Today's Morning Movers and Top Ratings: AMD, MS, UNH, BAC and More

Morning Movers

Gapping up

$Morgan Stanley(MS.US$ The stock climbed 2.8% following the announcement of increased profits in the first quarter, attributed to a rebound in investment banking from a two-year deal-making drought.

$UnitedHealth(UNH.US$ The stock surged 7.5% after the health insurer indicated that disruptions from a February cyber attack at Change Healthcare might lead to a hit of up to $1.35 per share to full-year profit, a significant amount but less than what was initially feared.

$Bank of America(BAC.US$ The bank's stock ascended 0.7% after it reported a notable rise in revenue from investment banking and wealth management, which helped counterbalance the anticipated dip in interest payments.

$Bank of New York Mellon(BK.US$ Shares of the lender increased by 1.6% after reporting a 5% profit rise, driven by higher investment services fees from rising asset values, which more than compensated for the decrease in interest income.

$Advanced Micro Devices(AMD.US$ The stock of the chipmaker went up 1% after HSBC upgraded its rating to 'buy' from 'hold', citing the substantial market potential in artificial intelligence.

$Trump Media & Technology(DJT.US$ The stock rose 1.9% with the media company announcing its plans to gradually launch a live TV streaming platform after a six-month testing period.

Gapping down

$Johnson & Johnson(JNJ.US$ The stock dipped 0.2% after the healthcare company reported first-quarter revenue that fell short of expectations, with sales from its leading psoriasis drug Stelara not meeting predictions.

$Tesla(TSLA.US$ Shares decreased by 2.3% upon news that CEO Elon Musk informed staff about reducing more than 10% of its global workforce in response to declining sales and a growing price competition in the electric vehicle market.

$PNC Financial Services(PNC.US$ The stock dropped by 0.7% after the financial institution disclosed a 21% decrease in first-quarter profit, impacted by lower interest income and higher customer deposit costs in a rising interest rate environment.

Source: CNBC; Investing.com

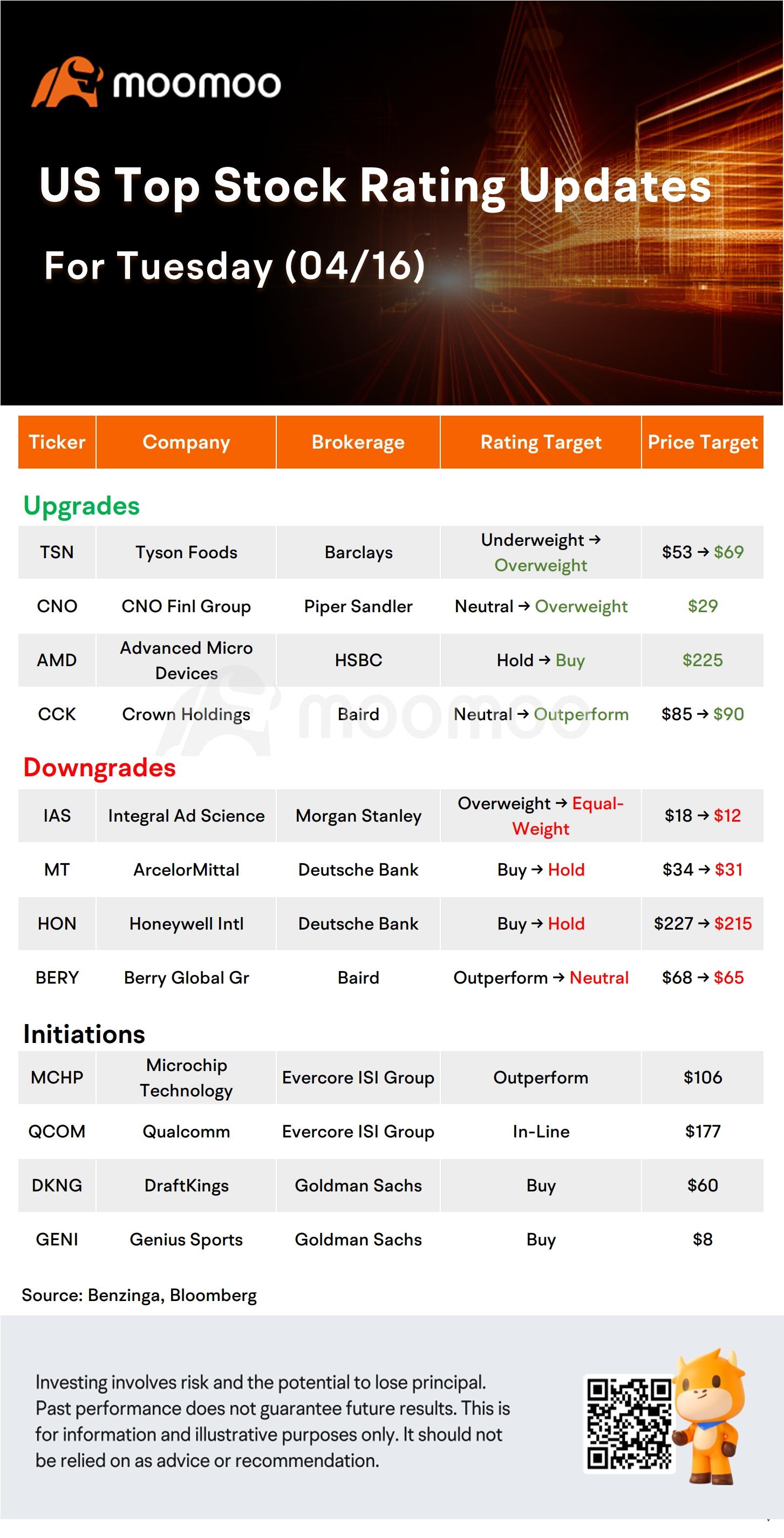

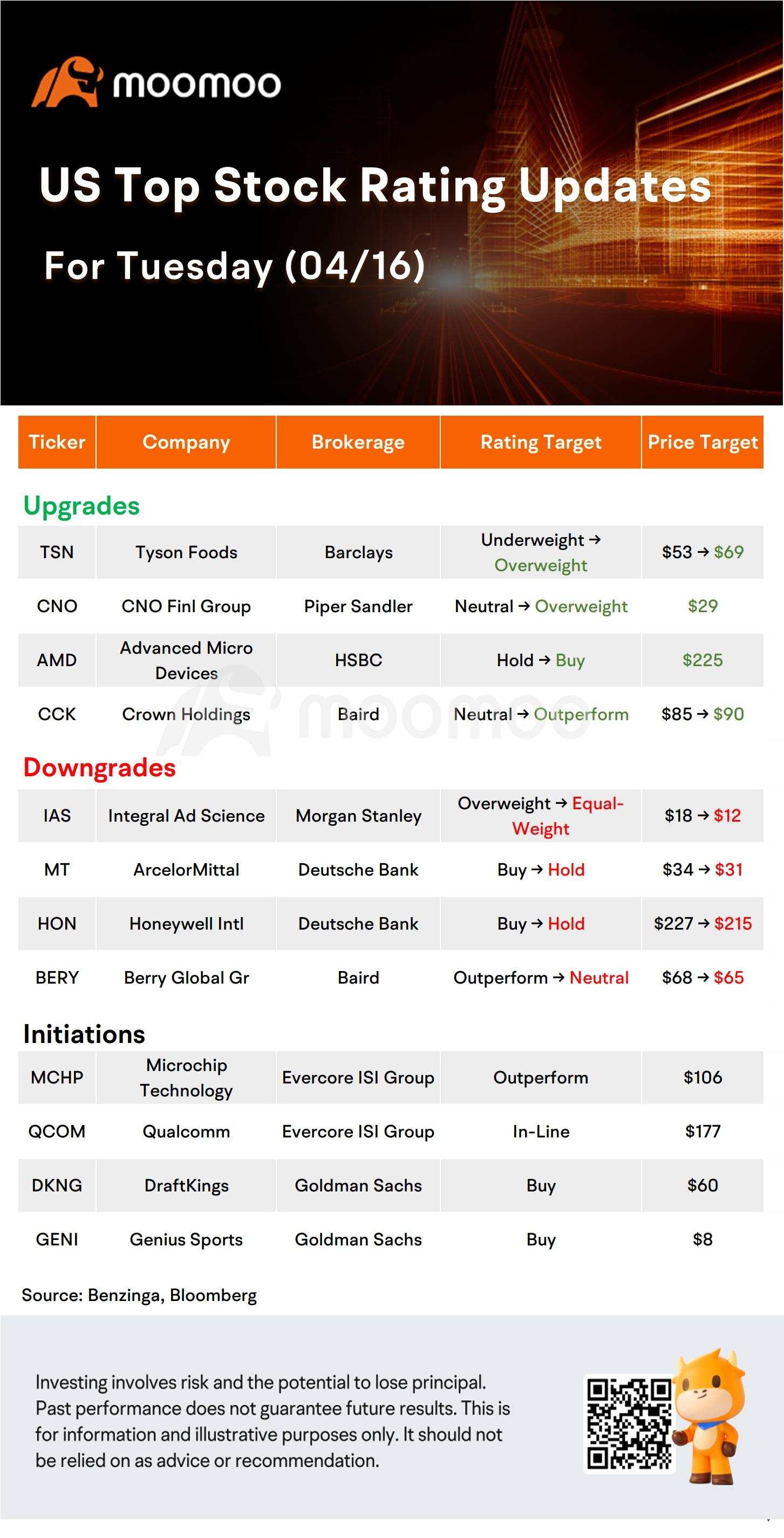

US Top Rating Updates on 04/16

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

104434073 : It seems like a large sum of money has flowed back into the deposits, allowing the banks to have collateral for more high-interest lending. Similarly, China had the same signal when the government cracked down on over-leverage property developers, with a first wave of savvy investors cashing out from their properties and put their cash back into bank deposits