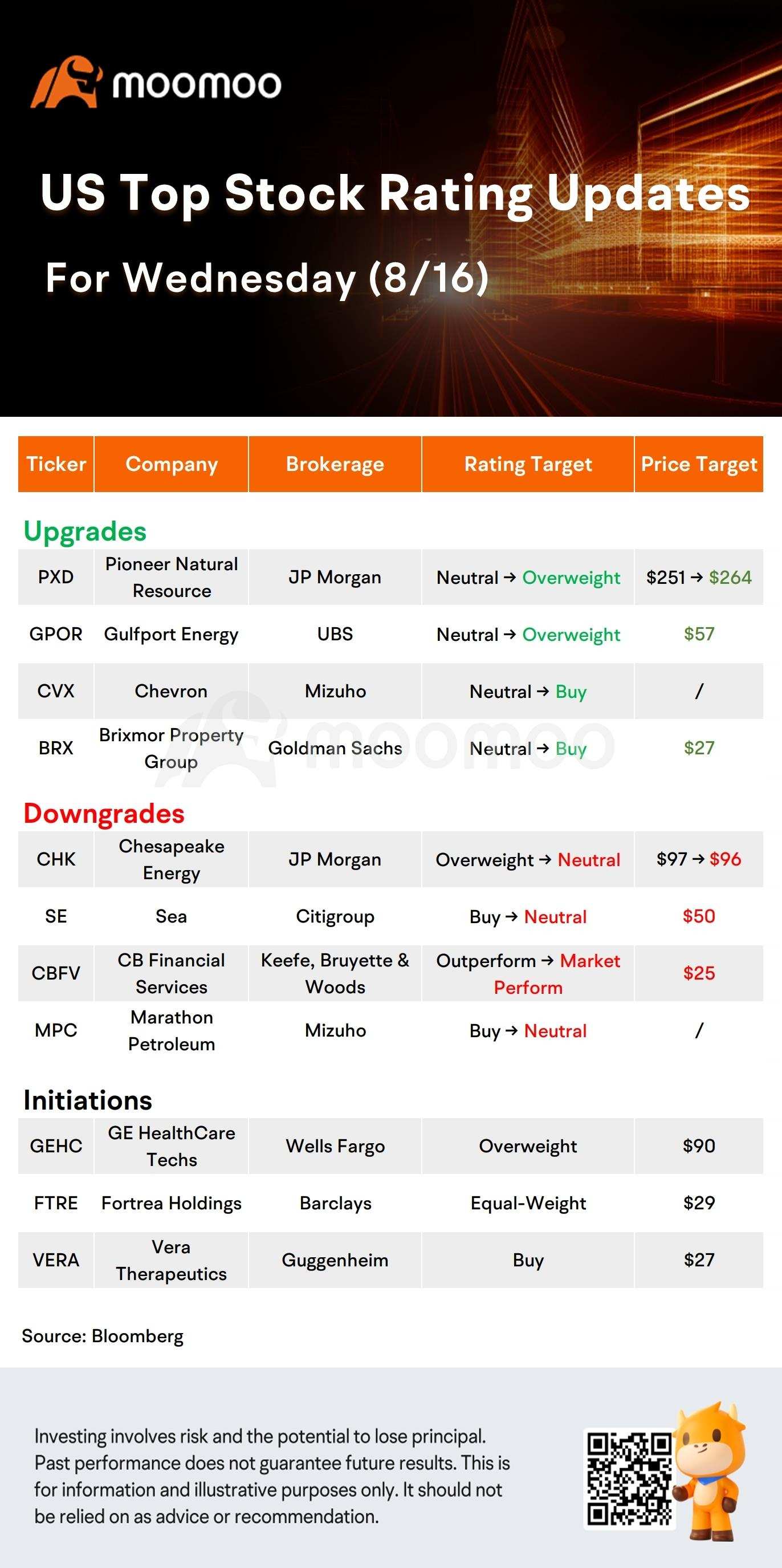

US Top Rating Updates on 8/16

$GE HealthCare Technologies(GEHC.US$ initiated at Overweight by Wells Fargo, announced target price at $90.

$Pioneer Natural Resources(PXD.US$ was upgraded by JP Morgan from Neutral to Overweight, increased target price from $251 to $264.

$Chevron(CVX.US$ was upgraded by Mizuho from Neutral to Buy.

$Sea(SE.US$ was downgraded by Citigroup from Buy to Neutral, decreased target price to $50.

CHK was downgraded by JP Morgan from Overweight to Neutral, decreased target price from $97 to $96.

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Silverbat : EXTREMELY?